The “terrifying” market place crash triggered by the FTX trading crisis has meant that Bitcoin miners proceed to endure extreme harm.

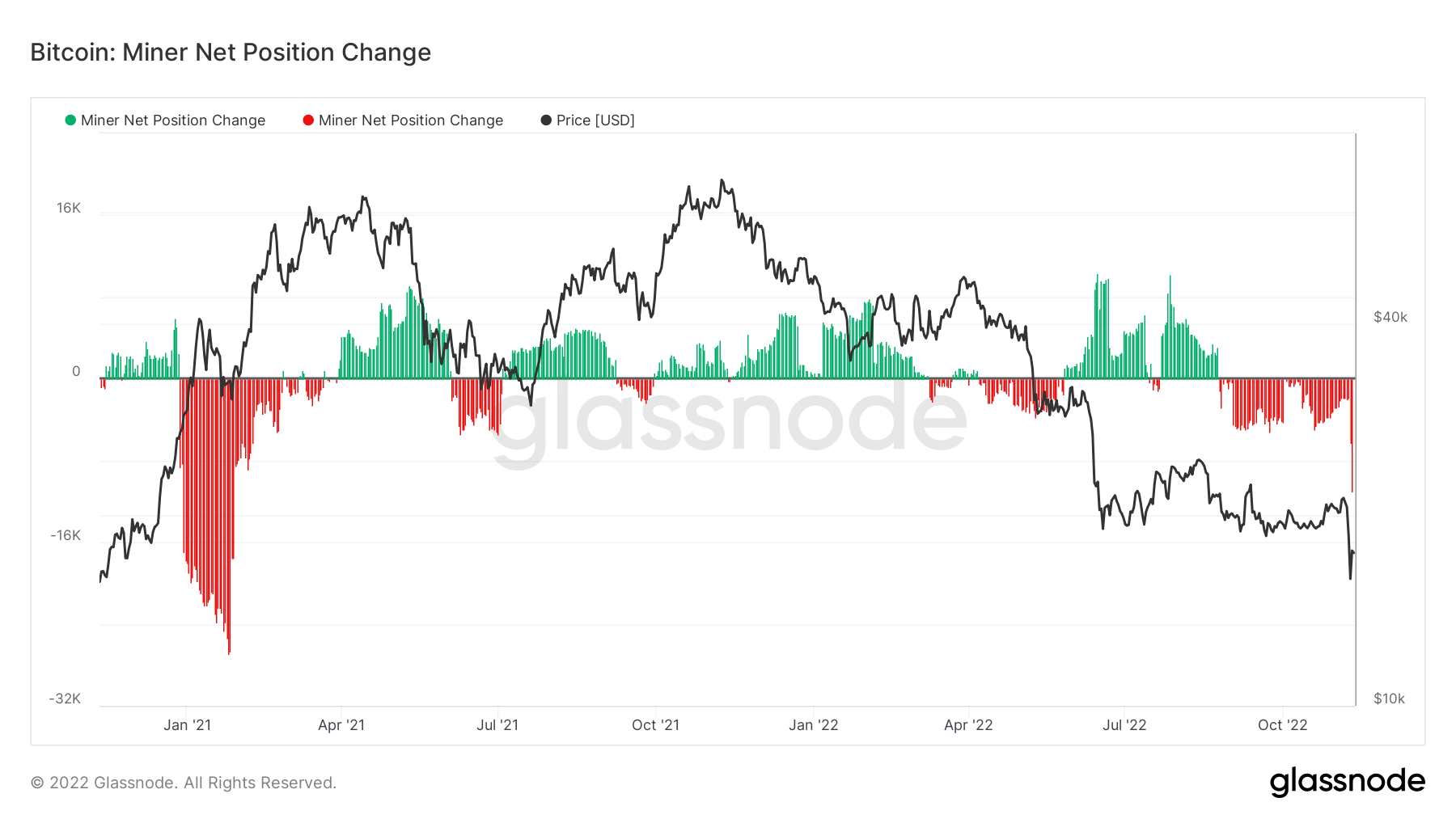

The market place has noticed the largest 1-day miner offering strain because January 2021 and it seems that this strain has proven no indicators of stopping so far, extending more from miners even as the typical hashrate selling price commences to decline.

In November 2022, the hashrate selling price was $.05. With Bitcoin’s existing $sixteen,000 selling price motion, mining is not only unprofitable for miners, but also heavily shortfall for massive investments in the cryptocurrency sector.

With the addition of tens of 1000’s of new ASIC miners to the market place in excess of the previous yr, with even the greatest mining operations in the red, number of would have anticipated hashrate rates to drop so significantly. At all around $9,000 every, the most up-to-date Bitmain S19Pro ASIC miner has a payback time period of one,500 days with an typical hashrate of $.06.

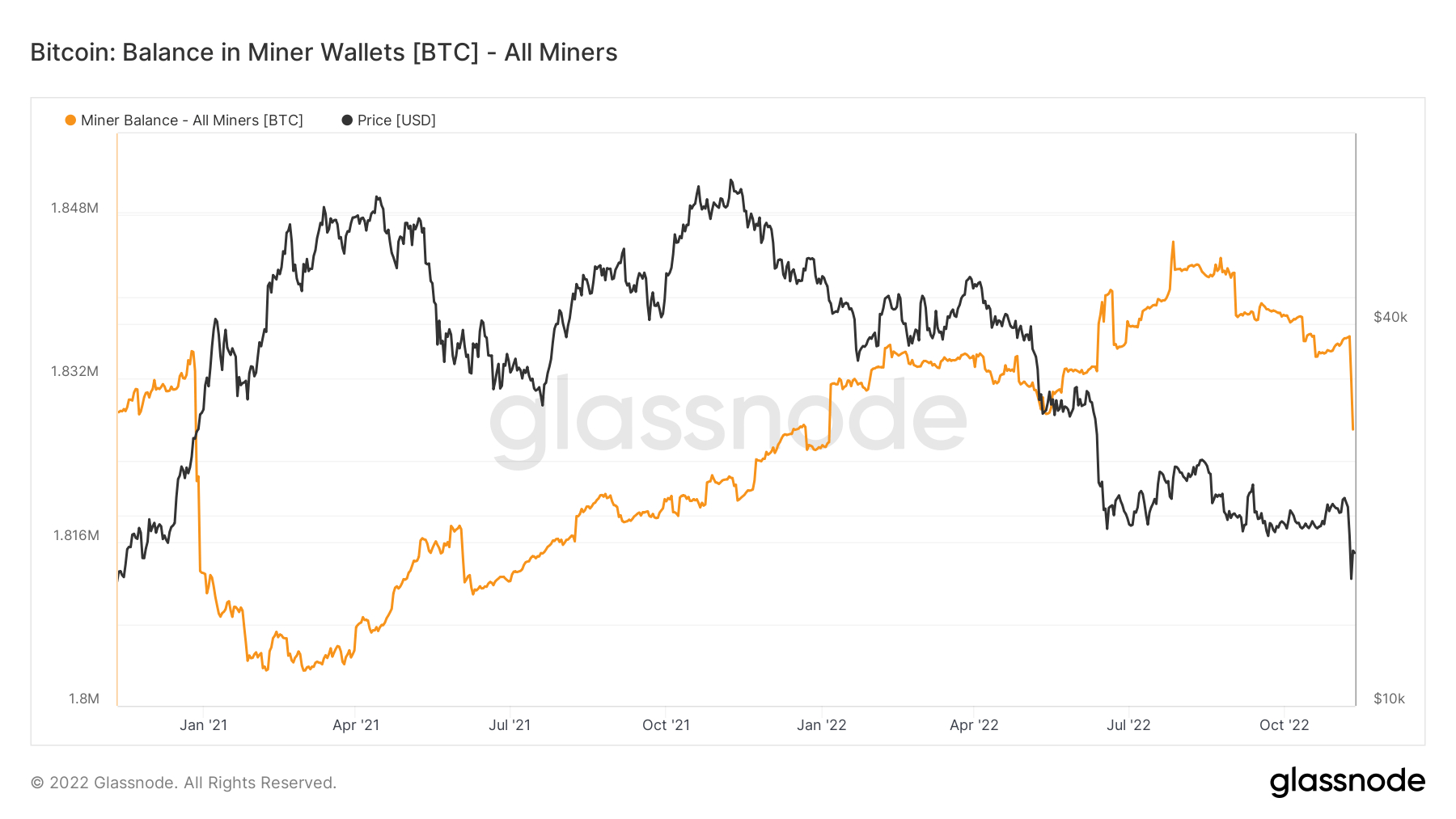

Therefore, this difficulty of rising mining expenses and reducing revenue has prompted miners to promote their holdings in Bitcoin. Since the starting of November, there has been a vertical decline in the balances of the miner wallets, which reached a minimal recorded in January 2021.

Furthermore, the alter in the net asset place of the miner correlates properly with the continuing downward trend in the selling price of BTC. With power rates anticipated to rise during the winter and the ongoing bear market place obtaining heavier, we may perhaps really very well see a wave of unprofitable miners totally closing their moves.

The over argument has been partly anticipated because final week, when there had been quite a few signals in the on-chain information that Bitcoin miners are seriously concerned about the existing state of Bitcoin, promote their BTC holdings to “save” the their place is inevitable.

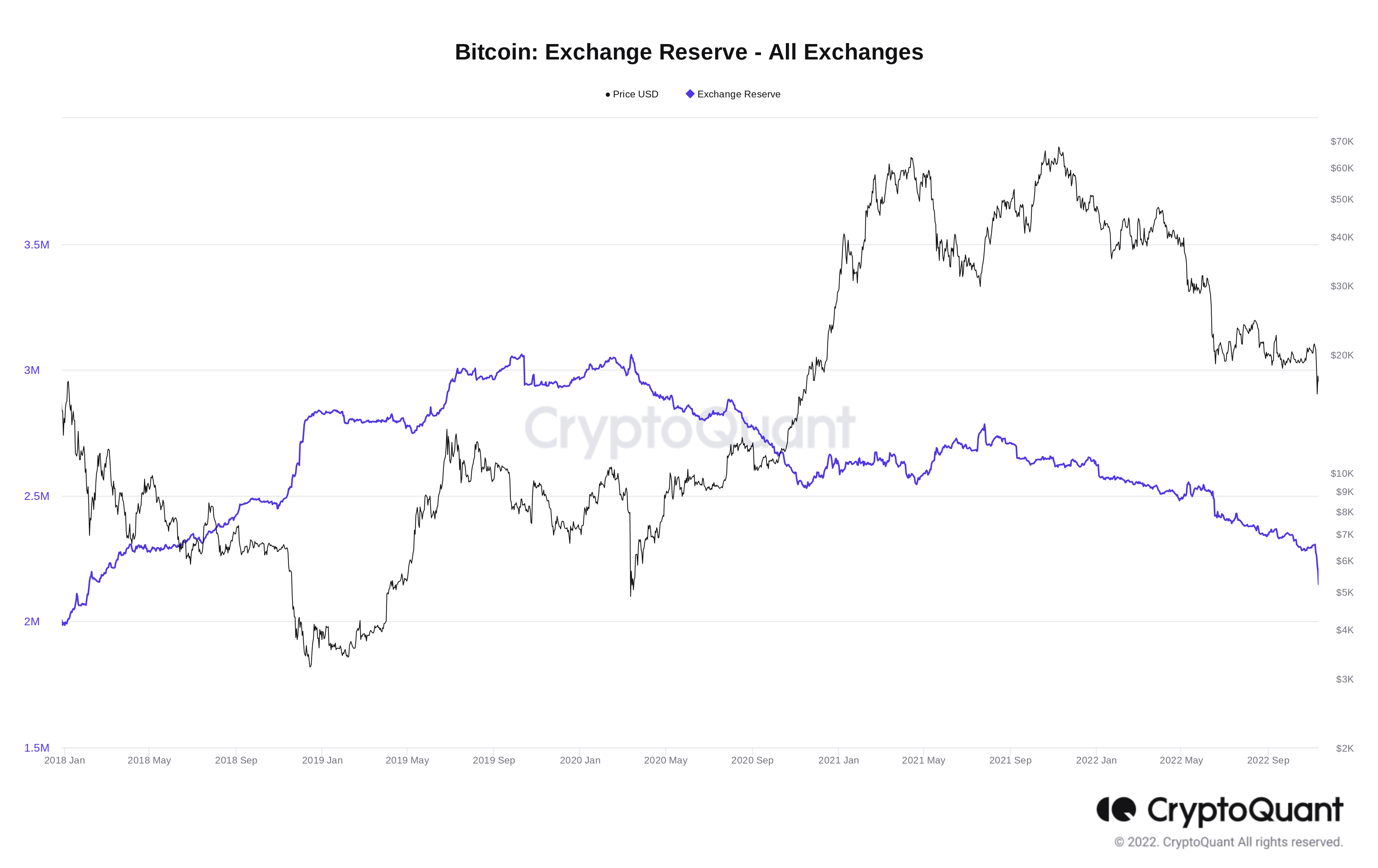

In an additional connected growth, traders are withdrawing money from exchanges at a price not noticed because April 2021 with virtually $ three billion in Bitcoin withdrawn in the previous 7 days, Cointelegraph reported. CryptoQuant tracks a complete of 38 exchanges, which includes these with reported fiscal issues this kind of as FTX and Kucoin, bringing the complete reserves of Bitcoin on exchanges to their lowest degree because February 2018.

Perhaps this kind of a enormous withdrawal of Bitcoin is due to the truth that traders are also exceptionally baffled by the impact of the withdrawal blockchain that will erupt right after the collapse of FTX, for instance, the exchanges of Crypto.com and Gate.io have had an action. weekend. However, the big difference is that alternatively of withdrawing fiat, they chose to withdraw BTC based mostly on PlanB’s rather convincing statement.

“If you want to withdraw from an exchange, look at not withdrawing in fiat (Usd, Eur, and so forth.) but Bitcoin, as this will enable boost the selling price of BTC. If you withdraw into fiat, the exchange should promote its very own Bitcoins or tokens to convert into fiat for you. If you withdraw with BTC, they will have to acquire * actual * BTC “.

If you want to withdraw money from an exchange, look at withdrawing not fiat (usd, eur and so forth) but bitcoin, due to the fact that will enable the selling price of bitcoin. If you withdraw in fiat, the exchange has to promote coins. If you withdraw in btc, the exchange should acquire actual btc.

– PlanB (@ 100trillion USD) November 13, 2022

Synthetic currency 68

Maybe you are interested: