Ethereum (ETH) is acquiring a tricky time holding onto its wealthiest traders as it has misplaced its help at $ four,000.

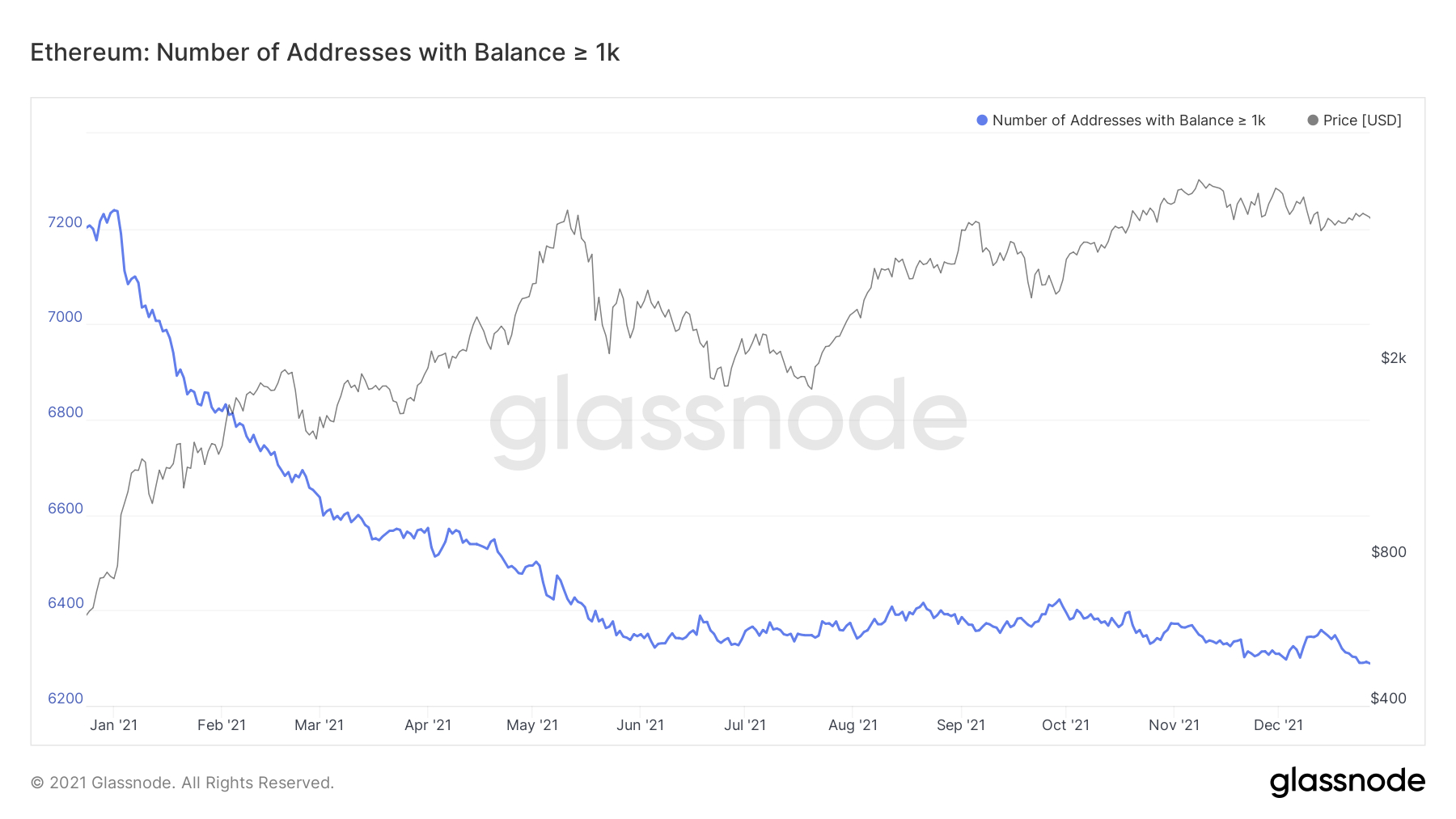

Glassnode information reveals that the variety of Ethereum addresses with at least one,000 ETH dropped to six,292 on December 27, the lowest degree considering that April 2017. The highest degree to date. This yr the figure was seven,239 recorded in January. .

On-chain analysts frequently observe the distribution of ETH concerning addresses to comprehend the degree of correlation concerning retail and institutional traders. They see portfolios that hold more than one,000 ETH (approximately $ three.92 million at today’s prices) as whales, generally due to their capability to influence short-term market place trends as a result of big obtain or promote orders.

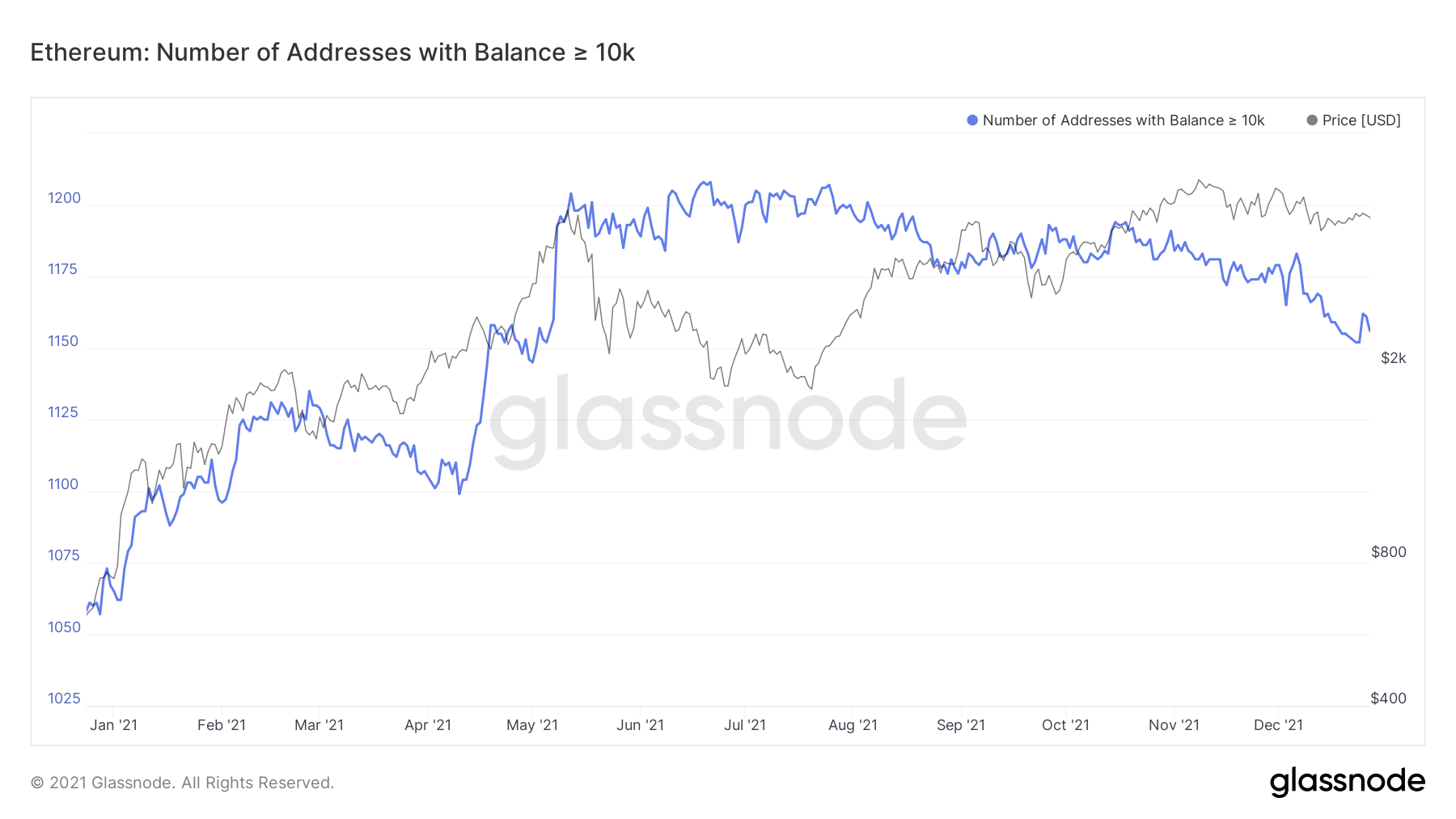

A broader indicator also displays the ongoing marketing trend between wealthier Ethereum wallet holders. The variety of Ethereum wallets that hold at least ten,000 ETH (or about $ 39.twenty million) dropped somewhat, from one,208 in June to one,156, marking a drop of virtually four.five%.

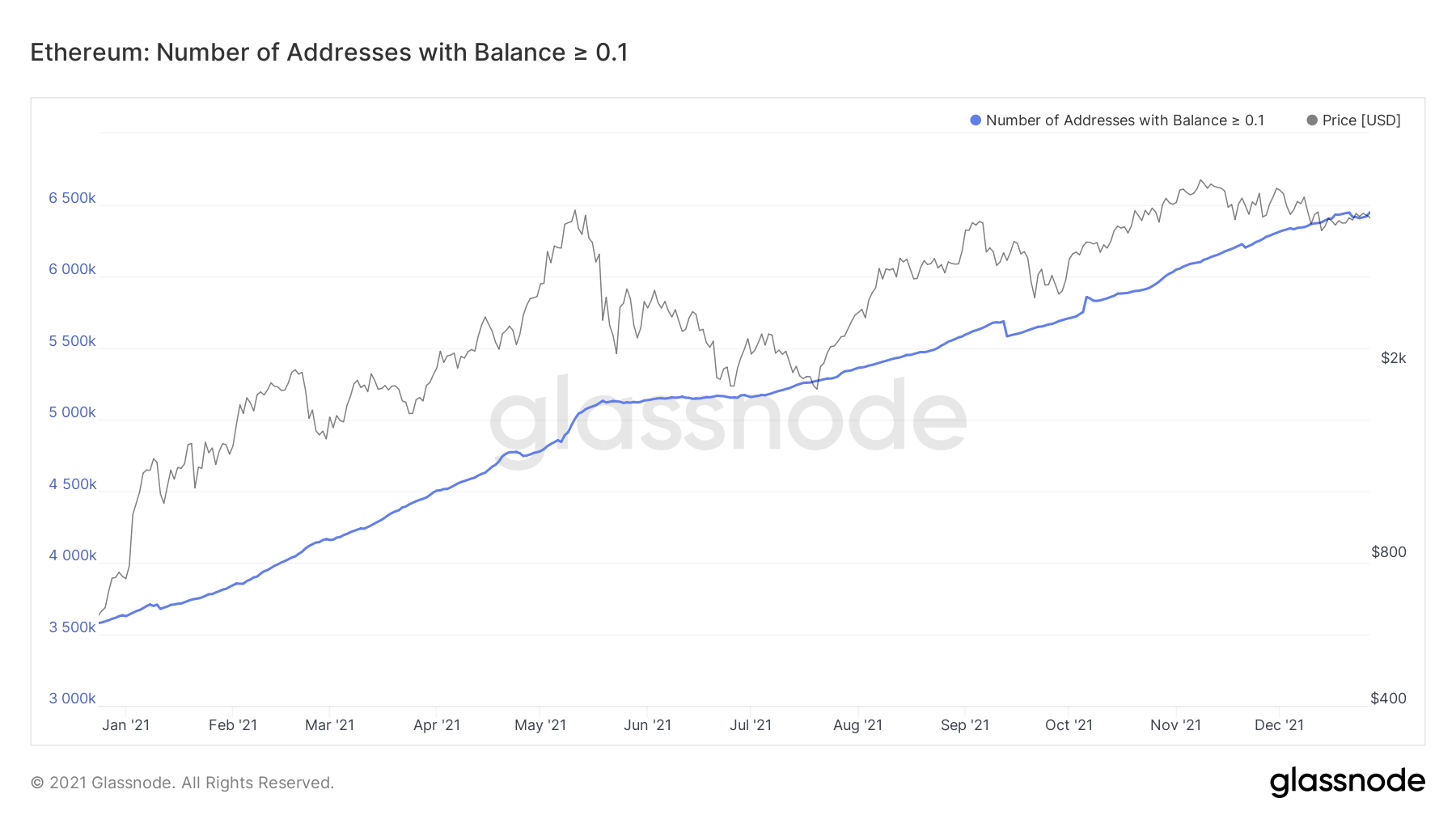

Unlike whales, smaller sized ETH wallets had been at the forefront of Ether’s 2021 bull run. The variety of retail traders hoarding Ethereum improved as ETH surpassed $ four,000. Earlier this week, Ethereum addresses with non-zero ETH balances hit an all-time higher of more than 71.23 million, up twenty.31 million from ten.66 million at the starting of the yr.

While the component of whale marketing strain could weigh heavily on ETH’s short-term price tag response, it is nevertheless uncertain in terms of the platform’s prolonged-phrase growth. Perhaps this is just the basic psychological circumstance of the market place prior to the correction of the “big brother” Bitcoin.

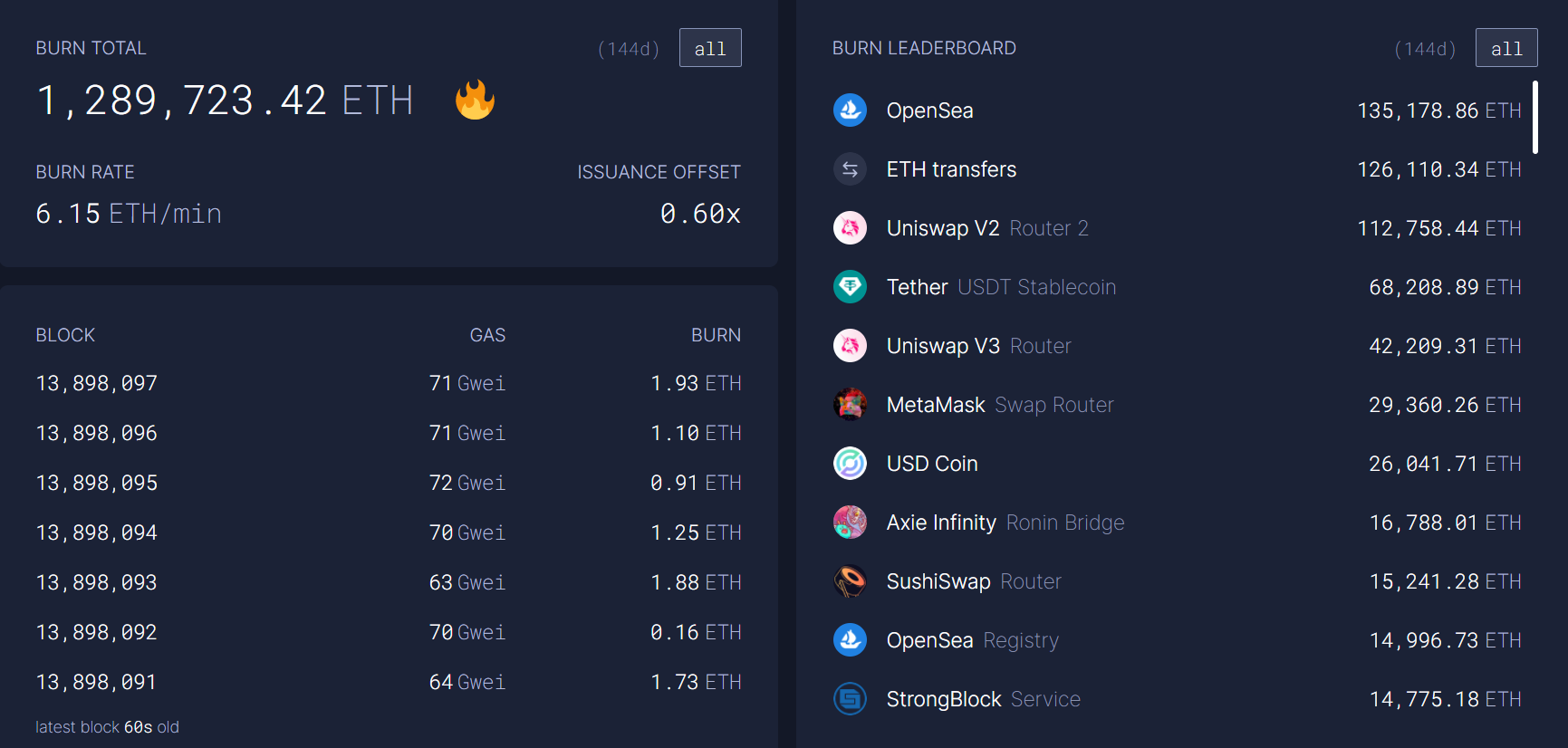

In terms of deflation, Ether is performing a fantastic career. As of press time, up to one,289 million ETH, equivalent to virtually $ five billion, have been purged from the burn up considering that the implementation of the EIP-1559 update about 4 months in the past.

This will aid ETH grow to be more and more scarce, and as the demand to acquire Ether to use all the application utilities in the DeFi area increases, the price tag of ETH will unquestionably advantage. It should really be mentioned that the Ethereum ecosystem accounts for more than 60% of the complete locked-in worth (TVL) in DeFi at $ 155.77 billion.

Furthermore, Ether is slowly demonstrating its hegemonic place on the biggest regular investment organization in the globe. The “tough” boss of the world’s biggest hedge fund Ray Dalio has unveiled that he has invested in ETH. Many specialists also agree with the see that Ethereum will overtake Bitcoin due to engineering, not inflation.

Finally, the largest hurdle commonly pointed out by the neighborhood is gasoline taxes. However, that will quickly be addressed with the growth team’s efforts in direction of Ethereum two. with the Beacon Chain heart in 2022.

Layer two protocols also strongly help ETH to lower costs, mixed with the biggest protection platform on Ethereum Tornado Cash is about to roll out a new update. This displays that anyone is defending and supporting ETH’s large intention in the long term.

Synthetic Currency 68

Maybe you are interested: