The worth traded on the Bitcoin network has improved not too long ago, reaching new highs final week, with above $ thirty billion paid on the Bitcoin blockchain in a single day.

Bitcoin’s day by day settlement worth just hit an all-time substantial on October six, with $ 31 billion well worth of transactions settled on the blockchain employing the Bitcoin network. The record marks an boost in the day by day settlement volume of the BTC network by about forty occasions due to the fact the starting of 2020.

There was $ 31 billion of settled worth on the bitcoin network in just one particular day final week.

This is the all-time substantial for a single day of settlement worth.

The international and decentralized payment process continues to grow to be additional dominant. (h / t @kerooke) pic.twitter.com/a6Q2FbPY3C

– Pump (@APompliano) October 10, 2021

Well-acknowledged analyst Willy Woo commented on the present boost in Bitcoin exercise and settlement worth which, while the volume of the Bitcoin blockchain is at an all-time substantial, it is nevertheless decrease than that of Bitcoin with the main centralized payment networks Visa. and Mastercard in the United States.

The Bitcoin network is at this time earning $ 190,000 per 2nd globally. Compare that to Visa’s $ 130,000 per 2nd for US buyers and Mastercard’s $ fifty five,000 per 2nd, which is nevertheless reasonably minimal.

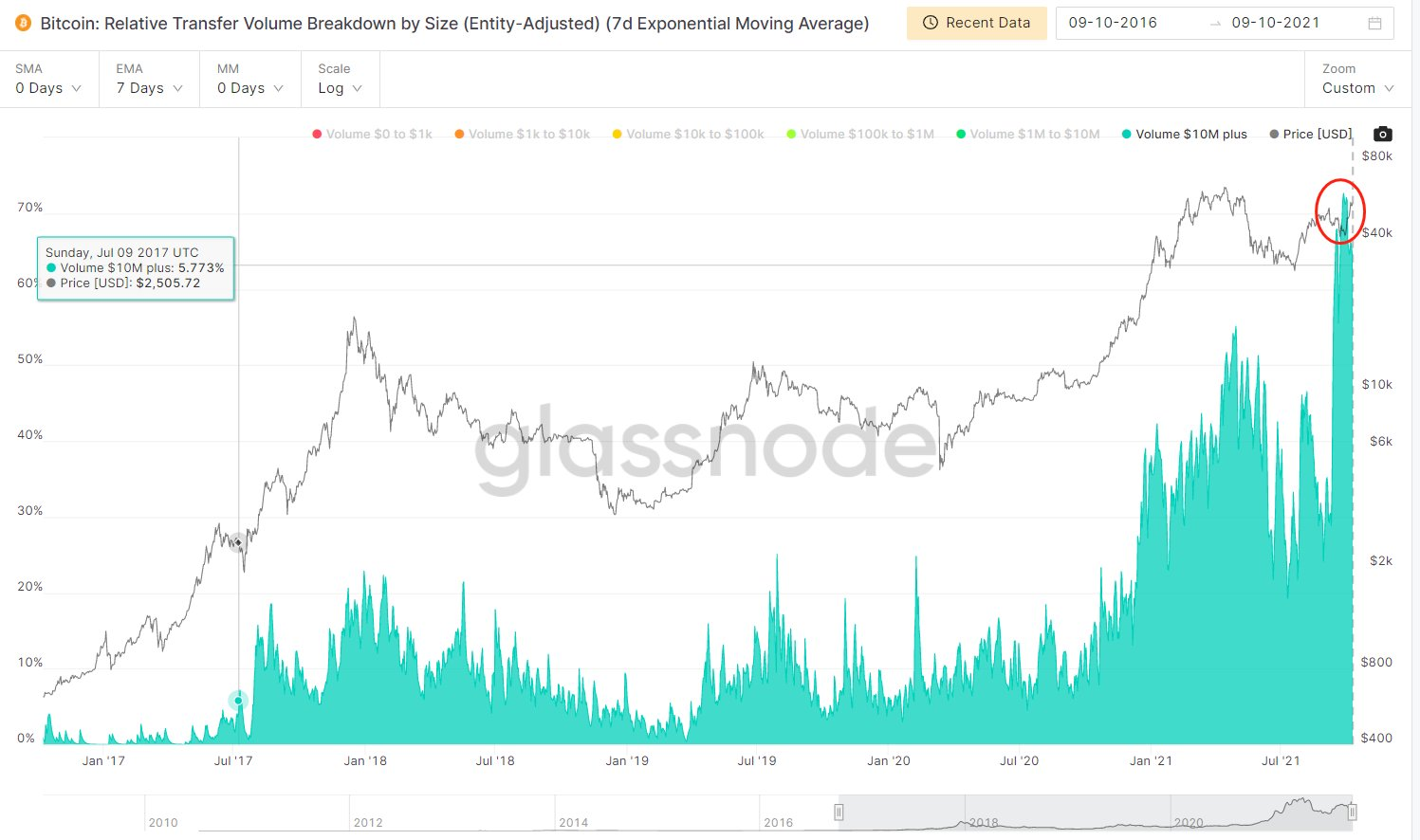

This suggests that this is only the starting for Bitcoin. The development probable for BTC adoption is massive in the long term in contrast to classic monetary rivals. The common worth of a transaction produced on the Bitcoin network has also improved steadily above the previous 3 months, reaching $ 732,000, up 273% due to the fact the starting of July, notably there was a sudden spike in the variety of transactions. of above ten million bucks.

By breaking down the volume on the blockchain by transaction dimension, we can also see that extremely big transaction sizes (above $ ten million) proceed to dominate. Total trading volume has largely returned to highs of $ 13.six billion to $ sixteen.eight billion per day.

The developing dominance of big transactions demonstrates Bitcoin’s developing maturity as a macro-scale asset with sturdy curiosity from substantial net well worth men and women, trading desks and institutions.

– See additional: Institutional traders are investing revenue in shopping for Bitcoin as an alternative of gold to battle inflation

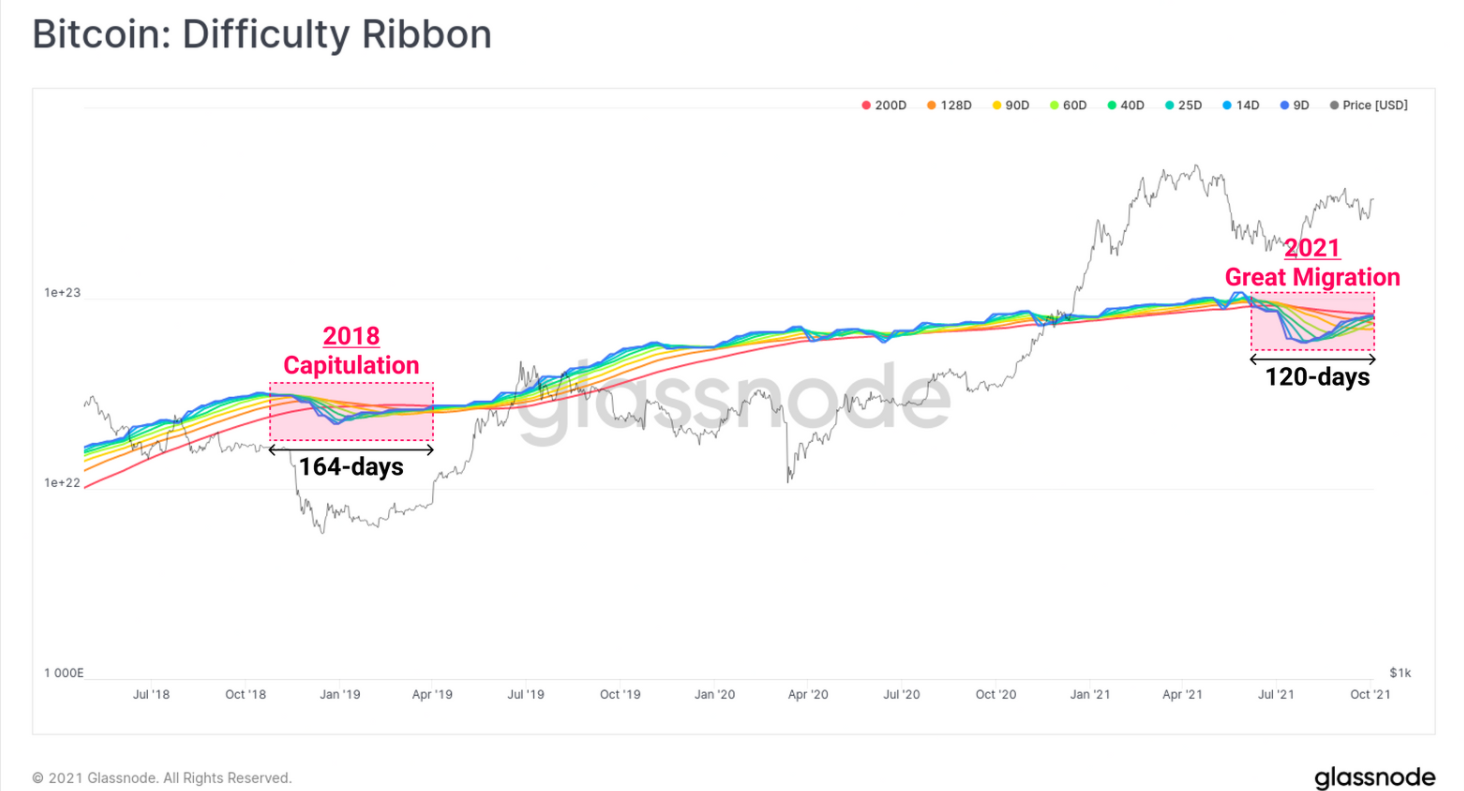

An intriguing piece of information and facts from the Glassnode information is the indicator “Fix tape“of Bitcoin. According to the graph, we can see”Fix tapeReversed and signaled a total recovery as the slower 200-day moving common crossed the more rapidly 9-day moving common.

The closest this indicator can assess to the present industry was following the bear industry occasion in December 2018, the cost of Bitcoin fell 50% to $ three,000. The 2018-19 rally took a complete of 164 days to totally reverse the bearish signal. The industry has now recovered in 120 days and is probable to comprehensive a more powerful reversal following the subsequent slight correction.

However, following the motives that aided Bitcoin return to the $ 50,000 mark for the to start with time due to the fact the July 9 drop, in spite of the third greatest Bitcoin whale wallet “dumped” just two days in the past, Bitcoin has continued to “break by means of. ‘universe’ now when it crossed the $ 56,000 mark and was trading at $ 56,940 at press time.

Synthetic Currency 68

Maybe you are interested: