Although it was only launched late final month, the ProShares Short Bitcoin Strategy ETF (BITI) seems to have turn out to be a star now.

From publicationAt the finish of June, ProShares Short Bitcoin Strategy ETF (BITI) fund. ETF The Bitcoin pioneer in the United States has taken a tricky hit. According to the information it is Arcane Research announced on the evening of July six, capital inflows are focusing largely on quick-promoting BTC ETF solutions.

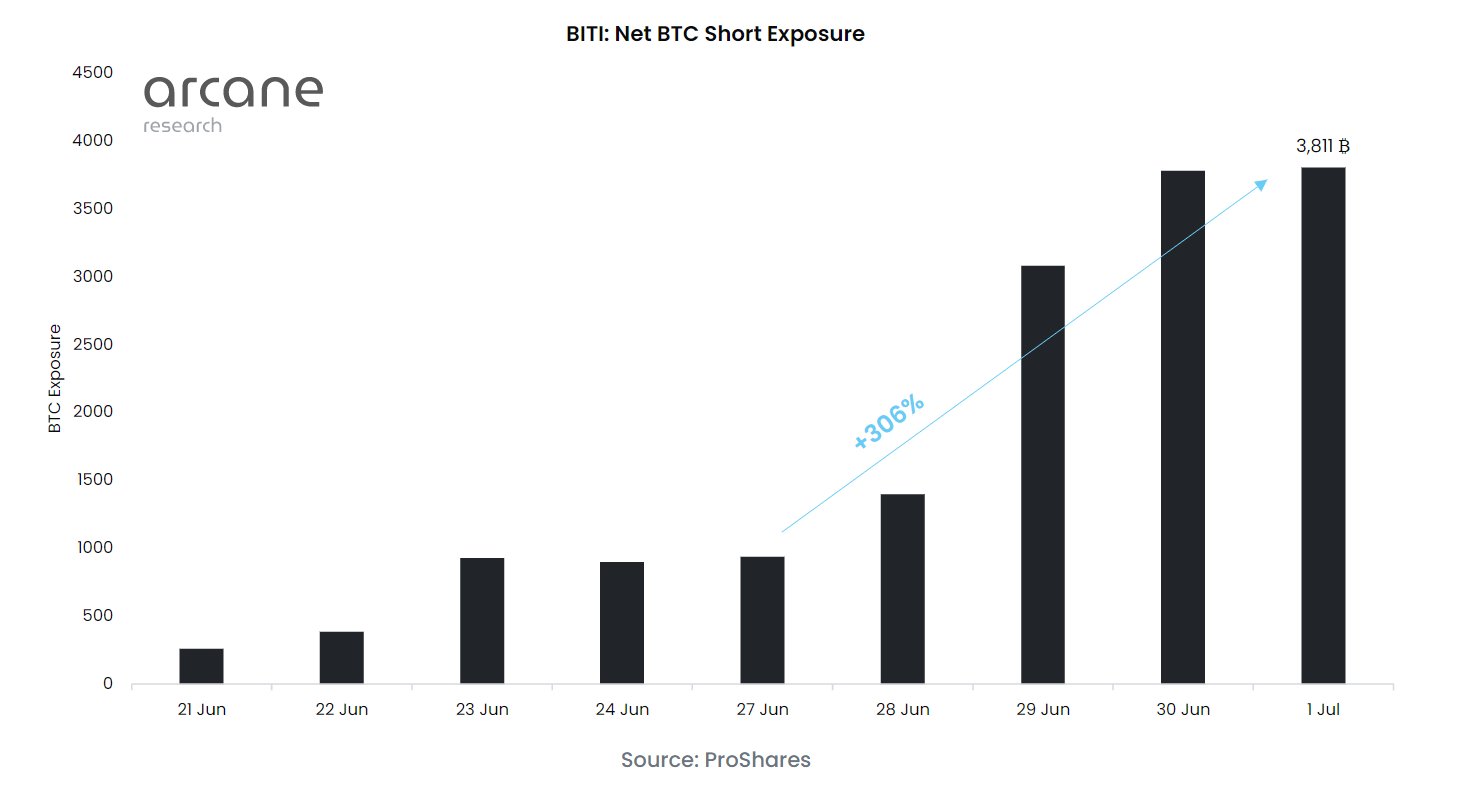

BITI has grown by above 300% in a handful of days, Arcane share in a tweet:

BITI, the to start with reverse BTC ETF, rose more final week.

After turning out to be the 2nd bitcoin-relevant BTC ETF in the US soon after just 4 trading days, the net quick publicity grew more and greater by additional than 300% final week. pic.twitter.com/wu0t8q3X0j

– Arcane Research (@ Arcane Research) July 6, 2022

The timing of BITI’s launch itself is also regarded rather excellent, as BTC plummeted to an 18-month minimal of $ 17,600 and is nonetheless entrenched all around the $ twenty,000 mark.

The GBTC premium, the big difference involving the Bitcoin spot marketplace price tag and the GBTC stock held by the believe in, has been unfavorable for above a 12 months. This metric displays that the influx of BTC has decreased drastically, major to a circumstance wherever GBTC is trading beneath the spot price tag in the marketplace.

Analysts’ expectations are nonetheless skewed in direction of the marketplace trend which will proceed to deteriorate, BTC will slide yet again and even the over figure from BITI by some means confirms the sentiment of the existing crowd.

To comply with CoinSharesweekly capital movement in quick-promoting BTC solutions 51 million bucks out of a complete of $ 64 million in inflows for the total week. Meanwhile, investments in (prolonged) BTC solutions are only $ twenty million.

As Cointelegraph reported, involving June twenty and June 24 alone, $ 423 million of institutional capital came out of digital investment solutions. Although a lot of large gamers withdrew from the marketplace, investment solutions supplying the chance of quick BTC have signaled a reversal, the explanation staying that ProShares has launched the to start with “short-sell” Bitcoin ETF, to start with in the United States.

ProShares emerged from the launch of the to start with Bitcoin ETF in the United States based mostly on futures contracts, hitting $ one billion in trading volume on the to start with day of launch, followed by various additional Bitcoin derivatives ETFs that have been confirmed one particular by one particular. . Securities and Exchange Commission (SEC).

Proshares Grayscale’s counterpart has been “estranged” from the SEC above and above yet again. Most not long ago, the SEC rejected a proposal to convert the Grayscale Bitcoin Trust (GBTC) into a Bitcoin spot ETF. With the over determination, Grayscale has filed a lawsuit towards the US Securities and Exchange Commission and is presently managing the Washington DC Appeals Court application.

Synthetic currency 68

Maybe you are interested: