Not possessing time to get pleasure from green development for lengthy, Bitcoin (BTC) rapidly plummeted to $ 39,000 as if practically nothing had occurred.

Notably, on March 9, immediately after rumors surfaced that President Biden was about to problem an executive purchase in favor of cryptocurrencies, the cost of Bitcoin quickly reacted strongly, skyrocketing to practically ten% from the past degree. from $ 38,900 to $ 42,594.

However, as the official executive purchase was announced at 6pm on the exact same day, BTC does not seem to have as well considerably volatility. Another equally significant legal occasion exactly where the UAE officially announced a new virtual assets law and the establishment of a cryptocurrency regulator did not enhance BTC.

And of program what is to come will come, just like the typical cost motion so far, anytime it does not “escape” correction in advance of a significant benchmark occasion, BTC will slide correct immediately after that. . At the time of creating, Bitcoin fell in cost in advance of information of the US cryptocurrency executive purchase, trading at $ 39,112.

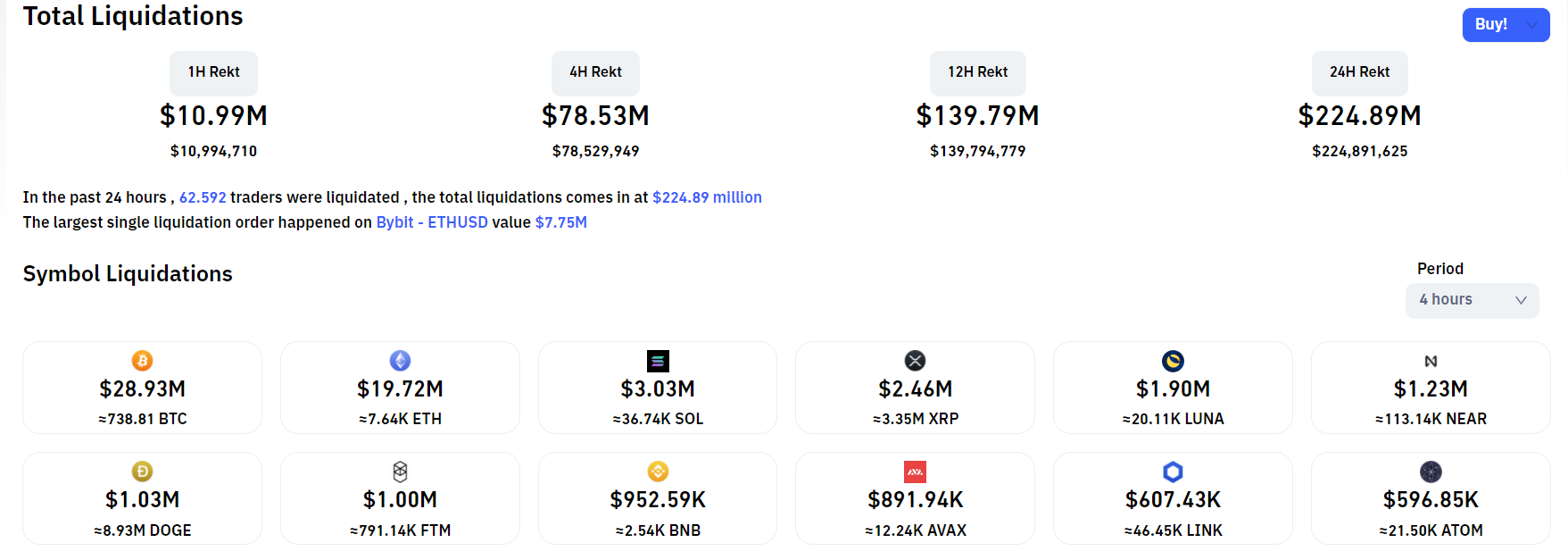

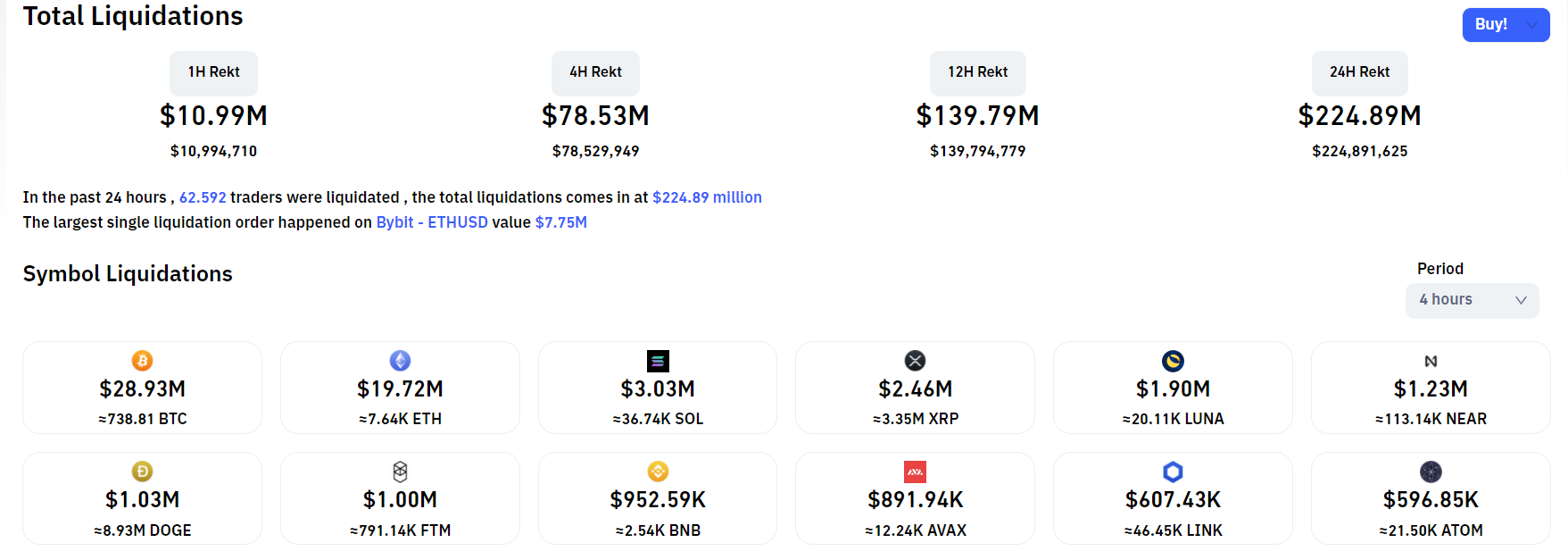

However, the sudden drop did not result in as well considerably injury to derivatives traders. According to Coinglass information, only about $ ten.99 million has been liquidated in the previous hour, generally from lengthy positions with a charge of 93.71%.

However, there are not a lot of particular causes but to clarify Bitcoin’s “tipping phase”. However, in the viewpoint of Coinlivethe most probably cause comes from the purchase to broaden the scope of sanctions towards Russia and Belarus to contain the European Union (EU) array of cryptocurrencies registered currently.

On the other hand, in spite of acquiring a good deal of sympathy not only from inside of the US government but also from crypto influencers for President Biden’s executive purchase, the key character induced a good deal of injury. A substantial influence on the cryptocurrency market place throughout the the previous tense is that SEC President Gary Gensler took this possibility to demonstrate his willingness to “dissuade” the business dramatically. Therefore, investor sentiment is probably to be impacted in some way by the over two pieces of information and facts.

Synthetic currency 68

Maybe you are interested:

Not possessing time to get pleasure from green development for lengthy, Bitcoin (BTC) rapidly plummeted to $ 39,000 as if practically nothing had occurred.

Notably, on March 9, immediately after rumors surfaced that President Biden was about to problem an executive purchase in favor of cryptocurrencies, the cost of Bitcoin quickly reacted strongly, skyrocketing to practically ten% from the past degree. from $ 38,900 to $ 42,594.

However, as the official executive purchase was announced at 6pm on the exact same day, BTC does not seem to have as well considerably volatility. Another equally significant legal occasion exactly where the UAE officially announced a new virtual assets law and the establishment of a cryptocurrency regulator did not enhance BTC.

And of program what is to come will come, just like the typical cost motion so far, anytime it does not “escape” correction in advance of a significant benchmark occasion, BTC will slide correct immediately after that. . At the time of creating, Bitcoin fell in cost in advance of information of the US cryptocurrency executive purchase, trading at $ 39,112.

However, the sudden drop did not result in as well considerably injury to derivatives traders. According to Coinglass information, only about $ ten.99 million has been liquidated in the previous hour, generally from lengthy positions with a charge of 93.71%.

However, there are not a lot of particular causes but to clarify Bitcoin’s “tipping phase”. However, in the viewpoint of Coinlivethe most probably cause comes from the purchase to broaden the scope of sanctions towards Russia and Belarus to contain the European Union (EU) array of cryptocurrencies registered currently.

On the other hand, in spite of acquiring a good deal of sympathy not only from inside of the US government but also from crypto influencers for President Biden’s executive purchase, the key character induced a good deal of injury. A substantial influence on the cryptocurrency market place throughout the the previous tense is that SEC President Gary Gensler took this possibility to demonstrate his willingness to “dissuade” the business dramatically. Therefore, investor sentiment is probably to be impacted in some way by the over two pieces of information and facts.

Synthetic currency 68

Maybe you are interested: