Coinlive would like to summarize for readers the most current information on the condition of the FTX exchange, the Alameda Research fund and CEO Sam Bankman-Fried commencing on the morning of November twelve, 2022.

Official FTX News

Sam Bankman-Fried’s assets fell to USD one soon after filing for bankruptcy

To stick to Bloomberg’s Billionaires Indexbillionaire’s wealth stats webpage, former FTX CEO Sam Bankman-Fried’s asset worth was recorded to drop $one soon after filing for bankruptcy.

The Bloomberg Billionaire Index now demonstrates SBF has a net really worth of a complete 3 bucks pic.twitter.com/Z9cYuC7X3D

– db (@ tier10k) November 11, 2022

At the finish of final week, Mr. SBF’s assets had been even now calculated at almost $sixteen.four billion, in advance of dropping to just below $900 million overnight soon after it was uncovered that FTX had reached a buyback deal. by Binance.

Miami Heat basketball staff cancels stadium naming agreement with FTX

Just hrs soon after FTX filed for bankruptcy, Miami-Dade County in the state of Miami (USA) and the Miami Heat basketball staff launched a statement terminating ties with the floor, successful instantly.

Photos circulating on Twitter display that the stadium management has begun to take away the FTX emblem.

Seen from my condominium in Miami, it seems to be like they are taking down the FTX Arena indicator! pic.twitter.com/3gaHimxEwy

– Shiv (@ shiv2268) November 11, 2022

In April 2021, FTX reached a $ 135 million sponsorship deal with the Miami Heat basketball staff, obtaining naming rights for the stadium for twenty many years.

During final year’s peak time period, the exchange also signed cooperation agreements with quite a few other big sports activities organizations this kind of as the American Baseball League (MLB), TSM esports staff, North American League of Legends (LCS), University of Sports Cal Athletics sportsman and American football legend Tom Brady, basketball star Stephen Curry and tennis star Naomi Osaka. The floor also invested a great deal of income acquiring ads at the Super Bowl Rugby Super Cup occasion in early 2022.

While the worth of these discounts is not disclosed, statistics display that FTX has invested at least $375 million advertising its picture.

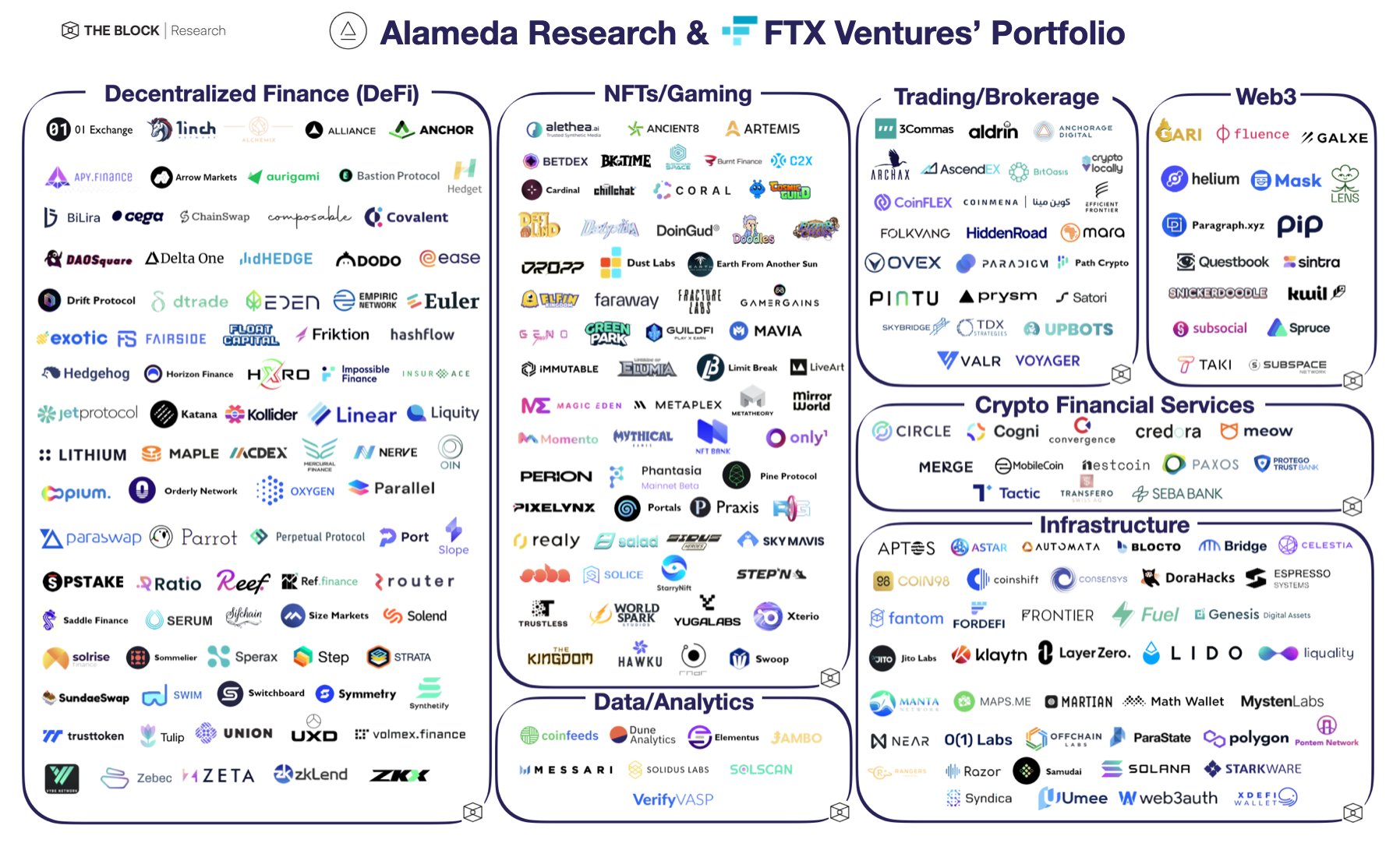

Portfolio of FTX Ventures and Alameda Research

Page The block has aggregated a lot more than 250 tasks that have so far been invested by the FTX exchange, the FTX Ventures fund and the Alameda Research fund.

In addition to emerging tasks this kind of as Aptos and Sui, quite a few names with Vietnamese roots also seem in the listing this kind of as the Ancient8 blockchain gaming infrastructure alternative, the Coin98 Wallet wallet application, the Sipher blockchain game, the Solscan blockchain viewer (formulated by Tomochain) and Sky Mavis (the business behind Axie Infinity).

Voices about FTX

In filing for bankruptcy, FTX stated that latest assets and liabilities are inside the array of ten-50 billion bucks.

Alameda accountability north of 10b wow pic.twitter.com/hPVvspcJEZ

— Tristan (@Tristan0x) November 11, 2022

However, in accordance to an unconfirmed supply, the latest assets of FTX have a huge quantity of illiquid Solana tokens this kind of as $two.one billion Serum (SRM), $543 million FTT, $616 million Maps.me (MAPS),… The challenge is that there is a higher chance that FTX will not be ready to liquidate these tokens at the declared worth, top to the The real assets of the exchange may well be significantly less than stated.

First draft of what the asset side seems to be like… likely some inaccuracies/missing things

It looks SBF was also the accountant (two.1b SRM? Lol) pic.twitter.com/yo5SJFcrus

– minigrogu (@minigrogu) November 11, 2022

The organizations concerned hold appearing

After FTX went bankrupt, there had been a lot more and a lot more businesses and crypto tasks that admitted to holding income, acquiring investments, and obtaining relationships with FTX.

Readers can see a lot more organizations that have admitted to remaining impacted by FTX – Alameda in preceding Coinlive updates right here and right here.

Ren protocol

The Ren Protocol (REN) blockchain bridge alternative mentioned it has obtained quarterly funding from Alameda Research in excess of the previous yr. Therefore, as Alameda went bankrupt, the task was excluded from funding. The task will proceed to keep track of the condition and will strive to keep the Ren two. roadmap.

one) An update from Ren Labs on current occasions:

– Ren (@renprotocol) November 11, 2022

Star Atlas

Solana-primarily based gaming task Star Atlas (ATLAS/POLIS) admits it has up to half of its income reserves on FTX and is in danger of dropping it all, but will not reveal particular numbers.

To examine this with complete transparency, join us at a Town Hall right now at 5pm EST onwards https://t.co/mCa6L6xBZj. pic.twitter.com/XnNuSdEaNG

— SW4²6N3R (@at_mwagner) November 11, 2022

Star Atlas apologizes to the local community and workers, stating that the project’s believe in has been “betrayed by FTX”. In the long term, the Star Atlas staff will target on raising a lot more money.

Brands Animoca

Prominent gaming/Web3 investment fund Animoca Brands mentioned it was hit by the FTX-Alameda situation, but the effect was not a lot.

one / our ideas on #FTX tldr saga we have minimum publicity and a incredibly sturdy stability sheet and we have to have to hold them #BUIDL # web3 and celebrate the victories they have enabled #teachers #creators #players and so on. a greater lifestyle by #digital property #NFT https://t.co/MxKvbXMOId

– Yat Siu (@ysiu) November 11, 2022

Animoca Brands reassured traders that the fund’s money overall health stays robust with $214 million in income, $940 million in cryptocurrencies and $three billion in crypto reserves. The fund is now investing in about 380 crypto businesses in the Web3 section.

Centigrade

Celsius, a cryptocurrency loan provider that went bankrupt in July 2022, mentioned it holds three.five million Serums (SRM) on FTX, as properly as a $13 million loan to Alameda Research.

In the curiosity of transparency, Celsius has approximately three.5mm SRM tokens on FTX, most of which are locked up, as properly as loans to Alameda totaling approximately $13 million (primarily based on latest values) that are now below -collateralised (primarily by FTT tokens) .

—Celsius (@CelsiusNetwork) November 11, 2022

Matrixport

Investment app Matrixport mentioned 3 of the company’s cryptocurrency cost savings goods had been exposed to FTX with 79 customers impacted, but did not disclose particular damages.

‼ ️ Important notice️ pic.twitter.com/kQXg1OVh4l

— Matrixport (@trueMatrixport) November 11, 2022

Genesis trade

After admitting to holding $175 million in FTX, the marketplace maker mentioned on the evening of Nov. eleven that it had obtained a $140 million bailout from mother or father business Digital Currency Group.

Crypto broker Genesis, whose derivatives business enterprise has $175 million locked in an FTX trading account, will acquire a $140 million equity infusion from its mother or father business https://t.co/UxJLFfYYHc

– Bloomberg Crypto (@cripto) November 11, 2022

The Yuga workshops

Yuga Labs, the business behind the NFT Bored Ape Yacht Club assortment and the Otherside metaverse task, says it was unaffected by moving money from FTX.US in advance of the exchange stopped permitting withdrawals.

Most of the company’s assets are in the kind of deposits in financial institution accounts and investments in government bonds.

FYI, that is all the ETH we had https://t.co/HDjroaAsck (seems as blockfolio on etherscan) Transferred to CB Custody earlier this week. Everything is moved to CB as portion of their method soon after this tx, so beware of amateur etherscan investigators.https://t.co/Wq15XVjtQ3

— GordonGoner.eth (Wylie Aronow) (@GordonGoner) November 11, 2022

It is incredibly possible that the amount of crypto organizations/tasks/businesses admitting to be concerned in FTX-Alameda will proceed to boost in the foreseeable long term when we will not be ready to thoroughly realize the effect of the incident.

— ThreadGuy (@notthreadguy) November 11, 2022

Synthetic currency 68

Coinlive published a series of content articles summarizing the Binance – FTX – Alameda drama, readers can see a lot more right here:

– Binance liquidates its total USD 580 million investment in FTX tokens

– Users massively withdraw from FTX

– The entire marketplace was heavily dumped, FTT misplaced 22 USD

– Binance has reached an agreement to purchase back FTX – Market promote-off

– FTX CEO’s assets drop by $14.six billion, he wrote a letter apologizing to traders

– CZ urges exchanges to supply evidence of client deposit

– The Solana method “endures the battle”

– Binance cancels FTX acquisition and most current updates

– Continuously quite a few organizations declare “union” from FTX

– Sam Bankman-Fried writes a letter of apology and updates on the FTX – Alameda catastrophe

– Update FTX condition on the morning of eleven/eleven/2022

– FTX files for bankruptcy, Sam Bankman-Fried actions down as CEO