The US Internal Revenue Service is making an attempt to acquire taxes from NFT traders, an spot that grew to become a serious craze in 2021, attracting enormous quantities of cash.

According to the newspaper Bloomberg, The US Internal Revenue Service (IRS) is hunting to acquire taxes from NFT traders, as the US tax return season in April just about every 12 months approaches.

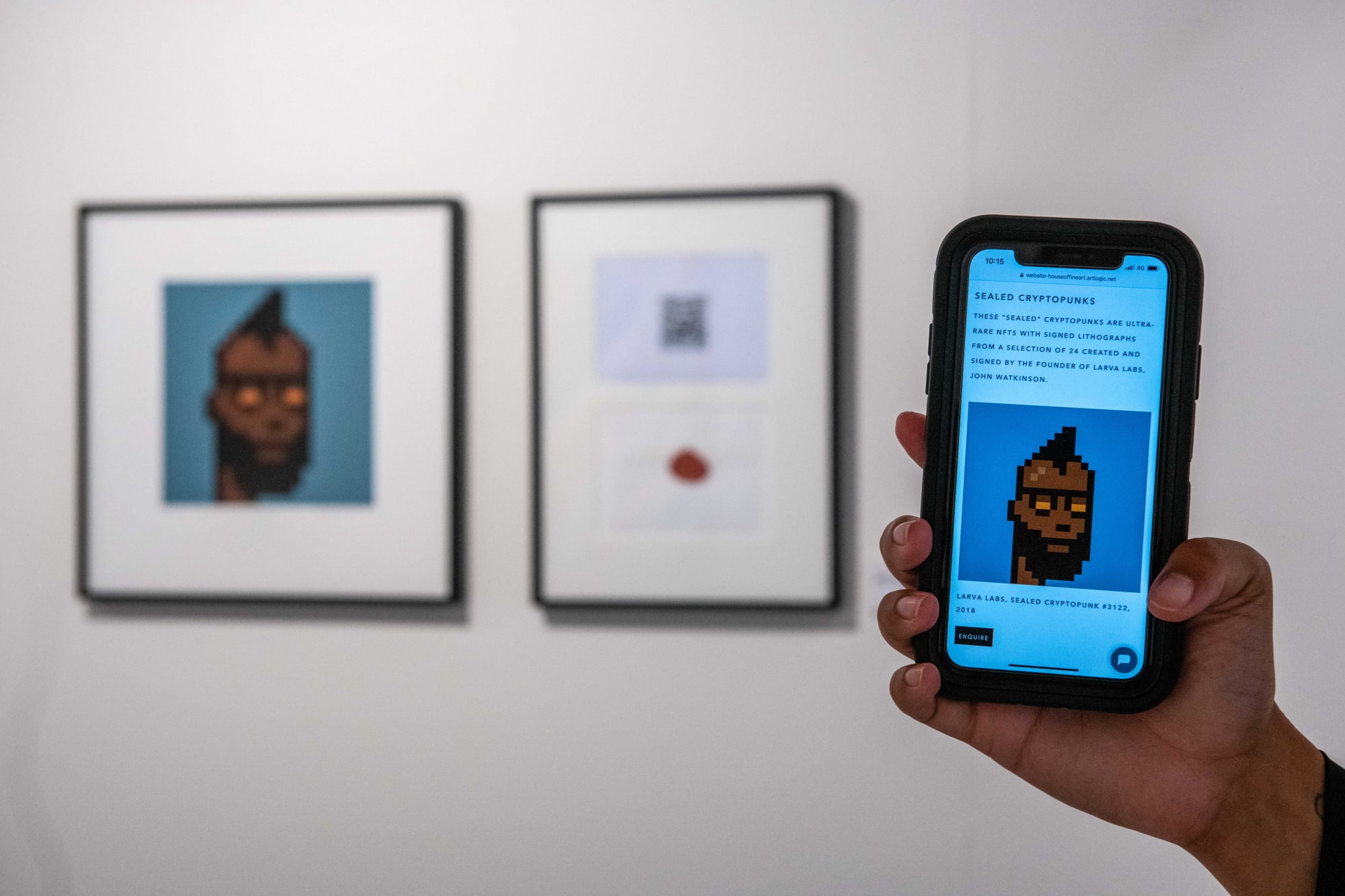

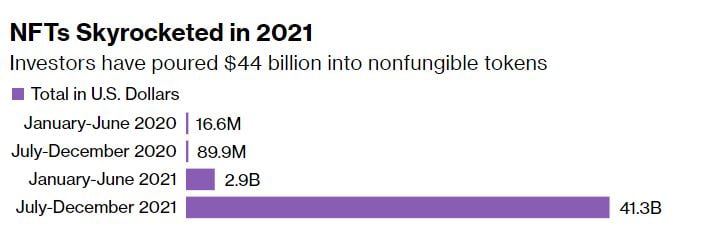

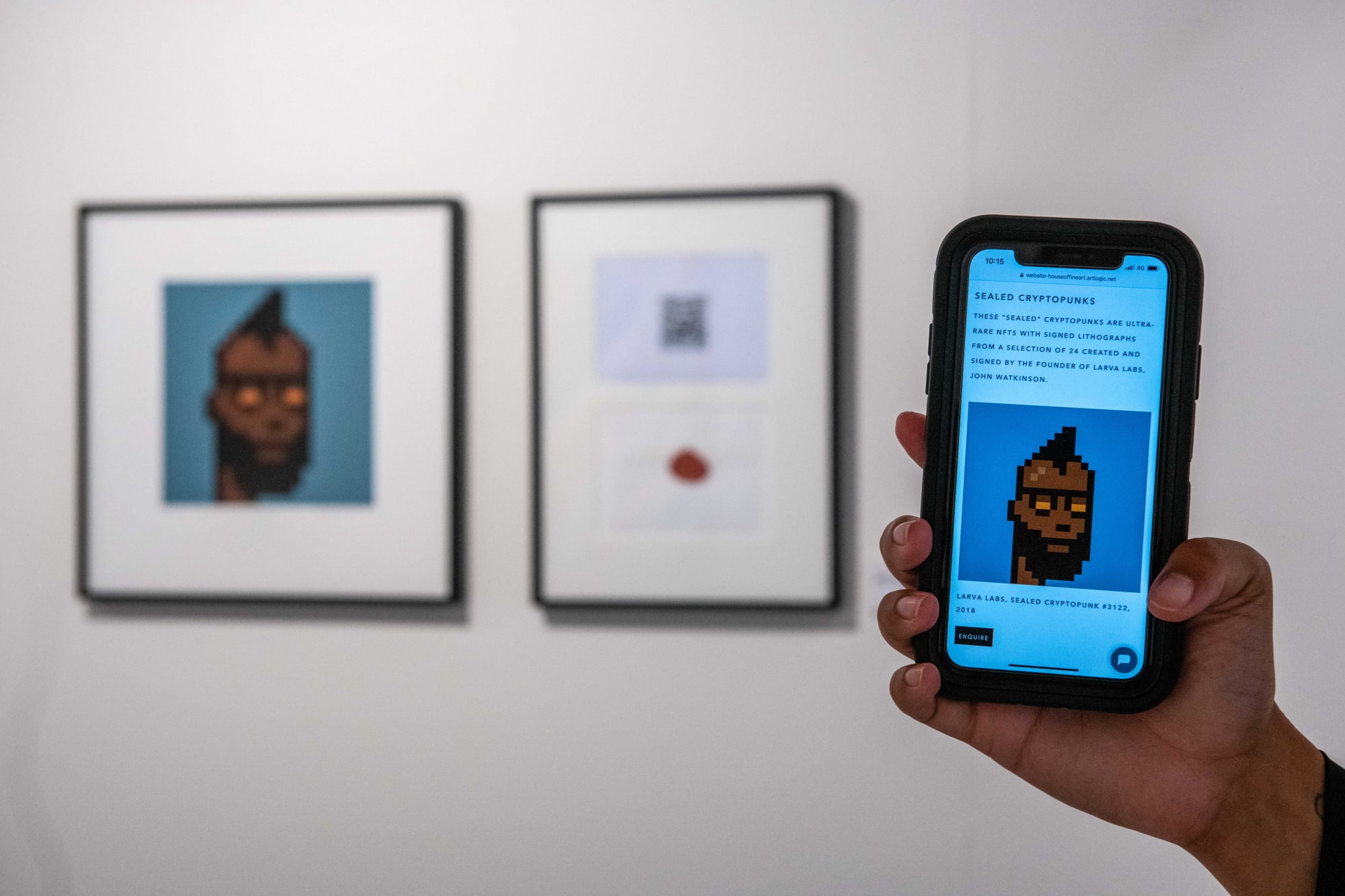

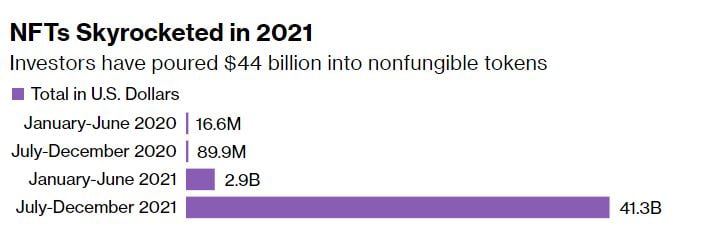

In 2021, NFT has grow to be an particularly sizzling key phrase for the folks of the United States, attracting not only cryptocurrency traders but also celebrities this kind of as former First Lady Melania Trump or brand names, the very best brand names in the globe. According to the Chainalysis industry analysis unit, the NFT industry worth in 2021 crossed the $ 44 billion mark, from NFT artwork to game products. The IRS as a result isn’t going to want to disregard that “lucky” income stream.

However, as the US does not but have precise rules on cryptocurrencies, allow alone how to determine taxes, a lot of folks truly feel actually puzzled when they have to declare revenue from this new sort of investment. Furthermore, getting to declare hundreds, often up to 1000’s of NFT transactions in the previous 12 months is nevertheless a “nightmare” for NFT traders. Not all people is ready or has the time to do so, as effectively as remaining mindful of getting to pay out taxes, with the chance of remaining “cold fined” by the NFT or accused of tax evasion.

According to legal industry experts, the revenue from NFT investments can be incorporated in the simple revenue tax bracket. This implies that when an investor sells NFTs by means of platforms like OpenSea, they can be taxed up to 37% based mostly on their revenue. Additionally, the cryptocurrency utilized to buy these NFTs will also charge capital gains tax.

However, most attorneys agree that the IRS will initial will need to audit some NFT traders and then clarify NFT tax calculation principles, from which it can demand traders to comply. Currently, the US has a controversial cryptocurrency tax provision connected to the infrastructure law that was signed by President Biden in November 2021, but is nevertheless awaiting clarification from the US Treasury Department.

Synthetic currency 68

Maybe you are interested:

The US Internal Revenue Service is making an attempt to acquire taxes from NFT traders, an spot that grew to become a serious craze in 2021, attracting enormous quantities of cash.

According to the newspaper Bloomberg, The US Internal Revenue Service (IRS) is hunting to acquire taxes from NFT traders, as the US tax return season in April just about every 12 months approaches.

In 2021, NFT has grow to be an particularly sizzling key phrase for the folks of the United States, attracting not only cryptocurrency traders but also celebrities this kind of as former First Lady Melania Trump or brand names, the very best brand names in the globe. According to the Chainalysis industry analysis unit, the NFT industry worth in 2021 crossed the $ 44 billion mark, from NFT artwork to game products. The IRS as a result isn’t going to want to disregard that “lucky” income stream.

However, as the US does not but have precise rules on cryptocurrencies, allow alone how to determine taxes, a lot of folks truly feel actually puzzled when they have to declare revenue from this new sort of investment. Furthermore, getting to declare hundreds, often up to 1000’s of NFT transactions in the previous 12 months is nevertheless a “nightmare” for NFT traders. Not all people is ready or has the time to do so, as effectively as remaining mindful of getting to pay out taxes, with the chance of remaining “cold fined” by the NFT or accused of tax evasion.

According to legal industry experts, the revenue from NFT investments can be incorporated in the simple revenue tax bracket. This implies that when an investor sells NFTs by means of platforms like OpenSea, they can be taxed up to 37% based mostly on their revenue. Additionally, the cryptocurrency utilized to buy these NFTs will also charge capital gains tax.

However, most attorneys agree that the IRS will initial will need to audit some NFT traders and then clarify NFT tax calculation principles, from which it can demand traders to comply. Currently, the US has a controversial cryptocurrency tax provision connected to the infrastructure law that was signed by President Biden in November 2021, but is nevertheless awaiting clarification from the US Treasury Department.

Synthetic currency 68

Maybe you are interested: