The downward motion in Bitcoin’s value seems to be a fantastic getting possibility for institutional traders at the minute.

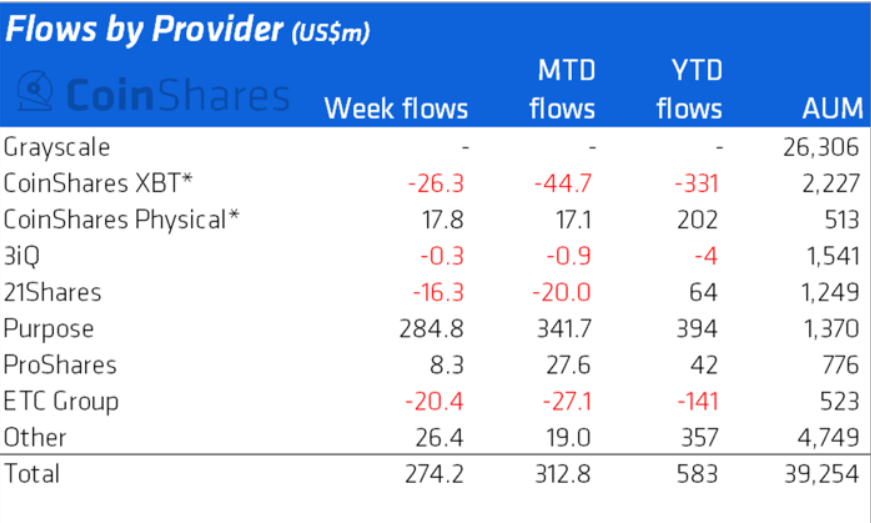

According to a new CoinShares report on the institution’s weekly investments, they have poured up to $ 299 million into Bitcoin solutions. James Butterfill, Head of Research at CoinShares, stated this is an “unprecedented” worth investment for BTC for the duration of a sharp market place downturn.

Investors are getting weak cryptocurrency charges with inflows totaling $ 274 million, the greatest weekly inflow this yr. #Bitcoin https://t.co/ZDEOS9rSbS

– James Butterfill (@jbutterfill) May 16, 2022

Additionally, it also exposed that this was the greatest week of investment flows because October 2021 and grew to become the 19th greatest week because CoinShares started monitoring the index in 2015.

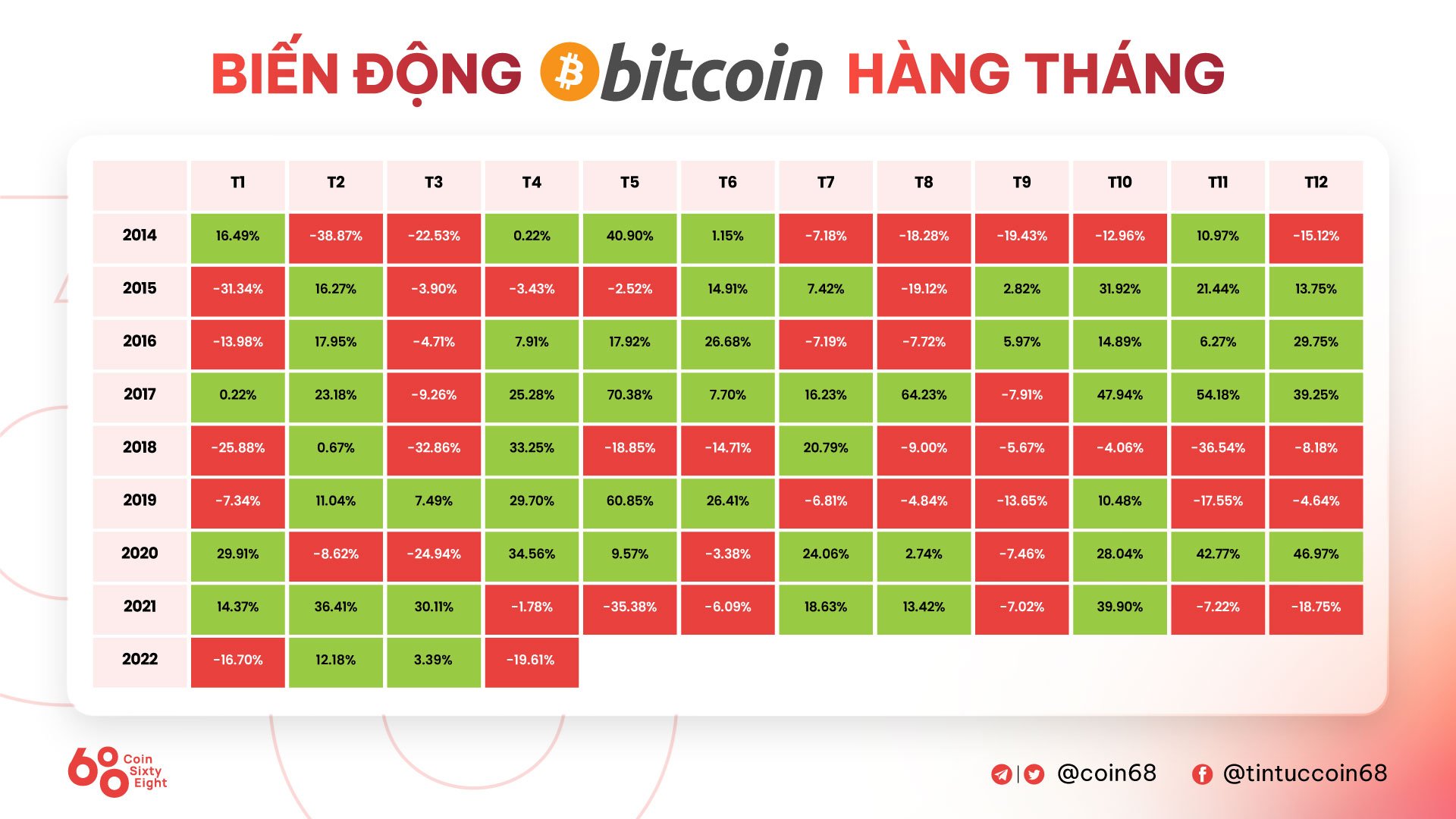

Notably, October 2021 is also the time when Bitcoin’s value is on a regular path to create an ATH at $ 69,000 with a market place cap reaching $ one.three trillion whilst institutional gamers shell out up to $ two billion for acquire Bitcoin, pushing their BTC investment to a record $ 9 billion.

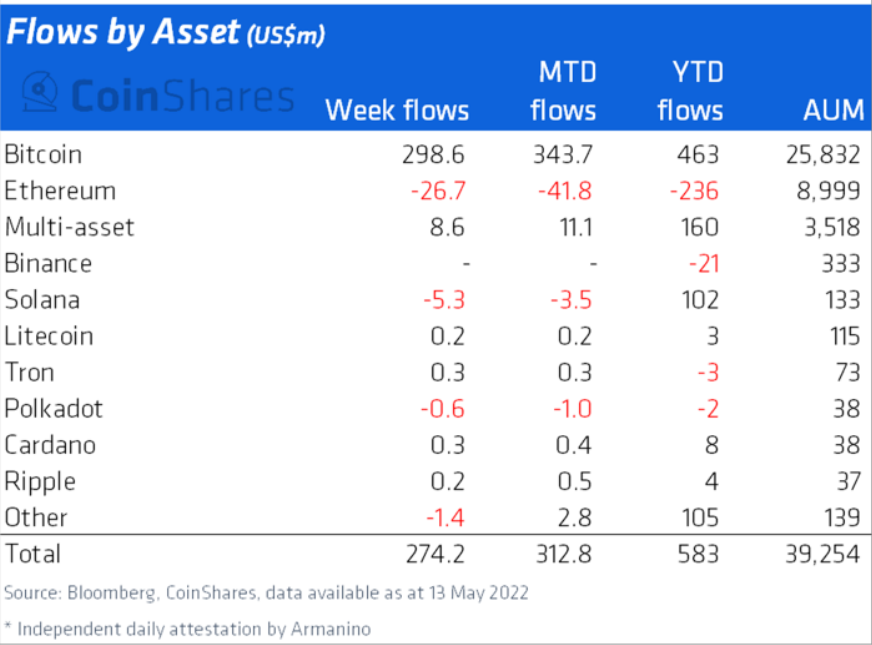

The CoinShares report also observed a $ 27 million withdrawal from Ethereum exchange-traded money final week, bringing the complete volume of ETH withdrawn in 2022 to $ 236 million. Solana (SOL), Polkadot (DOT) and numerous other assets all suffered equally detrimental amounts ranging from $ .six million to $ five.three million.

Of all the key crypto money, Grayscale stays the greatest, accounting for $ 26 billion of the $ 39 billion underneath management. Grayscale currently launched its very first ETF merchandise in the European market place pending the SEC’s selection to convert its Grayscale Bitcoin Trust (GBTC) fund into a Bitcoin spot ETF. The very good information is that Grayscale created a great deal of progress final week in meeting with the SEC on this situation.

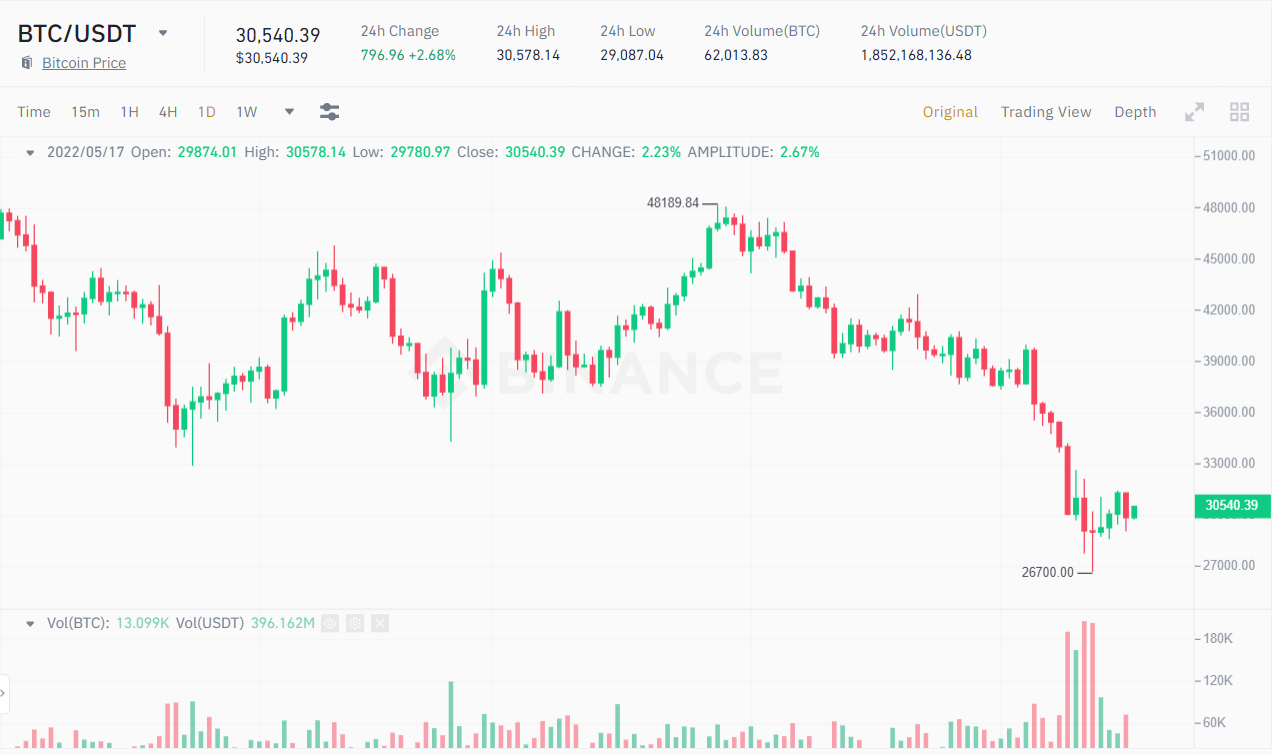

Looking back at the huge image, the sudden LUNA-UST catastrophe mixed with a variety of other vital variables this kind of as whale signals, the Fed’s move to increase curiosity costs, and the promote-off from aspect of the miners. The probability of Bitcoin miners’ shares plummeting concurrently has developed huge stress on Bitcoin, leading to BTC to drop to a 17-month minimal under the $ 28,000 mark for the very first time in two many years final week.

However, the enthusiasm returned by the institutional investment and a rather optimistic signal about the real working frequency of the BTC network via the recognition of Bitcoin’s mining problems that continues to peak, hashrate. Maintaining a somewhat substantial degree is bringing new hope. for BTC. Therefore, Bitcoin will encounter the possibility to shut seven consecutive weeks in the red, albeit “fragile” adequate to start a gradual recovery in the 2nd half of May.

As of press time, Bitcoin is trading at $ thirty,540 and is up two.68% in the previous 24 hrs.

Synthetic currency 68

Maybe you are interested: