What is Zafferanone Finance?

Saffron Finance is a peer to see danger trading protocol. Saffron Finance permits customers (taking part in liquidity provision) to decide on the danger and return they obtain from liquidity provision by way of the SFI pool tranches.

You can discover normal details about Saffron Finance in this paragraph.

The primary divisions of Saffron Finance embody:

- Liquidity pool: is a liquidity pool the place customers can deposit property to affix the protocol.

- Adapters: linking pooled property to profitable platforms.

- Strategy: is the automated technique of the protocol, which hyperlinks all swimming pools and adapters collectively and selects the perfect adapters for every pool. This can also be a technique to robotically generate and deploy SFIs after the epoch ends.

- Age: has a interval of precisely 14 days, which is a cycle during which liquidity is blocked and distributed throughout platforms for revenue.

- Tranche: Risk hierarchy in Saffron.

The steps for a consumer to take part within the protocol are as follows:

- Users (liquidity suppliers) deposit DAI or different property accepted by the Pool.

- LPs select the tranche they need.

- LPs obtain 2 varieties of Saffron LP tokens representing the principle and future revenue (dsec).

- At the tip of the epoch, LPs recuperate their principal and SFI rewards (calculated primarily based on dsec).

So what is the robust level that makes Saffron Finance totally different? Let’s be taught extra about tranches and danger decentralization!

Tranche and decentralization of danger

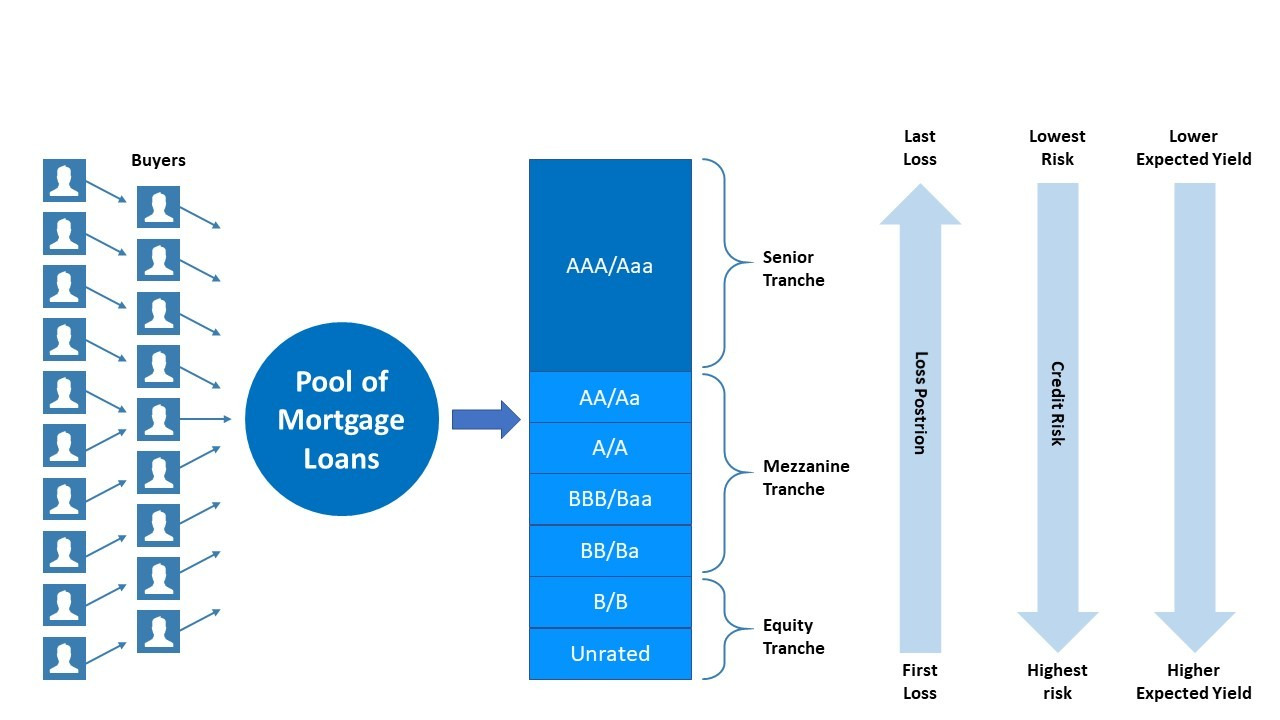

Tranche is a generally used time period in coated debt obligations (CDOs), asset-backed securities (ABS), mortgage-backed securities (MBS), and credit score default swaps.use (CDS). If you have ever seen the film The nice brief he will certainly be deeply impressed by this idea. If you do not already know, take a second to take a look at the reason under.

First, mortgage-backed securities (MBS) are securities issued in opposition to actual property collateral, whereas asset-backed securities (ABS) are securities issued that function on the idea of the security of money move, particularly money move. the issuance of securities with future proper (for instance, installment funds from debtors when taking out a mortgage for the acquisition of a automobile, and so forth.). And lastly, the CDO is created, by aggregating numerous varieties of debt obligations (home debt, vehicle debt, faculty debt, and so forth.) into one safety.

Surely you’re questioning who these titles are being offered to and what are the advantages? There might be 3 events concerned on this course of: the vendor, the issuer and the investor.

Seller These are the businesses that create debt to promote to the issuer. They might be credit score items (banks, monetary providers firms equivalent to FE Credit, and so forth.). They lend cash to prospects, then resell the mortgage to the issuer. Issuers it’s going to pool many loans, merge them into securities and promote them to buyers. The vendor will proceed to gather curiosity and principal from the borrower, then move the income to the Investors. The tranche is now used to categorise dangers. For instance, AAA is low danger, AAA inventory is a group of loans with a excessive share of collateral (equivalent to actual property) and an excellent file of debtors (good funds, no unhealthy debt) ….), AA it is going to be rather less safe .. And so on for BBB, BB….

With excessive tranche securities equivalent to AAA, the customer will obtain the decrease rate of interest, the decrease tranche will obtain the next rate of interest, in change when there’s a danger (default), the decrease tranche must soak up all losses to them first at full worth, then to the upper degree tranches.

With the above mechanism, each events will profit: the lender has extra money (from the sale of the loans) to re-lend, the issuer receives the brokerage charge, the investor receives a revenue. However, the danger of most of these securities is …

Saffron Finance’s mechanism of motion

Here you possibly can see the similarities: the vendor is just like the lending / lending platforms, the issuer is just like Saffron Finance (intermediaries) and the principle buyers are the liquidity suppliers.

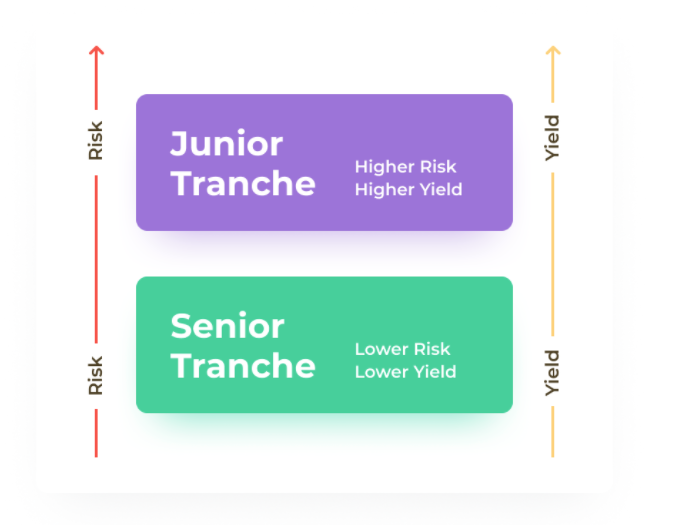

The Saffron Finance protocol at the moment contains 3 tranches for Liquidity Providers, together with:

– Tranche AA: it’s a tranche that pays little curiosity however is insured in case of danger. This insurance coverage quantity might be calculated with the principal and curiosity of Tranche A.

– one tranche: the curiosity obtained is increased than Tranche A, however within the occasion of danger, the LPs taking part in Tranche A will lose principal and curiosity.

This is the distinction between saffron and different yield crops, permit customers to handle the danger on their funding by way of tranches.

Saffron V2 – Updates and Results

New updates

Saffron V2 is certainly one of Saffron’s main updates, introduced round February 2021 and is about to be launched (beta) with updates equivalent to:

– Added 4 new swimming pools.

– Distribute on Binance Smart Chain and Ethereum, particularly on Venus and Alpha Homora platforms.

– Update pool V1.

– 4 new options launched:

- Permanent staking (one thing like after staking 1 epoch, as an alternative of getting to re-staking customers in the event that they need to proceed to take part in Tranche A, the system will accomplish that robotically, serving to to cut back operations and fuel prices;

- Unlocked swimming pools (customers can enter / depart the pool at any time);

- Liquidity concentrating on (gives the system for calculating the APY to lock in liquidity by offering rewards);

- Tranched change charges (change the change fee of V2 SAFF-LP, the longer customers present liquidity, the upper the change fee might be).

Result

Currently, after deploying V2, Saffron nonetheless encounters many UI / UX errors. At the time of writing, I used to be unable to attach the pockets to the protocol, I couldn’t examine the Total Locked Value on the protocol and within the swimming pools.

However, based on the data I’ve gathered, the amount of cash that customers deposit within the protocol is generally discovered within the S Tranche Pool. Although A Tranche swimming pools have increased profitability, they’re nonetheless not chosen by many individuals. The primary motive might be as a result of Saffron has not but accomplished the Smart-contract Audit.

Considering the long-term issue, the truth that Saffron step by step provides extra merchandise that customers can select from is a constructive issue, with the intention to appeal to extra liquidity for the mission. In the long run, when the consumer interface / UX is right and the product audit is accomplished, maybe TVL within the mission can have revolutionary progress.

Uses of SFI .token

Currently, SFI (Saffron Finance native token) has 2 primary options: Rewards (rewards for LP) and Staking (SFT stake when taking part in a tranche).

In the long run, SFI will even have a operate to make use of as a tariff for the protocol (originally of the tariffs). Currently, the variety of staking SFIs is round 10% of the full provide (you possibly can examine Here). The primary motive is as a result of small variety of individuals in A Tranche. Staking is SFI’s primary buy request, so the mission must do higher to encourage customers to take part in a tranche.

Currently, the advertising and marketing actions of the mission are comparatively restricted, primarily on Twitter and Youtube (the variety of views isn’t a lot). I hope that sooner or later, after enhancing the basic elements of the product, the mechanism of motion, and so forth., Saffron has a technique to additional promote its commercialization.

Competition with different platforms

In addition to Saffron, there are numerous platforms which might be additionally making an attempt to unravel the danger drawback in DeFi in numerous methods.

Granary Bridge

This is a protocol created to deal with DeFi dangers equivalent to fluctuations in yields or fluctuations in asset costs. The protocol’s Smart Yield utility will gather the consumer’s collateral and deposit it into mortgage protocols or agricultural manufacturing protocols.

The income will then be packaged in numerous tranches and tokenized. The revenue and danger divisions of the tranches are additionally extremely worthwhile: excessive danger, low return, low danger. Currently, BarnBridge is supported to make income on Compound, AAVE, CREAM …

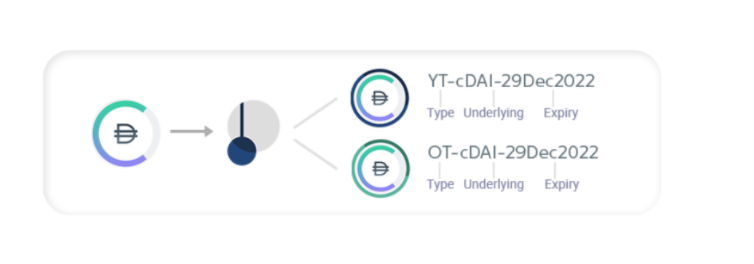

Pendle

Pendle permits trading and hedging on AMMs. The Pendle protocol doesn’t function as a decentralization of danger however as an alternative operates as an rate of interest swap.

Users will deposit tokens as artificial property equivalent to aUSDT or cUSDT in Pendle to mint Ownership Token (OT) and Yield Token (YT). OT (possession token) will signify possession of the deposited asset and YT (revenue token) will signify the proper to future income. At this level, customers can select from some ways to make use of YT Token, equivalent to:

- Sell YT Tokens on Pendle’s AMM for Cash Upfront.

- Deposit YT Tokens in Pendle’s AMM to supply liquidity, recuperate commissions and rewards.

finish

The Saffron Finance mission is a mission with a good suggestion in a distinct segment that I discover very vital. The mission has additionally raised capital from many well-known funding funds equivalent to Dragonfly Capital (lead), Multicoin Capital, Coinbase Ventures, DeFi Holdings … With the ecosystem of those funds, Saffron Finance has extra alternatives to broaden the protocol. additionally different tasks invested by these funds.

Currently, the market capitalization of the mission on the time of writing is round 27 million, whereas the utmost circulation / provide token is round 80%. Tokenomics of the mission additionally has completely no non-public / public gross sales shifts. Therefore, right now, the strain to completely discharge may be very low, which is an efficient situation for SFI to extend in the long run.

What do you consider Saffron and the decentralization of danger? Don’t neglect to depart a remark to debate with Coinlive!

Poseidon

See different articles analyzing different potential DeFi tasks by writer Poseidon:

.