TrueFi advancement in 2021

TrueFi is a decentralized unsecured lending platform that assists cryptocurrency lenders love eye-catching and sustainable prices of return and less difficult accessibility for borrowers without the need of requiring sources.

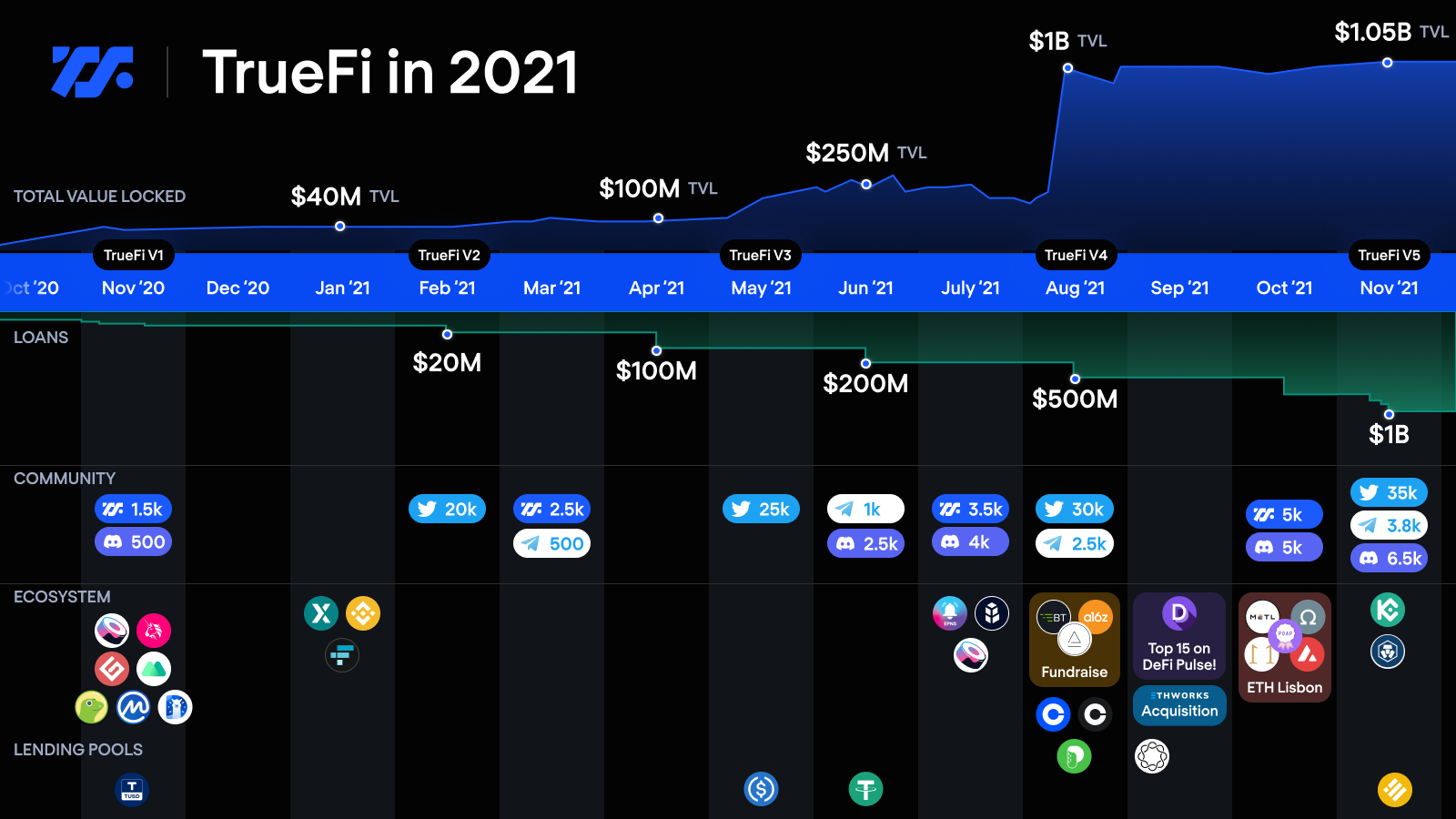

On November 21, 2020, TrueFi effectively raised the 1st $ three.five million from Alameda investigation. Since that historic second, the TrueFi protocol has continued to expand quickly and attain $ one billion in complete worth of frozen assets (TVL) in August 2021.

Two months later on, The total loan amount reached USD 1 billion just in time for the platform’s 1st anniversary, November twelve, 2021. Since its launch, TrueFi has maintained its default free of charge return fee and its prospects have earned somewhere around $ eight.five million in earnings.

Meanwhile, consumers preserve TRU for much more than 5000 personal wallets (not counting portfolios on Coinbase, Binance and FTX exchanges), at present participate in dozens of government vote as properly as guiding the path of the protocol.

In each operations and advancement, TrueFi is off to a fantastic start off, but protocol progress so far is just the starting. With the conventional international loan marketplace valued at $ six trillion, TrueFi will leverage the worth of decentralized believe in, transparency and pace to supply much more fulfilling consumer experiences.

TrueFi is based mostly on two beliefs:

- First, the pace, expense financial savings and transparency presented by blockchain technologies will in the end prevail in all lending globally.

- Second, capital efficiency will result in the unsecured loan to expand its complete locked-up worth (TVL) far past the mortgage loan loan in DeFi, all powered by a credit score rating procedure and efficient chance evaluation.

To notice the two beliefs over, TrueFi has continually scaled back the capital throughput, each at the personal loan degree and inside of the loan. This is the target of TrueFi V5. update, which involves significant enhancements to the borrower expertise, as properly as prototyping help for third get together asset managers who will launch their very own TrueFi pool, in conjunction with the launch of New BUSD loan pool.

Loan marketplace

TrueFi’s fantastic vision is to turn into the international lending protocol. Until now, TrueFi has been a closed ecosystem, giving substantial yield loan possibilities with the lowest chance.

These borrowers check the protocol and make the upcoming era of TrueFi achievable: building TrueFi accessible to third-get together wealth managers who will create new loan pools and serve them The form of borrower is also wholly new.

What does this indicate for TrueFi? Consider a comparable illustration: the launch of the 1st iPhone with 3 “homemade” apps: cell phone, music and camera. These distinguishing attributes weren’t accessible in a comparable gadget just before. In the identical way that unsecured loan and on-chain credit score score are the breakthrough for DeFi. However, the genuine possible of the iPhone was only recognized when the App Store was born, enabling third-get together developers to launch unique merchandise on the identical platform.

The approaching launch of the “loan market” is how TrueFi opens its doors to independent developers and third-get together asset managers who will create new versatile monetary and technical merchandise on the net. TrueFi’s lending infrastructure.

Simultaneously with the TrueFi V5 update, Believe inToken will be the 1st to launch an independent loan pool on the protocol. Believe inToken pool will supply B2B loans on unique terms than the present TrueFi pool, Believe inToken will accept the chance and complexity of third get together help to run much more smoothly.

Loan engine update

In version V4, TrueFi is proud to introduce Lines of Credit (LoC), which, topic to neighborhood approval, will supply borrowers with constant, self-services accessibility to capital at marketplace prices.

Important Note: These attributes will be rolled out steadily above two to three months, only just after passing a technical check scheduled for completion in December, in line with TrueFi’s core dedication to safety.

Automate loan curiosity prices

At the heart of this update is the automation of loan curiosity prices. The credit score model will be automated and prepared to set the loan restrict, curiosity prices and loan terms accordingly. Since the introduction of the credit score scoring procedure, the lending model has turn into much more rigorous and effective.

While the neighborhood will proceed to perform an critical position in approving borrowers, loan pools and contributing to the general protocol entry, TRU voting for personal loan approval will no longer consider area. As this will involve substantial gasoline expenditures and calls for a each day volume of TRU from the holders. Therefore, the huge vast majority think that this is no longer required.

Through the V5 update, TrueFi also introduces some brand new rewards of the TRU token:

To ascertain the creditworthiness of a borrower, TrueFi makes use of each on-chain information (this kind of as transaction information, liquidity and repayment background) and off-chain information (this kind of as asset background and calendar). corporation) to determine a score from to 255. Once presented to the neighborhood, this score will support create the terms for the borrower’s business enterprise on TrueFi. The score can be incrementally elevated just about every time the borrower repays loans, increases assets or decreases leverage, therefore also raising the borrower’s debt ceiling.

Most borrowers want the procedure to be rapid, the much more capital they borrow, the much more earnings they can make. So there is no stage in taking months to make and repay compact loans to increase your TrueFi credit score score!

TrueFi presents a much more effective method to capital. Users can bet TRU to maximize their credit score restrict and love much more favorable curiosity prices. In the occasion of a default, the SAFU fund will have total discretion above the borrower’s detached TRU.

- Borrow effortlessly with just one particular click

TrueFi supports one particular-click loan for loan approval. Where it took from two to seven days to vote approval, the new update shrank to all over thirty seconds with a basic “click”.

Note: The new update only prioritizes help for TrueFi’s highest-rated borrowers, with credit score scores better than 200.

- Still expanding throughout the audit

Although the V5 updates described over are total, TrueFi is nevertheless in the testing phase, which is anticipated to be finished no earlier than January 2022. During this time, TrueFi will proceed to create V6 core pools, connect and broaden the network with numerous new, new partners. prospects and will target on producing a sturdy neighborhood.

New BUSD loan pool

TrueFi has just launched a new BUSD loan pool to celebrate its 1st anniversary. The neighborhood has accredited the BUSD pool and numerous incentives in TRU, totaling forty,000 TRU per day that give incentives to consumers for a minimal of two weeks. The amount of incentives will be assessed at the finish of every single two weeks to adapt to the recent problem.

Orientation in 2022

With a international loan marketplace really worth trillions of bucks, TrueFi aims to push the boundaries of the cryptocurrency business, reaching more and more diversified borrowers with much more effective use of capital.

Maybe you are interested:

Note: This is sponsored written content, Coinlive does not straight endorse any info from the over posting and does not ensure the veracity of the posting. Readers need to perform their very own investigation just before building choices that impact themselves or their corporations and be ready to consider obligation for their very own alternatives. The over posting need to not be regarded as investment guidance.