When it comes to Bridge tasks, it really is really hard not to mention Synapse. Synapse has been working stably, securely and effectively for a lot more than two many years, supporting the motion of significant quantities of assets as a result of several diverse chains. In today’s write-up, we analyze SYN – Synapse Native Token to see if SYN is a excellent token to hold for the lengthy phrase!

Maybe you are interested:

About Synapse

Synapse (SYN) is a cross-chain protocol that securely moves cryptographic assets involving diverse chains.

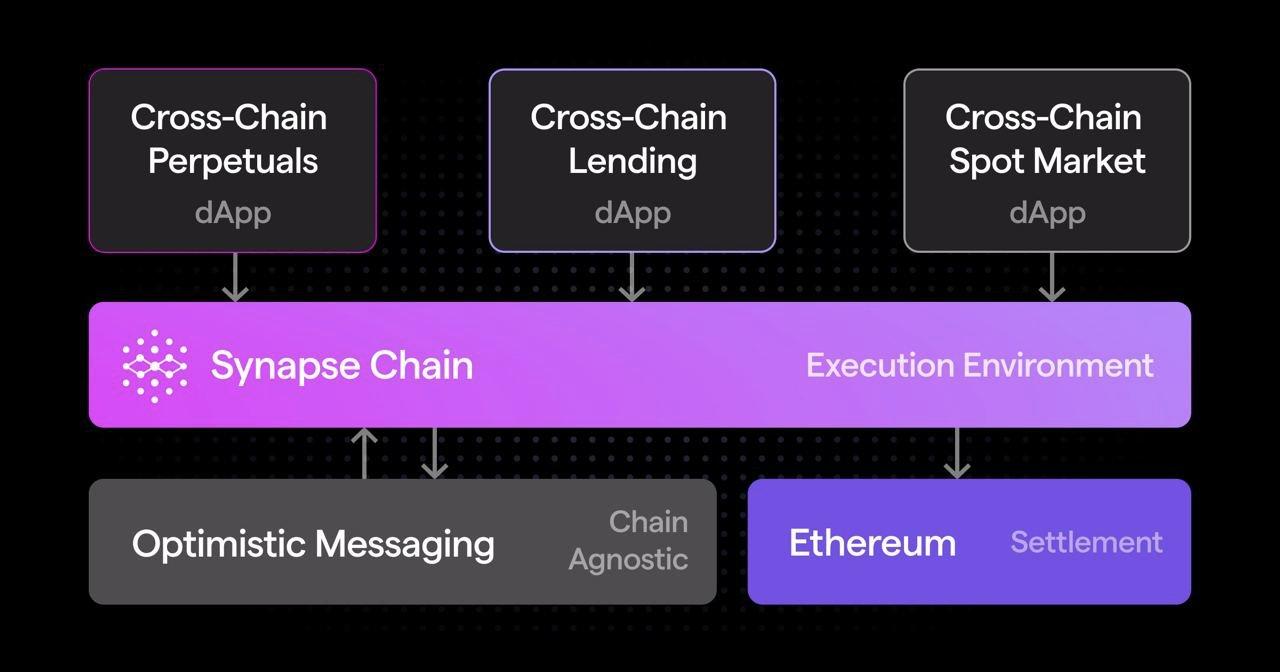

The Synapse protocol consists of three elements:

- Generalized cross-chain communication: a cross-chain facts relay.

- Optimistic Security Model: Optimistic protection mechanism.

- Synapse Bridge: Synapse Bridge.

one/ Generalized cross-chain communication: permits information to be sent as a result of chains securely and without the need of interruption. With this method, applications no longer will need to be distributed across several chains. Applications only will need to be deployed on a single blockchain and “communicate” with other blockchains for a single seamless consumer working experience. This information also consists of intelligent contract calls, making it possible for intelligent contracts to simply interact with each and every other.

two/ Optimistic protection model: The authentication mechanism of Synapse will work on the similar authentication mechanism of the Optimistic Rollup remedy. In essence, the mechanism will operate like this: transactions will be regarded as accurate till anyone proves it incorrect. If anyone doubts the accuracy of the transaction, he will have to go as a result of verification as a result of the implementation of transaction validation algorithms primarily based on offered information.

You can find out a lot more about Optimistic Rollup and Zk-Rollup at this paragraph.

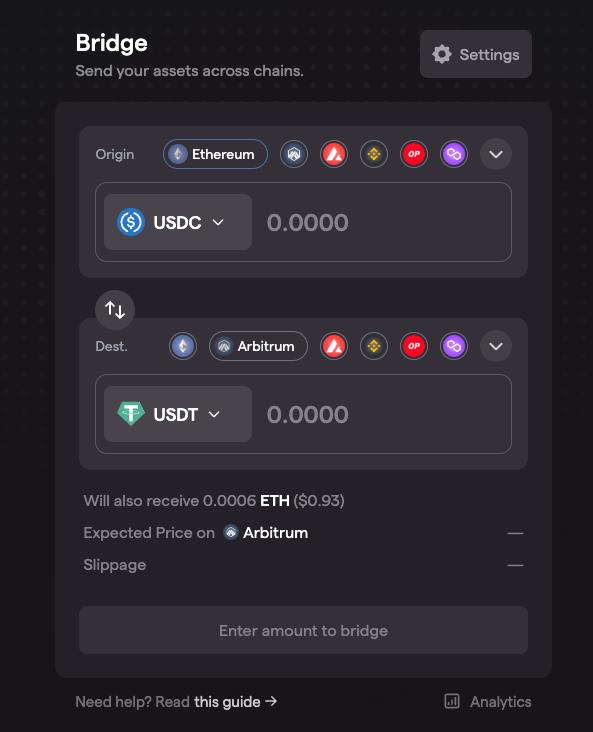

three/ Synaptic bridge: is a bridge that permits consumers to trade assets across a lot more than 15 blockchains in a risk-free and safe way. Synapse Bridge will assistance two varieties of bridges:

- Canonical Token Bridging: will support circulate assets in the type of wraps (e.g. WBTC, renBTC, stETH…)

- Liquidity-Base Bridging: Helps rotate authentic assets on chains with each and every other.

Furthermore, Synapse also permits developers to integrate cross-chain performance into their applications. As a outcome, developers can simply develop DeFi applications that run on several simultaneous chains.

Cross-chain AMM is Synapse’s flagship products for cross-chain asset trading. This products will work equivalent to a standard AMM, you will exchange token A for token B and vice versa. The only variation is that token A and token B are in two diverse chains.

In buy to convert tokens, Synapse AMM implements the StableSwap algorithm for pricing and rebalancing assets in a cross-chain liquidity pool to allow asset conversion with minimal slippage involving diverse chains.

According to the protocol announcement, Synapse will charge a commission of .04% of the transferred sum on each and every transaction.

tokenomics

SYN is a native Synapse token, with a Max Supply of 250 million tokens, a Total Supply of 192.seven million tokens, and a circulation of 139.eight million tokens.

Note: SYN is converted from NVR (previous task token) at the charge of one NVR = two.five SYN.

The existing SYN token has the following functions:

one/ Government: SYN is applied so that token holders can vote on proposals relevant to the operational governance of the protocol.

two/ Liquidity incentives: When liquidity companies deposit their assets to deliver liquidity to the protocol, they get a specific sum of reward (paid in SYN).

three/ Stakeout: validators to participate in information validation in the network (and get rewards) will have to consider a specific sum of SYN to assure accuracy and honesty for the duration of information validation. You must note that this characteristic is only offered when Synapse moves to the following stage of networking Archean and Proterozoic.

four/ Rates: SYN will be applied to pay out costs for network transactions.

SYN is a token allotted to liquidity pools, converted by NMR. So there will be no personal shifts for SYN. According to calculations, there will be around 630,000 SYN emissions each and every week.

The bull situation of SYN: The task will work nicely and attracts a good deal of volume => Rewards for liquidity companies + Validator improve => Attract a lot more liquidity + validator => More SYN staking.

Operational standing of the protocol

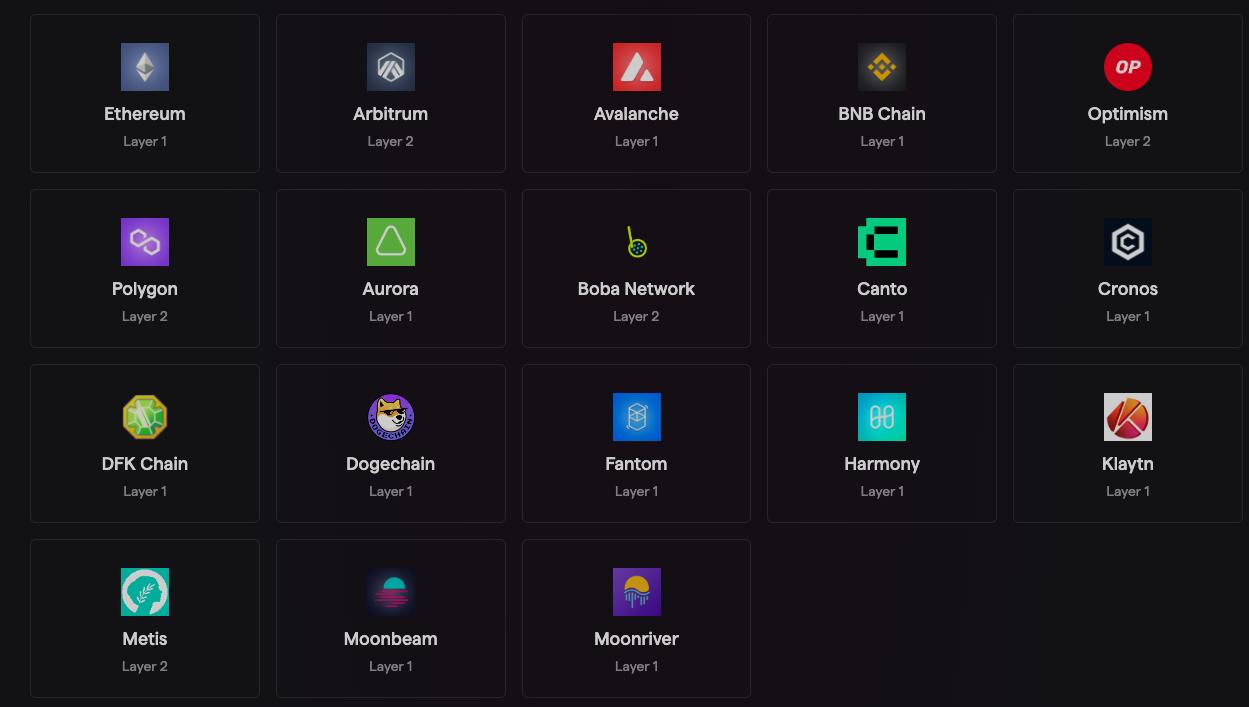

At the time of creating, Synapse supports 18 diverse blockchains, together with the most well-liked L1 and L2 blockchains. It can be stated that Synapse has performed a fantastic task in its background of protocol integration and self-proliferation. Recently, when the emerging Canto blockchain was observed, Synapse also integrated promptly and attracted a significant sum of volume from Canto.

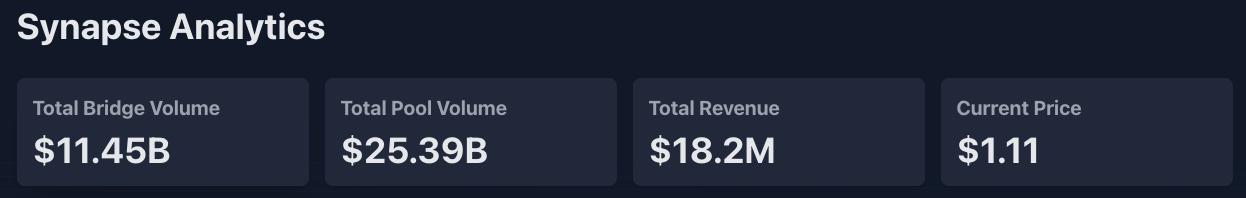

According to on-chain information, as of February ten, 2023, the complete volume of bridge as a result of Synapse reached $eleven.45 billion, resulting in a revenue of $18.two million.

Let’s evaluate volume and income involving Synapse and a number of other protocols:

| Rotation volume | TVL | Market capitalization | |

| Synapse | $eleven.45 billion | 200 million bucks | 187 million bucks |

| Multichain | $97.42 billion | $one.73 billion | 175 million bucks |

| Through | one billion bucks | 50 million bucks | eight million bucks |

Looking at the figures over, you will in all probability see that Synapse is priced very steeply in contrast to Multichain, a task with considerably greater figures. Is this statement accurate? I will analyze greater beneath!

Important update

Synapse V2 and chain of synapses is Synapse’s greatest and most essential update in 2022.

As an optimistic Ethereum-primarily based rollup made especially for cross-chain use circumstances, Synapse Chain will deliver developers with a generic intelligent contract interface for constructing native cross-chain use circumstances by leveraging the cross-chain messaging method. chain of Synapse. Applications primarily based on Synapse Chain will be in a position to execute their operational logic on any blockchain.

Synapse’s SYN Token will have several roles at the launch of Synapse Chain. Validators will will need to stake a specific sum of SYN to assure right and goal functionality of their purpose. In situation of fraud for the duration of the verification procedure, they will be fined or even shed the staked SYN. All consumers who personal SYN can stage to participate in network protection.

Going back to the pricing story, if Synapse Chain launches, the task is no longer just a “cross-chain bridge” but will be an ecosystem that can include several DApps. At this stage, Synapse’s $187 million industry cap will no longer be “expensive.”

SYN chain evaluation

To get a greater insight into the existing problem of SYN, let us analyze some on-chain information of this token.

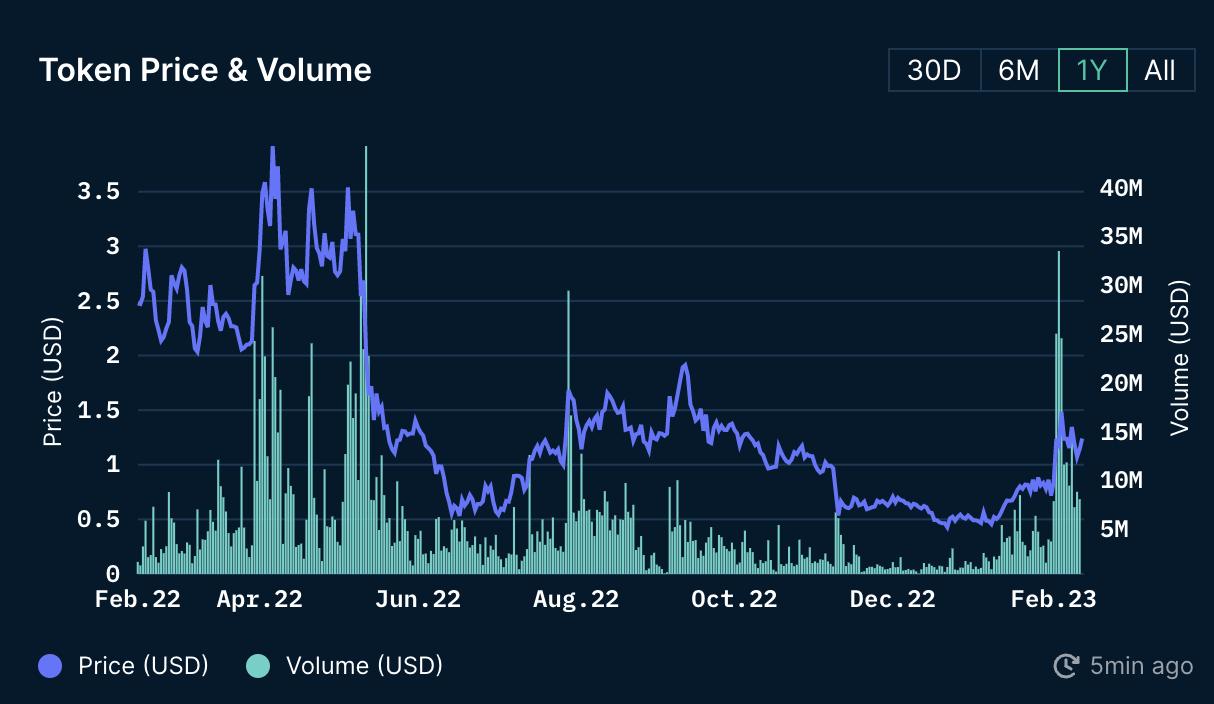

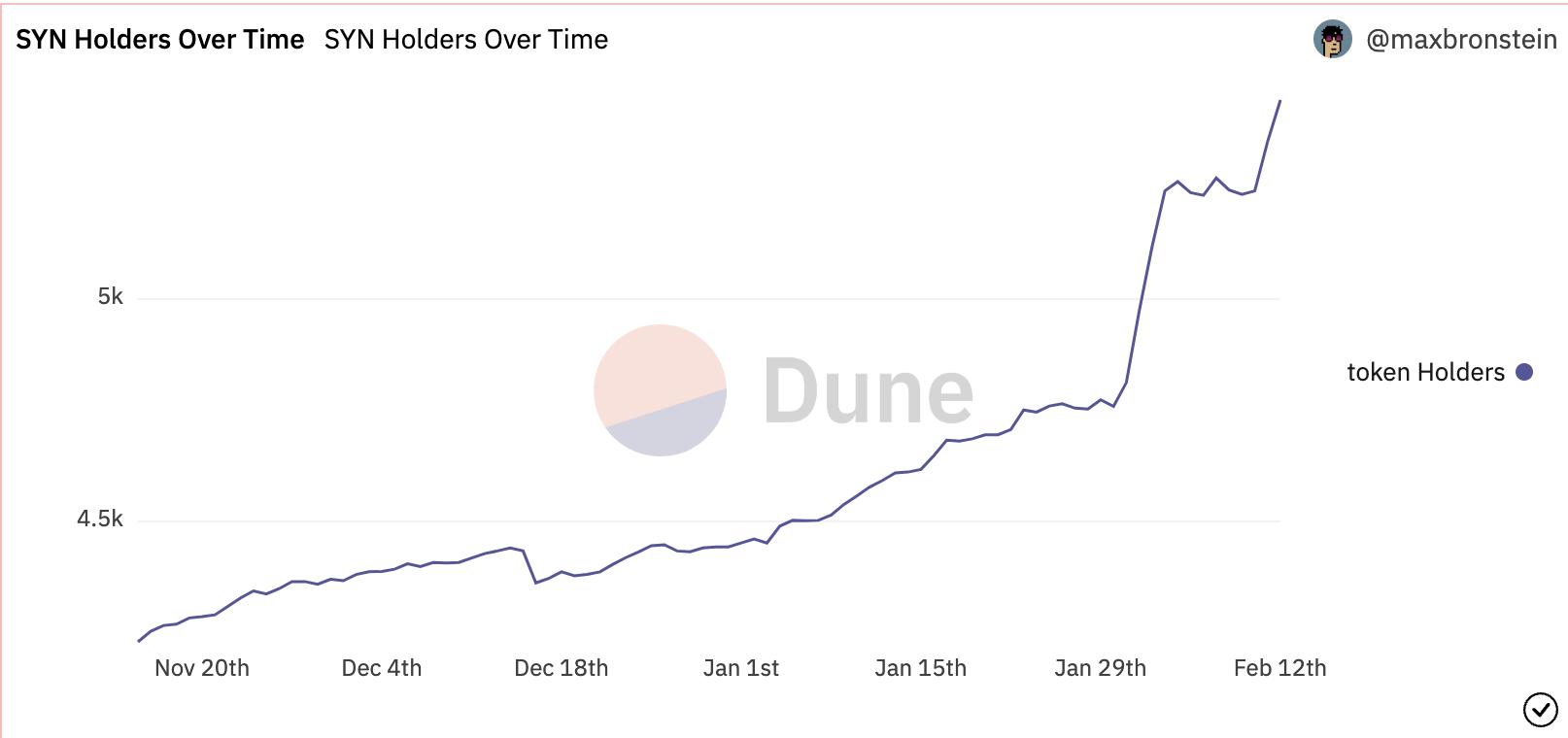

You can see that in January and February 2023, SYN was picked up very a good deal as volume elevated. You can see that the value sharply elevated right after that, but it did not lower considerably => the offering force was nevertheless not considerably and most of the customers in excellent positions have been nevertheless holding.

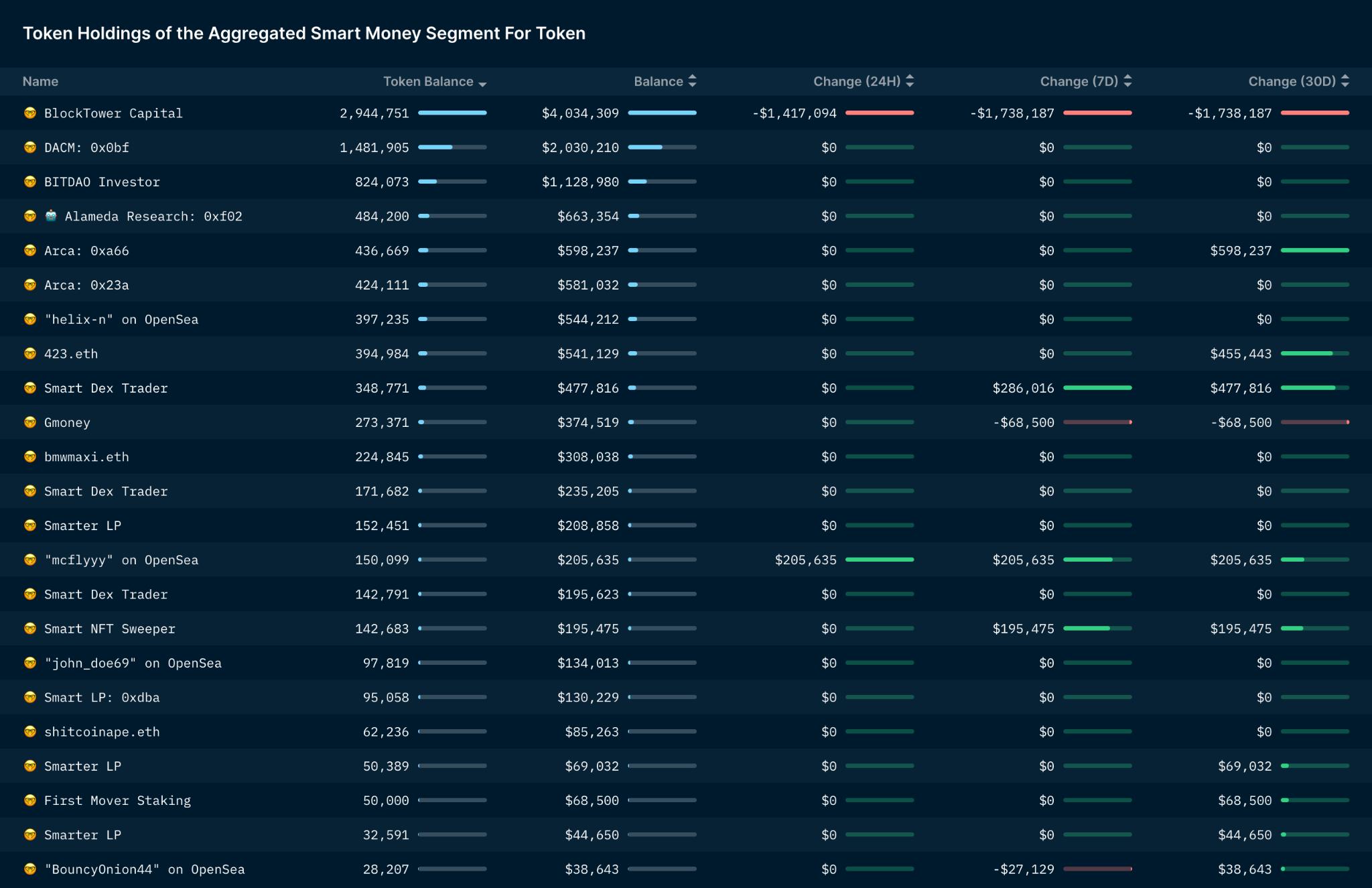

Next, my brothers and I looked at some “smart money” SYN holdings:

Most wallets holding SYN have not created any obvious moves. Most nevertheless carry on to “hold for the long haul”. You can examine a lot more facts Here.

The very first wallet is BlockTower Capital which not long ago moved a significant sum of SYN. I did a “trace” and located that BlockTower Capital was breaking down SYN to promote off steadily. Currently, BlockTower Capital’s portfolio is nevertheless the best SYN holder with around two.9 million SYN tokens in possession.

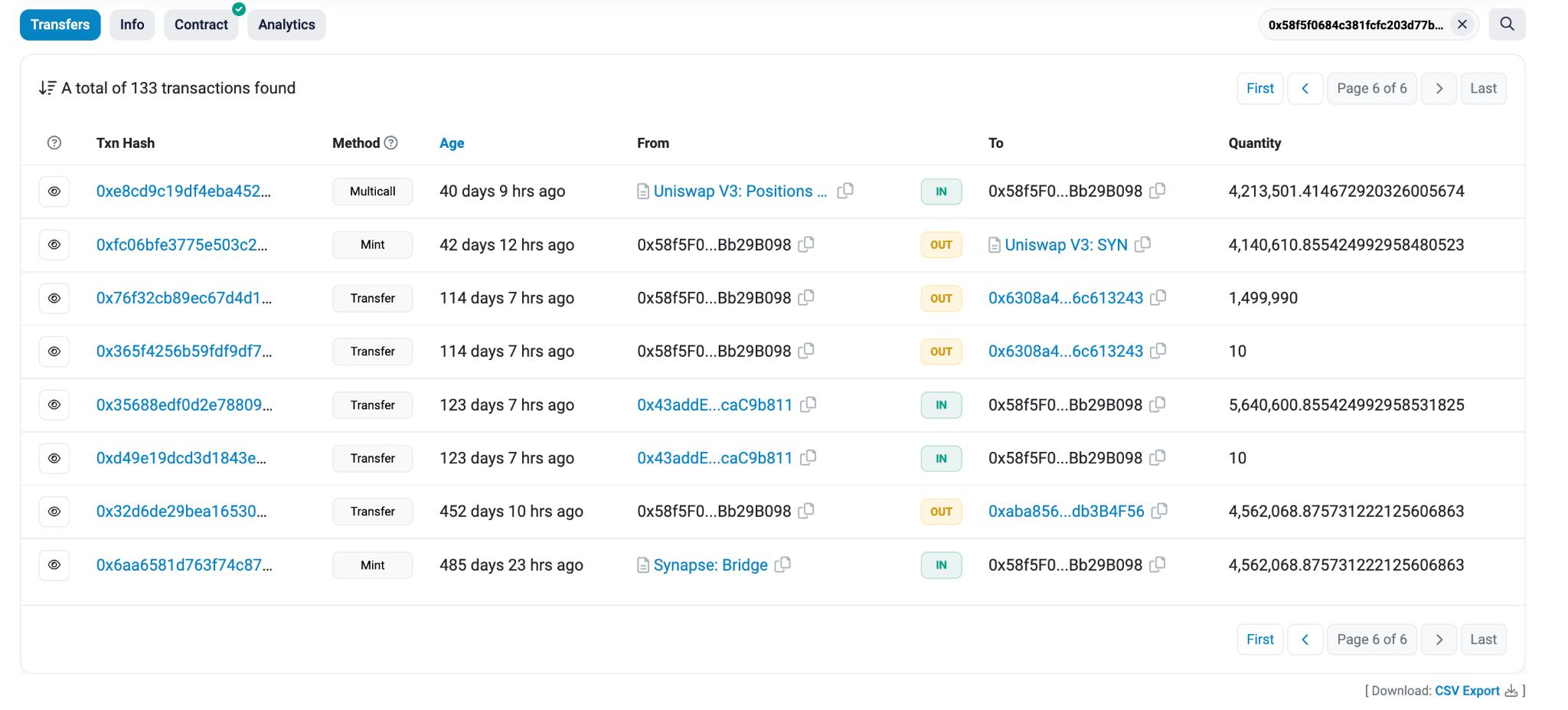

Going back, a lot more than a 12 months in the past, BlockTower Capital’s wallet obtained a lot more than four.five million SYN tokens (at that time they have been really worth about ~one.three USD/SYN).

This wallet then moved SYN as a result of two other wallets and came back with five.6M SYN tokens, then split it and supplied liquidity to four.2M SYN tokens in the pool on Uniswap v3.

From the over evaluation, we can see that BlockTower Capital has not created any revenue from holding SYN right after a lot more than one 12 months, it is probable that the move to promote the sum of SYN I talked about over is just closing a little portion of the place rather than promote right after revenue.

=> With the existing value all around ~one.two%, this is nevertheless a excellent place to take into account lengthy-phrase shopping for and holding for SYN.

The last

SYN is a token that has development options so far for a number of causes:

- The task has a products, secure operation, even at a excellent degree, producing a revenue even in a tough time when the industry is dealing with several problems.

- The approaching SYN Tokenomics will have several explosive spots at the launch of Synapse Chain, particularly the staking launch. I think this will support block a pretty significant sum of SYN.

- Synapse’s route is to develop the very best blockchain for tasks that want to build multi-chains. In truth, this niche now isn’t going to have several Synapse rivals. One of the greatest competing tasks is in all probability LayerZero, which is also just underneath development.

- Major wallets nevertheless hold SYN and have not but taken revenue. The existing value zone is also a excellent value zone for us to have a excellent place as intelligent cash.

However, I personally think that Synapse in basic and the SYN tokenomics nevertheless have points to do greater:

- Synapse Chain cast pace is nevertheless unclear. While there are several rumors about its launch in the close to potential, Synapse has but to make an official announcement.

- Competitive benefit risk…