TraderJoe is now even now the best one AMM on Avalanche. However, along with the decline of DeFi in standard, TraderJoe will have to also locate a way to regain its place. In early 2022, TraderJoe created many key tokenomic updates in hopes of attracting a lot more funds flows into the protocol and generating a lot more incentives for JOE. In this report, let us find these critical updates with us!

one. Current context

First, if you will not know, Trader Joe is the # one AMM Dex platform on Avalanche. At TraderJoe, you can trade pretty much all the prominent tokens in the Avalanche ecosystem in a decentralized way, at reduced value and with the greatest liquidity. You can discover a lot more about TraderJoe at this paragraph.

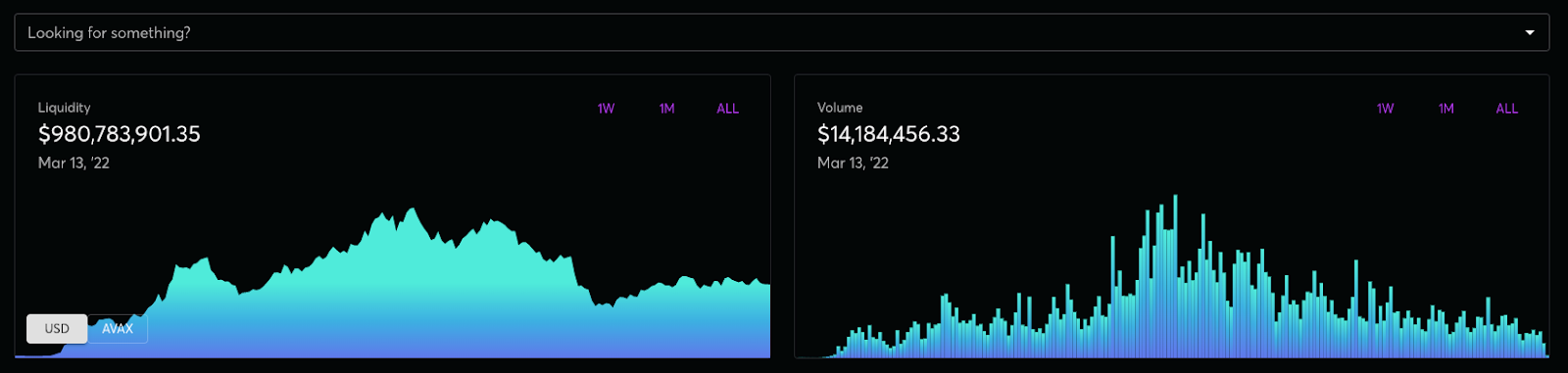

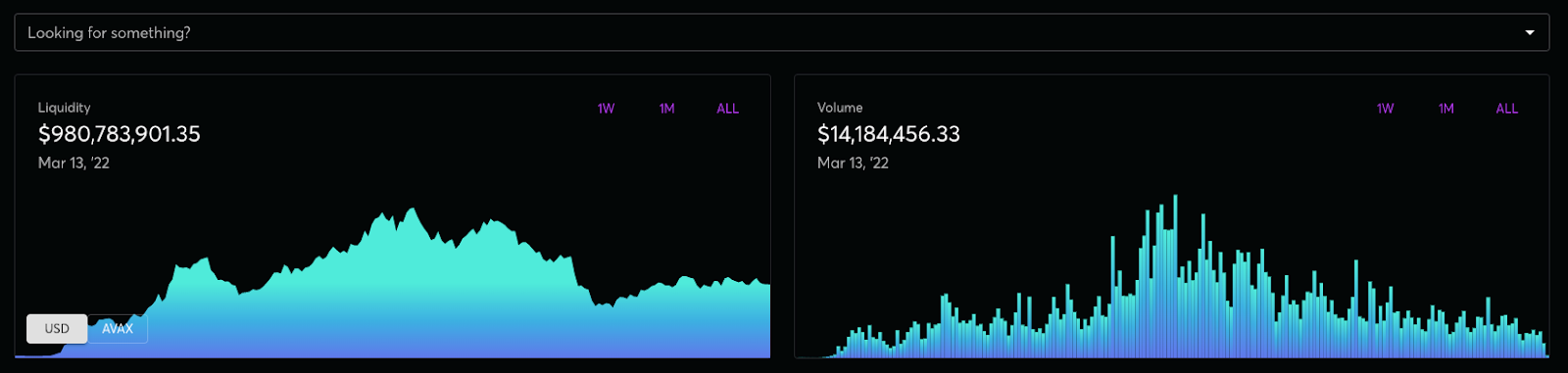

After the Avalanche boom, liquidity and trading volume on TraderJoe decreased substantially. However, to some extent, TraderJoe is even now trying to keep liquidity and trading volume at an common degree to be certain that the protocol continues to perform in a steady and worthwhile way (by means of costs).

In 2021 TraderJoe also launches a further critical item, Lending, with the aim of getting an All-in-one particular Defi Protocol in Avalanche. In distinct, consumers can borrow and lend on TraderJoe with no applying a further third celebration.

Besides, TraderJoe also has other solutions like Farming, Launchpad …

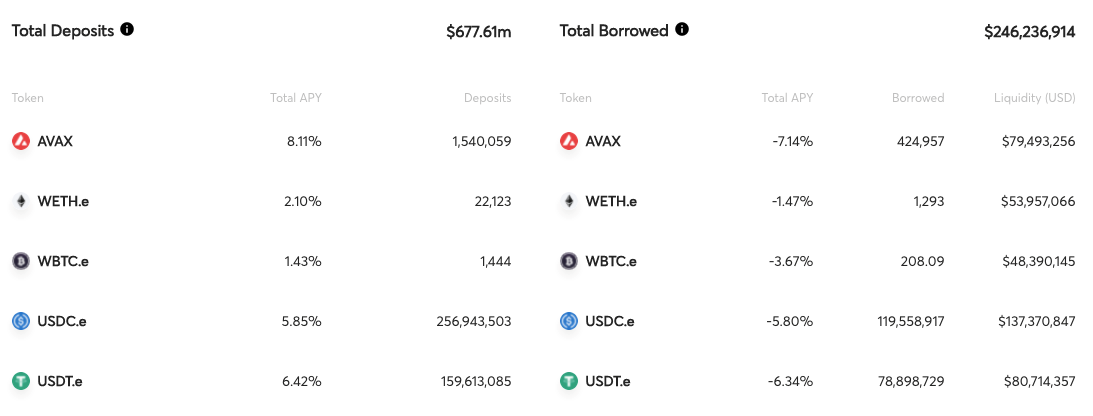

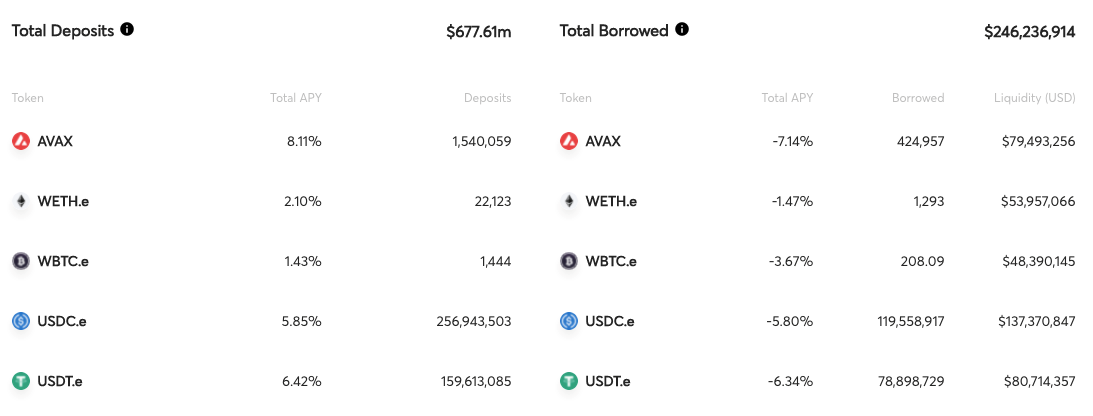

You can see that the complete deposit (loan) is all around $ 677 million, even though the complete loan is $ 246 million. Also, the APY when borrowing is even now unfavorable, which demonstrates that the loan application on TraderJoe is very smaller and the funds is largely deposited to take pleasure in passive APY.

Along with the marketplace correction, JOE’s rate also fell sharply:

two. Recent Important Updates

In the very first half of 2022, TraderJoe centered on obtaining the undertaking worth for JOE tokens with two key updates:

two.one. sJOE

sJOE is an choice that makes it possible for consumers to bet on JOE for a share of the protocol income in the kind of stablecoin (USDC).

In distinct: you will detach JOE in the pool and you will acquire sJOE, the protocol will share the commission collected for you based mostly on the amount of sJOEs you have. This component will be divided into USDC.

A wonderful stage is that you can unlock sJOE anytime you want (with no getting buried).

However, you must note that when you join the pool, you will have to shell out a sure charge (three%).

Currently, the sJOE pool has attracted virtually $ 80 million with a somewhat interesting April: 26.44%

With a JOE rate of ~ $ .9 at the time of creating, this usually means that roughly 90 million JOEs are staking in the sJOE pool, which equates to 50% of the exceptional JOE in the marketplace.

Another fairly interesting factor is that TraderJoe pays in USDC (as an alternative of JOE) => lowers JOE inflation.

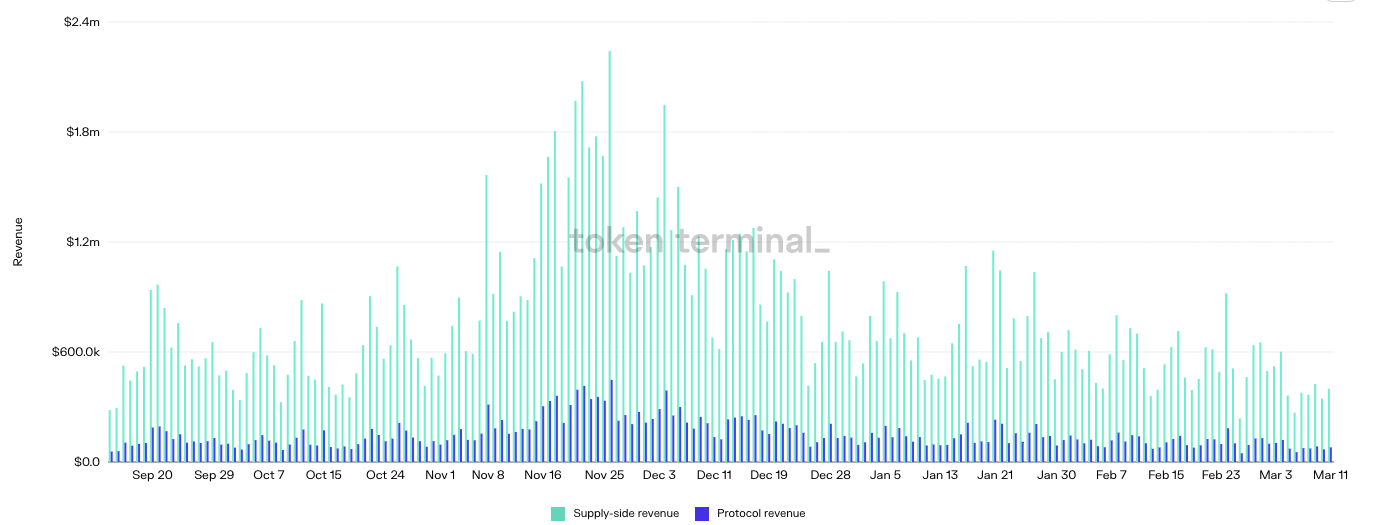

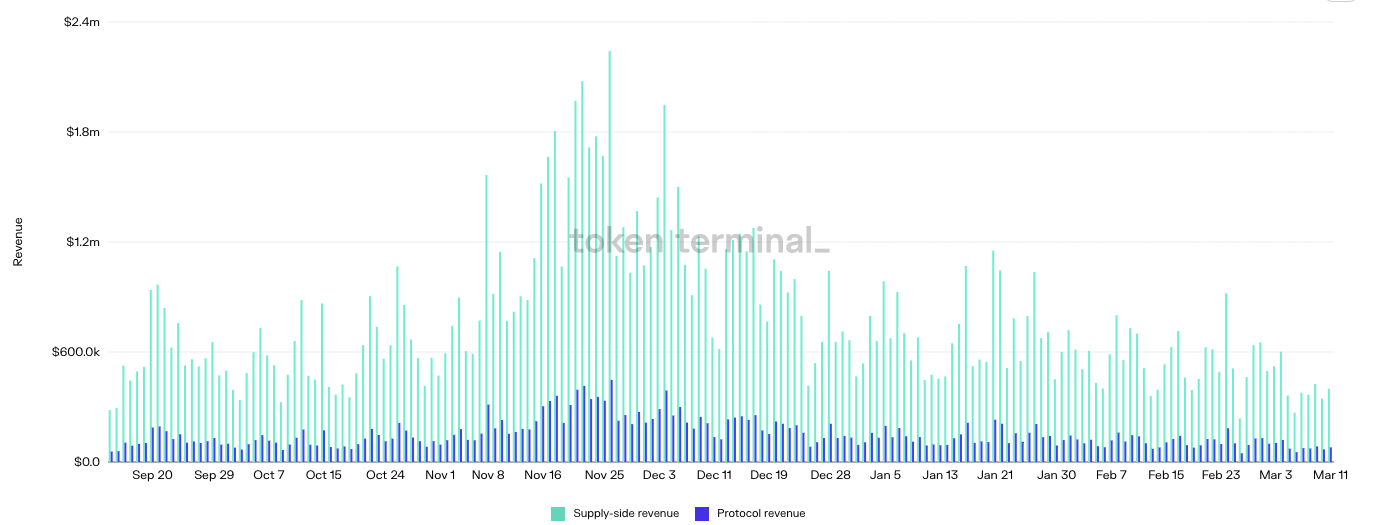

According to Token Terminal information, TraderJoe even now has amazing income, which is most likely why so several JOEs are betting on sJOE to take pleasure in this commission (.05% of the complete commission collected).

two.two. veJOE

For TraderJoe, sJOE alone is not sufficient. Recently, they officially announced the veJOE model. This model is very equivalent to veCRV. In distinct, you will detach JOE to acquire veJOE.

veJOE will have the following primary makes use of:

- There is the likelihood of self-accumulation if it freezes for longer.

- Helps improve APY in breeding pools (x2.five).

- Increase the pace of accumulation of veJOE itself: Specifically, the highest amount of veJOEs you can accumulate is one hundred occasions in contrast to staking $ JOE consider away. To accelerate the development of veJOE, you can deposit a lot more $ JOE to activate this function.

- Administrator rights (will be offered when the protocol alterations to this model).

Therefore, with veJOE, we have a far better development driver for JOE, in distinct:

JOE holder will detach JOE => veJOE => bootstrap APY => will get a lot more JOE bonus => will proceed to accumulate to accelerate the accumulation of veJOE + get a lot more veJOE => a lot more rewards.

Note: TraderJoe also has a “force” mechanism for consumers, ie when they drop JOE, they will get rid of all accumulated veJOEs.

This is not a new tokenomics model, but with TraderJoe’s strategy, they will attain two critical objectives:

- Build a neighborhood of lengthy-phrase supporters ready to stake JOE for a lengthy time.

- Pay people folks the rewards they deserve.

Also, when the veJOE model is utilized, smaller TraderJoe wars can arise amongst tasks attempting to get liquidity on this protocol (equivalent to Curve wars). Projects will locate strategies to very own as several veJOEs as doable to improve the reward on their funds pool => JOE is bullish.

Currently the veJOE model has been up to date only on the protocol documentation, not officially implemented. I assume JOE to have a major improve when this model is officially utilized.

What do you feel of TraderJoe’s latest updates? Leave a comment under in the remarks segment!

Poseidon

Maybe you are interested:

TraderJoe is now even now the best one AMM on Avalanche. However, along with the decline of DeFi in standard, TraderJoe will have to also locate a way to regain its place. In early 2022, TraderJoe created many key tokenomic updates in hopes of attracting a lot more funds flows into the protocol and generating a lot more incentives for JOE. In this report, let us find these critical updates with us!

one. Current context

First, if you will not know, Trader Joe is the # one AMM Dex platform on Avalanche. At TraderJoe, you can trade pretty much all the prominent tokens in the Avalanche ecosystem in a decentralized way, at reduced value and with the greatest liquidity. You can discover a lot more about TraderJoe at this paragraph.

After the Avalanche boom, liquidity and trading volume on TraderJoe decreased substantially. However, to some extent, TraderJoe is even now trying to keep liquidity and trading volume at an common degree to be certain that the protocol continues to perform in a steady and worthwhile way (by means of costs).

In 2021 TraderJoe also launches a further critical item, Lending, with the aim of getting an All-in-one particular Defi Protocol in Avalanche. In distinct, consumers can borrow and lend on TraderJoe with no applying a further third celebration.

Besides, TraderJoe also has other solutions like Farming, Launchpad …

You can see that the complete deposit (loan) is all around $ 677 million, even though the complete loan is $ 246 million. Also, the APY when borrowing is even now unfavorable, which demonstrates that the loan application on TraderJoe is very smaller and the funds is largely deposited to take pleasure in passive APY.

Along with the marketplace correction, JOE’s rate also fell sharply:

two. Recent Important Updates

In the very first half of 2022, TraderJoe centered on obtaining the undertaking worth for JOE tokens with two key updates:

two.one. sJOE

sJOE is an choice that makes it possible for consumers to bet on JOE for a share of the protocol income in the kind of stablecoin (USDC).

In distinct: you will detach JOE in the pool and you will acquire sJOE, the protocol will share the commission collected for you based mostly on the amount of sJOEs you have. This component will be divided into USDC.

A wonderful stage is that you can unlock sJOE anytime you want (with no getting buried).

However, you must note that when you join the pool, you will have to shell out a sure charge (three%).

Currently, the sJOE pool has attracted virtually $ 80 million with a somewhat interesting April: 26.44%

With a JOE rate of ~ $ .9 at the time of creating, this usually means that roughly 90 million JOEs are staking in the sJOE pool, which equates to 50% of the exceptional JOE in the marketplace.

Another fairly interesting factor is that TraderJoe pays in USDC (as an alternative of JOE) => lowers JOE inflation.

According to Token Terminal information, TraderJoe even now has amazing income, which is most likely why so several JOEs are betting on sJOE to take pleasure in this commission (.05% of the complete commission collected).

two.two. veJOE

For TraderJoe, sJOE alone is not sufficient. Recently, they officially announced the veJOE model. This model is very equivalent to veCRV. In distinct, you will detach JOE to acquire veJOE.

veJOE will have the following primary makes use of:

- There is the likelihood of self-accumulation if it freezes for longer.

- Helps improve APY in breeding pools (x2.five).

- Increase the pace of accumulation of veJOE itself: Specifically, the highest amount of veJOEs you can accumulate is one hundred occasions in contrast to staking $ JOE consider away. To accelerate the development of veJOE, you can deposit a lot more $ JOE to activate this function.

- Administrator rights (will be offered when the protocol alterations to this model).

Therefore, with veJOE, we have a far better development driver for JOE, in distinct:

JOE holder will detach JOE => veJOE => bootstrap APY => will get a lot more JOE bonus => will proceed to accumulate to accelerate the accumulation of veJOE + get a lot more veJOE => a lot more rewards.

Note: TraderJoe also has a “force” mechanism for consumers, ie when they drop JOE, they will get rid of all accumulated veJOEs.

This is not a new tokenomics model, but with TraderJoe’s strategy, they will attain two critical objectives:

- Build a neighborhood of lengthy-phrase supporters ready to stake JOE for a lengthy time.

- Pay people folks the rewards they deserve.

Also, when the veJOE model is utilized, smaller TraderJoe wars can arise amongst tasks attempting to get liquidity on this protocol (equivalent to Curve wars). Projects will locate strategies to very own as several veJOEs as doable to improve the reward on their funds pool => JOE is bullish.

Currently the veJOE model has been up to date only on the protocol documentation, not officially implemented. I assume JOE to have a major improve when this model is officially utilized.

What do you feel of TraderJoe’s latest updates? Leave a comment under in the remarks segment!

Poseidon

Maybe you are interested: