As USDD continues to be depeg, a large sum of revenue is made use of to hold the cost of the TRON ecosystem algorithmic stablecoin.

June 14 evening. The TRON DAO reserve claims it was “injected” with USDC 500 million to help USDD, following somewhere around USDC 700 million was paid out on June 13.

500 million #USDC far more al @trondaoriserva! Well accomplished! #USDD https://t.co/XnGw0LeJA5

– SE Justin Sun (@justinsuntron) June 14, 2022

USDC 700 million was injected @trondaoriserva for #USDD pegs. Well accomplished! https://t.co/r11PnBte4g

– SE Justin Sun (@justinsuntron) June 13, 2022

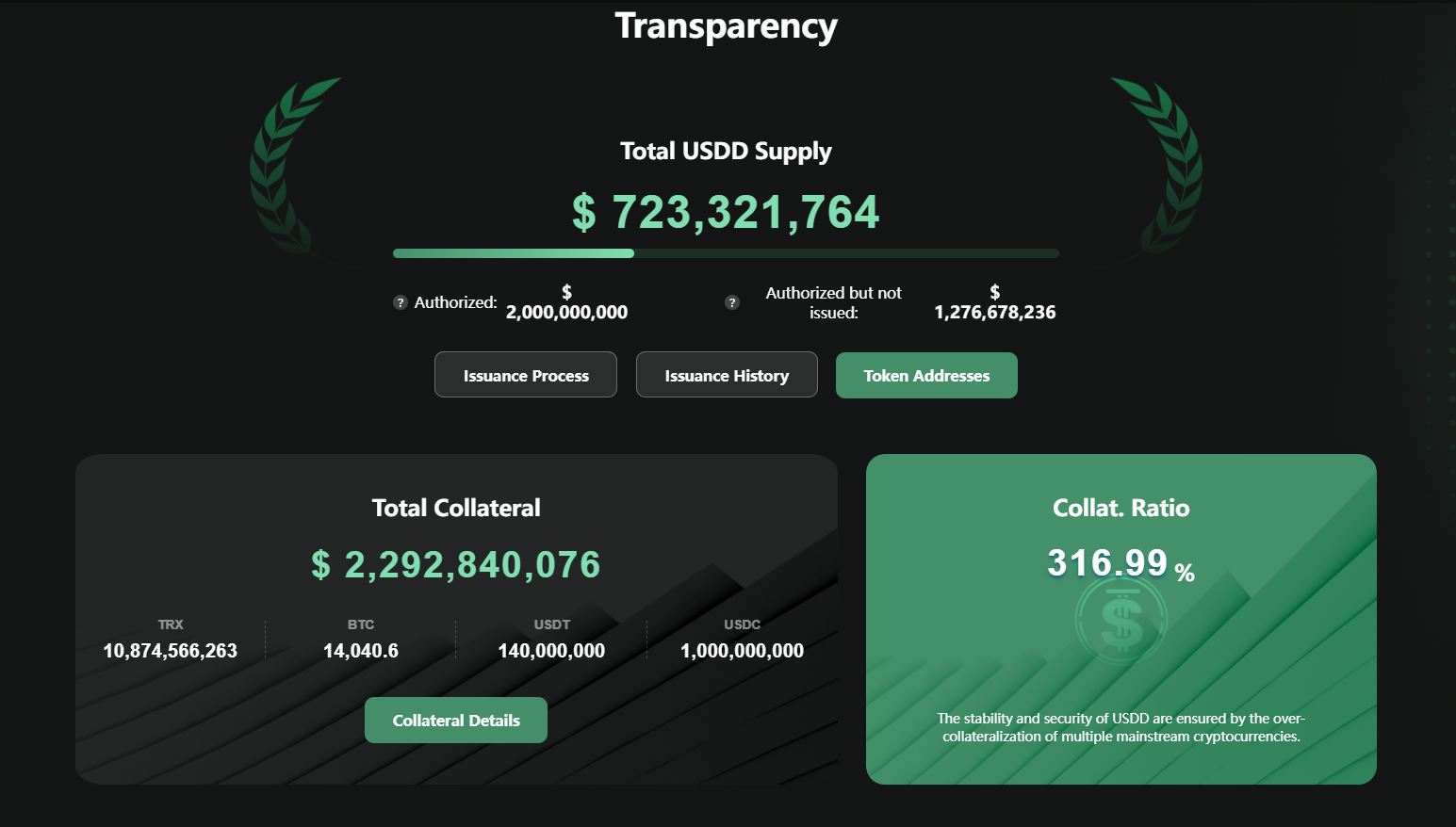

After utilizing USDC 200 million to acquire TRX on June 13th, the complete sum of stablecoins held by this fund is USDC one billion and USDC 140 million. Adding up to 14k BTC, the complete worth of the TRON DAO Reserve fund (excluding TRX) is somewhere around $ one.four billion, a margin of above 200% for the recent USDD providing of above USD 723 million.

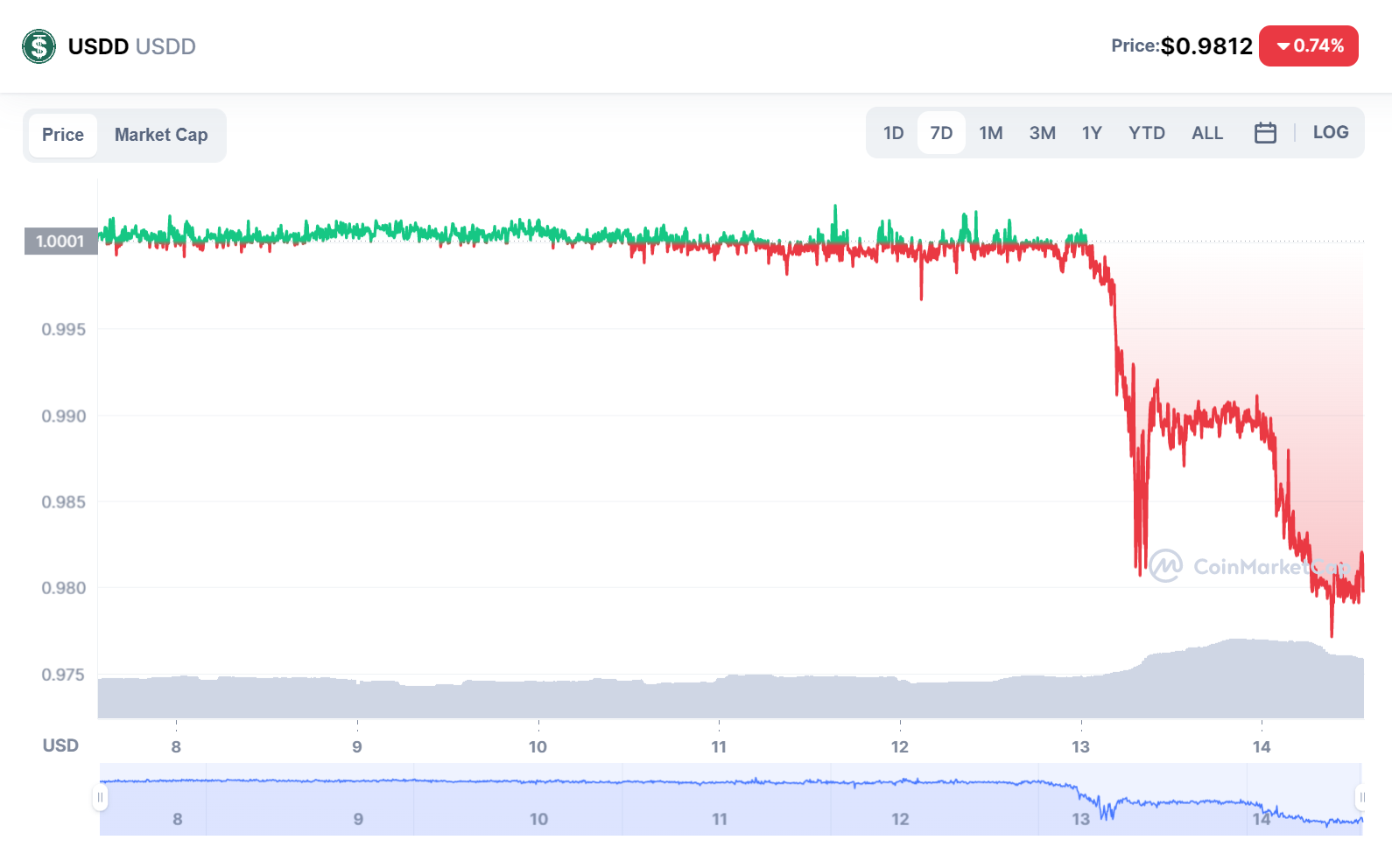

Even so, at the time of the update, the USDD stablecoin was even now down to $ .977 right now, in advance of recovering to $ .98 at press time.

As reported by Coinlive, Decentralized USD (USDD) is a new algorithmic stablecoin that was launched on the TRON blockchain in early May 2022, just days in advance of the collapse of LUNA-UST, resulting in an maximize in the complete capitalization of the two cryptocurrencies. to 60 billion bucks, “evaporated” from the industry in just two weeks.

USDD can be deemed a “copy” of the LUNA-UST model, when utilizing TRX mastering to make USDD, generating a margin fund in other cryptocurrencies for USDD and supporting a thirty.% APY curiosity when sending USDD in the protocols supported by the venture .

However, throughout the cryptocurrency industry dump because the weekend, USDD started to depeg (slide off the $ one worth), forcing TRON founder Justin Sun and TRON DAO Reserve hedge fund to have to launch quite a few moves of ” relief “, ie to deploy USD two billion to get required action.

Synthetic currency 68

Maybe you are interested: