The problem the place stETH is diverted from ETH continues to have the most current developments with the significant “drain” of the Three Arrows Capital fund.

As reported by Coinlive, a single of the primary causes for the collapse of the cryptocurrency industry in basic and Ethereum (ETH) in specific stems from the truth that stETH has been sliding in cost relative to ETH because June ten.

The panic spread even more on the morning of June 13 when the Celsius lending platform blocked deposits, withdrawals and transactions when there was not ample liquidity to meet consumer requirements. Celsius itself holds a large volume of stETH and might have been “hacked” to force them to liquidate their Compound, Aave and Maker loan positions to promote this stETH. However, on June 13, Celsius nevertheless charged 23,962 WBTC to borrow 278 million DAI, with a Bitcoin settlement cost of $ sixteen,800.

Celsius even more filled the vault:

– Liquidation cost: sixteen.8k

-23.9k wBTC caught in the vaultcontinues to double pic.twitter.com/FdPPYfjwoO

– Dylan LeClair 🟠 (@DylanLeClair_) June 14, 2022

Since then, the cost of ETH has been heavily dumped and has misplaced much more than forty% of its worth, plunging from $ one,800 on June ten to a lower in 2022 to $ one,075 on June 14. This is also Ethereum’s lowest worth because January 2021, immediately after a consecutive week of declines for the 2nd biggest cryptocurrency in the planet.

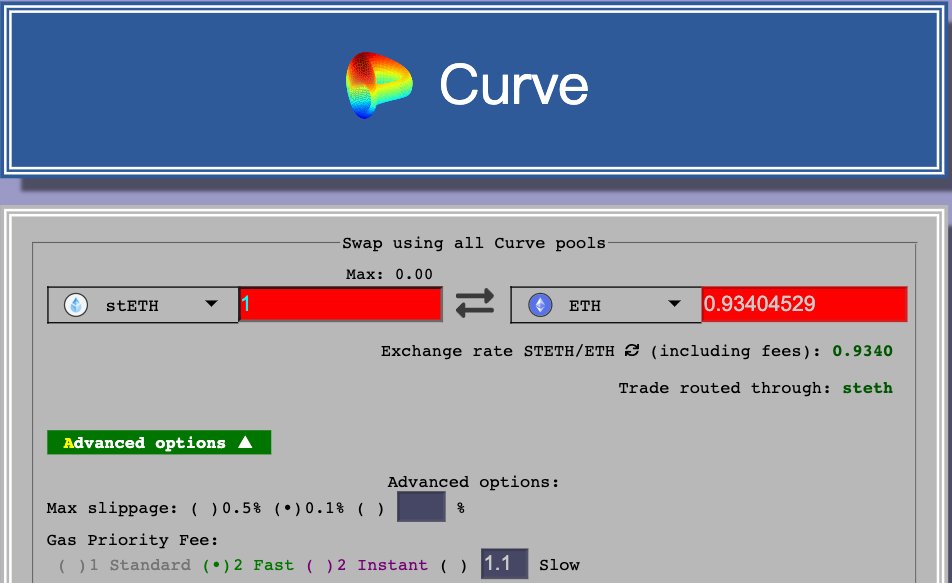

In the afternoon of June 14, the stETH and ETH charges on Curve continued to drop to .93, nevertheless unable to discover equilibrium.

The motive for the over fluctuations comes from the Three Arrows Capital (3AC) fund which dumps stETH and trades with ETH. According to blockchain information, 3AC wallets have offered in excess of thirty,000 stETH (really worth in excess of $ 33.seven million) in the final handful of hrs. Much of that was carried back to ETH, when the rest went back to about $ twenty million really worth of DAI stablecoins.

The 3AC wallet downloaded thirty,000 stETH (~ $ 33.seven million) on ETH a handful of hrs in the past (and subsequently unlocked positions on Aave).

The handle nevertheless has a different 19.6k stETH.https://t.co/ag4wyyZzkN

– mhonkasalo (@mhonkasalo) June 14, 2022

Even so, 3AC’s portfolio nevertheless has in excess of 19,600 stETH, really worth in excess of $ 21.eight million.

Additionally, the cryptocurrency neighborhood on Twitter is spreading rumors about Three Arrows Capital itself owning liquidity straits immediately after the industry has been constantly heavily dumped in the previous, as effectively as the relative influence of the LUNA-UST lawsuit has collapsed. early May However, this information and facts was not verified.

– kamikaz TH (@kamikaz_ETH) June 14, 2022

Three Arrows Capital is a single of the “strong” investment money in the Earth ecosystem, even although it manufactured a number of “hefty shillings” for LUNA-UST just ahead of the crash. Foundation CEO Zhu Su later on had to apologize to the neighborhood for his statements.

Some persons also observed that Mr. Zhu Su just lately deleted the hashtags ETH, AVAX, LUNA, SOL. Close to, MINA, DeFi and NFT from their Twitter web page, leaving only Bitcoin. These signify the currencies that Three Arrows Capital relies on.

Synthetic currency 68

Maybe you are interested: