The president of the US Securities and Exchange Commission (SEC) continues to express a “tough” viewpoint on the whole cryptocurrency marketplace, but “reveals” some factors that could deliver hope for the Bitcoin and Ethereum local community.

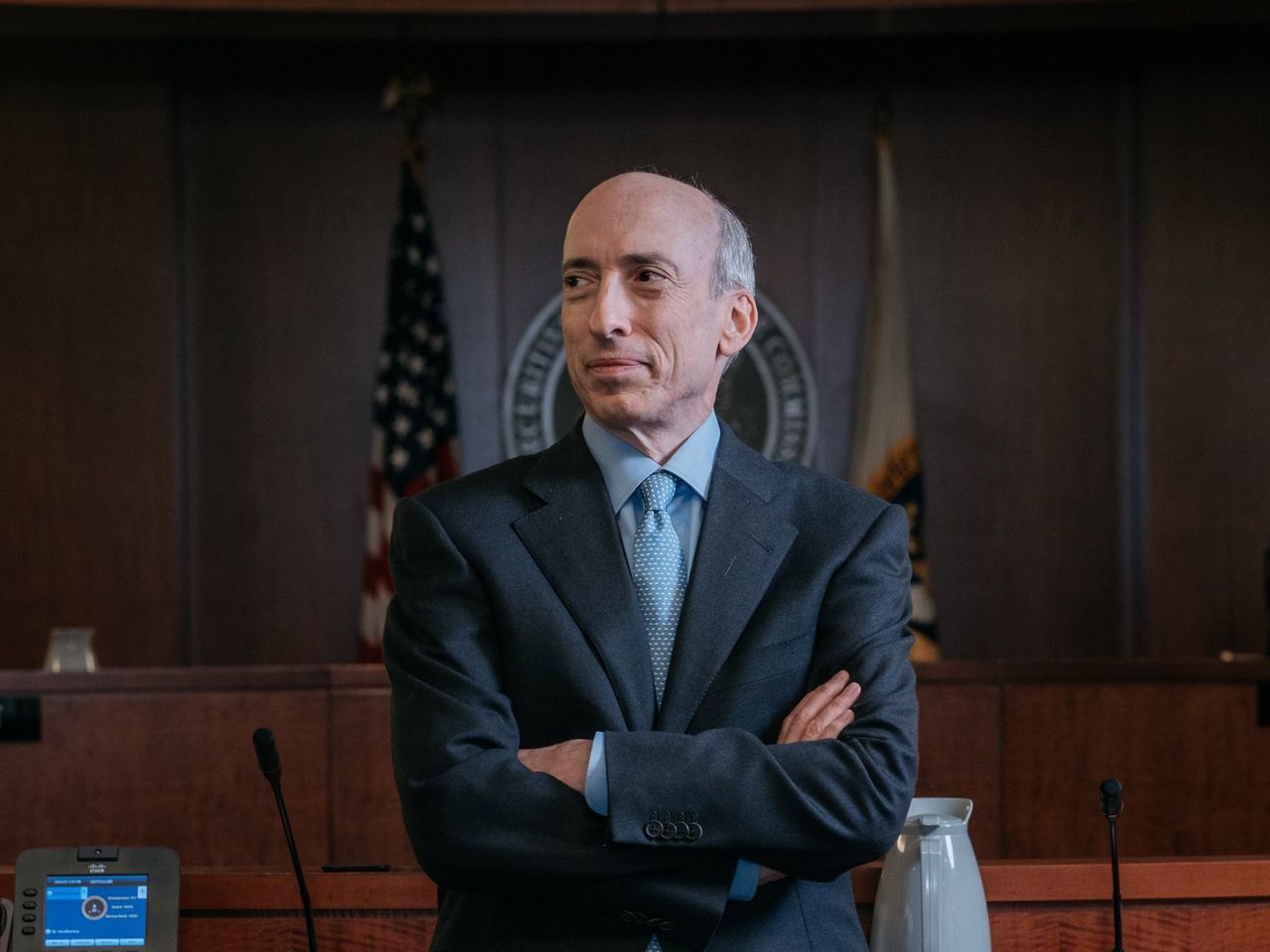

In a speech provided on the evening of September eight, Securities and Exchange Commission (SEC) chairman Gary Gensler stated that the cryptocurrency field does not need to have unique principles for the advancement of token issuance tasks. However, platforms that offer cryptographic providers have to normally stick to investor safety pointers.

“There is no exception for the cryptocurrency marketplace which is inconsistent with securities laws. The very same goes for investor safety, irrespective of their underlying technologies. “

The SEC chairman’s comment is possibly the clearest indicator that the regulator is intent on continuing to apply present principles and laws to the cryptocurrency field, contrary to the hopes of traders and entrepreneurs that the SEC will build some assistance by making it possible for blockchain business to problem tokens with out possessing to register as a securities platform. He additional:

“Of the nearly 10,000 tokens on the cryptocurrency market, I believe most of them are stocks.”

Additionally, the SEC chairman also warned that stablecoins could fall into the group of unregistered securities due to some of the functions they offer and probably compete with revenue marketplace money, other securities and depository banking institutions, though posing crucial political troubles. .

“Depending on the properties of stablecoins, such as generating interest payments across platforms, what mechanisms are used to retain value or how they are offered, sold and used within the system, a stellar cryptoecology. Everyone will need to register and deliver. significant investor protection “.

While this is a bit of a “tough” viewpoint, a small fantastic information for the local community is that Mr. Gensler also shared the viewpoint that some tokens may possibly not meet the definition of a stock that is floating in tiny quantities, but it has a actually outstanding worth. In this detail, we can very easily envision that Bitcoin and Ethereum are on the checklist in accordance to this SEC definition.

The evidence is that in late June 2022, the SEC chairman reaffirmed Bitcoin as a commodity in an interview with CNBC. Even on the Ethereum side, the regulator has not created any moves to recognize ETH as safety so far.

Also in 2017, former SEC official William Hinman frankly stated that ETH is not a stock, and this has develop into proof cited by Ripple in the lengthy lawsuit with the SEC more than the “border” of issuing non-securities. authorized by XRP.

Finally, there is one more optimistic information to be uncovered in the speech, Gary Gensler seems to be forward to offering the Commodity Futures Trading Commission (CFTC) higher authority more than the regulation of the cryptocurrency marketplace, as extended as the company does not “take away” energy and ” step foot “on the SEC. So, if Bitcoin and Ethereum from the SEC’s level of see are not stocks, but commodities, the scope of CFTC regulation will develop into a ideal driver for BTC, ETH.

This suggests the SEC is both entrusting custody of Bitcoin and Ethereum, or it can figure out which tokens the SEC does not give the CFTC this kind of a hand, making it possible for the SEC to emphasis additional on regulating the share of the rest of the cryptocurrency marketplace. In common, the SEC nevertheless has the energy to make a decision which tokens are securities and is looking at that most of the remaining tokens fall underneath this definition and are topic to the law, not Bitcoin and Ethereum.

Synthetic currency 68

Maybe you are interested: