What is the Trader Joe Project?

Founded in June 2021 by 0xMurloc and Cryptofish. Trader Joe’s roots grew out of a wish to mix, generate a special and genuinely ground breaking trading platform that will resonate with the emerging superiority of the Avalanche blockchain, serving a international audience and rising on the frontiers of decentralized finance. Since its launch, the platform has amassed in excess of $ four billion in assets and has obtained backing from some of the most broadly acknowledged traders in the field.

Trader Joe at first produced the AMM function, which lets for frequent token exchanges, immediately after a time period of extreme improvement. Currently Trader Joe has presented lots of DeFi options on the exact same platform from Trade, Zap, Swap, Lending, Yield Farming, Staking. Currently this is the AMM platform with the highest trading volume on Avalanche.

The highlights of Trader Joe

- Short “1-click” device: Trader Joe gives a basic and integrated device to make it possible for DeFi consumers to quick promote on an automated exchange. Users can see pertinent metrics (rate effect, slippage, and so on.) straight on the interface and conveniently control and update their positions on the dashboard.

- Foreign exchange marketplace without having authorization: Trader Joe lets consumers to immediately generate a dollars marketplace for any ERC-twenty token, supporting prolonged queues of sources. Anything from fractional NFTs to mature tokens can be listed on Trader Joe.

- Isolated collateral model: To assistance volatile assets, Trader Joe introduces an isolated collateral model wherever the consumer is only liable for collateral explicitly linked to a place.

Features of Trader Joe

Exchange tokens

As an automated marketplace-producing exchange “automated market maker “ (AMM) lets consumers to exchange tokens. Features are not in depth in this part.

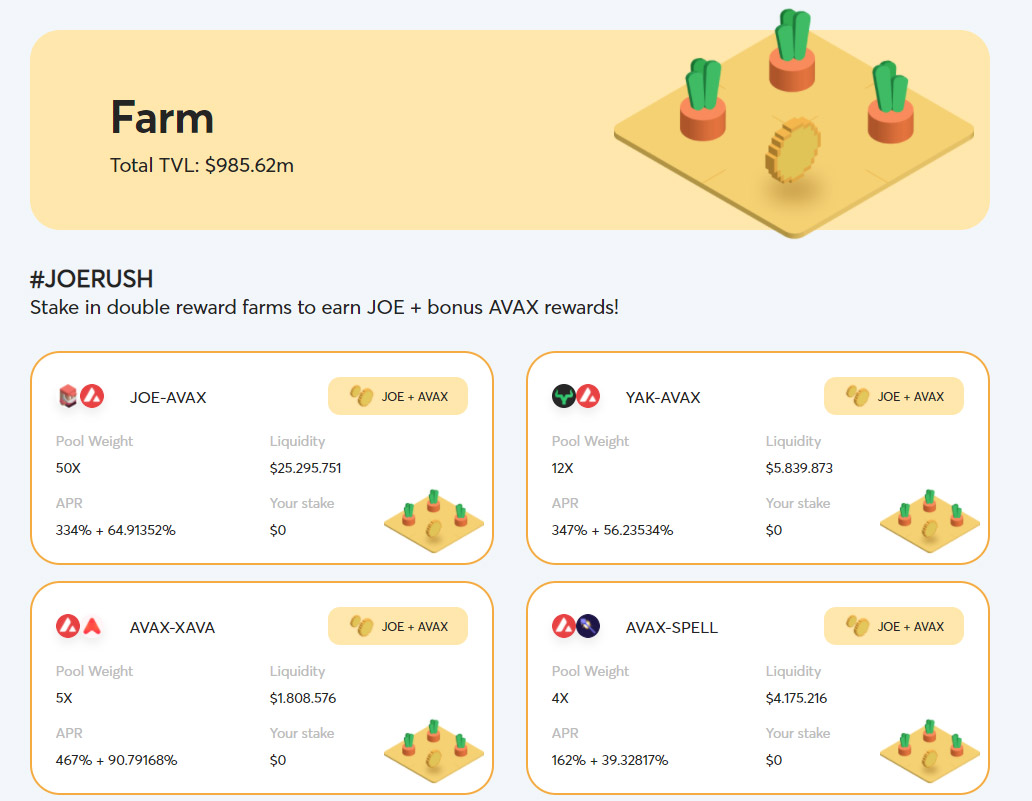

Farm tokens

Trader Joe aids consumers earn JOE by putting tokens that supply liquidity “liquidity provider “ (LP). Token farm performance will not be covered in detail in this post.

Bet tokens

Aim your JOE tokens to earn much more JOE primarily based on the assortment platform protocol charges.

xJOE is the principal staking mechanism on the Trader Joe ecosystem. When you bet your JOE, you will trade JOE for xJOE primarily based on a ratio. Over time, you will earn much more and much more JOEs by holding xJOE tokens.

This is simply because for just about every swap on Trader Joe a .05% commission is charged and sent to the xJOE crew. This charge is employed to redeem JOE tokens periodically (at the moment, redemption takes place each two days). So when you trade your xJOE for JOE, you will get much more JOE than you started out with.

Borrow Tokens

Users can lend and borrow tokens from Trader Joe and earn earnings by means of Yield or by utilizing “trading leverage”.

Loan give

To interact with Banker Joe’s solutions, consumers will go to the Lending web page on the web-site and deposit one particular of the tokens into the whitelist. In return, we will give them a receipt, for instance, the consumer deposits dollars in AVAX and in return receives jAVAX. The accrued curiosity will improve in excess of time (performs very similar to xJOE). When consumers return jAVAXreceipt to banker Joe, they will get the authentic AVAX + the added AVAX earned at the best.

Loan

In addition to giving an asset, consumers can also borrow towards that residence to use as collateral. For instance, a borrower could supply ETH to a jETH contract and then borrow AVAX from a jAVAX contract. The quantity of AVAX that a borrower can borrow is established by the collateral component of ETH. For instance, if a borrower has presented one ETH as collateral and the collateral component of ETH is 65%, they can borrow .65 ETH well worth of AVAX.

Roadmap

- State one: Take the standard AMM model but include lots of tiny enhancements. This stage is about mastering how to get the basis correct.

- Phase two: Lending mixed with trading benefits in leveraged trading. This phase consists of the delivery of nonetheless new items to Avalanche.

- Phase three: Our really serious investigate phase and our prolonged-phrase vision for Trader Joe – turn into the R&D hub for DeFi innovation. Some of the parts we are hunting at are restrict and derivative orders.

What is the JOE token? Joe’s essentials

JOE is the native token of the Trader Joe platform. JOE has a fixed complete provide and is distributed in a descending generation model.

- Administration.

- As a reward for token holders (Staker, Farmer, Provider LQ).

Basic Information Token Trader Joe (JOE)

- Token identify: Trader Joe’s Token

- Ticker: JOE

- Blockchain: Avalanche

- Standard tokens: ARC-twenty

- Circulation provide: 0x6e84a6216eA6dACC71eE8E6b0a5B7322EEbC0fDd

- Total original provide: 500,000,000 JOE.

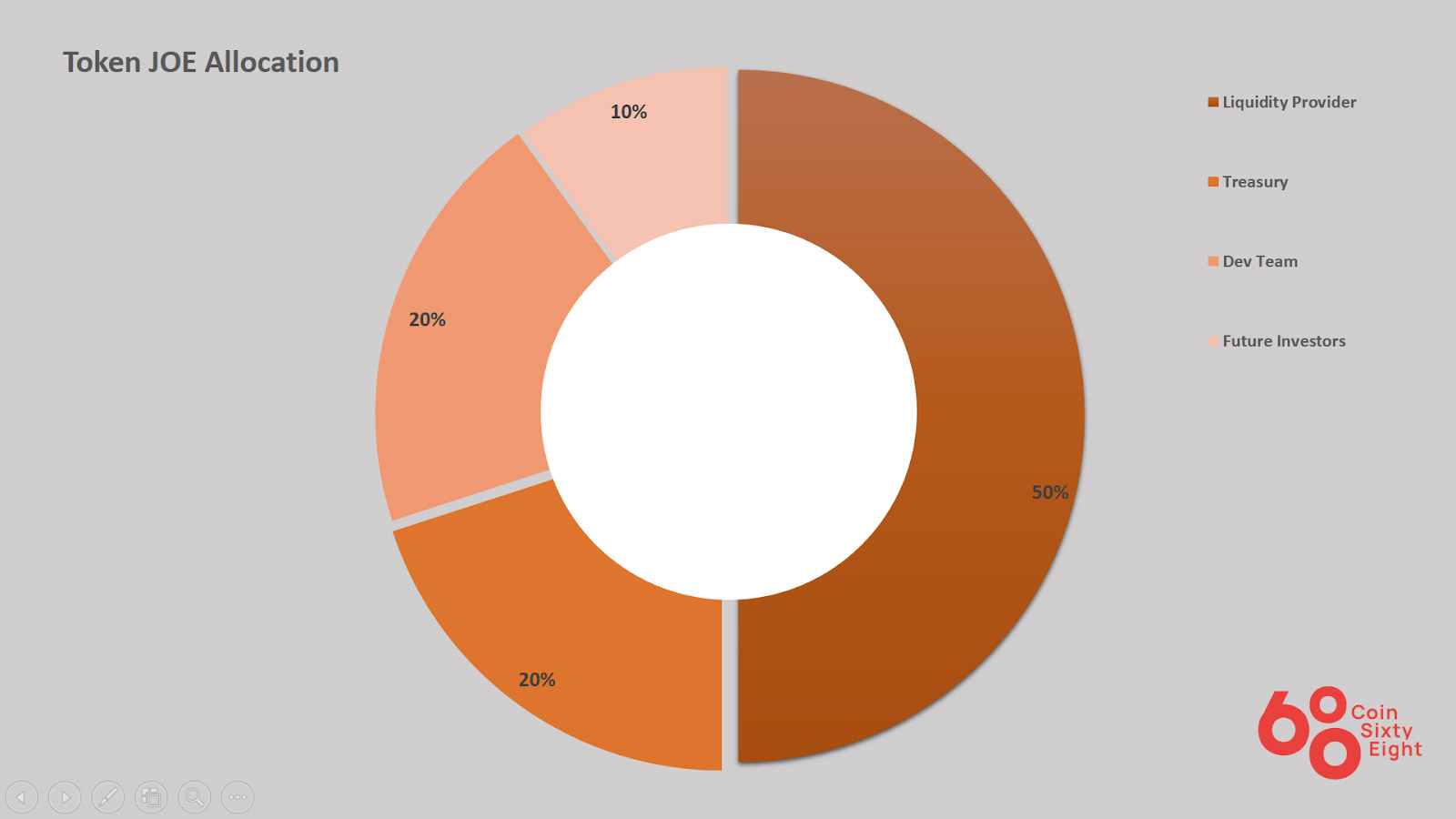

JOE Token Allocation

- Development crew: twenty%

- Future Investors: ten%

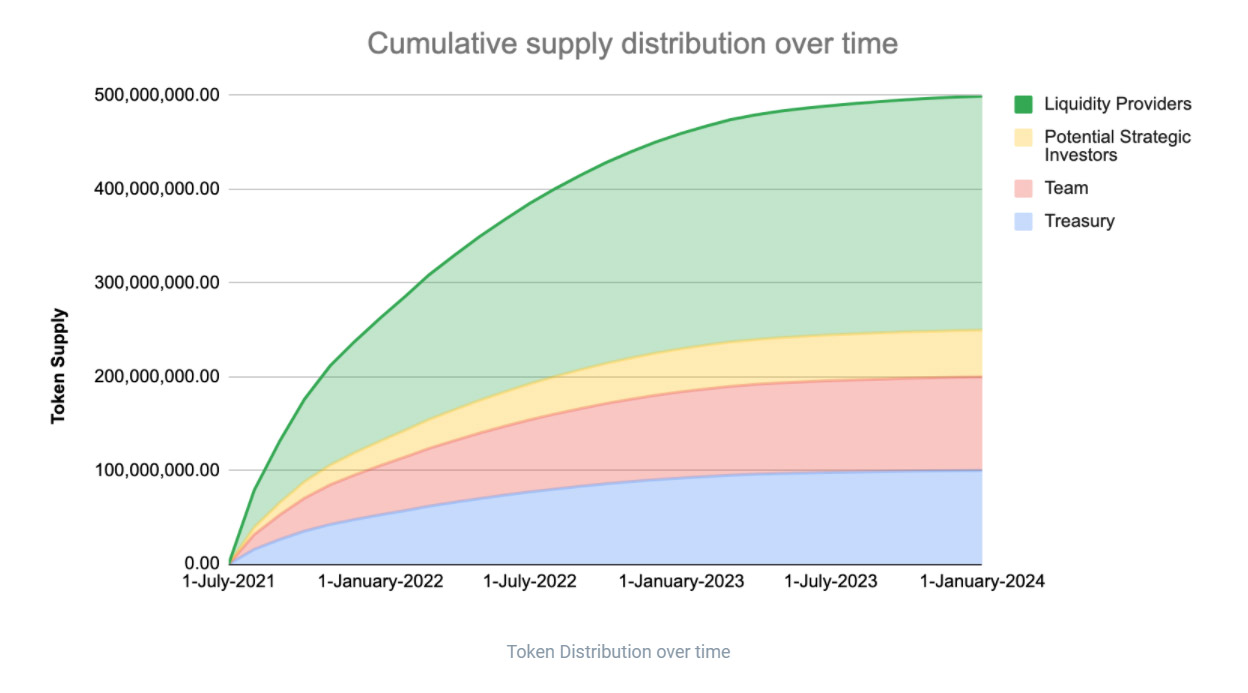

Token distribution roadmap

There is no presale, private sale, or pre-listing allocation of JOE tokens. All tokens are distributed in accordance to the issuance routine.

This signifies that crew money and treasury money are distributed at the exact same charge as LP farms. There is a withholding tax allotted for long term traders. This signifies that if Trader Joe raises capital in the long term, these traders will join immediately after the token is launched, not prior to.

Distribution of venture revenues

.05% of all transactions are paid to pool the charge for xJOE. A portion of the loan charges and settlement curiosity will also be paid to xJOE’s holding pool. % Will be established at the launch of the loan solution. JOE token holders can stake their JOE on xJOE and get a share of the income.

Project crew

Cryptofish – Co-founder

- Be a total and intelligent contract engineer. He primarily offers with contracts and culture. He was an early contributor to many Avalanche tasks this kind of as Snowball and Sherpa Cash. Most just lately, he worked at Google and a CEX that specializes in derivatives. He holds a Masters in Computer Science from one particular of the greatest universities in the United States.

0xMurloc – Co-founder

- As a complete-stack developer, his specialty is solution management. He is mostly accountable for Trader Joe’s items and applications. He has practical experience in commencing many startups and most just lately was Senior Product Manager at Grab. He holds a BA in Electrical Engineering from one particular of the greatest universities in the United States.

JOE swords and possessions

Currently the only way to trade with JOE is to obtain straight on DEX exchanges this kind of as Trader JOE, Pangolin or Gate.io.

Basic Guide to Trading on Trader Joe here

JOE storage wallet

JOE is a common ARC-twenty token on Avalanche – C Chain, at the moment you can only set up and keep it on Metamask or Coin98 Wallet.

Future of Trader Joe, should really I invest in JOE coin?

Trader Joe can be viewed as a big missing piece of the monetary puzzle DeFI. By offsetting DeFi’s volatility by establishing essential infrastructure and giving resources for consumers to quick tokens and leverage lending protocol collateral for optimum returns, this produces a much better marketplace for traders to guard their assets. All facts in the post is facts compiled by Coinlive and does not constitute investment guidance. Coinlive is not accountable for any direct and indirect hazards. Good luck!