Optimism and Base are two of the six blockchains that Circle is committed to supporting USDC in the close to potential, in an hard work to maximize its utilization to revive USDC capitalization.

The USDC stablecoin is supported on Optimism and Base. Photo: Circle

The USDC stablecoin is supported on Optimism and Base. Photo: Circle

On the evening of September six, stablecoin issuer Circle stated it started supporting USDC on two Ethereum layer-two platforms that have attracted a whole lot of focus in the previous, Optimism (OP Mainnet) and Base.

General crypto end users and institutions can start out issuing, redeeming and trading USDC versions of Optimism and Base primarily based on the respective good contract offered by Circle.

three/ Base USDC is a new asset natively issued by Circle

✅Token Symbol: USDC

✅Token handle: 0x833589fCD6eDb6E08f4c7C32D4f71b54bdA02913— Circle (@circle) September 5, 2023

With the addition of two new names, the amount of blockchains featuring USDC has enhanced to eleven, along with older platforms which include Algorand, Arbitrum, Avalanche, Ethereum, Flow, Hedera, Solana, Stellar, and TRON.

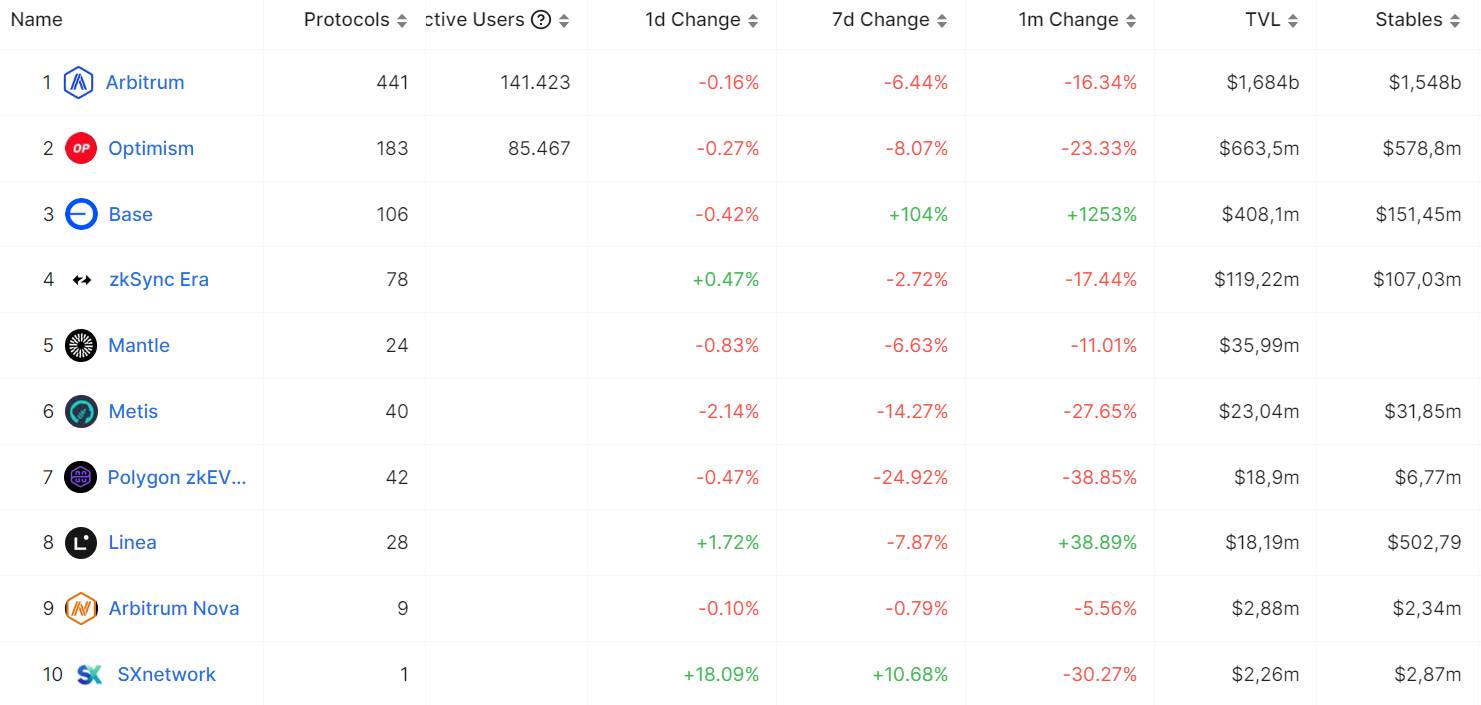

Optimism and Base are two blockchains that have acquired a whole lot of focus not long ago, with TVL ranked 2nd and 3rd in the top rated layer-two listing on Ethereum.

Statistics of layer-two options for Ethereum with the biggest TVL. Source: DefiLlama (September six, 2023)

Statistics of layer-two options for Ethereum with the biggest TVL. Source: DefiLlama (September six, 2023)

Yet, Circle also announced Cross-chain Transfer Protocol (CCTP) help for Optimism, permitting the transfer of USDC in between Optimism and 3 other blockchains that by now have CCTP, Ethereum, Arbitrum, and Avalanche with the mint-burn up mechanism. This minimizes the dangers. related with cross-chain token transfers.

The stablecoin issuer also announced a listing of a lot of partners that have CCTP on Optimism integrated, which include Celer Network’s cBridge, ChainPort, Interport, Li.Fi Protocol, O3 Labs, OKX Wallet, Router Protocol, Socket, Synapse, Wanchain and Wormhole.

one/ But wait, there is a lot more…

Cross Transfer Protocol (#CCTP), is now also offered on the mainnet for @optimismFND.

CCTP is a permissionless on-chain utility that allows $USDC to be securely transferred across chains by way of a native burn up-and-mint system.https://t.co/ry7mMMZdlv pic.twitter.com/WB0YMBOa9x

— Circle (@circle) September 5, 2023

As Coinlive reported, Circle not long ago took a lot of drastic methods to “relaunch” its primary stablecoin product or service, USDC, immediately after months of declining industry cap considering that the March 2023 depeg due to the US banking crisis. USDC’s capitalization for the duration of this time period fell from $42 billion to $26 billion as of this creating, even though rival USDT continued to maximize its industry share.

In mid-August, Circle stated it acquired extra funding from Coinbase, the biggest cryptocurrency exchange in the United States. The two sides also agreed to dissolve the Center joint venture to give Circle total rights to difficulty and convert USDC and sustain the agreement to share income primarily based on the quantity of USDC held.

Additionally, to maximize USDC utilization, Circle announced it will carry USDC to six new blockchains, which include Optimism, Base, Polygon PoS, Polkadot, Close to, and Cosmos in September and October.

USDC stablecoin capitalization fluctuations in the most current yr. Source: CoinMarketCap (September six, 2023)

USDC stablecoin capitalization fluctuations in the most current yr. Source: CoinMarketCap (September six, 2023)

According to statistics from Most holy, the complete capitalization of the top rated six stablecoins in the final two weeks of August 2023 enhanced by $663 million. This is the very first time this index has recovered considering that the FTX crash in November 2022.

🧐 The industry capitalizations of the top rated six #stablecoin press #crypto have steadily decreased by 25.9% above the previous 18 months. But for the very first time considering that #FTX slump final November, we see development. Since August 22, mixed industry capitalizations have grown by $663.two million. https://t.co/vA5uquc7OU pic.twitter.com/T0Y5UXGMDJ

— Santiment (@santimentfeed) September 3, 2023

Coinlive compiled

Join the discussion on the HOTTEST problems of the DeFi industry in the chat group Coinlive Chats with the administrators of Coinlive!!!