Continuing the Tokenomics Research Series, we study how the Cardellino credit score protocol performs and see if the project’s GFI token has in fact been integrated.

About Goldfinch

Goldfinch (GFI) is a decentralized credit score protocol that will allow customers to borrow cryptocurrencies without the need of collateral.

Lending protocols are not new when there are a lot of productive massive names like AAVE, Compound, MakerDAO … However, most of today’s lending and lending protocols need customers to do so. collateral (typically cryptographic) to borrow, so it only partially solves the marketplace demand.

Unsecured loans (unsecured loans) are a extremely possible marketplace and have an really substantial marketplace dimension. However, unsecured loans, while widespread in standard finance, are even now extremely seldom pointed out in crypto, the most important motive almost certainly staying the issues of identifying the identity + track record of the borrower. This increases the chance for the loan, building a lot of firms reluctant to create this section.

By incorporating the “trust by consensus” principle, Cardellino produces a way to fee borrowers based mostly on creditworthiness rather than collateral.

Currently, because it operates in the kind of unsecured, Cardellino only restricts its shoppers, i.e. the borrowers (Borrowers) who are lenders in standard finance. In a additional understandable way, the capital requirements of standard credit score institutions (banking institutions, unsecured credit score institutions …) are extremely substantial, when their ensures are restricted. To broaden the marketplace and shoppers, they can borrow crypto assets (USDC), then convert them into fiat on the standard marketplace and lend them back.

How the goldfinch performs

Before diving into tokenomics, I want to get a fast search at how Goldfinch performs.

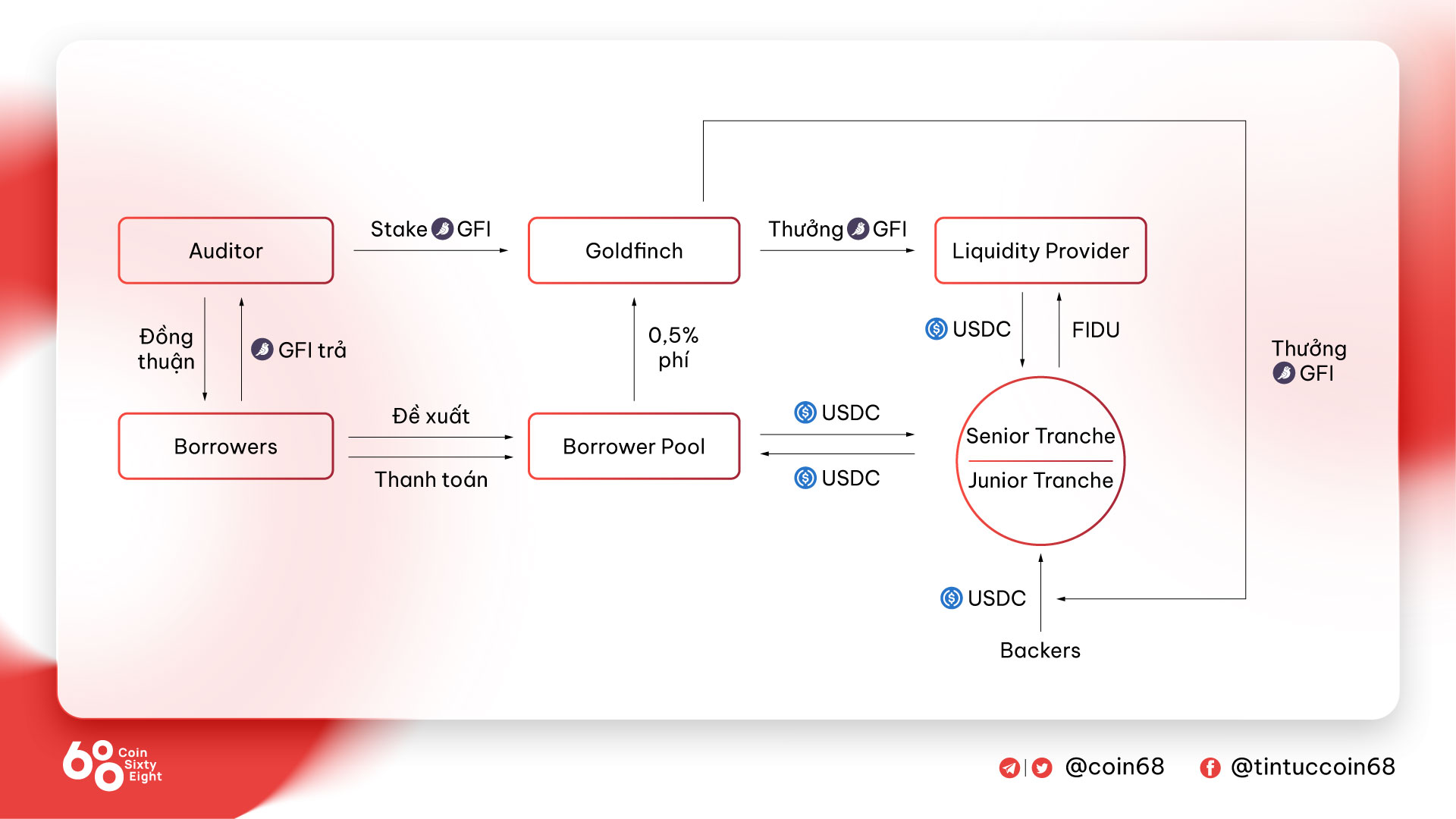

Participants in the protocol consist of: borrower, loan company and liquidity supplier, moderator (auditor). To comprehend the part of every part, I will describe in additional detail how Goldfinch performs.

First, the Auditors will be accountable for checking the Borrower’s track record and credit score historical past, then for approving if they meet the prerequisites. The auditor will will need to home loan a specified sum of GFI to make sure the accuracy of the approval (no matter whether violations will be fined in portion or all of the filed GFI). At the finish of the voting, the Auditor will be rewarded with a share of the GFI (paid by the borrower).

The borrower will make borrower pools, which consist of parameters this kind of as the complete sum to borrow, curiosity fee, payment phrase, payment phrase, late payment charge …

In purchase for the borrower pool to perform very well and stably and appeal to capital flows, the over ailments ought to be realistic and balanced in between the borrower and the loan company => the pool creator really should be accountable for generating the pool. Typically, the borrower will decide on a quantity of pool creators. These individuals will acquire an further reward (known as the startup charge).

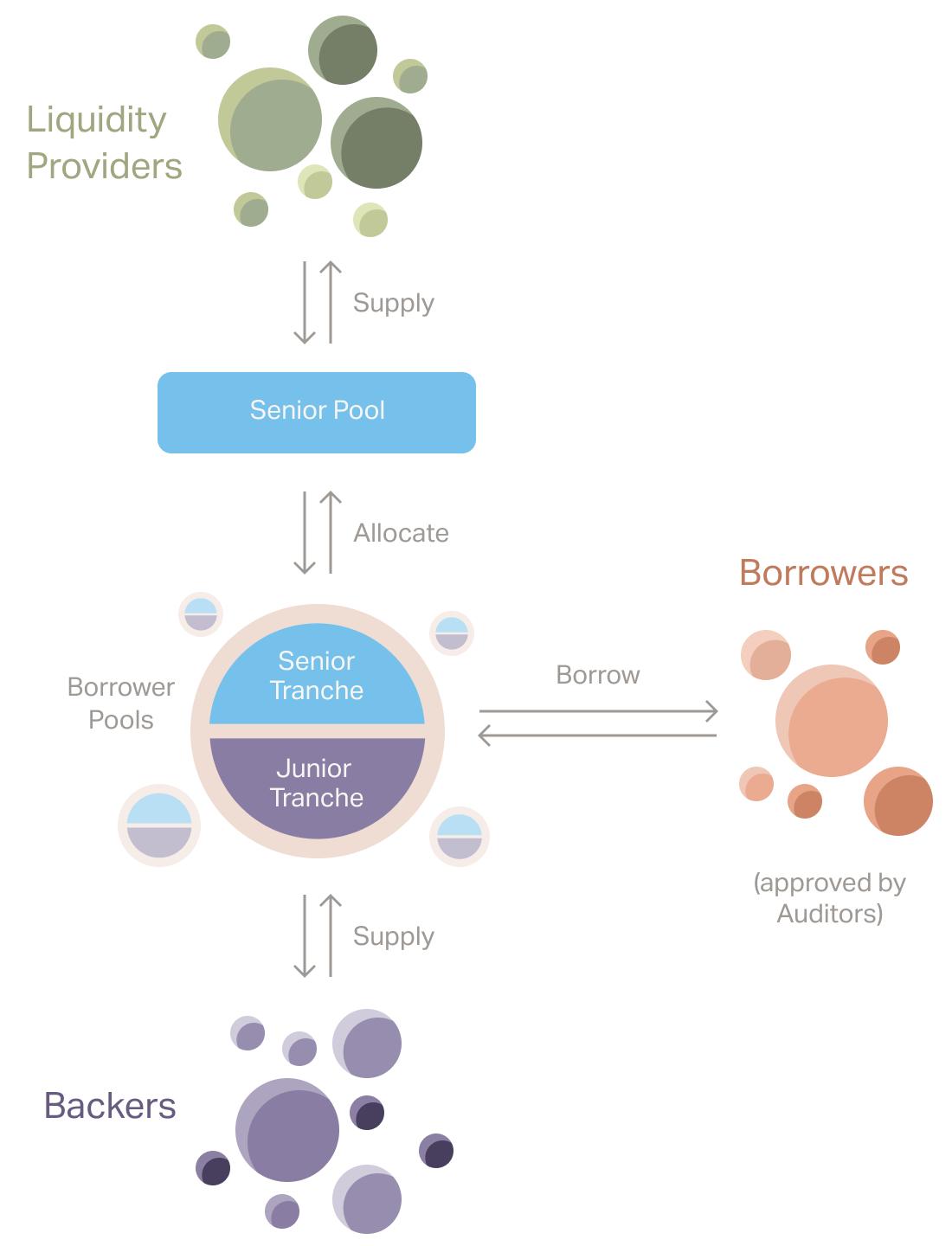

After the borrower pools have been proposed, traders can offer capital for this pool in two strategies:

- Offer immediately as a supporter

- Indirect provisioning through protocol (automated capital allocation), as Liquidity Provider.

So what is the big difference in between these two roles? To decentralize chance, Cardellino developed the two roles pointed out over. Lenders are the ones who make their personal loan choices immediately after evaluating the pool of borrowers, run the best chance (Junior Tranche), so they will take pleasure in a greater return. As additional and additional Backers assistance a Borrower Pool, that Pool has a greater track record => the Liquidity Provider’s capital is now allotted additional to that Pool. => The Liquidity Provider will take significantly less chance (Senior Tranche).

When the borrower repays the loan, the sum will be paid initial to the Senior Tranche, then to the Junior Tranche (greater chance).

Tokenomics

Goldfinch has two varieties of tokens, GFI and FIDU, in which GFI is the native token.

FIDU is a token that represents a deposit of the Liquidity Provider in the Senior Tranche pool. When liquidity companies offer money to the Senior Tranche, they will acquire an equal sum of FIDU. FIDU can be converted into USDC in Goldfinch at an exchange fee based mostly on the net assets of the Senior Pool, significantly less a .five% withdrawal charge.

The FIDU isn’t going to have a great deal to say. The most important token we are interested in is GFI. GFI is Goldfinch’s native token, the complete provide is 114,285,714 tokens. There are now additional than 22 million tokens in circulation (in accordance to CoinmarketCap information – September 18, 2022).

Characteristic

- Administration: GFI hodler has the suitable to participate in the administration of the undertaking.

- Incentives: GFI will be assigned to participants who offer liquidity.

- Bonus for supporters, auditors

- Stakeout: incorporates supporter staking and auditor staking. Specifically: the loan company can stake GFI to report its assistance to a distinct loan pool, the auditor will will need to stake GFI to make sure accountability in the borrower approval procedure.

- Grants: GFI can be applied to fund meaningful concepts or contributions (voted on by the local community).

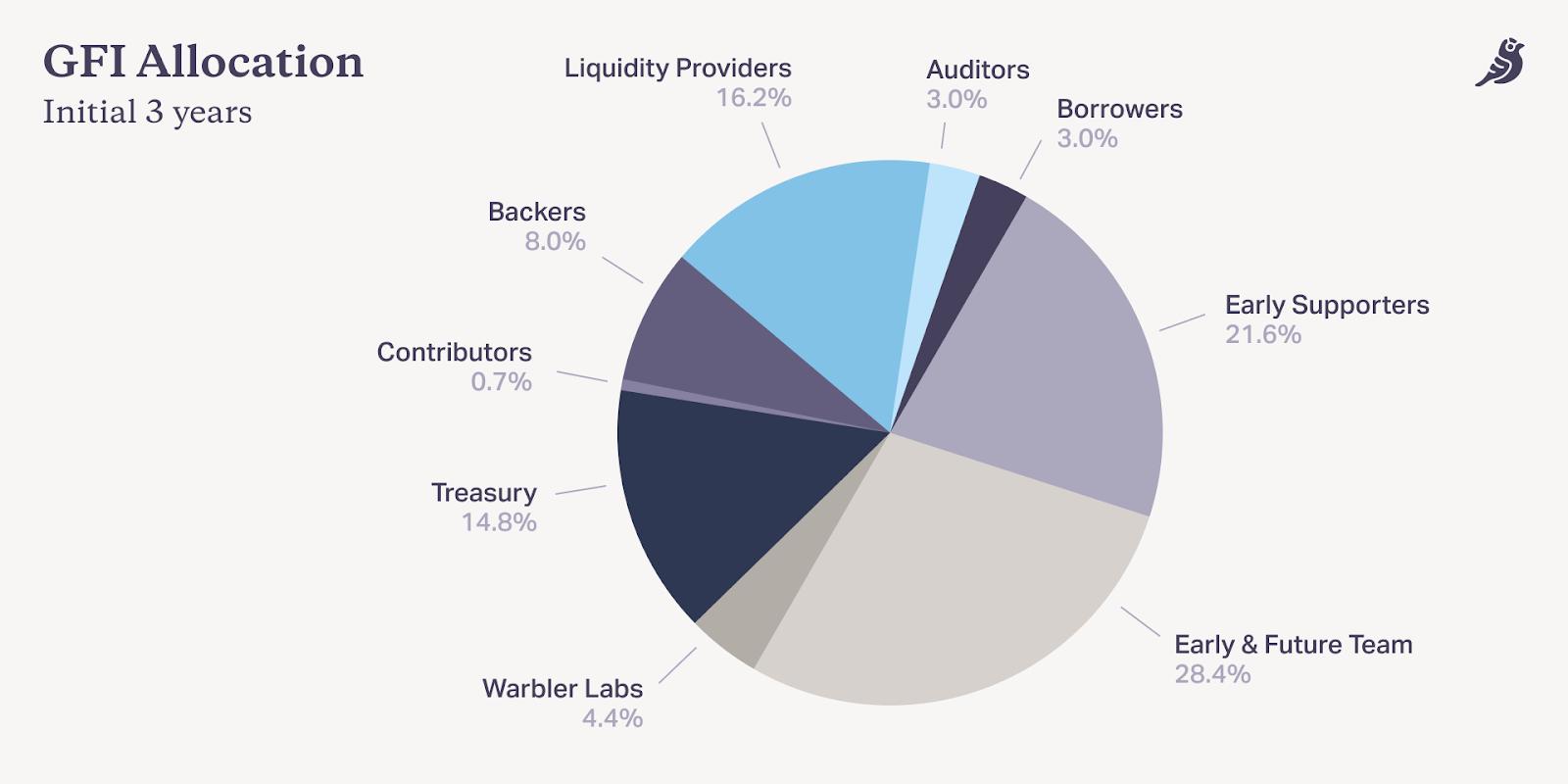

Token allocation

In it, you will need to target on some of the following allocation groups:

Early supporters: 21.six% was awarded to a group of above 60 who invested $ 37 million to support establish the protocol. These tokens will be locked for the initial six months, restricted to transfer for twelve months, and slowly unlocked for three many years.

Early and long term group: 28.four% is assigned to the Goldfinch’s preliminary group of above 25 staff members, consultants, and so on. This group will be blocked for four or six many years (for complete-time staff) and three many years (for portion-time staff). All are blocked for the initial six months and then paid in installments, restricted to the transfer for twelve months.

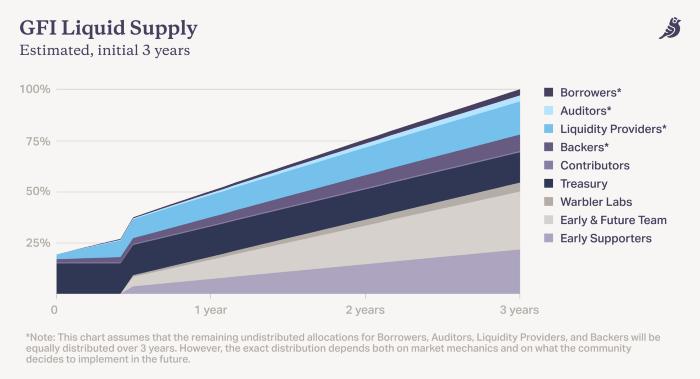

Token unlocking system

Analyses:

(one) Investment Funds, Investors and Teams held 50% of the complete giving. This is a reasonably substantial quantity. However, as GFI was at first applied as an administrator, I think the group and the investment money will continue to keep a substantial portion of it mostly for the function of stepping the undertaking in the suitable course.

(two) The unlocking routine for the aforementioned 50% tokens is really lengthy. This is a substantial aspect in the lengthy-phrase partnership of the group and the investment fund with the undertaking.

(three) While there are some traits, on the other hand, GFI’s bullish situation is not broad when demand comes mostly from the equity obtain by Auditor and Backer (I’ll break it down in detail beneath).

Flywheel for GFI

Basically, Auditor and Borrower are individuals who will need to get GFI, in which Auditor is a person who requirements to invest in GFI for a lengthy time. Furthermore, Backer can also depend on GFI to assistance Borrower Pool. Therefore, at the moment, the inspiration to get and personal GFI comes mostly from Auditors and Backers.

With the flywheel as over, for GFI to increase its selling price, the protocol ought to make sure:

- The quantity of Reviewers and Supporters increases quickly, which equates to a sufficiently beautiful reward for them.

- The sum of GFI that auditors have to target ought to be large, each to make sure their responsibilities when executing the perform and to make an application for GFI.

- The protocol ought to make an incentive for GFI holders to participate in GFI governance + participation.

- Reduce the percentage of GFI having to pay bonuses, alternatively of USDC.

However, with just a single flywheel as over that is even now really a bit for GFI. Currently, the protocol has a complete TVL of above $ one hundred million, of which above $ 99 million has been activated for the loan.

The protocol income above the previous thirty days is above $ one hundred,000. With a reasonably productive operation, Goldfinch can get sides definitive recommendation for GFI as follows:

(one) Indoor swimming pool: Similar to Maple Finance, Goldfinch can entirely establish a Cover Pool to protect against loan settlement chance, specially when working underneath the home loan model. The Cover Pool can perform as follows: Users ought to obtain GFI and offer mixed liquidity in between GFI and USDC in a specified proportion, of which GFI will signify a smaller sized proportion.

The motive why we should not use the whole GFI for the Cover Pool is for the reason that it is in essence a cover pool, which will be liquidated initial when an incident takes place, if we use GFI as a resource, it will lead to 02 consequences:

- GFI was massively depleted when Cover Pool was activated

- GFI diminished selling price => complete worth of the Cover Pool decreased, inefficient

(two) ve-GFI model: In my view, the protocol may well let GFI staking holders to acquire ve-GFI both to incentivize governance, to acquire a share of the charges collected from the transaction or to lower the charges for borrowers.

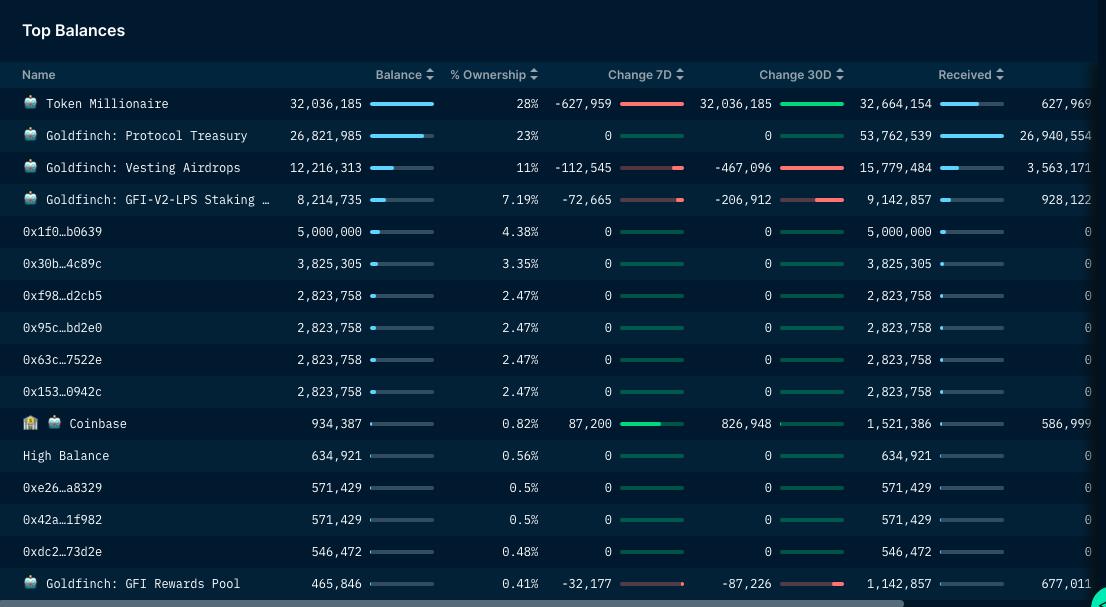

Situation of possession of tokens

It can be noticed that most of the finest GFI wallet holders are not building massive moves and even now continue to keep the token in the wallet. The elevated quantity of tokens has mostly decreased from airdrop wallets for customers and staking wallets.

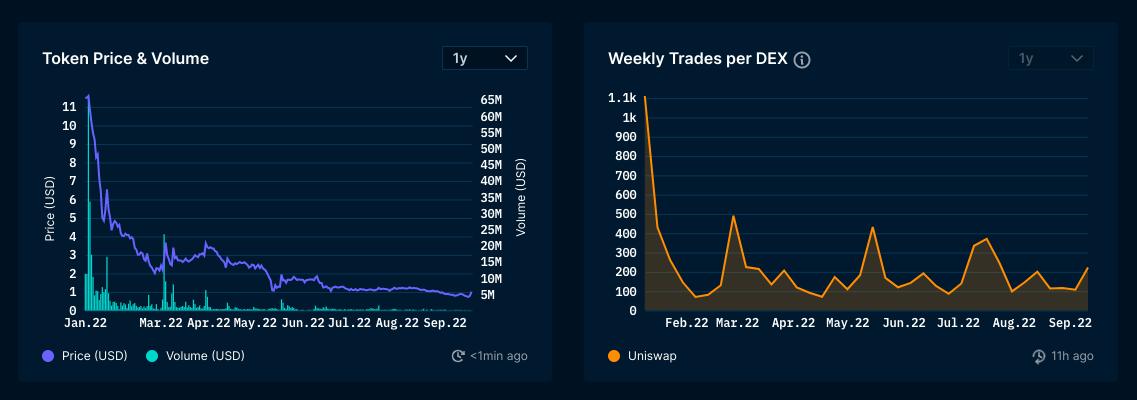

You can see that GFI’s transaction volume and transaction volume are each extremely reduced. This exhibits that substantial portfolios are not moving still. The trading comes mostly from retail traders / traders.

finish

GFI is a token that plays a specified part in the economics of the Goldfinch protocol, but there are even now a lot of factors to proceed to establish and refine to make a additional fantastic flywheel. Personally, I even now place GFI underneath handle for a lot of factors, such as the reality that Goldfinch is a pretty very well-organized undertaking, supported by a lot of substantial investment money, and is working and constructing steadily. If the undertaking continues to strengthen tokenomics in the long term, I imagine this will also be an chance for you to research and comprehend.

See you guys in the following posts!

Poseidon

See other content articles by the writer of Poseidon: