Today we will carry on to get to an incredibly significant subject in trading in standard and in the Price Action process in specific: Trend.

Find out extra about Price Action:

Why are trends significant?

“The trend is a friend” has been a well-known saying amongst traders for a extended time, demonstrating the significance of identifying the suitable trend for a thriving trade.

Basically, you place revenue into a trade purchase, which is to bet on the get side (Long) and the promote side (Short) to win. If the general trend is an uptrend (like the most recent Crypto Bull run), it may well not be required to analyze, obtaining any altcoin will win, which exhibits the power of the trend.

So how do you determine the suitable trend? My brother and I also discover out under.

Stick Investment Community 68 Trading on Telegram for technical examination of probable coins right here: Channel announcement | Discussion on the channel

Types of trends

There are 3 varieties of trends in the market place:

- Bullish trend: formed with a greater backrest greater than the earlier 1, the latter greater than the earlier 1.

- Downtrend: formed with the upper back decrease than the former, the decrease back decrease than the former.

- Lateral trend (also regarded as the trendless market place): There is no clear upper and decrease framework like the two varieties of trends pointed out over.

Examples of trend varieties:

In the instance over, you can see anything extremely intriguing that whilst in the 4H time frame, BTC is down, but the 1H frame is lateral. To make clear the trend big difference amongst the occasions, let us study the up coming aspect.

Trend amounts

If you discover, there are little ripples in a significant wave. The trends are the very same, there are important trends, intermediate trends and quick-phrase trends.

Main trend: form of extended-phrase trend. As for the cryptocurrency market place, I temporarily “limit” the key trend to a timeline lasting three months or extra.

Intermediate trend: are extended-phrase trends in the assortment of one week – much less than three months.

Short-phrase trend: these are trends that come about in a quick time, a couple of hrs, a couple of days.

In the examples over, you can see that whilst 4H BTC tends to lessen, in smaller sized time frames like 1h or 15M, BTC can be sideways or up, which is the degree of the trend. .

If you trade in a smaller sized frame, for instance 15m, 1H, 4H, you can re-split the trend degree as you like!

Identify the trend by trend line

To accurately determine a trend, traders frequently use trend lines.

The uptrend line will be a straight line from the bottom up, connecting the lows in purchase from the bottom up. Note: To be legitimate, the up coming reduced ought to lead to a greater peak than the earlier 1.

The trend continues and the trend is broken

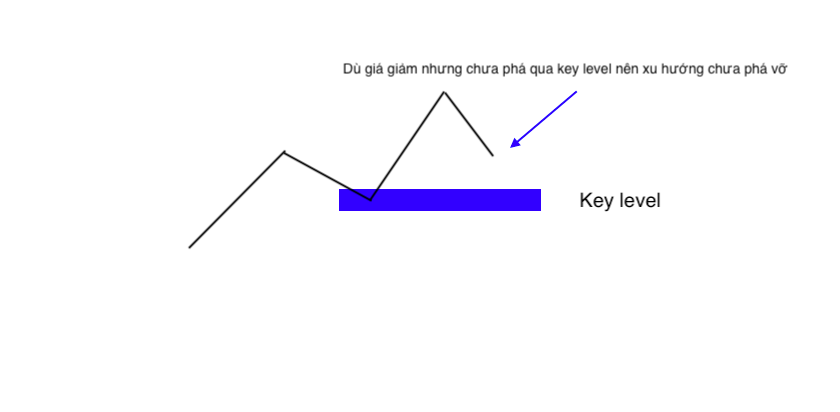

The trend can carry on or be stopped. In Price Action, a trend is thought of to carry on when the crucial degree of that trend has not been broken and vice versa, it is stopped when the value breaks by way of the crucial degree and reverses if pairs of highs and lows are formed. the opposite rule to the earlier trend (if the earlier trend is bullish, soon after the bullish trend is broken, the value kinds a higher decrease than the earlier higher, a reduced decrease than the earlier reduced, it is a trend reversal. reduction …)

Example of a continuation trend:

In this instance, soon after identifying the crucial degree of the trend (the value region main to the up coming higher), you can see that the value has fallen but has not broken this crucial degree, so the trend in the market place This situation is nevertheless a uptrend (taking into consideration the very same timeframe).

Example of an interrupted trend:

Here is an instance of AXS / USDT. You can see that the value broke the crucial degree of the uptrend (4H frame), so it was re-examined and crashed to make a new reduced under the previous 1. Therefore, in this situation the trend is the two broken and reversed.

genuine battle

Surely you come across circumstances the place the 4H frame is down, but 1H is up and you do not know how to location the purchase primarily based on the trend?

Here is my way:

Step one: Identify appropriate occasions. For instance, if I do 15m scalping, I am interested in greater timeframes like 1H and 4H (to determine the key trend and the significant crucial degree).

Step two: Identify trends from a significant time frame to a little time frame. When on the lookout at the graph, I will prioritize on the lookout at the significant frame initially and then the little frame.

Step three: Trade the major frame trend. If 4H is a bearish trend, we will only go quick.

Step four: Wait for synchronicity. If 4H is a bearish trend, 1H is a bearish trend but 15m exhibits an uptrend, bear in mind the trend amounts. If the crucial degree of 1H, 4H has not been broken, nevertheless identify that this bullish wave is only a short-term retracement, a little trend. Then wait 15 minutes to reverse a downtrend (so four hrs, one hour and 15 minutes is all a downtrend), then let us go quick. Right now, the win price is extremely higher due to the fact all three occasions are in agreement.

Note: In the instance over, you can quick if the value rejects (rejects) the region at the crucial degree and kinds great configurations in quick devoid of waiting for the turnaround. Obviously, the payout price will be decrease than the patient waiting for all three occasions to agree.

The over is all the most standard of the trend in value action. See you in the up coming elements of Trading Class 101!

Poseidon

See other posts analyzing other probable DeFi tasks by writer Poseidon: