The United kingdom Tax Authority (HMRC) has published a controversial set of tips that could influence innovation in the DeFi area.

The up to date regulation focuses on managing crypto assets solely for DeFi lending and staking functions in the United kingdom. The company questioned whether or not the revenue or rewards from these providers need to be regarded as capital or income for tax functions. Due to its sophisticated nature in terms of definition and enforcement, DeFi is on the radar of tax pros, as they are uncertain of how present principles need to be utilized.

HMRC has up to date its tips on the remedy of crypto and digital assets, exclusively for decentralized finance (DeFi) lending and staking in the United kingdom, appreciably altering their classification and remedy. Full report and our response right here – https://t.co/8XXD0bm34O pic.twitter.com/Q3N7La5FVX

– CryptoUK (@CryptoUKAssoc) February 2, 2022

The HMRC update states the following:

“Lending / staking by means of DeFi is an ever-shifting discipline, so it is unattainable to define all scenarios the place liquidity lenders / companies revenue from their operations and the nature of that revenue. Instead, we are operating to come up with some unique guiding rules. “

This usually means that revenue by way of the over strategies are “profits” as cryptocurrencies in the United kingdom are not regarded as a currency but an asset for tax functions. As a consequence, CryptoUK CEO Ian Taylor says the new laws will generate an pointless burden for cryptocurrency traders, who are at a disadvantage to stock marketplace traders mainly because they do not have a challenging time lending stocks.

HMRC has up to date its tips on the remedy of crypto and digital assets, exclusively for decentralized finance (DeFi) lending and staking in the United kingdom, appreciably altering their classification and remedy. Full report and our response right here – https://t.co/8XXD0bm34O pic.twitter.com/Q3N7La5FVX

– CryptoUK (@CryptoUKAssoc) February 2, 2022

“HMRC considers cryptocurrencies to be an asset that falls entirely within the scope for tax purposes. However, this is not in line with the approach currently being taken by the government and other regulators in the UK, including the Treasury and the FCA. “.

Taylor additional that the new more rule would be as well demanding for traders and confuse tax compliance as they would have to report on hundreds or even 1000’s of transactions. Especially in DeFi in distinct and in the marketplace in basic, when transactions are anonymous, it is tricky to trace the facts in a quick quantity of time.

HMRC’s hottest move is not an sudden downside to the United kingdom for the cryptocurrency sector. In October 2021, the nation was regularly criticized for “strangling” the marketplace, when the Bank of England Deputy Governor repeatedly urged speeding up regulation to halt cryptocurrencies. He also bluntly stated that the worth of cryptocurrencies could “plummet” to zero, main the United kingdom Advertising Standards Regulator (ASA) to ban crypto marketing on a lot of big platforms this kind of as Coinbase, Kraken or eToro.

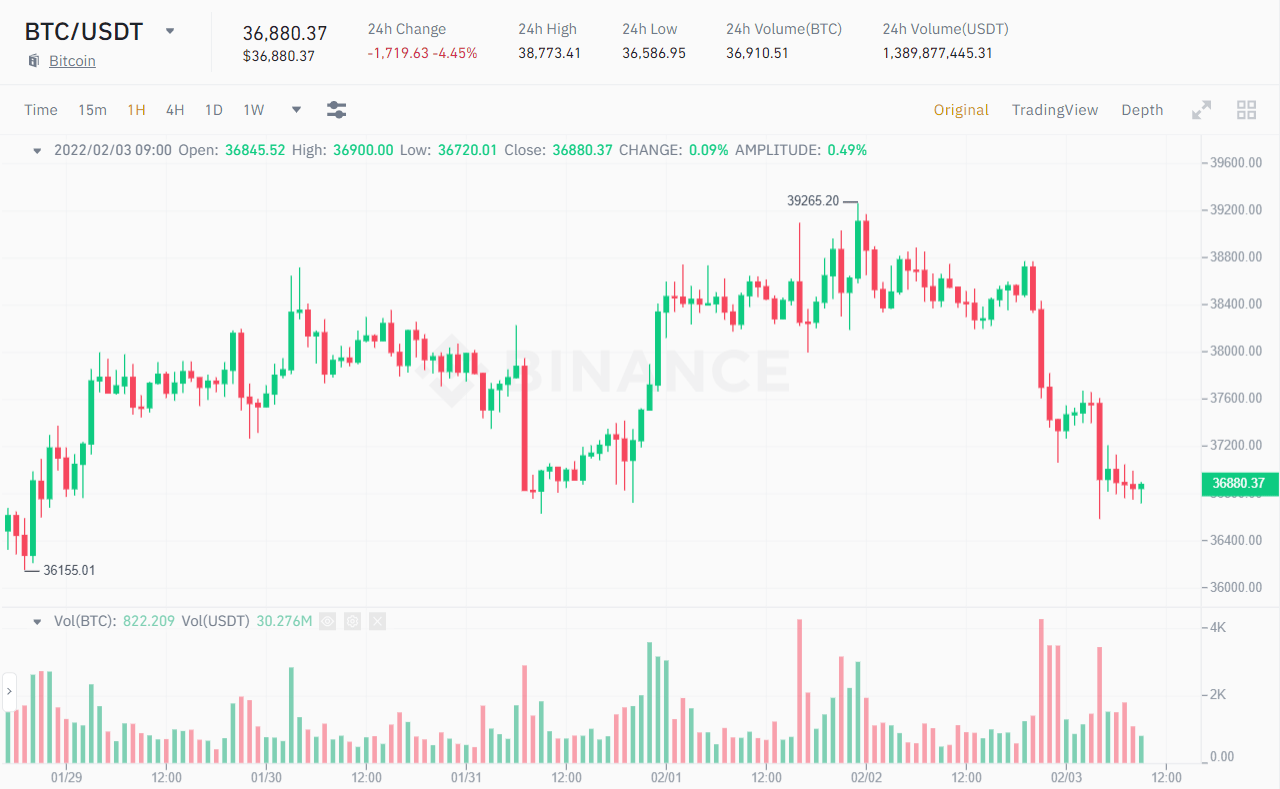

However, Bitcoin’s collapse of more than $ two,000 on the early morning of February three is most probably due to the stress of the information and facts over. Because for the previous couple of days BTC has been constantly obtaining somewhat very good macro information. For illustration, the Indian government stated it does not take into account cryptocurrency trading unlawful, immediately after announcing its prepare to employ CBDC and imposing a thirty% tax on cryptocurrencies, the Russian government has agreed to create a roadmap for regulate cryptography, regulate cryptocurrencies as a substitute of banning and Thailand abandoning cryptocurrency taxation.

At press time, BTC is trading all around $ 36,880.

Summary of Coinlive

Maybe you are interested: