In Part one, you have been launched to Price Action, a trading system based mostly on value movements. So exactly where need to we seem at the value action? There are several techniques, the most popular of which is by way of candlestick charts.

In the 2nd portion we will understand how to study candles and candlesticks.

Get concerned Investment Community 68 Trading on Telegram for technical evaluation of probable coins right here: Channel announcement | Discussion on the channel

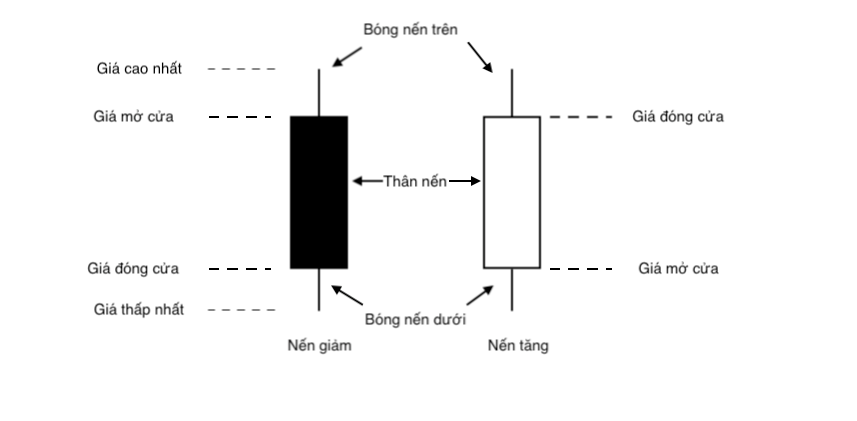

Basic framework of a candle

The candlestick chart is a chart manufactured up of several candles, exactly where just about every candle will signify a time period (time period of time). For instance: if you open a four hour candlestick chart, just about every candle has a duration of four hrs, a 1D chart, just about every candle is one day …

Note: my bullish candle for chart setting is white, bearish candle is black, beard is black. You can customize the shade so this isn’t going to matter guys. By convention, bullish candles are green and bearish candles are red.

In the picture over is the framework of a standard candle, such as:

– Candle entire body: is the connection in between the opening value and the closing value of the candle.

– Candle shade: is the junction in between the highest / minimal value and the opening / closing value.

For bullish candles: the opening value will be reduced than the closing value.

For bearish candles: the opening value will be greater than the closing value.

Note: Each candle can have a total entire body and a shadow, it can also have only a shadow or only a entire body … Because the form of just about every candle is so unique and so unique, we require to understand to study and fully grasp the marketplace by way of just about every candle and candle cluster.

How to study just about every candle

Each candle is a battle in between the prolonged side and the quick side, so studying the candles is quite critical in the value action.

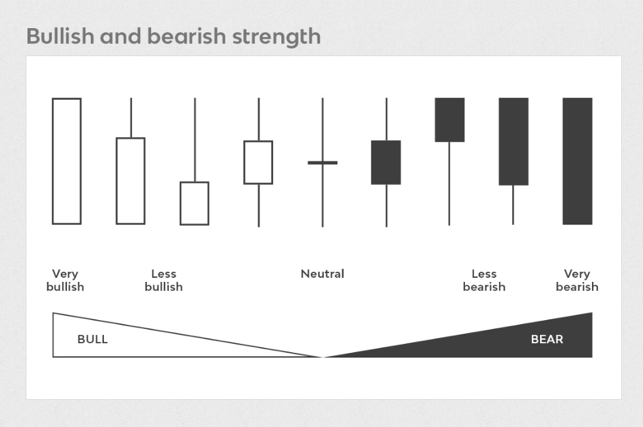

– About the length of the candle: The length of the candle is calculated as the distance in between the highest value and the lowest value. The longer the candle, the more powerful the volatility, the smaller sized the candle, the reduced the volatility.

– About the candle entire body: The entire body of the candle is the area to display you the effects of the battle. If the true entire body is white, the bulls win, if it is black, the sellers win. The longer the entire body, the more powerful the force, the a lot more mind-boggling it demonstrates.

– About Candle Shadows:

- Upper Shadow: Represents the spot exactly where the value experimented with to rise but failed to break by way of. The upper shadow of the candle represents the sale, the longer the shadow, the more powerful the product sales force.

- Lower Shadow: Represents the spot exactly where the value experimented with to go down but failed. The reduced shadow represents the paying for force, the longer the shadow, the more powerful the paying for force.

You can see that the picture over is the buy of the candles with reducing purchasing / marketing energy. Try applying the studying comprehension over and clarify the purpose for the evaluation.

How to study and fully grasp candlesticks

After studying and comprehending just about every candle, you require to get made use of to studying and comprehending just about every cluster of candles. The marketplace is usually closely linked, so you require to study and hyperlink several candles collectively to see the total image.

Note: When you study and fully grasp the candle cluster, you require to place the candles in a comparative partnership.

For instance:

At cluster two of candle no. one: After a earlier bearish trend, the initial candle has 02 upper and reduced shadows which are really prolonged and are longer than the true entire body, the entire body is modest and white, exhibiting:

- With a modest accurate white entire body, it demonstrates that consumers have entered the marketplace and temporarily stopped the decline. However, the bullish power is obviously not mind-boggling as the upper shadow is even now prolonged. Also marketing, the sellers experimented with to reduced the value but ended up closing a white candle. It can be explained that this candle demonstrates the indecision of the marketplace.

- The up coming candle demonstrates powerful bullish power with a prolonged beardless true entire body, exhibiting that the consumers have overwhelmed the sellers.

- The up coming candle has a huge entire body and fully overwhelms one kilometer, exhibiting the mind-boggling force of the earlier indecision (the correlation in between the two candles).

At cluster two of candle quantity two:

- The initial candle is a bullish candle, but the upside power is really modest, there is a modest upper shadow, which demonstrates the sellers have come collectively to promote down, but it is not clear.

- The up coming candle is a powerful bearish candle with a prolonged true entire body (3x the earlier a single) and has quite handful of reduced shadows, exhibiting that the bears have fully dominated the marketplace.

Through the two examples over, you will have to have understood how to study the candlesticks. For the situation of three or four candles, you can certainly do the very same, usually note assess the correlation in between the candles to get the most aim see, guys!

I think that if several of you have headaches simply because you do not don’t forget the “textbook” versions like Morning Star, Doji Morning Star, Bullish Harami … then by way of this short article, you can absolutely identify it. just about every candle and just about every candle logically group collectively devoid of making an attempt to memorize something.

Read and fully grasp candles with delicacy and simplicity, connect and uncover out what the marketplace is making an attempt to say!

A minor pleasurable: there will be several brothers studying candles and they will meet several instances exactly where they do not fully grasp what the marketplace is carrying out, a single tree goes up, a different tree goes down, a different goes up :)) The marketplace is in some cases hit by sudden information, when you do not fully grasp the marketplace, the easiest is… disregard. Enter when you are absolutely sure. See you in the up coming portion.

Poseidon

See other content articles analyzing other probable DeFi tasks by writer Poseidon: