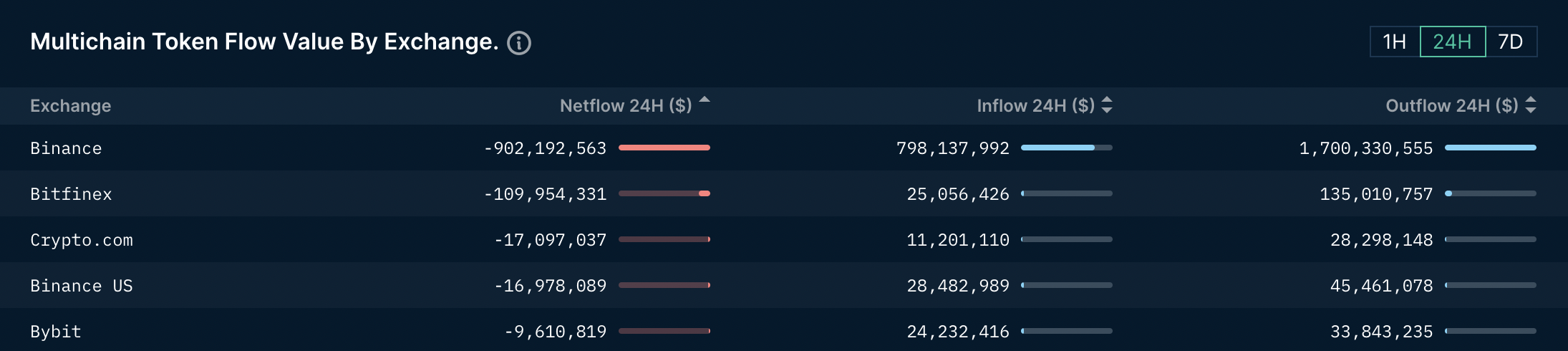

Up to USD 902 million in net inflows flowed out of the Binance exchange in the previous 24 hrs, in accordance to nansen.

Binance, the world’s greatest cryptocurrency exchange by trading volume, is encountering a surge in withdrawals amid the FUD siege.

Netflow, which is calculated as the variation in between the volume of assets getting into/depositing (Inflow) and leaving/withdrawing (Outflow) from the exchange, reached USD 902 million in the final 24 hrs, in accordance to Cointelegraph statistics . platform nansen.

This quantity is even larger than the sum of all other centralized exchanges on the identical benchmark frame and 9 instances larger than Bitfinex, which has the 2nd highest deposit and withdrawal spread in the statistical record.

Withdrawal from Binance is the record considering that eleven/13, two days later on FTX file for failure protectionTo observe Arkham intelligence.

Still, the outflow “doesn’t look too unusual or severe,” Arkham analyst Henry Fisher wrote in Telegram, evaluating the outflows to $64 billion in assets above Binanza.

Notably, Jump Trading and Wintermute are the two names that have quietly transferred the greatest volume of cash from Binance above the previous seven days.

Jump has net outflows from Binance exceeding $146 million for the week and no inflows

If Binance’s books appear totally drained of all liquidity, the release of maybe the greatest MM is most likely a very good cause why

Source: https://t.co/aasol67vsX https://t.co/GbeXfXqwce pic.twitter.com/yLYXgBEsSW

— Andrew T (@Blockanalia) December 12, 2022

Specifically, Jump manufactured a net withdrawal of USD 146 million, of which BUSD 102 million, USDT 14 million, ETH ten million, and a handful of hrs in the past it traded about BUSD thirty million from Paxos. Meanwhile, Wintermute has withdrawn eight.five million wBTC and five.five million USDC.

The wave of enormous withdrawals came just after a quantity of Binance-connected suspicions have been extensively reported in the media, the particulars are welcome to read through additional in the up coming part.

Criminal expenses towards Binance

As reported by CoinliveBinance has been suspected of violating sanctions and anti-cash laundering laws considering that 2018. Theo ReutersSeveral prosecutors filed criminal expenses towards twelve Binance executives, together with CZ. However, various other prosecutors are looking for even further proof towards Binance.

This 12 months, the information company Reuters it has also performed a number of independent investigations into Binance, the exchange says weak anti-cash launderinghardly ever cover your eyes for a massive volume of dirty cash up to two.35 billion bucks And disclosure of information and facts to Russian authorities. In July, Binance also assisted Iranians set up accounts and trade on the exchange, bypassing the US embargo.

Also on the evening of December twelve, Binance confirmed that the Reuters report was totally fabricated and counterfeit. The exchange claims to nevertheless enhance technologies specifications to enhance anti-cash laundering. CZ also posted a tweet that meant “cheating” the media and urged the neighborhood to “ignore FUD.”

smh, some media are nevertheless operating for…

—CZ Binance (@cz_binance) December 12, 2022

By the finish of final week, Binance is condemned by the neighborhood made a decision to block a user’s account due to “absurd” allegations. how block withdrawals from accounts that unexpectedly advantage from it from the fluctuations of the Sun Token, Ardor, Osmosis, Exciting and Golem coins on the exchange.

Not only that, even if it was announced Proof of Reserves (PoR) authentication on blockchain And licensed by audit unit to hold 101% Bitcoin, Binance has however to meet media demands. Sheet Wall Street Journal pointed out that Binance’s capital buffer report omits inner fiscal controls and is relatively shady.

Synthetic currency68

Maybe you are interested: