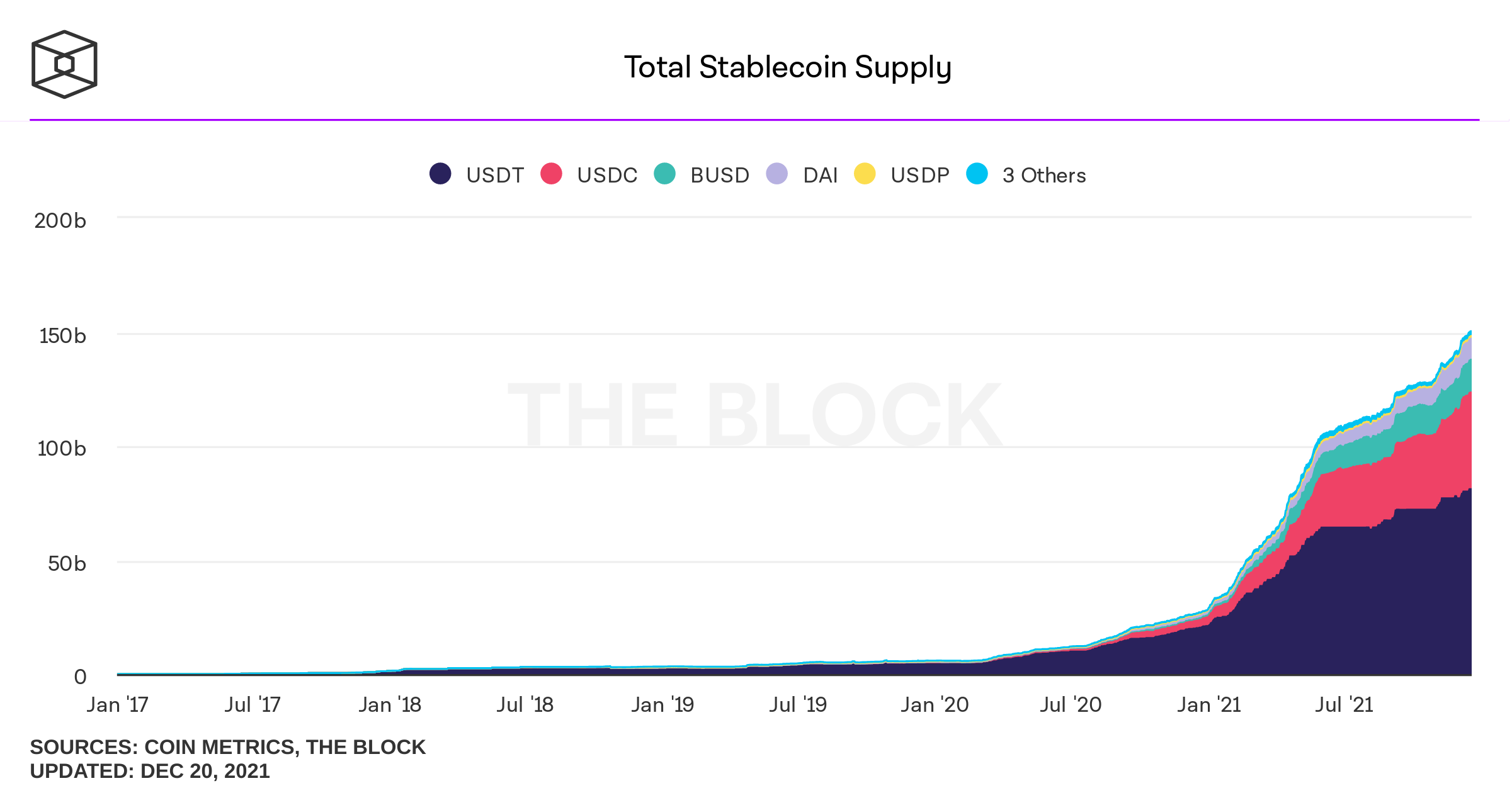

The stablecoin sector has viewed a yr of phenomenal development, with the complete provide of stablecoins growing by 388% considering the fact that the starting of January 2021.

According to the statistics of The block, the complete capitalization of stablecoins went from virtually $ thirty billion in early 2021 to far more than $ 150 billion at press time.

In which, Tether (USDT) continues to be the dominant stablecoin with a 270% capitalization boost, from $ 22 billion to $ 81.five billion. Compared to a market place share of more than 73% at the get started of the yr, USDT’s market place share is now just more than 54.three%.

The result in of this is the rise of other stablecoin tasks, normally USDC Coin (USDC). USDC’s capitalization greater tenfold, from $ four.two billion to $ 42 billion. Compared to a market place share of only 14% at the get started of the yr, USDC’s complete provide now assists very own 28% of the stablecoin “pie”.

Other stablecoins like USDT, BUSD, DAI, and so on. they recorded an boost in the complete provide of far more than two occasions.

The purpose for the wave over is quick to see. 2021 was a really profitable yr for the cryptocurrency business in basic and the DeFi sector in certain. As a gateway connecting standard dollars to cryptocurrencies, the demand for stablecoins is growing not only with retail traders but also with DeFi exchanges and tasks, making certain liquidity for end users.

Even so, 2021 will also see stablecoins in the sights of a lot of international money regulators, notably US officials. In November, President Biden’s Financial Advisory Group launched a report on stablecoins, listing dangers to money sector stability. Subsequently, the US Senate and House of Representatives held hearings with cryptocurrency business leaders on the stablecoin concern in December. There are also a lot of suggestions calling for the US Congress to quickly enact legislation to regulate this section as a financial institution.

While the cryptocurrency market place has proven indications of downward correction more than the previous couple of months, a lot of nevertheless feel that 2022 will proceed to be a yr of possibility for stablecoins. Jeremy Allaire, CEO of Circle, the issuer of USDC, explained up coming yr will mark that a lot of of the key payment organizations will move to accept stablecoins. He explained:

“We are seeing increased demand from CeFi, DeFi and even general payment uses.”

Synthetic Currency 68

Maybe you are interested: