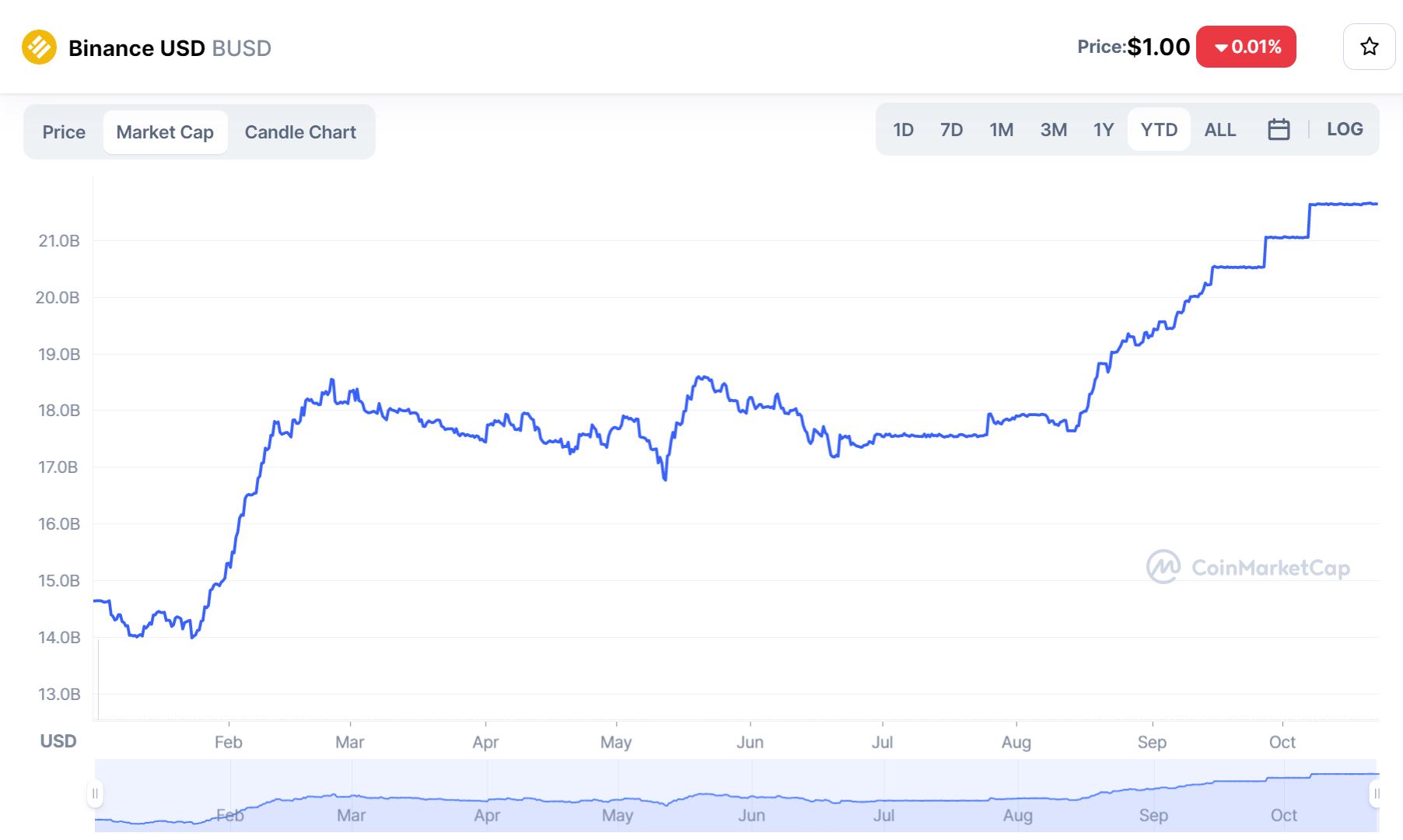

Both complete provide and industry share of Binance USD (BUSD) in the stablecoin section have set new highs in current instances.

According to statistics, the capitalization of the stablecoin Binance USD (BUSD) because the finish of September 2022 has exceeded the threshold of twenty billion bucks for the very first time in historical past and is at this time steady at close to 21.six billion. This is a continuation of the continued boost in the complete stablecoin provide supported by the world’s biggest cryptocurrency exchange Binance.

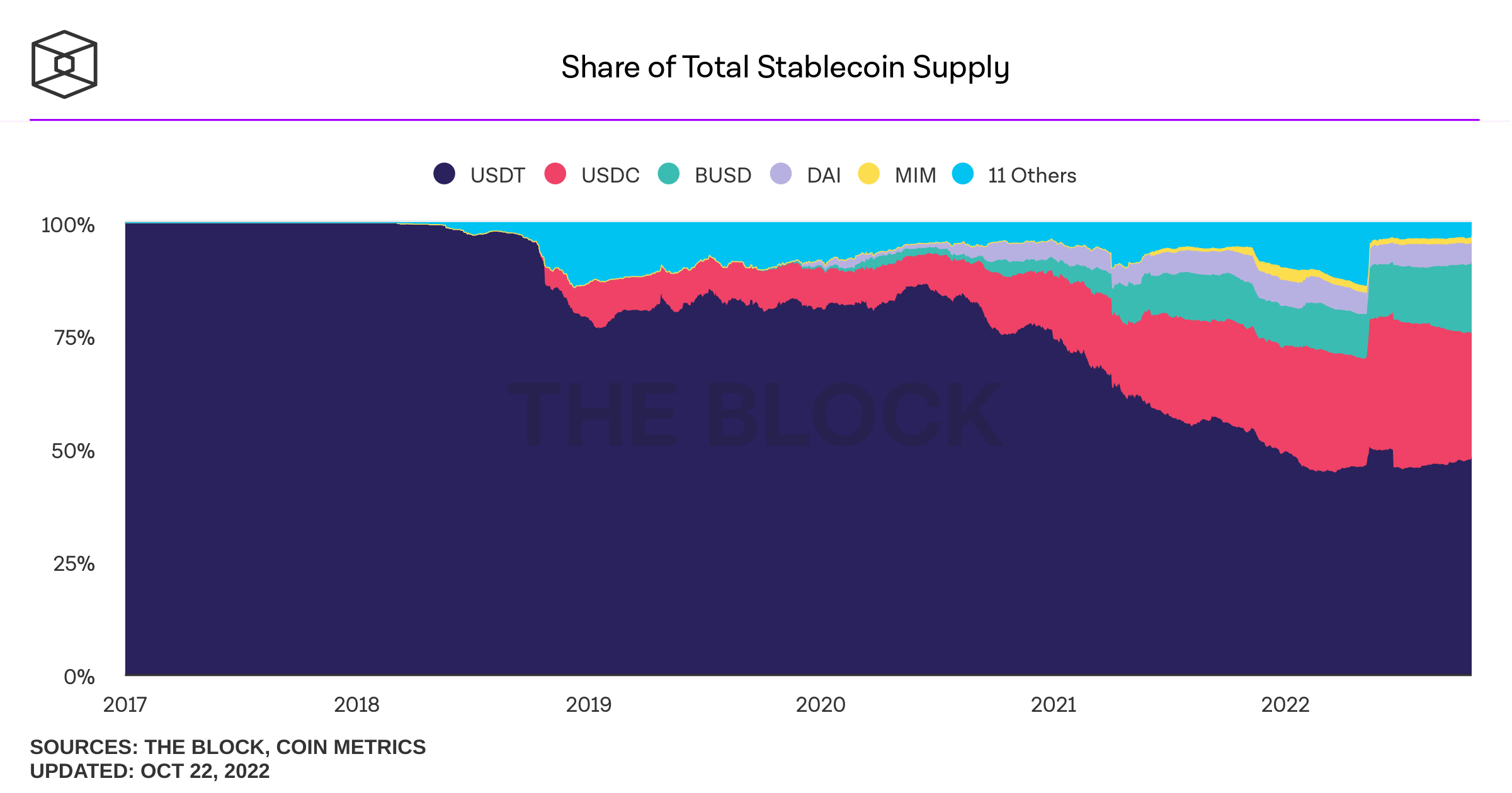

While other main stablecoins this kind of as Tether (USDT) and USD Coin (USDC) each seasoned a sharp boost in aggregate provide following the LUNA-UST crash in May and the resulting liquidity crisis of main cryptocurrency corporations, BUSD is nonetheless regular. development and at this time has a industry share of 15.48% of the complete capitalization of a lot more than $ 140 billion of the complete stablecoin array.

The biggest stablecoin is nonetheless USDT with a industry capitalization of USD 67.five billion, followed by USDC at USD forty.four billion. However, it is clear that USDC’s capitalization has dropped considerably in current instances, primarily when it was found that the business behind Circle may perhaps be freezing consumer money following the Tornado Cash incident.

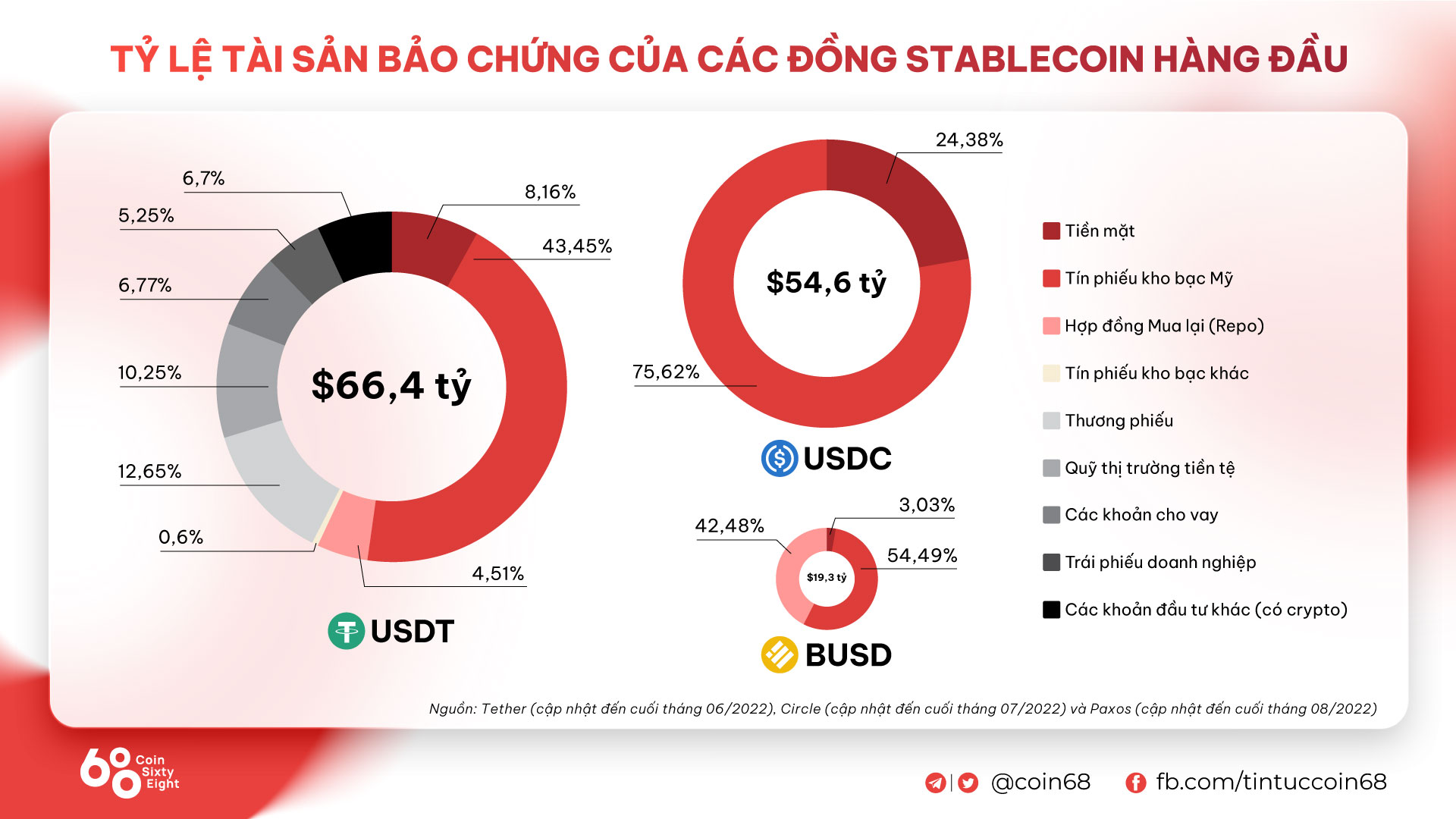

Even so, all 3 of the over stablecoins are regarded to be safer than decentralized stablecoins or algorithmic stablecoins on the industry, with the primary motive currently being that they are backed by true bucks or equivalent assets with income, rather than cryptocurrency.

BUSD also gains from Binance’s current system transform. As a end result, as an alternative of acting only as a stablecoin in the Binance and BNB Chain ecosystem, BUSD is now geared in direction of expanding to other blockchains this kind of as Polygon and Avalanche.

Not stopping there, at the finish of September 2022, Binance also announced the consolidation of all stablecoin balances in BUSD, with the exception of USDT. Users can nonetheless deposit and withdraw other stablecoins usually, but all will be normalized to BUSD when viewed to the consumer. Binance says the move is to simplify trading operations, as very well as eliminate liquidity barriers when making use of the exchange.

Synthetic currency 68

Maybe you are interested: