On August eight, the United States Department of the Treasury issued a specific sanction choice towards Tornado Cash, a platform that lets consumers to shield their privacy when transacting on the Ethereum blockchain, for its involvement in alleged assist to cash laundering exercise considering the fact that 2019. That signifies that the assets of any US citizen and organization situated on the platform will have to also be frozen and reported to the Office of Foreign Assets Control (OFAC).

A new underground storm has emerged in the DeFi marketplace.

When DeFi can’t escape the “hands” of the government

Starting with Circle, the firm behind 1 of the stablecoins with the biggest marketplace share in the cryptocurrency marketplace – USDC, has moved to freeze USDC 75,000 belonging to Tornado Cash consumers and USDC 149 that have been donated to this platform.

Following in Circle’s footsteps, infrastructure tasks this kind of as Infura, Alchemy, and DEX exchanges this kind of as dYdX, Balancer, or Uniswap have also announced that they are blocking consumers from accessing Tornado Cash.

when the defi apps begin spying on you, with backlinks

2021-ten-25 uniswap https://t.co/ym0wdNPJS6

2022-05-ten lace https://t.co/9588mTitKe

2022-06-29 balancer https://t.co/5V1FaxPUOn

2022-08-eleven oasis https://t.co/GzkOQXXPb9

2022-08-twelve aave https://t.co/vYY8MjqZ1p

(under no circumstances) wish, bend pic.twitter.com/1FkgVPnUqb– banteg (@bantg) August 12, 2022

Notably, in response to Circle’s lawsuit, MakerDAO, the task behind the algorithmic stablecoin DAI, hinted at promoting USDC as a reserve asset to DAI to obtain back ETH. This MakerDAO action has sparked fairly a bit of controversy, since it could indirectly push DAI into the LUNA-UST path not extended in the past: the cost of ETH is probably to drop sharply and the collateral worth for DAI is also pulled down, forcing Maker to promote ETH to anchor the cost of DAI, and consequently will more lessen the cost of ETH.

According to information from Defi Llama, in the previous week USDC’s marketplace capitalization has fallen by all around one.02%, DAI has fallen by all around two.85% though USDT has improved by .85%.

Tornado Cash and E-Gold lessons

Until August ten, an person from Tornado Cash’s advancement staff, Alexey Pertsev, was arrested by Dutch police. The cryptocurrency neighborhood on Twitter was shocked following this choice, since it sees it as an act towards freedom in a democratic society.

They arrested the developer of tornado money.

I repeat: a guy was arrested for creating code that served a public very good for persons to sustain their privacy on the net.

They place a guy in prison since lousy persons applied his open supply code.

This can’t hold up in any absolutely free society.

– RYAN SΞAN ADAMS – rsa.eth 🦇🔊 (@RyanSAdams) August 12, 2022

But Gold & Silver Reserve Inc.’s E-Gold lesson was even now there in the early 2000s. E-Gold is deemed to be 1 of Bitcoin’s precursor digital currencies. Similar to Bitcoin, E-Gold can be traded anonymously on the Internet and it is this aspect that tends to make E-Gold a favored device for cybercriminals. A quantity of unlawful actions this kind of as fraud and cash laundering have been carried out with E-Gold. In 2007, Douglas Jackson and his associates, who founded G & SR, had been accused by the United States Department of Justice of cash laundering and arranging unlawful cash transfers. He was sentenced to 300 hrs of neighborhood support, a $ 200 fine and 3 many years of household arrest.

When the danger turns into the cost of decentralization

Obviously, neither E-Gold nor Tornado Cash intend to be accomplices of criminals, they just want to produce platforms that can shield users’ privacy, a pretty genuine require of any one.

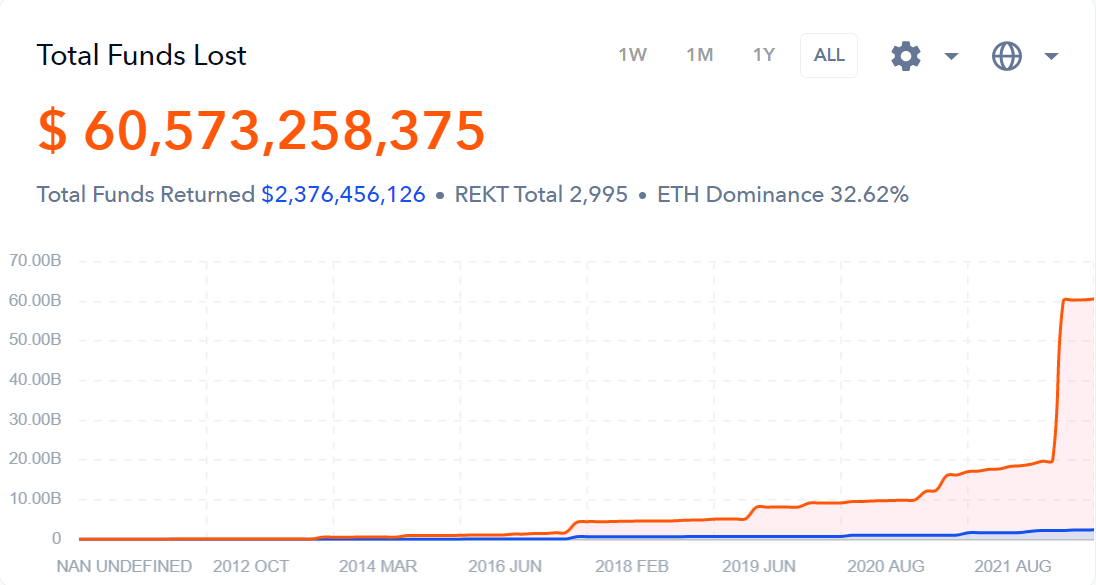

But the pretty existence of Tornado Cash inadvertently produces a safe and sound exit for cybercriminals with the unlawful coins they earn. According to statistics from REKT Database, there have been virtually three,000 cryptocurrency attacks and scams so far with a complete reduction of more than $ 60 billion – approximately the capitalization of a third-biggest coin in the marketplace – no compact quantity. And though the volume of cash returned is not significantly, just more than five% of the stolen money, it can be even now a significant energy to guarantee fairness to all marketplace participants in the cryptocurrency room.

Perhaps it is time for the cryptocurrency neighborhood to query the part and significance of decentralization and economic freedom in the fairness and equality of all marketplace participants.

Decentralization is designed by the blockchain to guarantee fairness, but in which is justice when consumers are not protected from the evil forces that are often waiting to assault them?

Never Fan

See other articles or blog posts by writer Mai Phan: