With Bitcoin always failing thus far, failing to recuperate from its 50% fall from April’s all-time large, is crypto winter actually coming?

In its weekly report for the period ending June 21, 2021, CoinShares showed $79 million outflows from institutional crypto funds. This report marks the third successive seven-day period which has seen a negative balance in the flow of funds monitored by CoinShares for the first time since the bear market in 2018.

Bitcoin accounted for the majority of the outflows recorded last week at $89 million, with complete BTC outflows currently over $487 million since the beginning of the year. According into CoinShares, this represents about 1.6percent of their total assets under control of the funds obtained in the analysis.

On the other hand, Ethereum (ETH) only sees minimum outflows, totaling $1.9 million to deliver ETH outflows in 2021 to about $14.6 million, or 0.14percent of their total assets under management. this fund. Despite seeing just a tiny outward movement, ETH per week trading quantity by institutional investors has dropped by approximately 80% since peaking in May.

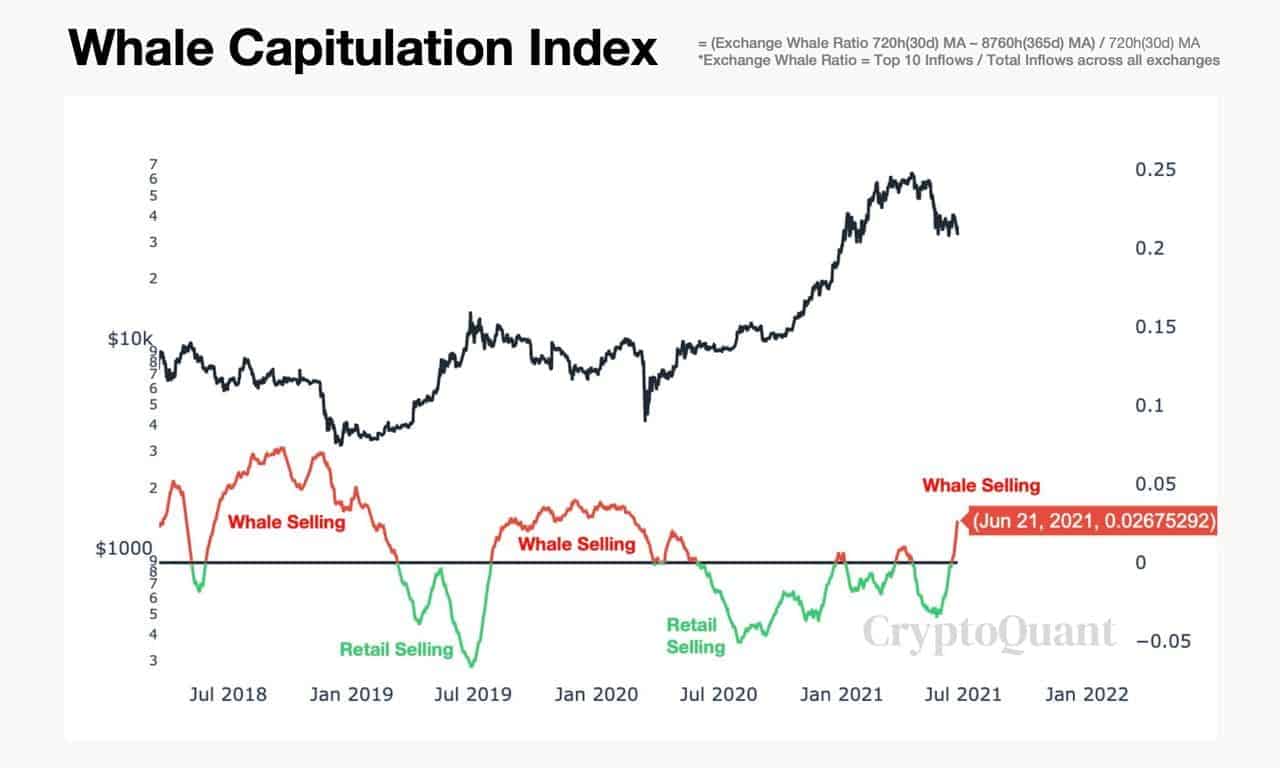

What’s more pernicious is that CryptoQuant CEO Ki Young Ju emphasized the platform’s whale fascination index showing a substantial increase in inflows in the pockets of major whales to Bitcoin exchanges. .

I hate to say this, but it seems like the Bitcoin keep market supported the trend. Too many whales are sending BTC to exchanges.

And Bitcoin cost action proves it. BTC plunged directly from the $35,000 place to the service level that’s regarded as the strongest around the threshold of $30,000 – $31,000. According into the normal cycle, when it strikes support and pulls out, BTC will immediately recover. But in the present context, things continue to be quite pessimistic.

See more: FUD from China: The reason BTC dropped to 32,000 USD is that?

Bitcoin Dominance is trending slightly up and now at 46.8percent at press time. However, using its capacity to lead the market rally, a small increase in Bitcoin Dominance is not sufficient to begin a new uptrend from the crypto market as the index should reach higher levels concerning behavior. short-term price movements.

Synthetic

Maybe you’re interested:

.