With the demise of UST and LUNA, lots of folks are skeptical of new algorithmic stablecoins with substantial yielding commitments, most just lately TRON’s USDD. In today’s posting, we review USDD’s working model and assess the effectiveness and advancement of this stablecoin in the long term.

Note: This posting could signify the author’s individual views and opinions. It should not be viewed as investment guidance.

USDD overview

USDD (decentralized USD) is an algorithmic stablecoin issued by TRON (TRX) which claims to be stablecoin three.. Implementing this strategy, TRON officially launched USDD on May five, 2022, just days just before LUNA-UST “evaporated”.

Mechanism of action

USDD’s working model is wholly very similar to UST. USDD will be pegged to the US dollar (USD), with one USDD equal to one USD. In the brief phrase, the USDD worth will be supported by TRON’s TRX token, very similar to how LUNA was applied to help UST.

To get USDD, end users should enter their TRX to get a corresponding sum of USDD. In situation you want to get TRX back, you just have to do the opposite, which is to return USDD to the USDD contract and have the transaction send USDD back. This is precisely like the mint-burned model from UST and LUNA.

For instance: you can use $ one of TRX to mint $ one USDD, conversely, use $ one USDD to redeem and get $ one of TRX (note that $ one is the TRX worth, not one TRX token. Please).

Therefore, the USDD value balancing mechanism will be primarily primarily based on provide / demand, in certain:

– Case one: When USDD <$ 1, for example $ 0.98, the market will create an arbitrage opportunity, allowing users to buy cheap USDD ($ 0.98) for the mint to receive $ 1 of TRX, i.e. make a profit 2%. This will reduce the USDD supply and increase the TRX supply. Buying USDD + reducing USDD bid brings the price back to the peg's price.

– Case 2: When USDD> $ one, for instance $ one.02, the consumer can use $ one of TRX mint for $ one USDD and promote for $ one.02 on the market place, creating a revenue. This triggers the USDD provide to rise, though the TRX provide decreases. Selling USDD + raising provide triggers the USDD value to return to the peg value.

Collateral ownership

As for the collateral, in accordance to the discover of the escrow fund TRON DAO Reserve, USDD will be supported by a mixed basket of stablecoin cryptocurrencies this kind of as USDT and other cryptocurrencies together with BTC and TRX. According to TRON, the USDD Collateral Ratio will constantly be assured over 130%.

At this level, individuals of you who are not positive, should distinguish:

TRX and USDD have a connection with just about every other primarily based on the mint / redemption mechanism of stablecoin creation. However, USDD is an asset-backed stablecoin primarily based not only on TRX but also on BTC and USDT.

thirty% APY

USDD is primarily applied to get thirty% of APYbut very similar to LUNA-UST’s twenty% APY degree, the place this variety comes from, there is not actually a clear explanation.

USDD functionality

Resource information

To analyze the functionality of USDD, we can use the information on https://tdr.org/#/ – USDD on-chain web site.

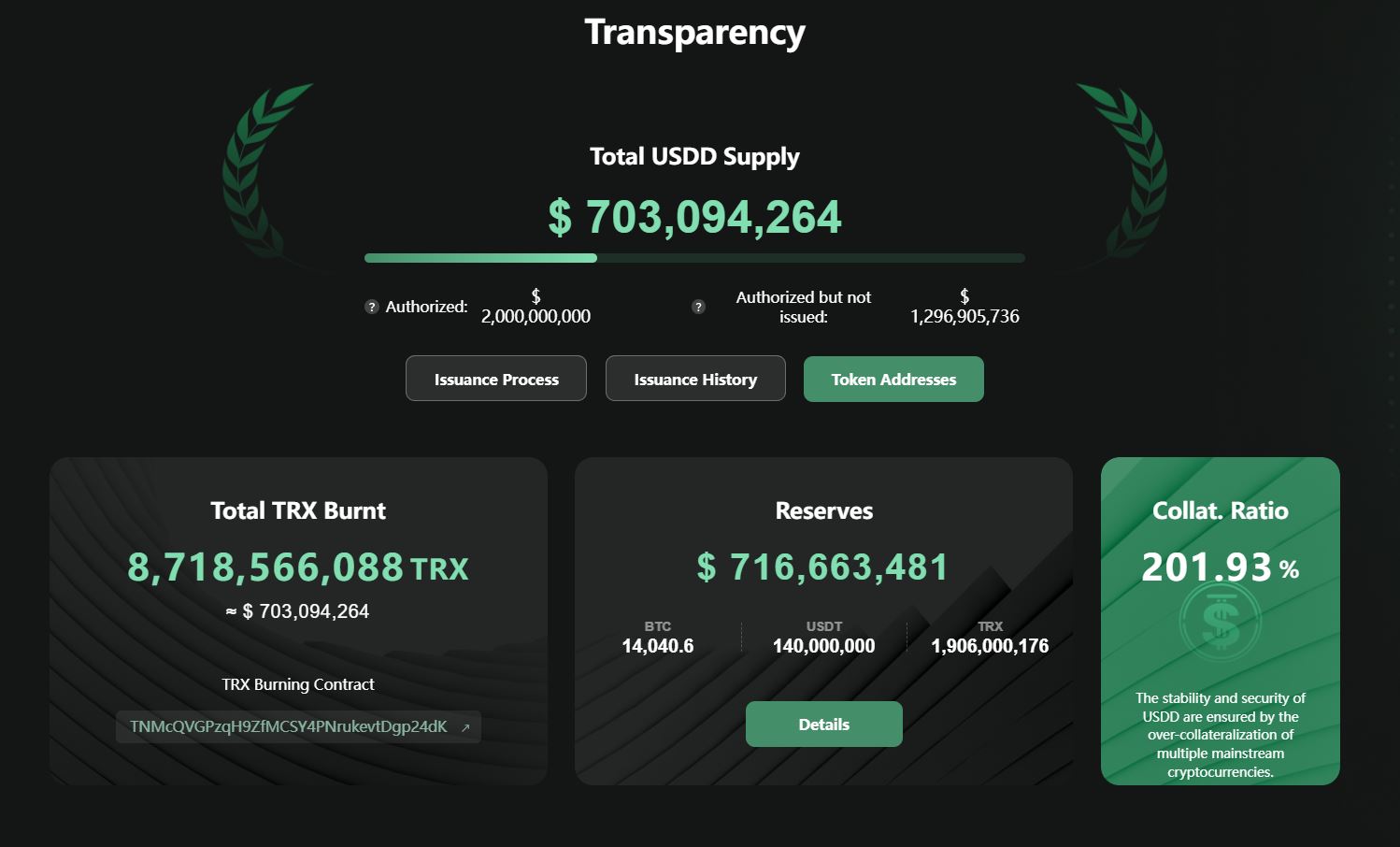

As you can see, now the complete provide of USDD is two billion USDD but only 703 million USDD has been circulated, equivalent to the complete sum of TRX burned is eight.seven billion TRX (valued at 703 million USD) .

Regarding collateral, the margin fund now has 14,040.six BTC, 140 million USDT and one.9 billion TRX, for a worth equivalent to 716 million USD.

About the assure price

Let’s go back to some easy calculations:

First of all, the Collateral Ratio (collateral ratio – CR for brief) will be calculated in accordance to the formula:

CR = Total Guarantee / Total USDD issued

If you observe the over formula, CR = $ 716 million / $ 703 million = 101.eight%

We presume that this computation is computation (one).

So why does the variety on the web site demonstrate 201.93%?

I experimented with yet again, if we include the complete sum of TRX burned to get USDD, the numbers will transform somewhat:

CR = (complete collateral + complete worth of TRX burned) / complete USDD issued

So existing CR = ($ 703 million + $ 716 million) / $ 703 million = 201.08% ~ 201.93%

Therefore, CR on TRON utilized the calculation approach (two). So is it appropriate?

Let’s break it down a bit: the essence of collateral is the sum of assets applied to protect against the USDD value from slipping off the peg. It would not be proper for TRON to look at the sum of TRX burned as collateral, as TRX is a volatile asset by nature.

Under usual disorders, the slight reduction of USDD peg < $ 1 => end users who obtain USDD redeem on TRX to get earnings will not encounter lots of difficulties. However, when USDD critically reverses, the power of the TRX discharge at that time will be extremely huge => the assured sum of TRX will be tremendously lowered => Not sufficient TRX to assure end users to burn up the USDD ransom => panic.

Not to mention, now in TRON DAO Reserve, in addition to USDT and BTC, there is nevertheless a huge sum of other TRXs. This is not positive.

In my individual viewpoint, TRON DAO Reserve ought to take out the sum of TRX burned, i.e. calculated in accordance to (one) to be exact. Therefore, TRON’s real CR at the minute is only all over 102.eight%. If we carry on to take out the sum of TRX out there in Reserves, CR is now <100% which means USDD is not fully protected.

The recent move by TRON DAO Reserve

Similar to the previous Luna Foundation Guard, TRON DAO Reserve continues to put coins on the exchange to buy more BTC, in order to increase reserve assets for USDD.

This move is exactly the same as the Luna Foundation Guard did before the collapse of the FSO. This means that buying BTC as collateral is not the solution to the root of the problem. Not to mention that the fund used USDT, a stablecoin with a value considered stable, to switch to assets with greater volatility such as BTC and especially TRX.

.@trondaoriserva moved #USDT reserve to buy more #BTC And #TRX as a reserve. https://t.co/mkK2aEAR2n

– SE Justin Sun (@justinsuntron) June 7, 2022

Buying more BTC by TRON DAO Reserve will not prove that the USDD’s future is fully guaranteed and you risk losing the anchor, for me personally, this is just a move to bolster user confidence. .

end

When most users just mint USDD to receive 30% APY, this stablecoin continues to expand, thus conquering the market and being used as a regular stablecoin (i.e. payment, store of value, exchange …) is still a lot. difficult to become reality in the near future. If users only come for APY, when the USDD freezes or the APY goes down, it can become a 2nd UST. Currently, the total supply of USDD is not very large, so I think that thinking about the collapse The fall may be soon enough, but not impossible. Therefore, you need to carefully consider the risks when investing in TRX or USDD during this period.

What is your opinion? Leave a comment to discuss!

See other articles by the author of Poseidon: