Statistics demonstrate that some Russians are turning to cryptocurrencies as the nation turns into more and more financially isolated from the West.

As reported by Coinlive, on the morning of February 27, the United States and European Union (EU) nations announced the exclusion of some Russian banking institutions from SWIFT, a international payment data transfer network that plays an essential part in global trading.

This is the most recent sanctioning move by the West in the context of the even now really tense conflict amongst Russia and Ukraine. Russian troops carry on to assault big cities in Ukraine, such as Kiev and Kharkiv, as very well as attacking a lot of military internet sites across Ukraine. The total globe is now awaiting the to start with negotiation amongst the two sides, which is anticipated to get area on February 27 in a area situated on the border amongst Ukraine and Belarus.

On February 28, the Russian ruble misplaced a record worth. Since Russia commenced attacking Ukraine, the ruble has dropped practically forty% towards the US dollar. The Russian stock marketplace was unable to open on today’s trading day for worry that traders would promote. The Russian central financial institution has meanwhile announced that it will increase curiosity prices from 9.five% to twenty% to present emergency support to the economic climate.

Images of Russians have appeared on social media waiting in prolonged lines in front of banking institutions to withdraw money, fearing that financial instability will worsen.

👀 Lines forming outdoors Russian ATMs pic.twitter.com/3wkNxd1Q5r

– Bitcoin Magazine (@BitcoinMagazine) February 27, 2022

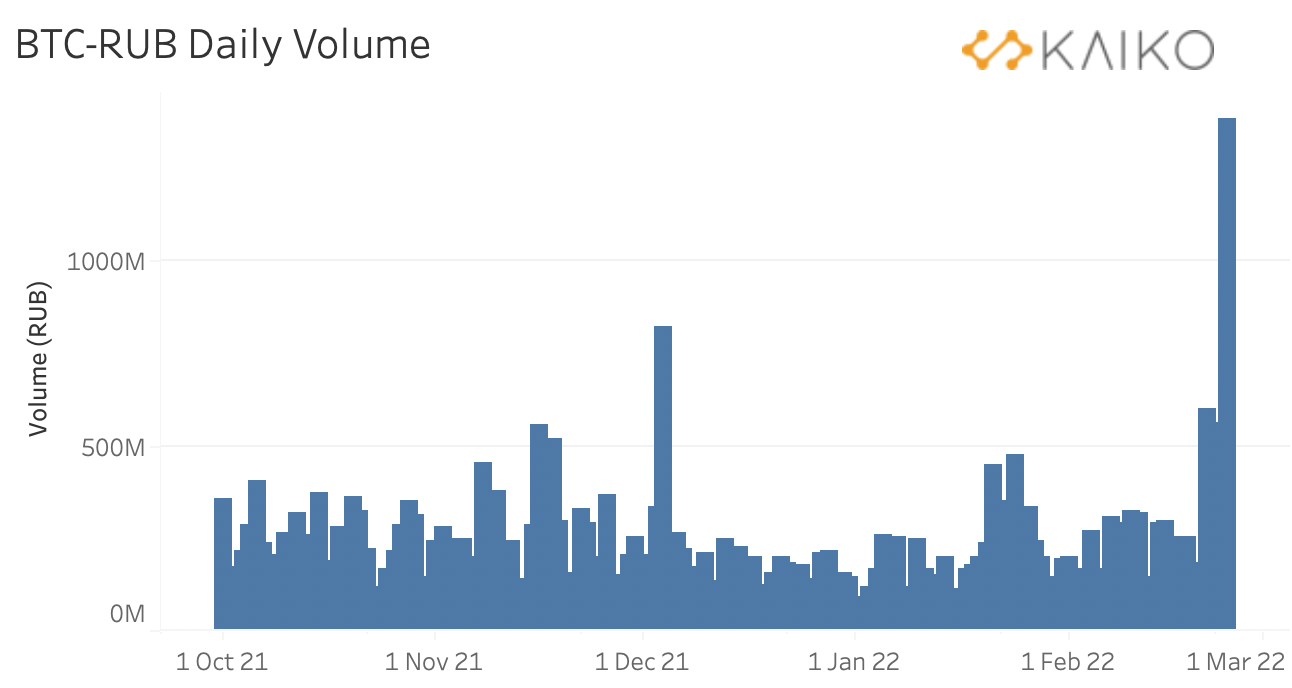

According to statistics from the cryptocurrency study unit Kaiko, the volume of trade amongst Bitcoin and the Russian ruble has just greater to a optimum of 9 months, reaching one.five billion rubles. Not just BTC, the stablecoin Tether (USDT) is also the cryptocurrency of preference for a lot of Russian traders.

This displays that the Russians are making an attempt to decentralize cryptocurrencies to escape the decline in the worth of the ruble. Kaiko extra that the volume of cryptocurrency exchanges is mostly targeted on Binance and community cryptocurrency exchanges.

The identical trend is occurring with the Ukrainian hryvnia and big cryptocurrencies, as Ukrainians are also more and more working with cryptocurrencies as an choice to money.

The monetary blockade of the West is very likely to give Russian authorities a additional increase to switch to the use of cryptocurrencies. As a outcome, there have been a lot of calls to impose restrictions on the country’s capacity to trade cryptocurrencies to avert Russia from circumventing the law.

On the morning of February 28, Ukrainian Deputy Prime Minister and Minister for Digital Transformation Mykhailo Fedorov named on big cryptocurrency exchanges to block cryptocurrency wallet addresses from Russia in buy to sabotage efforts to use cryptocurrency exchanges. working with cryptocurrencies to circumvent financial sanctions.

I am asking all big cryptocurrency exchanges to block Russian consumer addresses.

It is necessary to block not only addresses linked to Russian and Belarusian politicians, but also to sabotage ordinary end users.

– Mykhailo Fedorov (@FedorovMykhailo) February 27, 2022

Fedorov also confirmed that DMarket, a German NFT trading platform, had frozen Russian and Belarusian consumer accounts, as very well as working with the confiscated funds to assistance Ukraine.

Got the most recent information. @dmarket, a platform for trading NFT things and In-game Metaverse, has made the decision to block consumer accounts from the Russian Federation and Belarus. Funds from these accounts could be donated to the war hard work. Robin Hood these days. Good boy.

– Mykhailo Fedorov (@FedorovMykhailo) February 27, 2022

However, not all crypto platforms have answered the phone from Ukraine. Kraken CEO Jesse Powell, who emerged with notable statements about the Canadian protest motion in mid-February, mentioned it would not be doable to unilaterally freeze this kind of consumer accounts except if ordered by the government. He also extra that most cryptocurrency end users, irrespective of Russian or other nationality, are frequently liberal-minded, extremely individualistic, and resistant to government censorship. Freezing their accounts would violate their privacy rights and go towards the basic philosophies of cryptocurrencies.

one/six I comprehend the cause for this request but, regardless of my deep respect for the Ukrainian men and women, @krakenfx we are unable to block the accounts of our Russian buyers devoid of a legal obligation to do so.

Russians need to be conscious that this kind of a necessity may possibly be imminent. #NYKNYC https://t.co/bMRrJzgF8N

– Jesse Powell (@jespow) February 28, 2022

However, Mr. Powell mentioned he would be forced to block Russian consumer accounts if requested by Canada. The CEO also extra that if he have been to block the account of a citizen of a nation “because his government attacks him for no reason and incites violence in the world”, he will block the account of the citizens of the nation, the American end users to start with.

six/six Also, if we have been to voluntarily freeze the monetary accounts of residents of nations that assault unfairly and induce violence close to the globe, stage one would be to freeze all US accounts. In practice, this is not a viable business possibility for us.

/ 🧵– Jesse Powell (@jespow) February 28, 2022

Ukrainian authorities have also been asking for cryptocurrency donations given that final weekend to assistance the battle towards Russia. In significantly less than 48 hrs, the cryptocurrency neighborhood sent cryptocurrencies really worth in excess of $ eleven million to Ukraine, of which $ ten million was withdrawn and offered in money from Ukraine.

Synthetic currency 68

Maybe you are interested: