In portion one, we discovered about help / resistance and their critical traits. In portion two, let us practice and locate out how to properly use these supports / resistors.

See extra about Price Action:

one. How to use help and resistance

The help / resistance cost regions can be applied by you to:

- Looking for entry factors

- Look for revenue

- Set quit reduction (quit reduction)

two. Specific use

To use help / resistance properly in the initially area, you need to have to determine the trend and stick to the trend. You can consider some time to critique the short article on identifying trends in trading right here.

After identifying the trend in the massive time frame, critical help / resistance ranges can be drawn from which to await good entries.

My illustration:

In this figure, ATOM has made an uptrend in the 4H frame. At this level, we can stick to the four-hour trend for a lengthy time, waiting for the cost to retreat into two critical help regions (blue).

Why are these two regions this kind of an critical help? The initially zone you can see is the outdated spike that the cost just crossed. If you keep in mind the traits of the help / resistance, when the resistance is broken => it turns into help. The 2nd zone is the essential degree of the trend, the reduced can make the following substantial => also an critical help.

We enter frame 1H and observe:

In the 1H frame, the cost has respected the green place (the green candle signifies the purchasing electrical power) and at the exact same time it merges with the trendline => you can go lengthy soon after the green candle, stoploss beneath the green place. The consequence of our command is to win with R: R = one: three

So, just in the illustration over, you noticed how to use the help to locate the entrance, set the stoploss.

Furthermore, we can also use help / resistance to locate a affordable revenue level. For illustration: if you go lengthy in the 1h frame in accordance to the 4H trend, you can consider revenue at the 4H or 1D frame resistances.

three. Some notes on utilizing help and resistance

three.one. Steps to stick to

When utilizing help and resistance to trade, you need to have to stick to these techniques:

- Identify the trend (constantly observe and keep in mind this phase guys).

- Draw critical help / resistance regions.

- Wait for the cost to touch these regions, observe the cost response. If the cost respects the new purchase.

- Don’t neglect to set stoploss. And decide on options that have a great R: R (Risk / Reward) ratio.

three.two. How to draw help / resistance appropriately?

There will be no typical on how to draw help / resistance. Some individuals draw lines, many others use zones. In my personalized view, trading are not able to be definitely correct, so I desire to use cost zones that ascertain help / resistance. The way to draw is like on the lookout at it “reasonably” and “touching most of the price zones”.

three.three. Which help / resistance is critical?

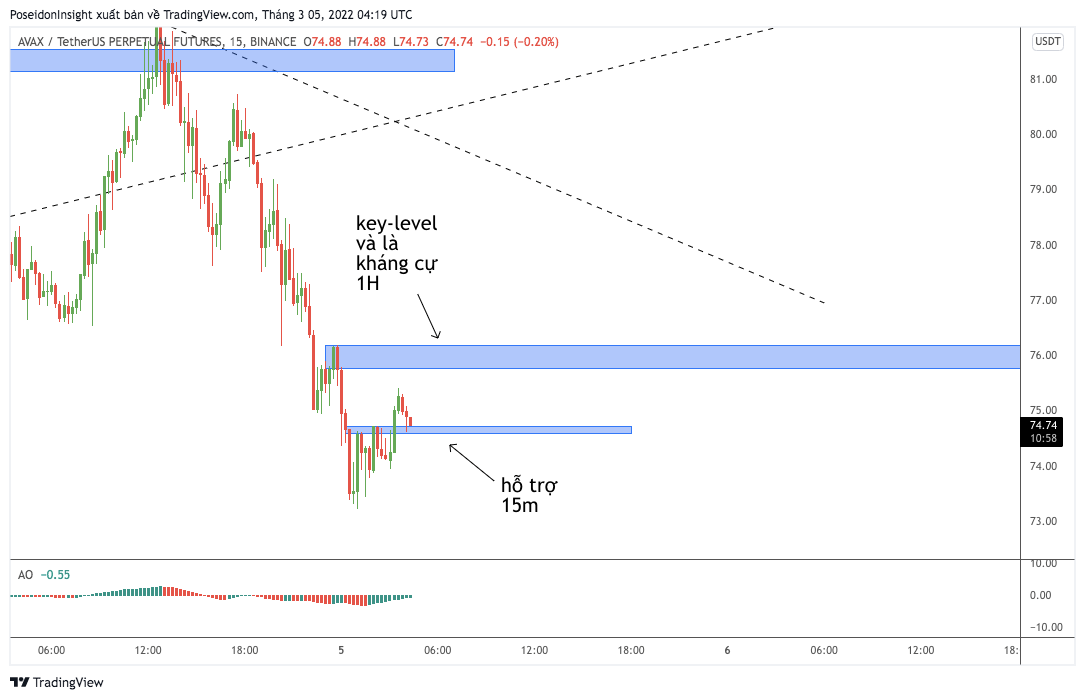

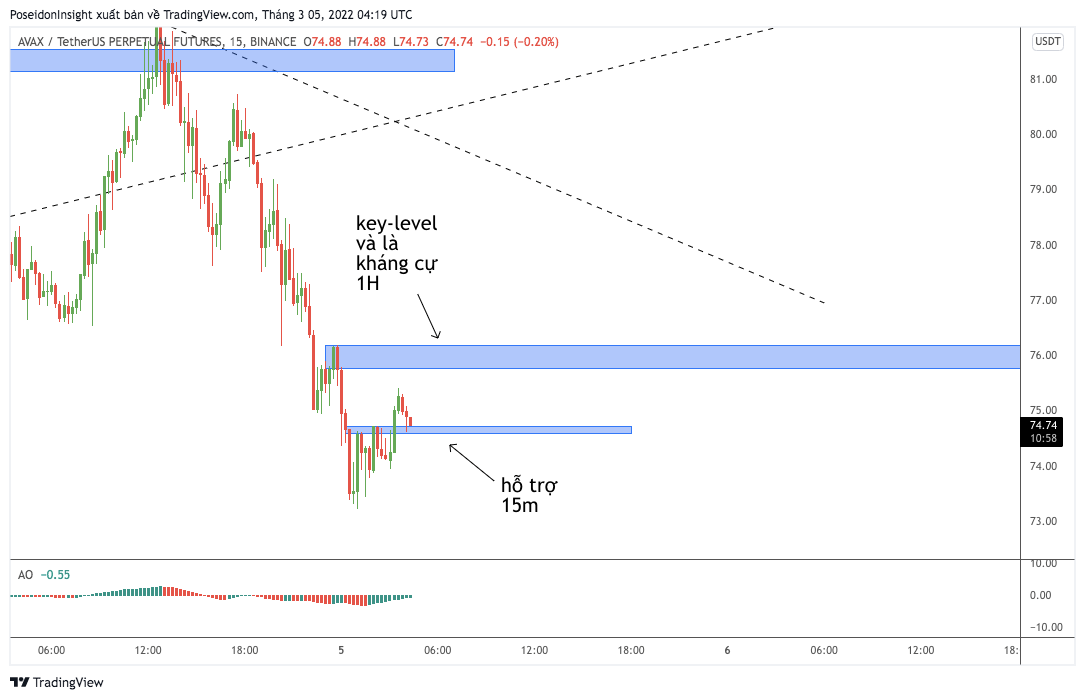

There will be quite a few brothers when you use to draw quite a few help / resistance regions on the chart. For illustration:

This leads to numerous troubles:

- The R: R purchase is reduced (mainly because by default you continue to keep blocking these cost regions).

- I do not know lengthy / quick, chaos.

Therefore, in trading, we only need to have to determine critical regions. If you trade the time frame, say 4H, 1H and 15m mixed, you need to only determine the essential help / resistance place of 4H and 1H. Pay focus to regions wherever the cost normally reacts a whole lot or to essential ranges. Likewise, if you swap 1H, 15m, and 5m, only specify the 1H and 15m frames.

For illustration:

I want you to trade to reap a whole lot of revenue. Don’t neglect to stick to Coinlive to acquire extra handy posts on cryptocurrency trading and investing.

Poseidon

See other posts analyzing other prospective DeFi tasks from the writer of Poseidon:

In portion one, we discovered about help / resistance and their critical traits. In portion two, let us practice and locate out how to properly use these supports / resistors.

See extra about Price Action:

one. How to use help and resistance

The help / resistance cost regions can be applied by you to:

- Looking for entry factors

- Look for revenue

- Set quit reduction (quit reduction)

two. Specific use

To use help / resistance properly in the initially area, you need to have to determine the trend and stick to the trend. You can consider some time to critique the short article on identifying trends in trading right here.

After identifying the trend in the massive time frame, critical help / resistance ranges can be drawn from which to await good entries.

My illustration:

In this figure, ATOM has made an uptrend in the 4H frame. At this level, we can stick to the four-hour trend for a lengthy time, waiting for the cost to retreat into two critical help regions (blue).

Why are these two regions this kind of an critical help? The initially zone you can see is the outdated spike that the cost just crossed. If you keep in mind the traits of the help / resistance, when the resistance is broken => it turns into help. The 2nd zone is the essential degree of the trend, the reduced can make the following substantial => also an critical help.

We enter frame 1H and observe:

In the 1H frame, the cost has respected the green place (the green candle signifies the purchasing electrical power) and at the exact same time it merges with the trendline => you can go lengthy soon after the green candle, stoploss beneath the green place. The consequence of our command is to win with R: R = one: three

So, just in the illustration over, you noticed how to use the help to locate the entrance, set the stoploss.

Furthermore, we can also use help / resistance to locate a affordable revenue level. For illustration: if you go lengthy in the 1h frame in accordance to the 4H trend, you can consider revenue at the 4H or 1D frame resistances.

three. Some notes on utilizing help and resistance

three.one. Steps to stick to

When utilizing help and resistance to trade, you need to have to stick to these techniques:

- Identify the trend (constantly observe and keep in mind this phase guys).

- Draw critical help / resistance regions.

- Wait for the cost to touch these regions, observe the cost response. If the cost respects the new purchase.

- Don’t neglect to set stoploss. And decide on options that have a great R: R (Risk / Reward) ratio.

three.two. How to draw help / resistance appropriately?

There will be no typical on how to draw help / resistance. Some individuals draw lines, many others use zones. In my personalized view, trading are not able to be definitely correct, so I desire to use cost zones that ascertain help / resistance. The way to draw is like on the lookout at it “reasonably” and “touching most of the price zones”.

three.three. Which help / resistance is critical?

There will be quite a few brothers when you use to draw quite a few help / resistance regions on the chart. For illustration:

This leads to numerous troubles:

- The R: R purchase is reduced (mainly because by default you continue to keep blocking these cost regions).

- I do not know lengthy / quick, chaos.

Therefore, in trading, we only need to have to determine critical regions. If you trade the time frame, say 4H, 1H and 15m mixed, you need to only determine the essential help / resistance place of 4H and 1H. Pay focus to regions wherever the cost normally reacts a whole lot or to essential ranges. Likewise, if you swap 1H, 15m, and 5m, only specify the 1H and 15m frames.

For illustration:

I want you to trade to reap a whole lot of revenue. Don’t neglect to stick to Coinlive to acquire extra handy posts on cryptocurrency trading and investing.

Poseidon

See other posts analyzing other prospective DeFi tasks from the writer of Poseidon: