After Part one, in Part two, we invite you to practice the Tokenomics evaluation measures of the Ethereum (ETH) venture!

five. Ethereum Token Analysis

To make you have an understanding of how to do it, in today’s report I will analyze the Ethereum Tokenomics.

As a common Layer-one venture with an infinite provide, ETH is a single of the excellent examples to analyze with each other.

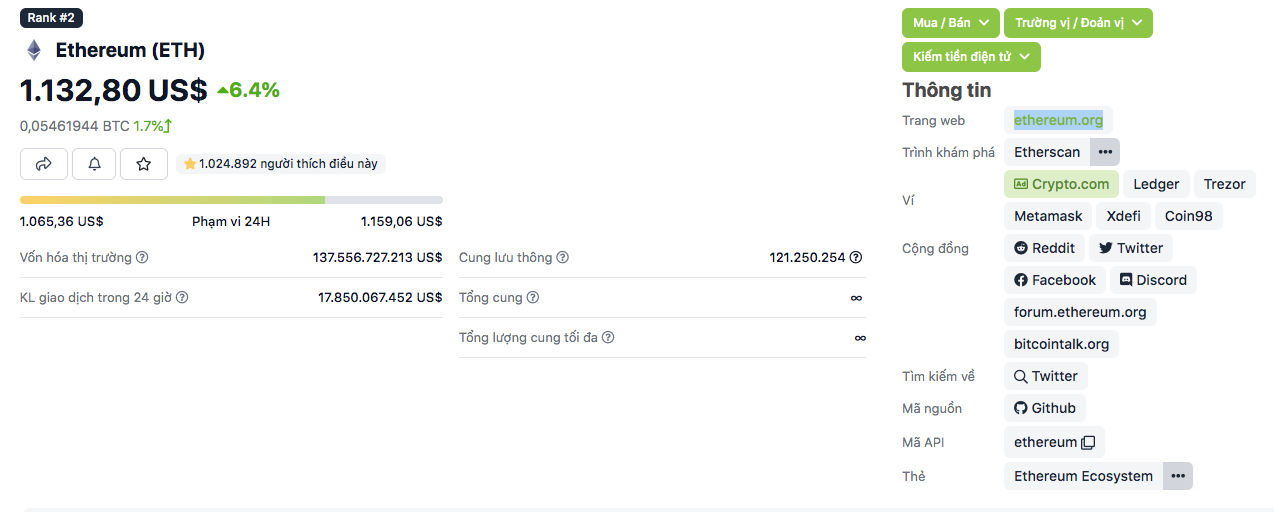

First, you can use CoinGecko to come across common info about the venture.

via CoinGecko, immediately get info about Circulation (circulation), Total and greatest provide of ETH. Next, we’ll delve into 3 vital factors: use situation, allocation, and release.

five.one. Token use situation

Usually, to master about the use situations of tokens, I normally go through on the venture household webpage or on paperwork this kind of as Whitepaper.

ETH has the following primary functions:

- Reward for mining and staking: Previously, Ethereum utilised Proof-of-Work, so ETH was utilised to reward miners. With the launch of ETH two., Ethereum switched to Proof-of-Stake, ETH will be awarded at Validator Nodes.

- Commissions: ETH is the native currency of the venture, so it is also utilised to spend all transaction charges that interact with the Ethereum network.

- Stake: With the gradual transition to Proof-of-Stake, ETH adds an vital characteristic which is staking.

- Burn: following the proposed EIP-1559, an volume of ETH in transaction charges will be burned to minimize inflation.

However, if we prevent at the degree of evaluating ETH’s use situations, it will be a significant gap. Being the coin with the initially two marketplace caps, you require to deepen the qualities of ETH:

- Warranty: DeFi protocols like AAVE, MakerDAO, Compound … all enable the use of ETH as collateral for loans. More especially, MakerDAO or Liquidity each enable you to use ETH to mint stablecoins.

- Payment: Almost to participate in the invest in and sale of NFTs on Ethereum, you ought to generally use ETH. Additionally, ETH is also a currency utilised by massive organizations to deliver solutions (for illustration, to join some DAOs, there will be a sure minimal ETH necessity).

- Create new asset lessons: With its advancement, lots of assistance solutions appeared to assistance the Ethereum venture, together with Lido Finance. Lido produced it much easier for consumers to join ETH two. and made a new liquid asset named stETH.

- Investing and storing assets: Many crypto and conventional investment money have ETH getting and holding portfolios. ETH has also grow to be a area to retail outlet assets and invest.

Therefore, we can quickly draw the following conclusion:

ETH, in addition to the essential use situations for Ethereum, there are lots of other use situations for the Crypto marketplace.

Therefore, the demand to invest in, hold and trade ETH has generally existed and is exceptionally massive. This is a single of the vital points to enable ETH generally have a place in the marketplace and have a great bullish situation.

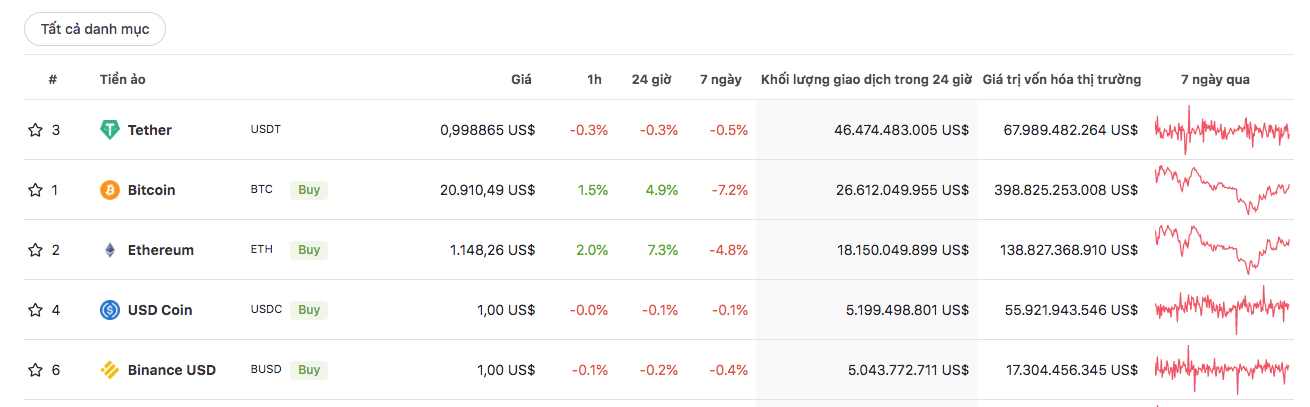

As you can see, Ethereum has a 24-hour trading volume of up to $ 18.one billion, just behind USDT and BTC as of June 21, 2022.

five.two. Token allocation

CrowdSale open for sale: The ETH was open for public sale by the Ethereum Foundation from July 22, 2014 to September 9, 2014, resulting in the sale of 60 million ETH (80% of the 72 million ETH was at first made available for sale). This volume of ETH will be unlocked following the launch of Genesis Block (July 31, 2015). In this round, the rate of ETH was set at one BTC = two,000 ETH from July 31, 2015 to August five, 2019, just before linearly raising to one BTC = 1337 ETH. Approximately 31,000 BTC, equivalent to $ 18.three million, was raised through this round.

The residual volume of twenty% of ETH, equivalent to twelve million ETH, is allotted as follows:

- 3M ETH for a extended-phrase investment (unknown).

- 6M ETH distributed to 85 traders in the pre-CrowdSale rounds.

- The remaining 3M ETH are reserved for Team developers, making it possible for them to invest in this ETH at a crowdsale rate.

Therefore, at the time of 2022, the preliminary allocation of Ethereum tokens is nevertheless of small use worth (due to the fact the allocation and unlocking time is also extended). In this situation, if you depend on the unique allocation, it will be extremely unfounded.

In this situation, we can only draw conclusions:

Previous product sales rounds will not have a significant influence on the present ETH rate.

So we have to use other resources.

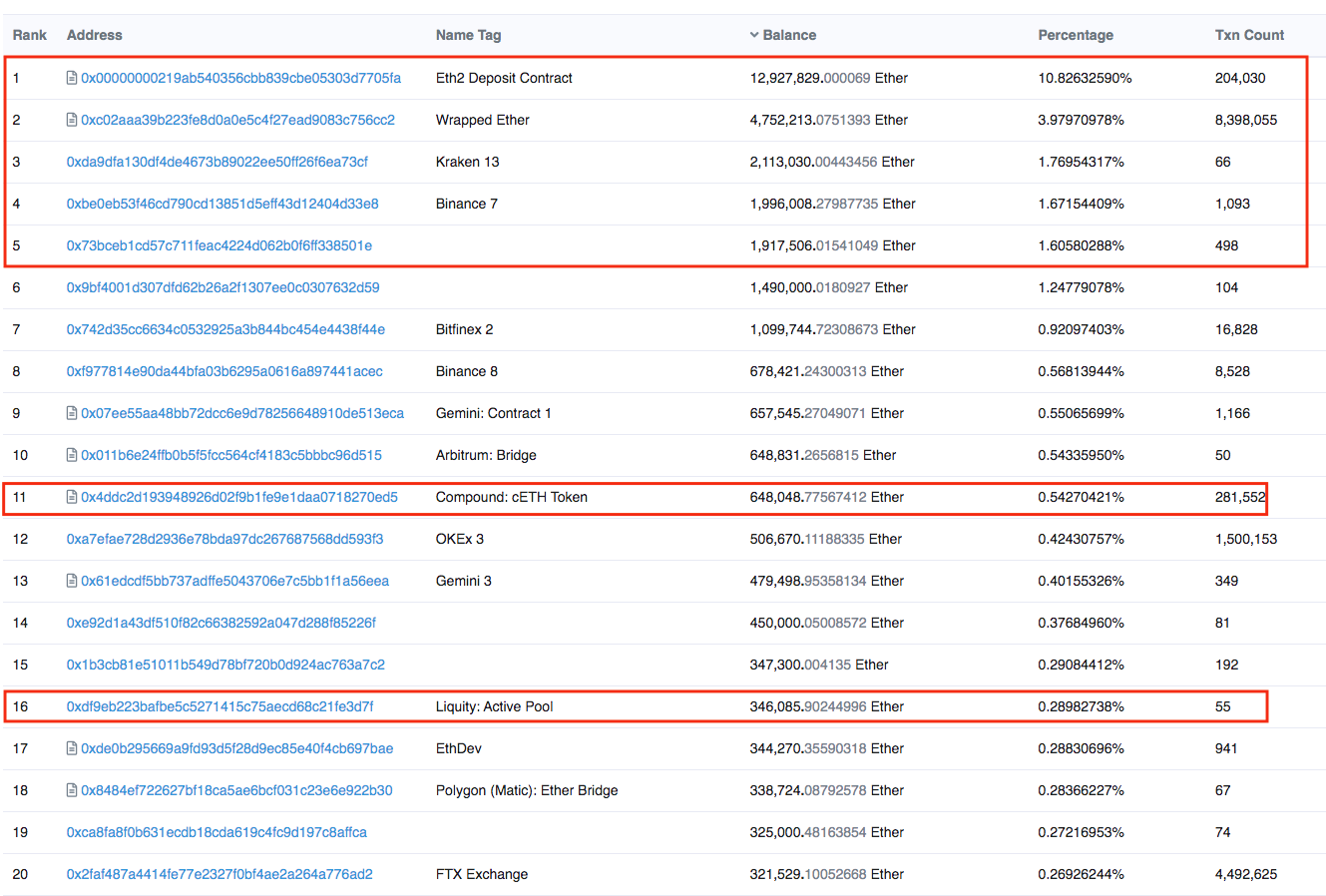

First, I’ll use Etherscan – Ethereum explorer to check out the leading of the biggest portfolios holding ETH:

You can see that the volume of ETH blocked in ETH two. represents above ten% of the complete circulating ETH. Furthermore, mostly in the leading twenty there are the wallets of the primary exchanges this kind of as Binance, Kraken, Bitfinex, FTX …

We also require to spend awareness wallet quantity eleven (Compound) e wallet quantity sixteen (Liquidity). These are two wallets exactly where consumers deposit ETH as collateral, so if the rate of ETH in the marketplace goes down, it is probable that this volume of ETH will be liquidated (marketplace sale), partially affecting the marketplace. .

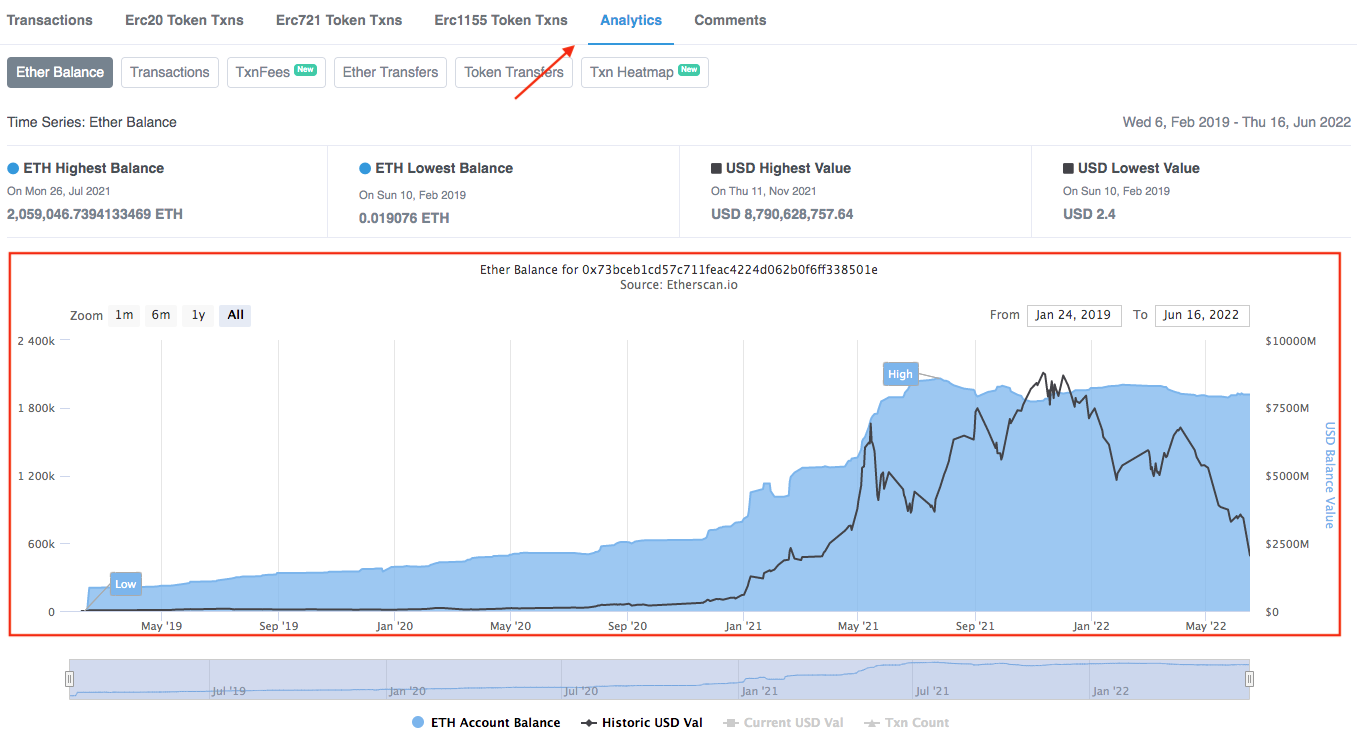

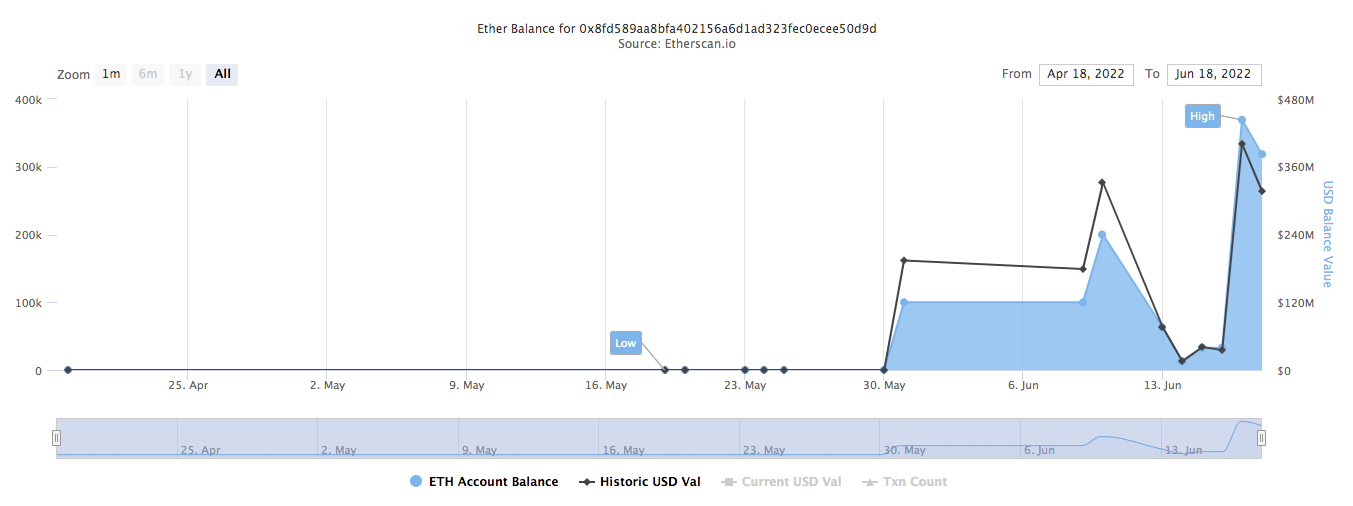

Next, we will seem at wallets without having stickers (typically fund wallets, whales …) to see what they are accomplishing? An uncomplicated way to check out: click on that portfolio, then choose the Analytics area.

The five ideal wallets

We ought to distinguish: the blue region is the information on the volume of ETH, even though the black line is the worth in USD.

Here, all through 2019 so far, this wallet has only purchased a lot more ETH and though the revenue obtained (black line) has elevated enormously, this wallet has not offered significantly and nevertheless holds. The final time the marketplace fell (the black line goes down), this portfolio is nevertheless on the move hold and wait.

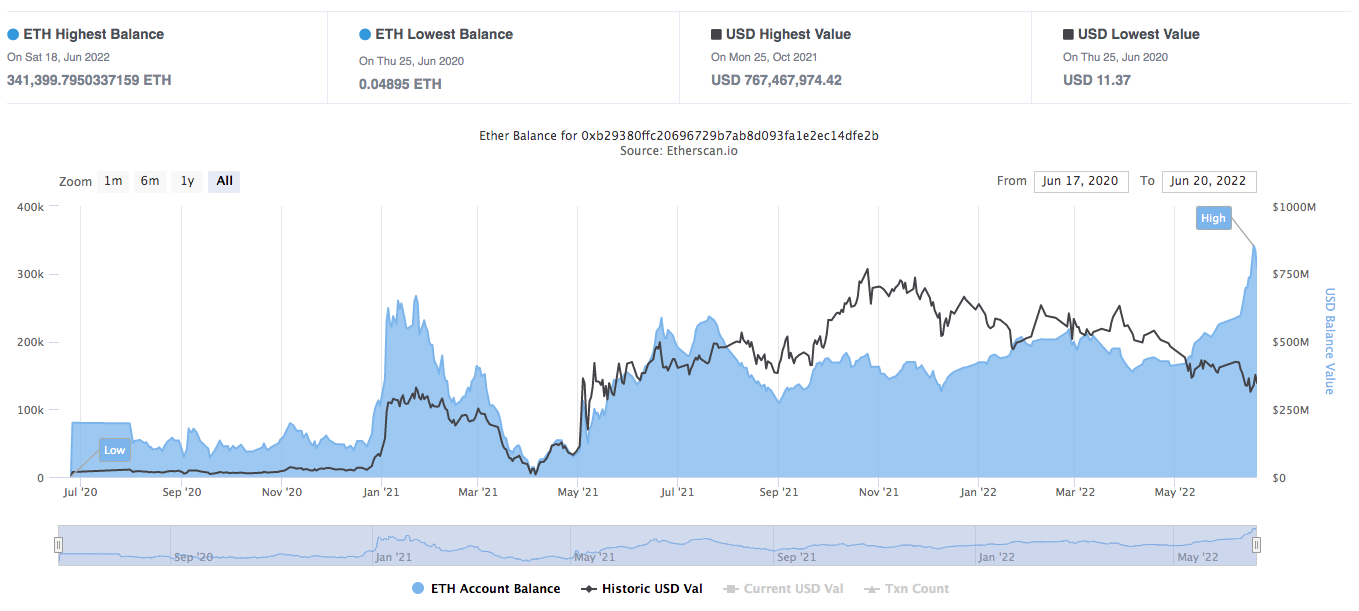

The 21 ideal wallets

The initially 21 wallets, following remaining offered out close to ten-13 June, have been straight away repurchased in bigger quantities. I guess the proprietor of this wallet made a quick-phrase trade It is presently successful rather significant.

The ideal wallet 23

Next, I will check out the portfolio of the leading 23. You can see that even even though ETH has decreased appreciably in the final week, this portfolio is nevertheless difficult the boost in the volume of ETH and is reaching the ATH of the volume of ETH held in the portfolio. . Hence, wallet quantity 23 has a move “goods collection”.

Likewise, I continue to keep checking some portfolios, the leading 27, 29 and thirty portfolios have no stock to invest in or promote, nevertheless in the state wait.

From the over information, you can draw feedback:

- This rate selection is no longer the rate selection exactly where significant hands promote the most.

- Some whales have started off getting.

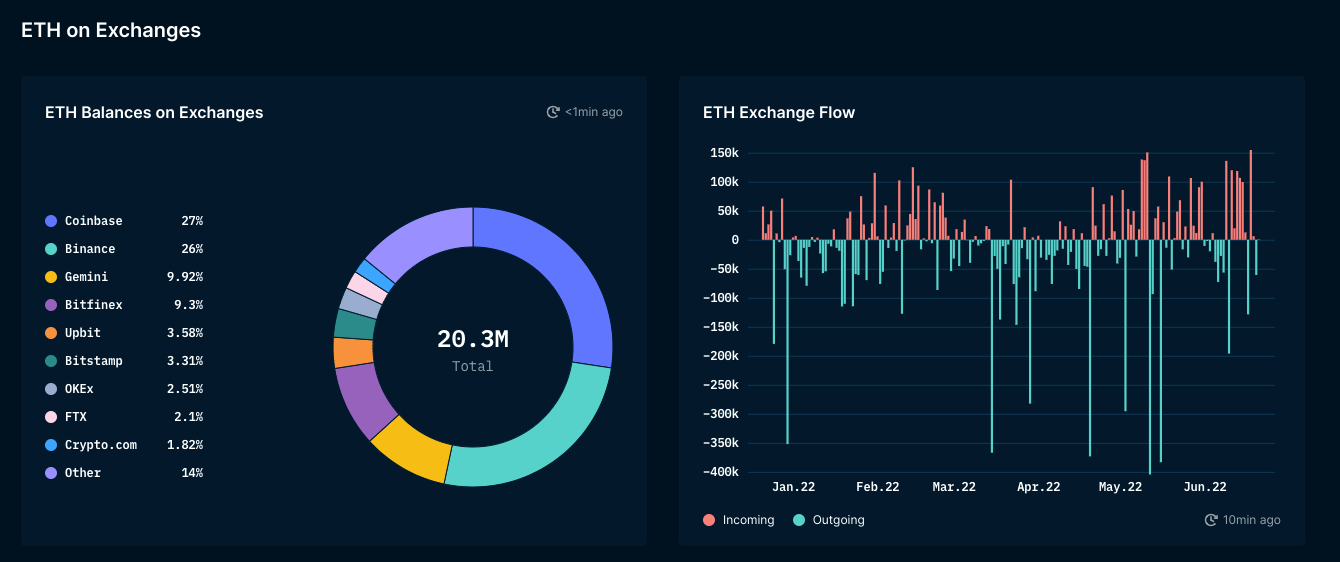

To master a lot more about ETH information posted on exchanges, you can use the device on Nansen. From the information in the picture, you can see that ETH is presently remaining posted the most on Coinbase, followed by Binance, Germini, and Bitfinex. These are all remarkably liquid exchanges. Also, we can see from January 22, 2022 to June 21, 2022, through the marketplace dump, there are generally withdrawals of ETH from extremely massive bags (blue bars). This demonstrates that there are nevertheless “big hands” that, following getting ETH on the stock exchange, straight away withdraw and hold for a extended time.

five.three. Token system release

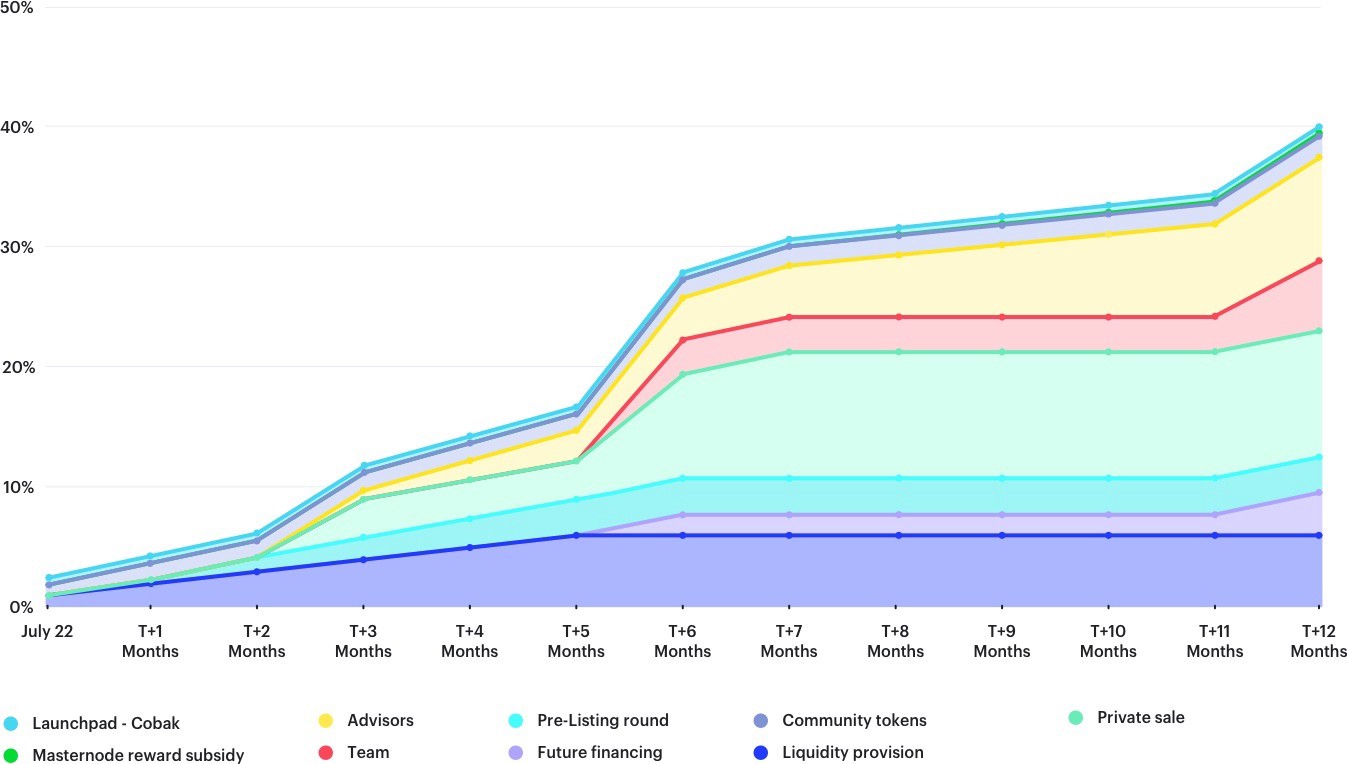

Usually with new tasks, you will require to spend awareness to the Token Schedule Release to have an understanding of the instances when investment money are unlocked a massive volume of tokens. The token payment routine is typically proven in the type of a graph as follows:

So what if ETH has previously paid for tokens for former rounds? We will be interested in the story inflationary And burn up this time.

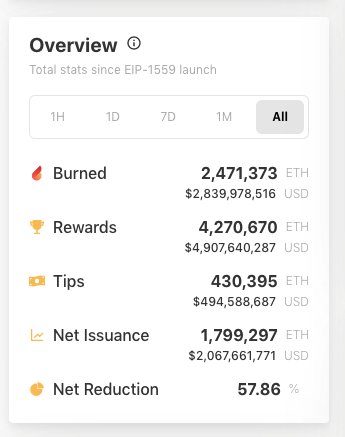

To seem up the information, I use Watch The Burn:

In the picture over there is information on the volume of ETH burned, the volume of ETH as a reward, and so forth. considering that EIP-1559 was distributed.

You can see that the volume of ETH burned is close to two.four million, even though the reward (together with prizes and strategies) is close to four.seven million. Therefore, ETH nevertheless has inflation. However, it are unable to be denied that with the ETH burned a whole lot via the proposed EIP-1559, it assisted to minimize the inflation fee of this coin a whole lot.

One of the good reasons for ETH’s large inflation is nevertheless due to the fact Ethereum has not absolutely switched to Proof-of-Stake. In the potential, when you thoroughly improve to ETH two., reward inflation will go down => this is a extended-phrase bullish situation for ETH.

So, with each other we have analyzed ETH’s Tokenomics in detail and have witnessed some quick-phrase bullish situations for this coin priced at 900 – one thousand USD. You can apply the exact same to analyze other tasks.

six. Some resources utilised

To summarize for your comfort, I will listing the resources I normally use to analyze Tokenomics:

- Token information aggregators: CoinGecko, CoinMarketCap …

- Websites with info obtainable on the venture: CoinliveCoin98 …

- About the token payment calendar: Vestlab

- Project explorers: Etherscan, Avasca, Solsca…

seven. Some notes through the Tokenomics evaluation

Tokenomics evaluation is extremely vital, but it really is not all to enable you make great investment choices.

Basically, you require to place your evaluation in the proper and ideal context. In addition to Tokenomics, you also require to assess:

The nature of the venture

Is the venture great? Does the item have true consumers? Does the venture make a revenue to survive complicated instances? How does it evaluate to tasks in the exact same niche?

Position of the events

As I explained, whales are ready to hold out for five-ten many years, due to the fact their capital is extremely abundant, but not all retail traders can. So, if you want to swim with the whale, you require to put together a whole lot.

How investment money perform

If you are cautious, you will recognize that when you unlock the token, alternatively of the steeply falling rate, it is “pushed” fairly a whole lot. The explanation is understandable due to the fact when the money are launched, they will want to promote …