Total cryptocurrency marketplace cap has rebounded over $ two trillion soon after falling under this threshold given that mid-January.

After the marketplace carnage that lasted given that December 2021, culminating in the collapse of Bitcoin to $ 33,000 triggering traders to reduce $ two.five billion, a constructive signal has appeared with in excess of $ 500 billion returned to the cryptocurrency marketplace in the final two weeks. .

Statistics present that as of January 24, the complete marketplace capitalization is hovering about $ one.five trillion. Since then, the index has steadily entered a steady phase, raising by a lot more than 36%, to attain the milestone of $ two.08 trillion on February seven, 2022. Bitcoin (BTC) at this time holds a marketplace capitalization share of 39.four % on the marketplace even though Ethereum (ETH) is 17.9%.

Much of the market’s traction, of program, largely depends on Bitcoin’s volatility. Despite remaining stalled from recovering to $ two,000 by pressures from United kingdom tax authorities, BTC adapted rapidly and maintained its development momentum thanks to professional-crypto macro information from quite a few nations, as nicely as solid investment action from big businesses. institutions.

The Russian government has officially “turned the wheel”, agreeing to perform out a roadmap to regulate cryptocurrencies alternatively of a complete ban in accordance to the central bank’s proposal presented in late January, a trigger for panic. BTC marketing strain. Because the Russian people today personal a lot more than $ 200 billion really worth of cryptocurrencies, which is twelve% of the complete marketplace capitalization.

Following Russia’s action is India. The nation also announced ideas to employ a CBDC and impose a thirty% tax (the highest tax fee in India) on cryptocurrencies, which was accredited by Prime Minister Narendra Modi. Despite the introduction of incredibly higher tax laws with the aim of limiting the wave of investment by people today in the nation, this is also deemed a move to “legitimize” the cryptocurrency marketplace with respect to the absolute hostility in direction of the nation right here in the Village.

Furthermore, El Salavador’s determination contributes considerably to the trend of creating self-confidence in Bitcoin’s possible in the long term. Although the International Monetary Fund (IMF) has asked El Salvador to end applying Bitcoin as its currency, the nation has nevertheless firmly rejected this present, following the authentic line of growth of Bitcoin in accordance to the wishes of President Nayib Bukele. Recently, El Salvador also launched a Bitcoin schooling center as nicely as upgrading the Chivo wallet.

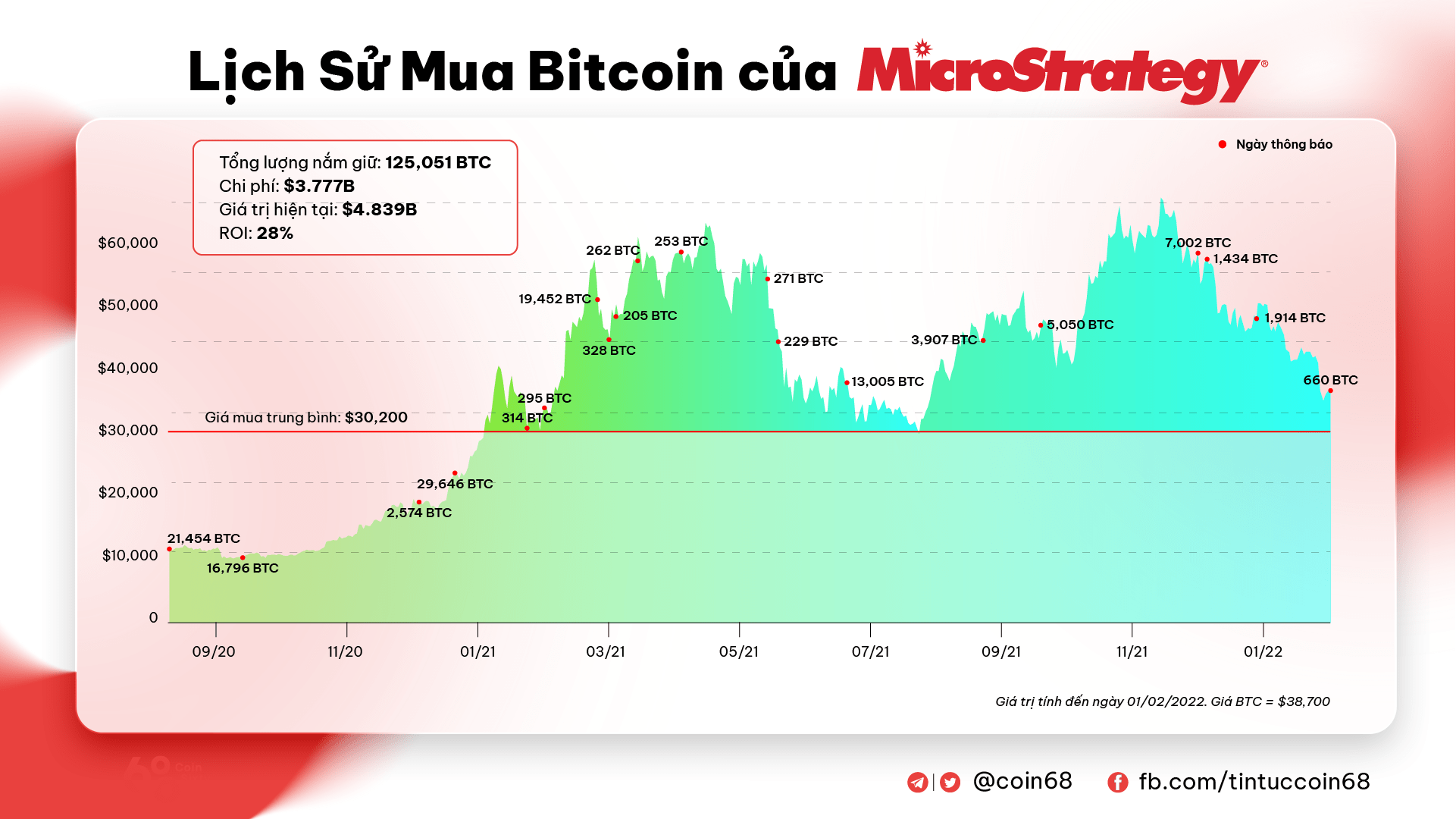

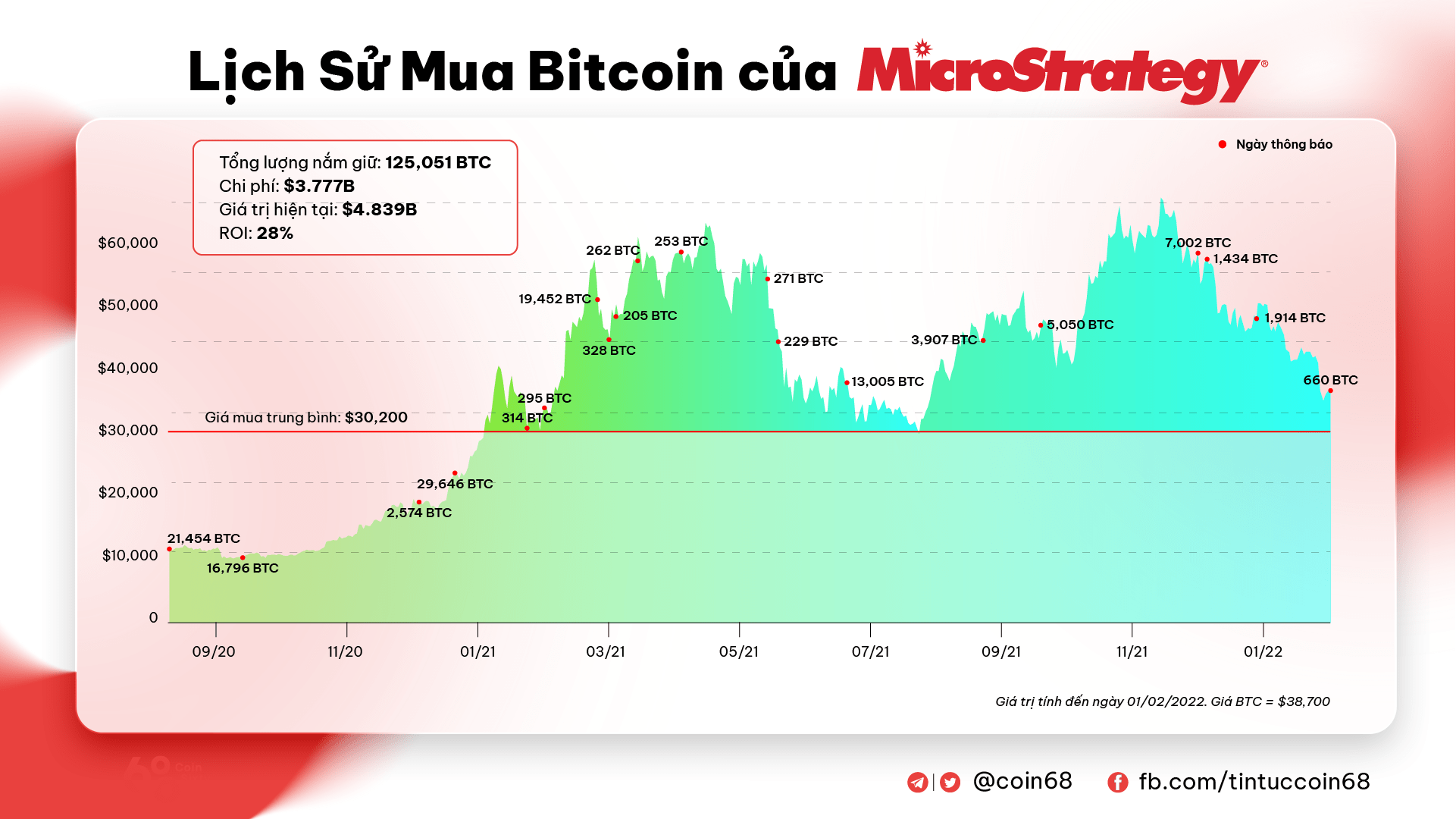

In terms of institutional investment, MicroStrategy is almost certainly the most mentioned representative. Have there been considerations that MicroStrategy will promote its BTC as the marketplace enters a extended-phrase bearish cycle? Reality demonstrates a entirely diverse image.

MicroStrategy went on to purchase one more $ 25 million in Bitcoin in early February, bringing its Bitcoin holdings to 120,051 BTC, at an regular value of $ thirty,200 per BTC. MicroStrategy’s Chief Financial Officer mentioned the company’s system is to stay constructive to include Bitcoin this 12 months regardless of adverse marketplace response. Meanwhile, CEO Michael Saylor himself has stated that he will certainly not promote any Bitcoins.

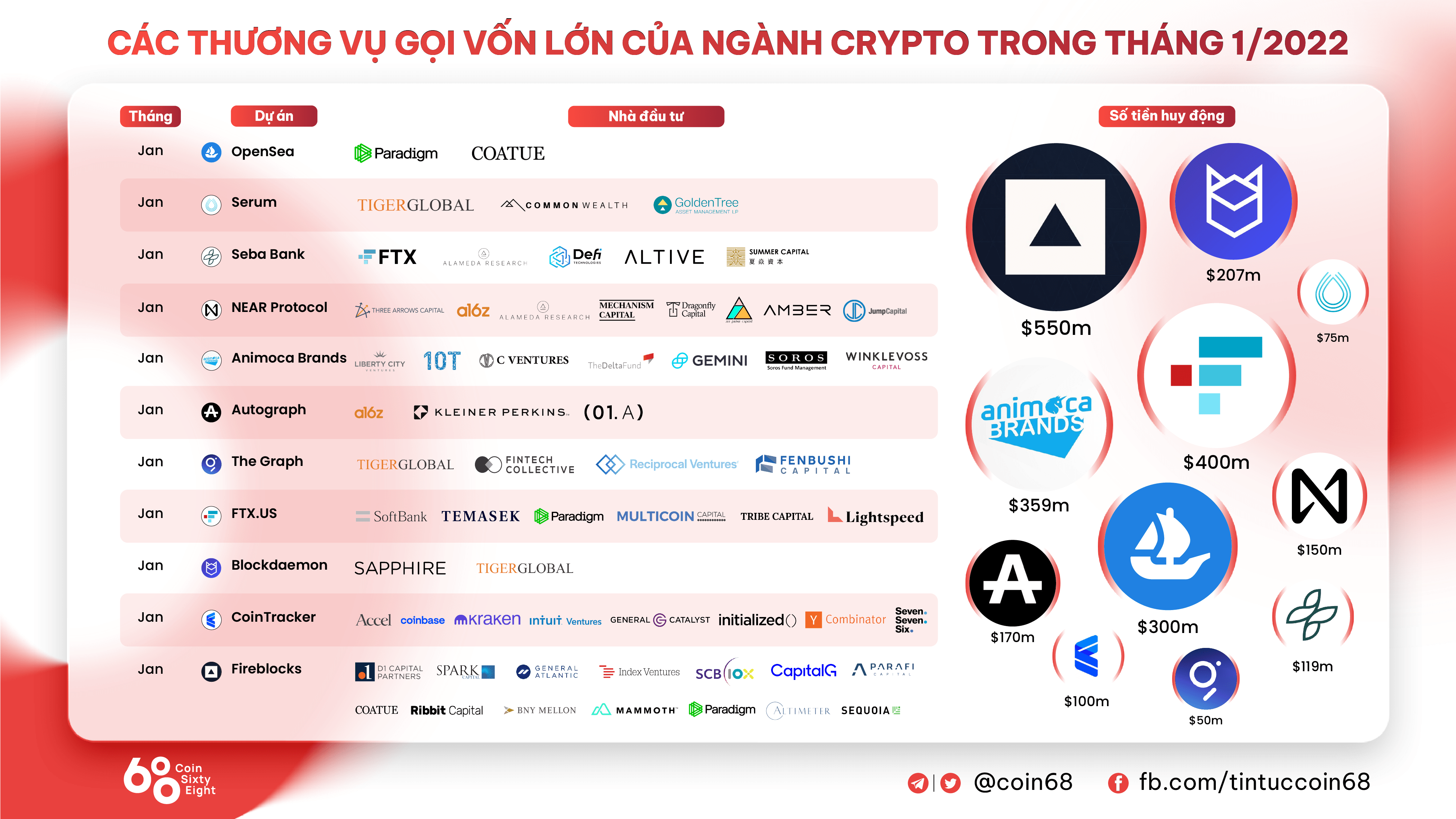

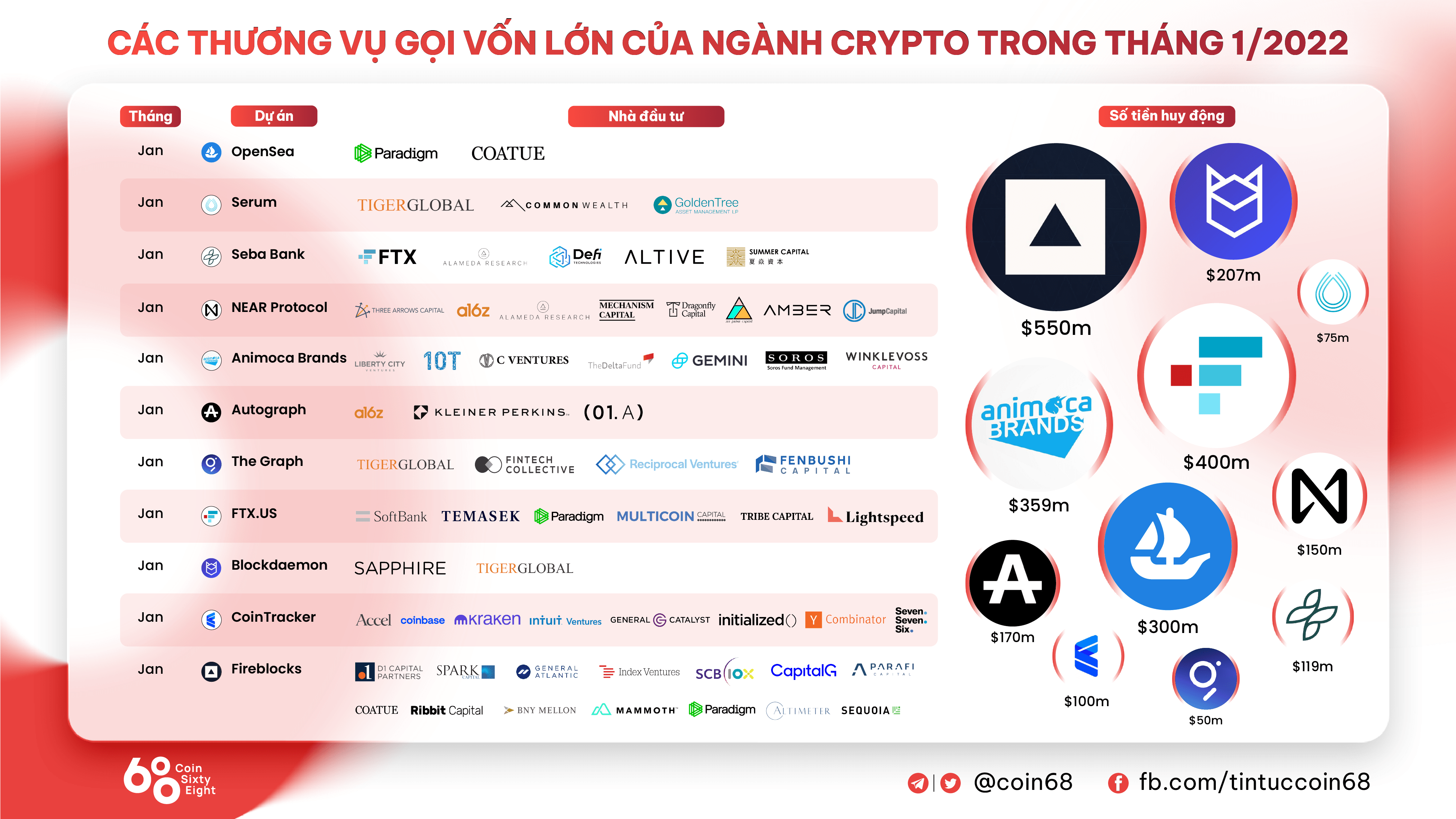

On the other hand, the explosion of the altcoin assortment has also attracted pretty solid funds flows to the marketplace, primarily from the wave of fundraising, investment discounts and the launch of the ecosystem growth stimulus bundle from quite a few common platforms for proceed to capitalize on possibilities and strengthen the place in the sector.

In the 1st month of 2022 alone, the over listing was continually expanded by a series of pending discounts this kind of as FTX Exchange ($ two billion), FTX.US ($ 400 million), Animoca Brands ($ 359 million). bucks). , Microsoft (acquired Activision Blizzard for $ 68.seven billion), OpenSea ($ 300 million), NFT Autograph platform ($ 170 million), Secret Network ($ 400 million), ICON ($ 200 million) , Close to Protocol ($ 150 million), Serum ($ 75 million)) and Polygon ($ 450 million).

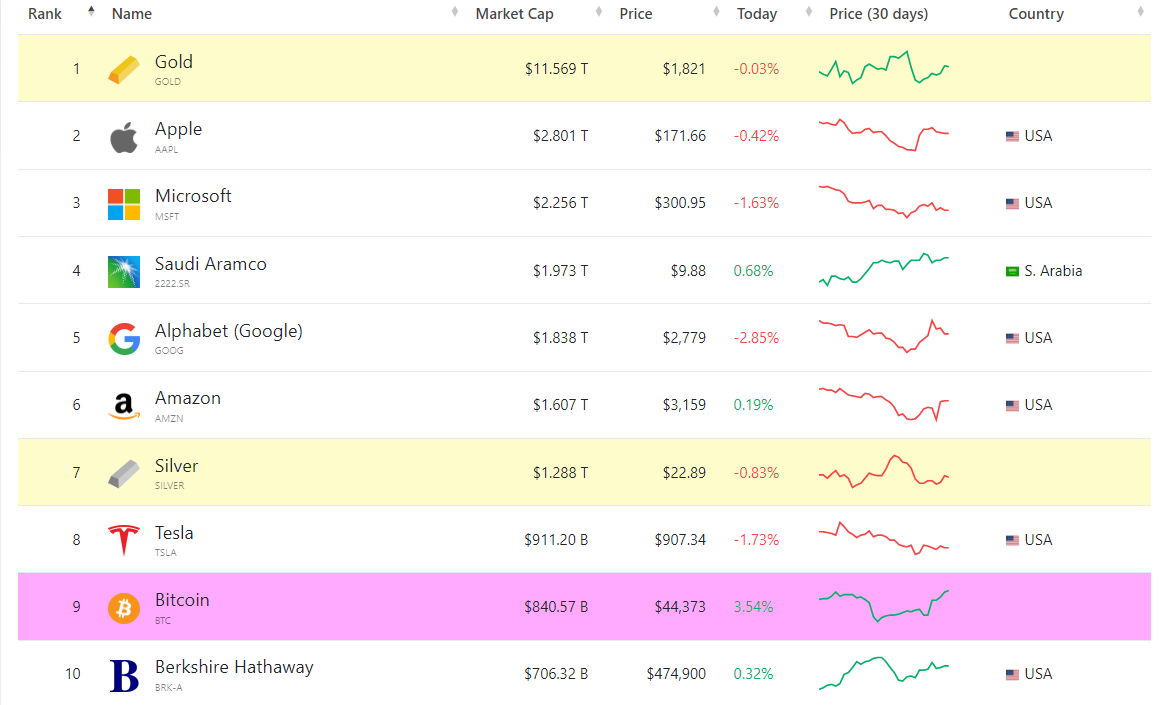

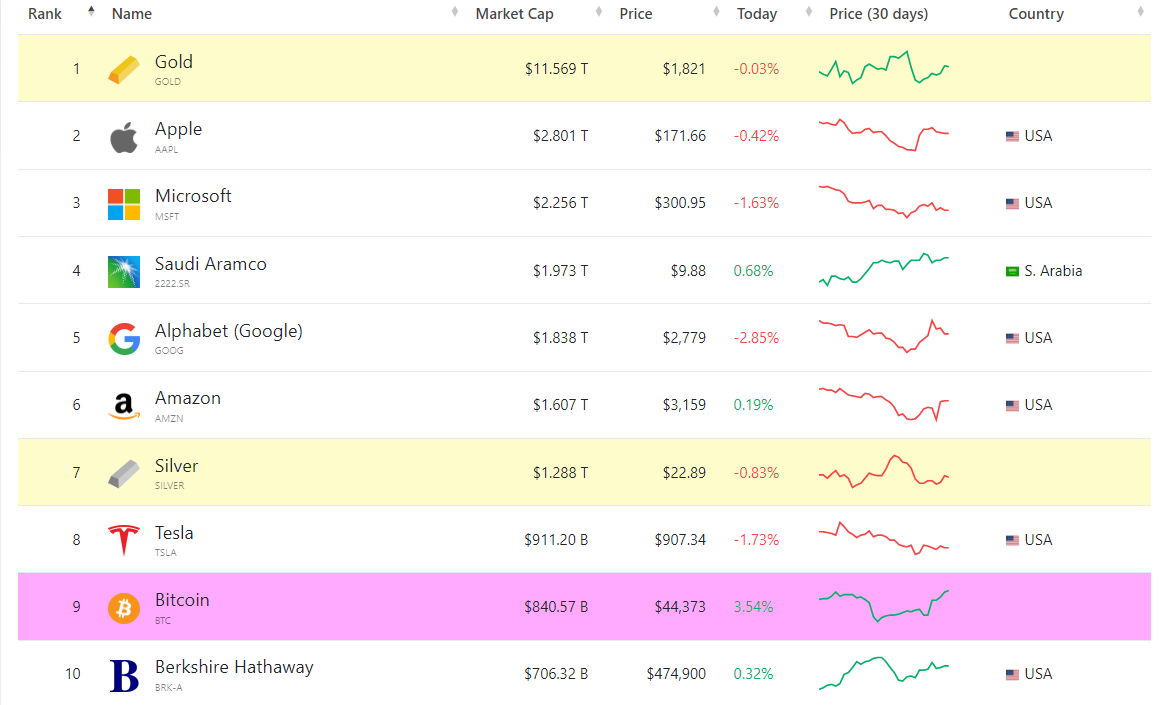

Overall, with the milestone of just in excess of $ two trillion, Bitcoin the moment yet again entered the leading ten most useful assets by all round valuation with $ 840.57 billion in marketplace capitalization. However, BTC nevertheless desires a lot more momentum to proceed reaching more in the close to long term, instantly beating the record $ three trillion complete marketplace capitalization recorded in November 2021.

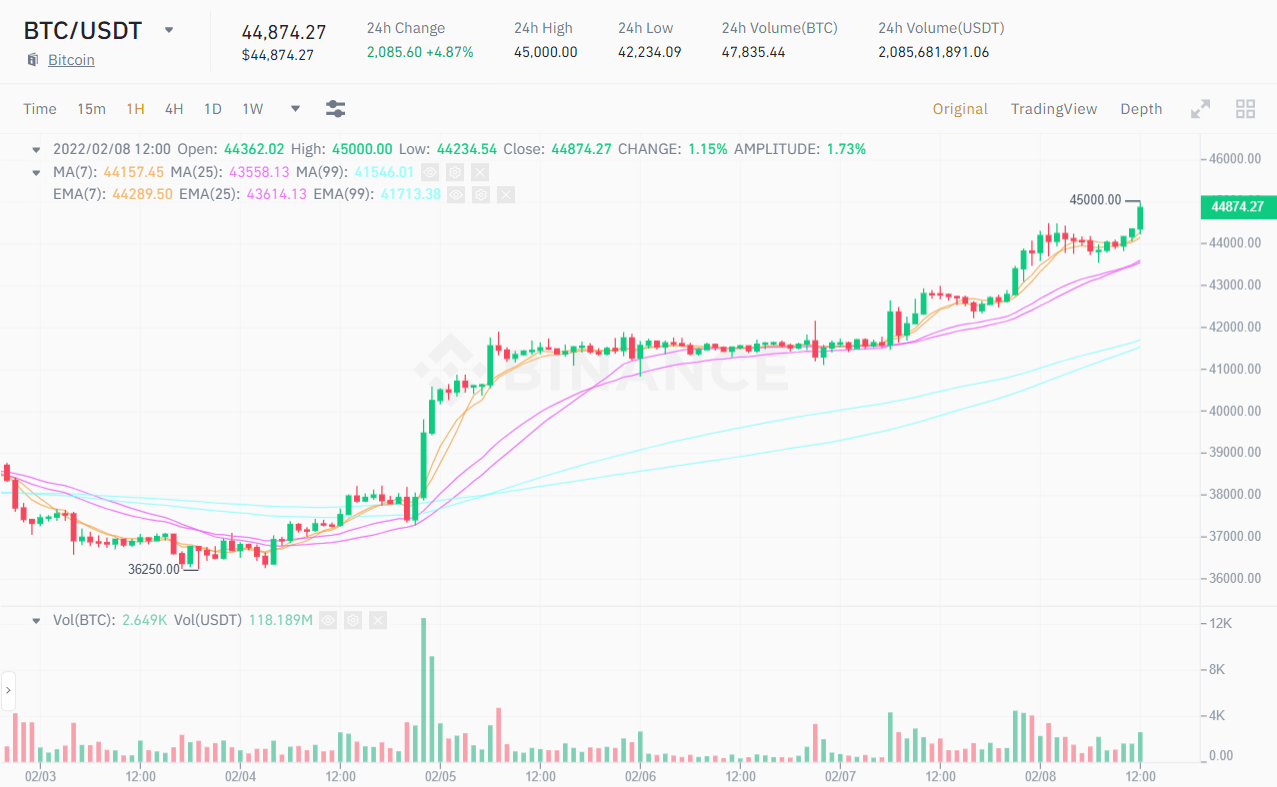

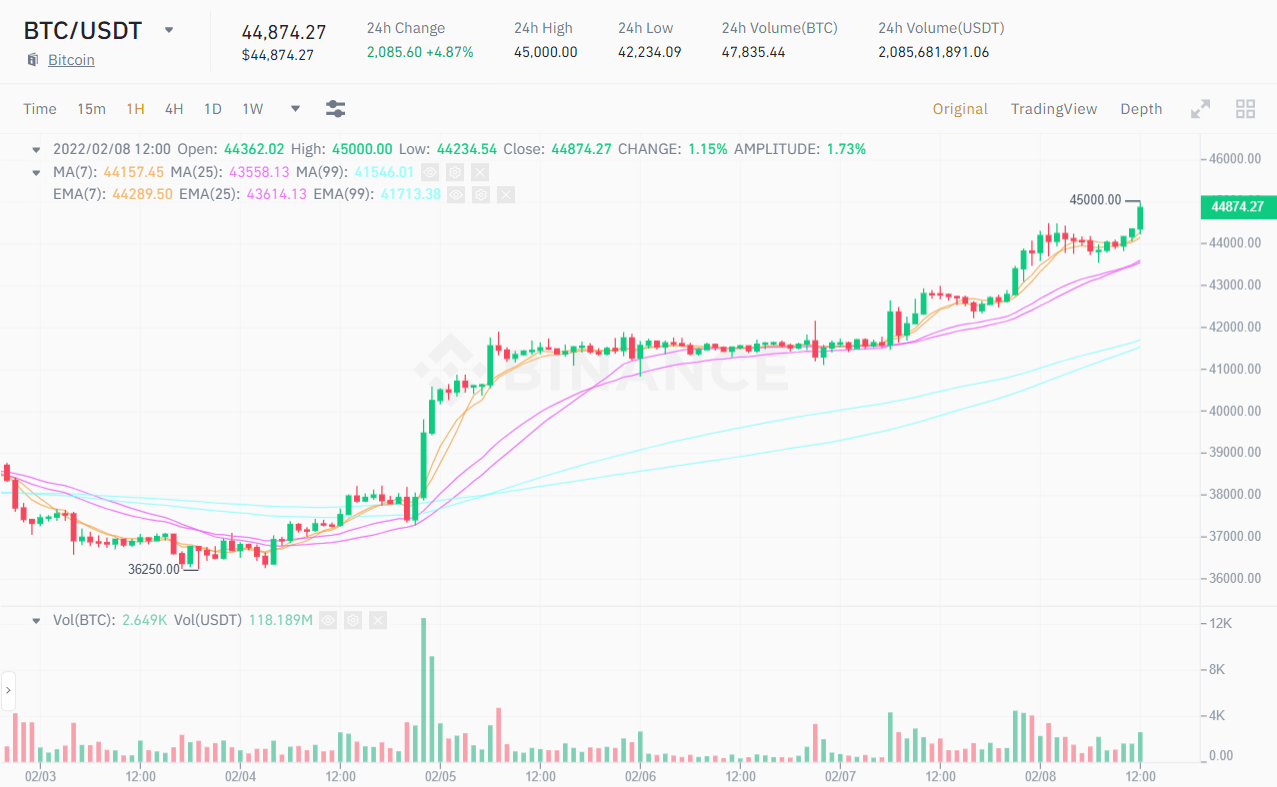

As of press time, Bitcoin has maintained nutritious bullish momentum in excess of the previous 24 hrs, trading at $ 44,874, an intraday higher of $ 45,000.

Synthetic currency 68

Maybe you are interested:

Total cryptocurrency marketplace cap has rebounded over $ two trillion soon after falling under this threshold given that mid-January.

After the marketplace carnage that lasted given that December 2021, culminating in the collapse of Bitcoin to $ 33,000 triggering traders to reduce $ two.five billion, a constructive signal has appeared with in excess of $ 500 billion returned to the cryptocurrency marketplace in the final two weeks. .

Statistics present that as of January 24, the complete marketplace capitalization is hovering about $ one.five trillion. Since then, the index has steadily entered a steady phase, raising by a lot more than 36%, to attain the milestone of $ two.08 trillion on February seven, 2022. Bitcoin (BTC) at this time holds a marketplace capitalization share of 39.four % on the marketplace even though Ethereum (ETH) is 17.9%.

Much of the market’s traction, of program, largely depends on Bitcoin’s volatility. Despite remaining stalled from recovering to $ two,000 by pressures from United kingdom tax authorities, BTC adapted rapidly and maintained its development momentum thanks to professional-crypto macro information from quite a few nations, as nicely as solid investment action from big businesses. institutions.

The Russian government has officially “turned the wheel”, agreeing to perform out a roadmap to regulate cryptocurrencies alternatively of a complete ban in accordance to the central bank’s proposal presented in late January, a trigger for panic. BTC marketing strain. Because the Russian people today personal a lot more than $ 200 billion really worth of cryptocurrencies, which is twelve% of the complete marketplace capitalization.

Following Russia’s action is India. The nation also announced ideas to employ a CBDC and impose a thirty% tax (the highest tax fee in India) on cryptocurrencies, which was accredited by Prime Minister Narendra Modi. Despite the introduction of incredibly higher tax laws with the aim of limiting the wave of investment by people today in the nation, this is also deemed a move to “legitimize” the cryptocurrency marketplace with respect to the absolute hostility in direction of the nation right here in the Village.

Furthermore, El Salavador’s determination contributes considerably to the trend of creating self-confidence in Bitcoin’s possible in the long term. Although the International Monetary Fund (IMF) has asked El Salvador to end applying Bitcoin as its currency, the nation has nevertheless firmly rejected this present, following the authentic line of growth of Bitcoin in accordance to the wishes of President Nayib Bukele. Recently, El Salvador also launched a Bitcoin schooling center as nicely as upgrading the Chivo wallet.

In terms of institutional investment, MicroStrategy is almost certainly the most mentioned representative. Have there been considerations that MicroStrategy will promote its BTC as the marketplace enters a extended-phrase bearish cycle? Reality demonstrates a entirely diverse image.

MicroStrategy went on to purchase one more $ 25 million in Bitcoin in early February, bringing its Bitcoin holdings to 120,051 BTC, at an regular value of $ thirty,200 per BTC. MicroStrategy’s Chief Financial Officer mentioned the company’s system is to stay constructive to include Bitcoin this 12 months regardless of adverse marketplace response. Meanwhile, CEO Michael Saylor himself has stated that he will certainly not promote any Bitcoins.

On the other hand, the explosion of the altcoin assortment has also attracted pretty solid funds flows to the marketplace, primarily from the wave of fundraising, investment discounts and the launch of the ecosystem growth stimulus bundle from quite a few common platforms for proceed to capitalize on possibilities and strengthen the place in the sector.

In the 1st month of 2022 alone, the over listing was continually expanded by a series of pending discounts this kind of as FTX Exchange ($ two billion), FTX.US ($ 400 million), Animoca Brands ($ 359 million). bucks). , Microsoft (acquired Activision Blizzard for $ 68.seven billion), OpenSea ($ 300 million), NFT Autograph platform ($ 170 million), Secret Network ($ 400 million), ICON ($ 200 million) , Close to Protocol ($ 150 million), Serum ($ 75 million)) and Polygon ($ 450 million).

Overall, with the milestone of just in excess of $ two trillion, Bitcoin the moment yet again entered the leading ten most useful assets by all round valuation with $ 840.57 billion in marketplace capitalization. However, BTC nevertheless desires a lot more momentum to proceed reaching more in the close to long term, instantly beating the record $ three trillion complete marketplace capitalization recorded in November 2021.

As of press time, Bitcoin has maintained nutritious bullish momentum in excess of the previous 24 hrs, trading at $ 44,874, an intraday higher of $ 45,000.

Synthetic currency 68

Maybe you are interested: