Bitcoin (BTC) seems unable to return over $ 60,000 just after exhibiting slight development on November 25th. The COVID-19 pandemic is even now a important risk to the globe in addition to the developing inflation challenge in the United States.

While there was an complete cryptocurrency industry that acquired some momentum right now, it was rapidly extinguished. Traditional monetary markets are also engulfed in a red sea of concerns in excess of a new variant of the COVID-19 virus. While Bitcoin is trading four.18% under its 24-hour higher of $ 59,390 to $ fifty five,333 at press time, S&P 500 futures are down one.three%.

The MSCI Asia Pacific Index slipped one.eight% and the commodity complicated is bleeding, with oil on each sides of the Atlantic down extra than two%. Even so, other hedging assets this kind of as the Japanese yen and the USD are even now bullish.

The decline that impacted significantly of international monetary markets comes just after reviews of a new variant of the COVID-19 virus identified in Botswana, South Africa and Hong Kong that may possibly be resistant to a vaccine. If these considerations demonstrate real, lots of nations may possibly have to re-impose economically unpleasant sanctions. Richard Lessells, an infectious illness doctor at the University of KwaZulu-Natal in Durban, South Africa, stated he was even now conducting a thorough examine of the situation ahead of extra considerable confirmations have been out there.

Five speedy tweets on the new variant B.one.one.529

First warning: the information right here is * extremely * preliminary, so every little thing could transform. nevertheless, improved safe and sound than sorry.

one) Based on the information we have, this variant is outperforming some others * significantly * speedier than Beta and even Delta has carried out 🚩🚩 pic.twitter.com/R2Ac4e4N6s

– John Burn-Murdoch (@jburnmurdoch) November 25, 2021

“There are a good deal of issues we will not comprehend about the new variant. The profile of the mutation worries us, but now we need to function to comprehend the significance of the variant and its implications for the response to the pandemic. “

However, the truth that Bitcoin (BTC) has not nonetheless recovered from its extraordinary recovery and is trading intermittently all over $ 56,000 – $ 59,000 amid this danger aversion exhibits that the cryptocurrency is not nonetheless accepted as a safe and sound haven.

However, the quarantine buy will probably exacerbate provide chain stagnation, expanding inflation, which is a favourable for Bitcoin, as BTC is observed by lots of as a shop of worth. But the truth that the epidemic condition is getting extra and extra unpredictable is one thing no one particular desires.

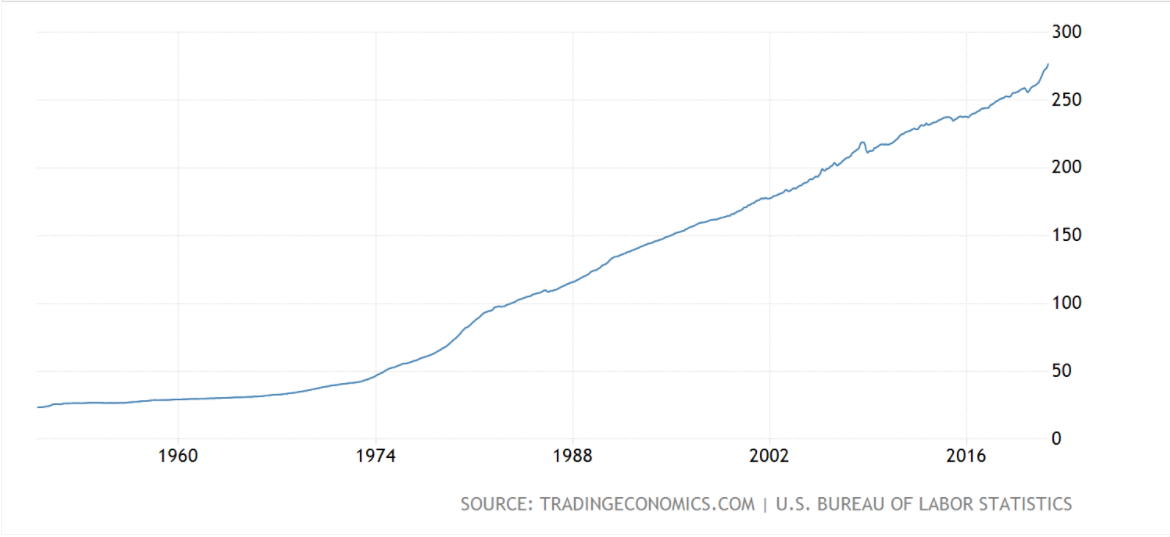

The shopper rate index (CPI) and inflation in the United States hit a thirty-12 months higher. Further CPI readings could trigger the US Federal Reserve (Fed) to prioritize inflation handle in excess of development by getting rid of stimulus measures extra rapidly. This could lead to asset rate deflation.

Bitcoin is inherently extremely vulnerable to Fed tightening. Highlighted just after plummeting to the area of $ 56,000 on Nov 19 just after a warmer-than-anticipated US CPI raised considerations about an anticipated price hike by the US. Fed. Immediately just after becoming reappointed as Fed chairman, Mr. Jerome Powell promptly launched the minutes of the Fed’s November meeting launched on November 24, exhibiting that the price hike would come sooner than anticipated.

On the other hand, the Fed’s financial policy in excess of the previous 12 months has not nonetheless been in a position to persuade traders to thoroughly believe in the company in the potential. Mexico’s third richest billionaire just lately recommended purchasing Bitcoin (BTC), due to the fact he thinks the US is steadily taking on the visual appeal of a nation with no accountability for its actions. Despite Bitcoin (BTC) “doing”, the prolonged-phrase investor index even now hits a record higher.

Overall, Bitcoin has obtained a specific volume of momentum to be prepared to conquer the existing trouble and move up to a improved rate. However, considerations about the new COVID-19 pandemic presented over and the “ambiguity” about the Fed’s phase to increase curiosity charges to increase inflation can strike at any time, will be obstacles that will considerably have an impact on the rate response of BTC in the quick phrase.

Synthetic currency 68

Maybe you are interested: