Support and resistance are 1 of the most essential ideas that you require to discover when you start out studying about trading. If you have not mastered this idea still, get a minute to get started out this paragraph.

However, we can not constantly enter correctly with assistance/resistance. In today’s post, I will share with you some “tips” to enable you boost your win charge when trading with assistance and resistance.

See other articles or blog posts in the Price Action Trading series:

Is various check assistance and resistance seriously that superior?

Usually, when you discover about assistance and resistance, you will be guided to come across selling price zones in which there is a “reaction” several instances. The far more instances a assistance and resistance is examined (examined), the far more useful it will be. This is correct, but it is not ample.

In reality, you can make complete use of the “new” untested locations of assistance and resistance to prepare your trades and have superior entry factors. The motive is pretty uncomplicated:

When a assistance/resistance has been examined several instances, the liquidity in that selling price location will be significantly less and significantly less. For instance:

- The twenty,000 USDT zone is the Bitcoin assistance, the selling price has examined this zone two instances.

- Assuming the invest in buy volume of traders on the Binance exchange in the USDT twenty,000 location is USD five million, right after two exams, this volume was matched to ½ and is only USD two.five million.

- The selling price continued to check two far more instances, at this time, the invest in buy volume in the USDT twenty,000 location was only close to USDT 500,000.

- Therefore, if the selling price is nevertheless unable to rebound appropriate now, we have to draw a conclusion: Although the acquiring electrical power in the USDT twenty,000 location is huge and has been matched several instances, that acquiring electrical power is not still ample to push the Bitcoin selling price larger. . Therefore, if the selling price turns back once again later on, the acquiring force at that time may well not be ample, and the selling price will very easily go past the path of the dump (break the assistance).

=> Limit Long and you require to view far more and be prepared for a Short prepare when the selling price explodes.

With the over evaluation, it can be possibly effortless for you to have an understanding of why you should not use a assistance or resistance as well several instances. If we have had superior entries one or two instances in advance of, you must think about utilizing that previous selling price array for the upcoming entry.

Example on the graph:

Hyperlink has resistance examined three instances in the selling price location of 5.792. If you comply with the inertia of “short resistance”, it is effortless for you to go quick as quickly as the red candlestick seems on the 4th touch and this buy can prevent reduction.

How to strengthen your win charge: area orders only right after there are superior setups in assistance or resistance locations, for instance: double tops, heads-shoulders, reversal candles…

Too several assistance and resistance shut to just about every other, what to do?

During the trading system, there will be instances when you determine far more than 1 probable assistance/resistance, but they are pretty “close to each other”. Usually, in this situation, the selling price will have a tendency to conquer the two individuals assistance and resistance locations to get superior liquidity, and also sweep the Traders prevent reduction.

For instance:

So, in this situation, we can manage it in two means:

Method one: If you are afraid of missing an chance and you are not as well positive that the selling price will go deep ample to attain the assistance under (or the resistance over), you can prorate the anticipated entry volume. with two entries. The stoploss will now be positioned in the reduced assistance zone.

Method two: Wait patiently for the selling price to move back to the final assistance/resistance location, generate false breakouts to wipe out the prevent reduction, and then enter.

Combination of tricky assistance and resistance and dynamic assistance and resistance

Hard assistance and resistance are selling price locations, trend lines, Fibonacci areas…, whilst dynamic assistance and resistance are MA lines, Bollinger Bands…

To boost the probability of winning, you can mix utilizing the two these sorts of assistance and resistance.

For instance:

I had two entries with CHZ via a mixture of tricky assistance and dynamic assistance which is EMA (twenty) – blue line

I had two entries with CHZ via a mixture of tricky assistance and dynamic assistance which is EMA (twenty) – blue line

Command one: You can see that CHZ is up in the 30m frame and kinds tricky assistance at .252. The selling price follows a triangular pattern and then breaks out. At that minute, the selling price respects the tricky assistance of .252 whilst also respecting the dynamic assistance of the EMA (twenty). Combined with the trend breakout, I entered extended and took revenue with R:R = one:two.

Command two: The selling price then broke the assistance developing a downtrend. So, I area a prevent-promote when the selling price breaks the lower side of the sideways array (.243). At this level, we will trade in a downtrend, the trend-breaking selling price mixed with the selling price under the EMA (twenty) – this time acting as dynamic resistance. This command I also took revenue with R:R = one:three.

Use line charts to determine assistance and resistance

There will be several instances when the industry will be illiquid, so you will see several beards and at the identical time the selling price gets “uncomfortable”, and for that reason it will grow to be tricky to accurately determine essential assistance/resistance. . In this situation, you can use line graph (line graph) to make factors less difficult and far more productive.

How to switch from candlestick chart to line chart:

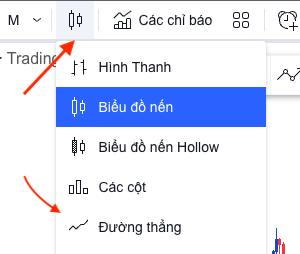

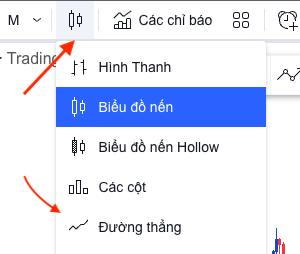

I will give an instance on TradingSee. You can click on the candlestick (if you are on a candlestick chart) upcoming to the timeframes and decide on Line Chart, then the chart will instantly flip into a line chart.

Let’s see the effects in two graphs:

“Clean” assistance and resistance.

Unlike assistance and resistance locations which have been examined several instances, clean assistance and resistance are untested assistance/resistance locations. These will be higher impact entry locations which you can use to boost your winning probability simply because typically promote at resistance or invest in at assistance orders right here are nevertheless thick and have not been matched => promote at resistance/invest in at assistance it can be superior.

For instance:

I hope the over five ideas enable you strengthen your trading efficiency with assistance and resistance. Do you guys have any other ideas? Share with us right in the feedback part! Also, do not neglect to subscribe Community 68 Trading to get far more helpful information and good quality trading signals from us!

Poseidon

See other articles or blog posts by the writer of Poseidon:

Support and resistance are 1 of the most essential ideas that you require to discover when you start out studying about trading. If you have not mastered this idea still, get a minute to get started out this paragraph.

However, we can not constantly enter correctly with assistance/resistance. In today’s post, I will share with you some “tips” to enable you boost your win charge when trading with assistance and resistance.

See other articles or blog posts in the Price Action Trading series:

Is various check assistance and resistance seriously that superior?

Usually, when you discover about assistance and resistance, you will be guided to come across selling price zones in which there is a “reaction” several instances. The far more instances a assistance and resistance is examined (examined), the far more useful it will be. This is correct, but it is not ample.

In reality, you can make complete use of the “new” untested locations of assistance and resistance to prepare your trades and have superior entry factors. The motive is pretty uncomplicated:

When a assistance/resistance has been examined several instances, the liquidity in that selling price location will be significantly less and significantly less. For instance:

- The twenty,000 USDT zone is the Bitcoin assistance, the selling price has examined this zone two instances.

- Assuming the invest in buy volume of traders on the Binance exchange in the USDT twenty,000 location is USD five million, right after two exams, this volume was matched to ½ and is only USD two.five million.

- The selling price continued to check two far more instances, at this time, the invest in buy volume in the USDT twenty,000 location was only close to USDT 500,000.

- Therefore, if the selling price is nevertheless unable to rebound appropriate now, we have to draw a conclusion: Although the acquiring electrical power in the USDT twenty,000 location is huge and has been matched several instances, that acquiring electrical power is not still ample to push the Bitcoin selling price larger. . Therefore, if the selling price turns back once again later on, the acquiring force at that time may well not be ample, and the selling price will very easily go past the path of the dump (break the assistance).

=> Limit Long and you require to view far more and be prepared for a Short prepare when the selling price explodes.

With the over evaluation, it can be possibly effortless for you to have an understanding of why you should not use a assistance or resistance as well several instances. If we have had superior entries one or two instances in advance of, you must think about utilizing that previous selling price array for the upcoming entry.

Example on the graph:

Hyperlink has resistance examined three instances in the selling price location of 5.792. If you comply with the inertia of “short resistance”, it is effortless for you to go quick as quickly as the red candlestick seems on the 4th touch and this buy can prevent reduction.

How to strengthen your win charge: area orders only right after there are superior setups in assistance or resistance locations, for instance: double tops, heads-shoulders, reversal candles…

Too several assistance and resistance shut to just about every other, what to do?

During the trading system, there will be instances when you determine far more than 1 probable assistance/resistance, but they are pretty “close to each other”. Usually, in this situation, the selling price will have a tendency to conquer the two individuals assistance and resistance locations to get superior liquidity, and also sweep the Traders prevent reduction.

For instance:

So, in this situation, we can manage it in two means:

Method one: If you are afraid of missing an chance and you are not as well positive that the selling price will go deep ample to attain the assistance under (or the resistance over), you can prorate the anticipated entry volume. with two entries. The stoploss will now be positioned in the reduced assistance zone.

Method two: Wait patiently for the selling price to move back to the final assistance/resistance location, generate false breakouts to wipe out the prevent reduction, and then enter.

Combination of tricky assistance and resistance and dynamic assistance and resistance

Hard assistance and resistance are selling price locations, trend lines, Fibonacci areas…, whilst dynamic assistance and resistance are MA lines, Bollinger Bands…

To boost the probability of winning, you can mix utilizing the two these sorts of assistance and resistance.

For instance:

I had two entries with CHZ via a mixture of tricky assistance and dynamic assistance which is EMA (twenty) – blue line

I had two entries with CHZ via a mixture of tricky assistance and dynamic assistance which is EMA (twenty) – blue line

Command one: You can see that CHZ is up in the 30m frame and kinds tricky assistance at .252. The selling price follows a triangular pattern and then breaks out. At that minute, the selling price respects the tricky assistance of .252 whilst also respecting the dynamic assistance of the EMA (twenty). Combined with the trend breakout, I entered extended and took revenue with R:R = one:two.

Command two: The selling price then broke the assistance developing a downtrend. So, I area a prevent-promote when the selling price breaks the lower side of the sideways array (.243). At this level, we will trade in a downtrend, the trend-breaking selling price mixed with the selling price under the EMA (twenty) – this time acting as dynamic resistance. This command I also took revenue with R:R = one:three.

Use line charts to determine assistance and resistance

There will be several instances when the industry will be illiquid, so you will see several beards and at the identical time the selling price gets “uncomfortable”, and for that reason it will grow to be tricky to accurately determine essential assistance/resistance. . In this situation, you can use line graph (line graph) to make factors less difficult and far more productive.

How to switch from candlestick chart to line chart:

I will give an instance on TradingSee. You can click on the candlestick (if you are on a candlestick chart) upcoming to the timeframes and decide on Line Chart, then the chart will instantly flip into a line chart.

Let’s see the effects in two graphs:

“Clean” assistance and resistance.

Unlike assistance and resistance locations which have been examined several instances, clean assistance and resistance are untested assistance/resistance locations. These will be higher impact entry locations which you can use to boost your winning probability simply because typically promote at resistance or invest in at assistance orders right here are nevertheless thick and have not been matched => promote at resistance/invest in at assistance it can be superior.

For instance:

I hope the over five ideas enable you strengthen your trading efficiency with assistance and resistance. Do you guys have any other ideas? Share with us right in the feedback part! Also, do not neglect to subscribe Community 68 Trading to get far more helpful information and good quality trading signals from us!

Poseidon

See other articles or blog posts by the writer of Poseidon: