Two members of the United States Congress have announced the most current bill to regulate stablecoins and crypto wallets, two legal subjects of wonderful curiosity to the United States Congress in current occasions.

Law on the regulation of stablecoins

On the evening of February 15 (Vietnam time), Congressman Josh Gottheimer of the Democratic Party launched the “Stablecoin Improvement and Protection Bill”, proposing recognition and insurance coverage for some stablecoins with the aim of “Defining valid stablecoins, separating them from volatile cryptocurrencies, and imposes protections on consumers and investors “.

For cryptocurrency to thrive right here in the US, rather than overseas, we have to have to deliver additional certainty to enable drive innovation and defend customers.

That’s why I’m releasing the Stablecoin Innovation and Protection Act to define qualifying stablecoins. ️https://t.co/J96VZQqSli

– Representative Josh Gottheimer (@RepJoshG) February 15, 2022

The bill would assess which stablecoin tasks are “viable” to be regulated, with the most significant criterion getting that they are constantly convertible one: one into US bucks and would not be viewed as a currency, securities or commodities.

Banks, non-banking institutions and fiscal institutions that situation these stablecoins will have to have to meet a income reserve necessity to back them up in an account with the Federal Deposit Insurance Corporation (FDIC). ).

Responsibility for overseeing stablecoin issuers will fall on the Office of the Comptroller of the Currency (OCC), which will set the laws on leverage, auditing, anti-dollars laundering / terrorist financing,… for stablecoins.

Mr. Gottheimer stated he cautiously consulted the Financial Advisory Group’s Stablecoin Report to President Biden launched in early November 2021, as reported by Coinlive.

The parliamentarian stated:

“The rise of cryptocurrencies presents tremendous opportunities for our economy. But in order for the cryptocurrency industry to thrive and thrive in America, instead of just monitoring, we need to provide guidance and guarantees to promote progress and protect the public. Here’s why. I am proposing the Stablecoins Protection and Improvement Bill to encourage the growth of the cryptocurrency industry in the United States, define what a valid stablecoin is, and protect the American people from threats such as organizations with bad intentions and terrorism. “

Invoice to defend crypto wallets

Then, at dawn on February sixteen, Republican Congressman Warren Davidson proposed a bill to defend non-custodial crypto wallets from scrutiny by federal regulators.

A bill presented by the Rep. @WarrenDavidson (R-Ohio) would defend crypto wallets not hosted or self-hosted by government companies. @BrandyBetz relationshipshttps://t.co/1ELLUHEJY1

– CoinDesk (@CoinDesk) February 15, 2022

Mr. Davidson’s bill aims to “prevent federal agencies from preventing people from using virtual currencies to buy and sell goods and services for personal needs.” Additionally, the bill does not let the government to ban men and women from employing non-custodial crypto wallets – wallets presented by third events other than exchanges, forcing customers to self-regulate – maintain the personal important and use it at their very own chance.

This is a response to the past cryptocurrency wallet management proposal, which was “relaunched” by the US Treasury in late January 2022, requiring verification of data on the owners of cryptocurrency wallets, irrespective of whether custodial or non-custodial.

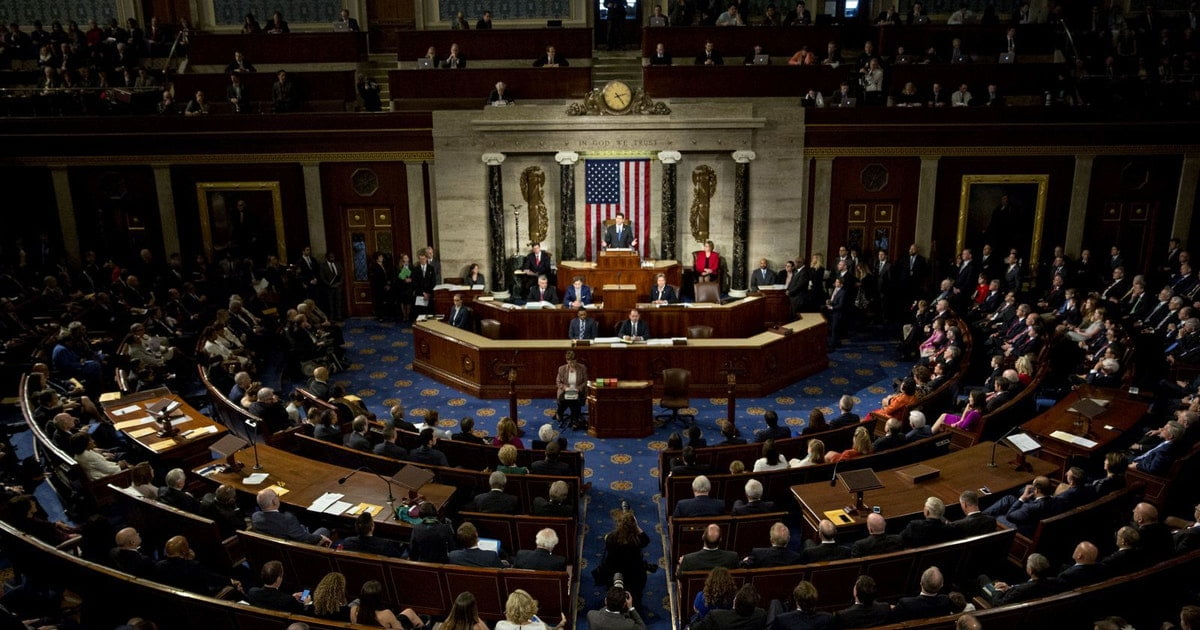

However, the two of the over expenses are only at the proposed degree. They will very first have to obtain the help of a amount of parliamentarians from the two sides to be presented to the House of Commons, then talked about in advance of the practical committee and then presented and debated in advance of the total House. , transfers it to the Senate, and carries out a comparable revision procedure, lastly submitting it to the President for signature into law.

Legal circumstance of cryptocurrency in the United States

The crypto legal area in the United States is acquiring hotter than ever in current occasions. Between the time the Financial Advisory Group launched the report and the two chambers held hearings in December, President Biden signed a bill that incorporates provisions to tax cryptocurrencies and assigns the Treasury Department to identify what. we imply by “crypto broker” – the vague notion that that phrase has been heavily criticized. By February 2022, the US Treasury Department lastly took an official place on this idea, temporarily easing public issues.

Subsequently, a US fiscal policy company, the Financial Stability Oversight Committee (FSOC), stated it will proactively restrict the hazards of stablecoins if Congress dwells on the situation for also extended.

By 2022, several US Congressmen announced their bill to totally regulate cryptocurrencies. The Internal Revenue Service (IRS) needs to be capable to tax cryptocurrency investors’ earnings from NFT speculation. And the US Treasury Department just lately “revived” a controversial cryptocurrency wallet regulation that is stated to be capable to “squeeze” the cryptocurrency marketplace in the United States.

Faced with the regulatory chaos of cryptocurrencies, it was rumored that in February the White House would situation an executive buy requiring government companies to unify their place and strengthen oversight of the cryptocurrency sector. Both the US Senate and the House of Representatives held hearings on the stablecoin situation in mid-February.

In the opposite path, several candidates for government positions are employing the “get cryptocurrency” card as an benefit to lure voters ahead of this year’s mid-phrase elections in November this yr. .

Synthetic currency 68

Maybe you are interested: