The United States is thinking of opening an investigation to decide no matter whether stablecoins are threatening the stability of the country’s fiscal sector.

The US Treasury Department and other federal companies are really shut to permitting the Financial Stability Oversight Council (FSOC) to carry out an investigation into the potential. stablecoin section of the cryptocurrency industry. The FSOC is the entire body that will assess no matter whether a provided company model or exercise poses a risk to the fiscal method, a “label” that will normally lead to stricter rules.

If investigated and observed by the FSOC be “financial risk”, the two stablecoins in specific and the cryptocurrency industry in common will absolutely endure a great deal. Stablecoins have prolonged been a helpful instrument for traders, assisting to connect true funds with other Bitcoins and altcoins.

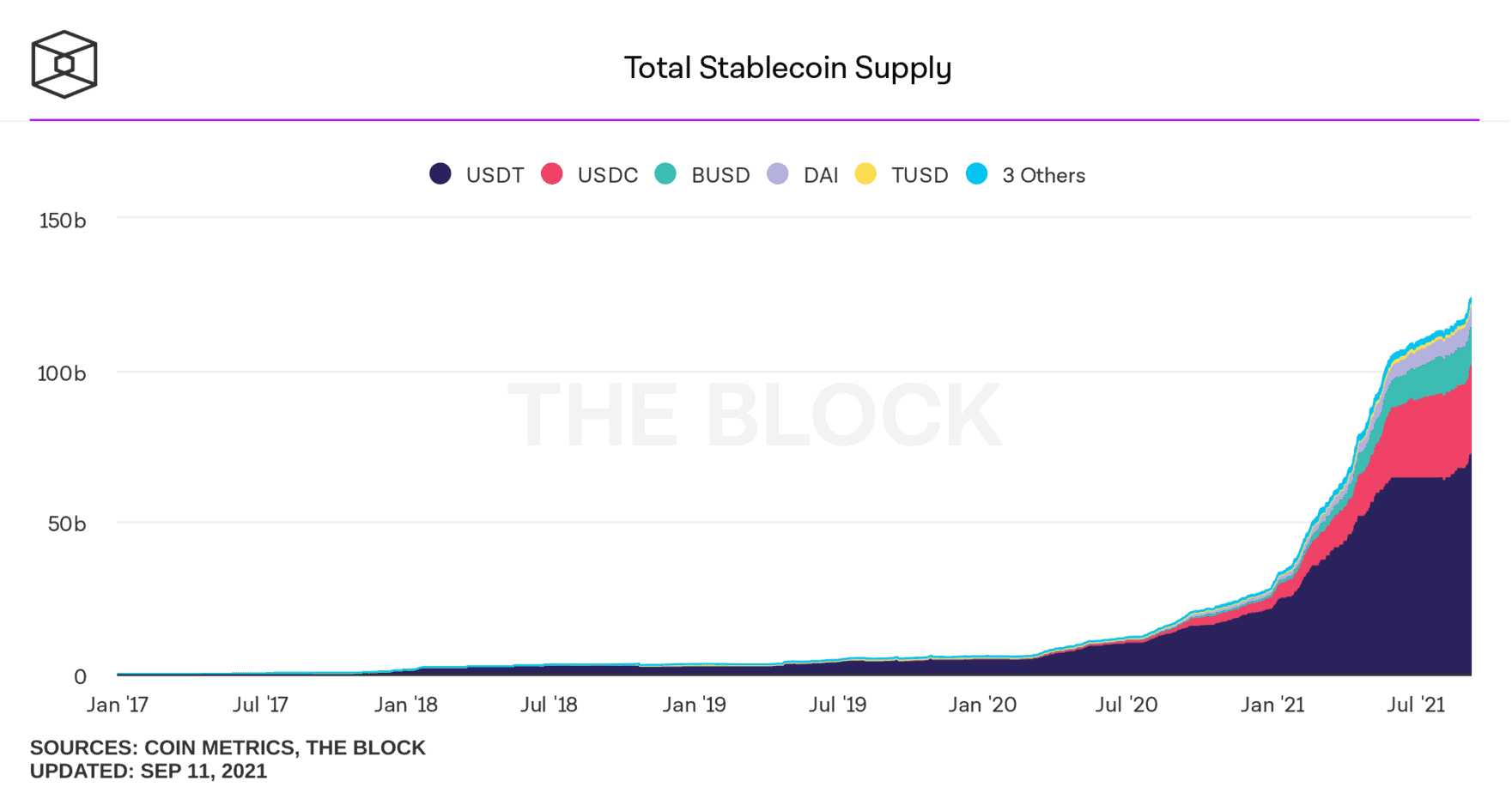

The stablecoin section in latest many years has also grown steadily in the route of the advancement of the crypto industry. According to information from The block, as of September 2021, the complete capitalization of stablecoins has exceeded $ 122 billion, which accounts for six.one% of the cryptocurrency industry share.

US regulators argue that in latest many years stablecoins have more and more served to resemble classic fiscal merchandise, this kind of as financial institution cost savings accounts, but without having the property protection investment. Therefore, it can trigger “financial risk”.

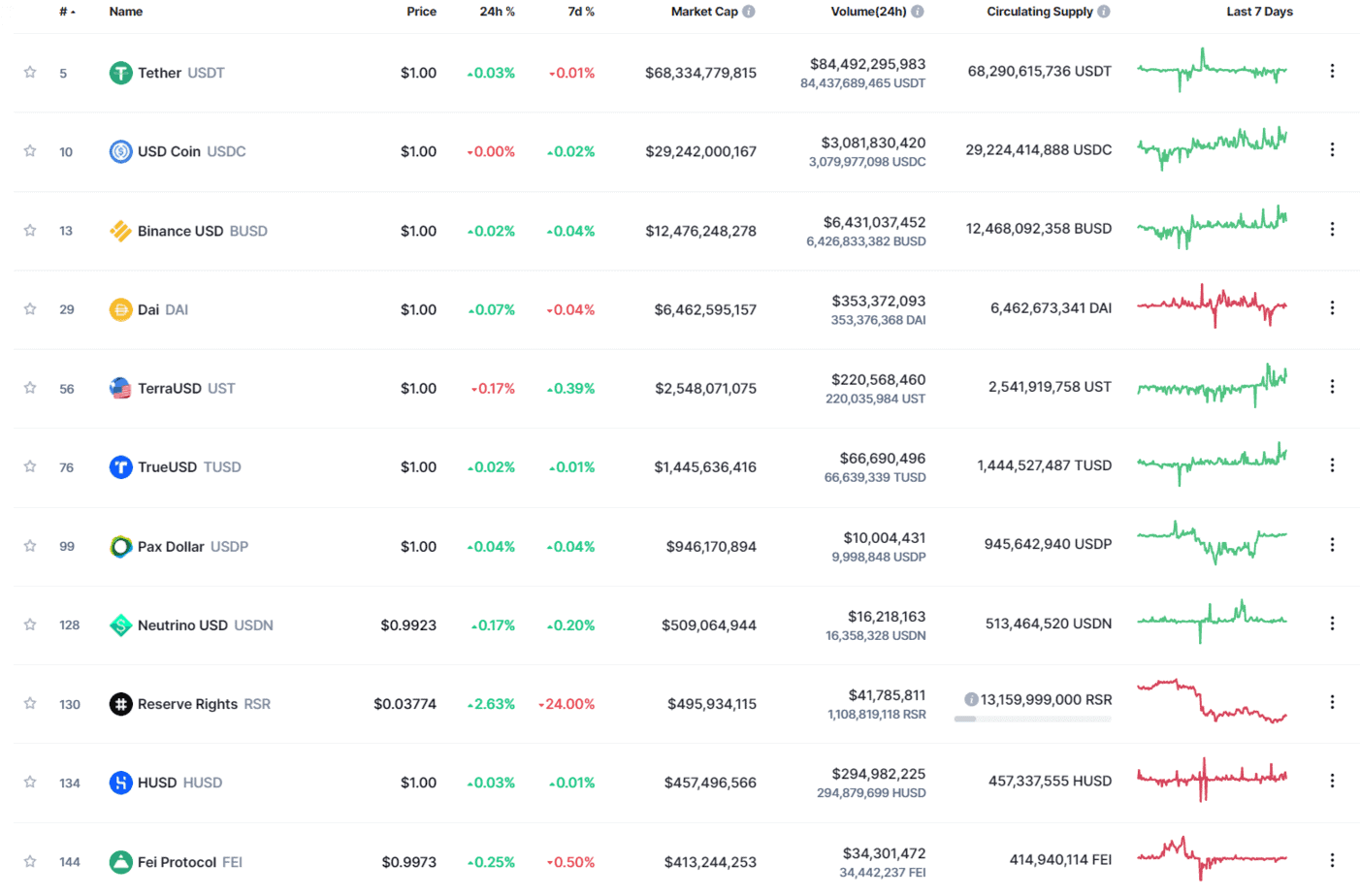

Another trigger for concern for US officials is the “custodial” factor of stablecoins. Most significant stablecoins declare that each and every digital currency they build is backed by true or choice US bucks. However, this is only real for BUSD, USDP (previous PAX) and to some extent USDC, but not for the greatest stablecoin at the second, Tether (USDT). The cause is that a huge volume of USDT’s collateral is held in the type of corporate bonds, quick-phrase bonds issued by corporations to increase capital. This carries the possibility that in the occasion of a company insolvency, the bonds grow to be worthless, affecting the stablecoin they are supporting, a widespread pattern that produces “financial risk”.

US President Biden’s Financial Markets Advisory Group – led by Treasury Secretary Janet Yellen and also contains other prominent fiscal officials this kind of as Federal Reserve Chairman Jerome Powell along with US Securities and Exchange Commission (SEC) Chairman Gary Gensler – ought to existing a report recommending stablecoins in December, in which the advisory group asks the FSOC to offer a rating on the degree of fiscal riskiness of the stablecoin sector.

The background of cryptocurrencies in the United States is receiving hotter in latest instances. This week, the greatest US cryptocurrency exchange Coinbase announced it is “threatened by the SEC” if it continues to uphold its intention to launch a cryptocurrency lending products. The SEC then did not offer any good reasons for its choice, in spite of Coinbase getting complied with all the requests produced. Given the new details exposed over, this is most possible portion of an energy to see cryptocurrencies and stablecoins as “financial risk”. Meanwhile, an additional scorching exchange, Uniswap, has also caught the focus of this company.

Synthetic Currency 68

Maybe you are interested: