The US bankruptcy court has accredited the FTX exchange’s proposal to promote cryptocurrencies, which contains $three.four billion in the type of SOL, BTC, ETH and various other altcoins.

US Court Allows FTX to Sell $three.four Billion of Cryptocurrencies

A Delaware County Bankruptcy Court judge on September 13 (US time) made the decision to approve the proposed cryptocurrency sale of FTX, an exchange that went bankrupt in November 2022.

Previously, as reported by Coinlive, FTX had submitted a proposal to the court at the finish of August, asking to promote the restored cryptocurrency for money, though getting ready a compensation system for victims for the following use, though guaranteeing that no was impacted by fluctuations. in the cryptocurrency marketplace.

The exchange has also expressed its wish to open hedge orders for BTC and ETH to restrict the dangers linked with marketing these currencies. Especially in the situation of ETH, FTX would like to target Ether for more income.

The revenue method will be carried out by way of Galaxy Digital, a digital financial institution that supports cryptocurrency and is a single of the renowned cryptocurrency custodian institutions in the United States. According to the proposal, the worth of the sale will be somewhere around one hundred-200 million bucks per week.

FTX is necessary to notify the U.S. Government Trustee of revenue transactions ten days in advance, but is not necessary to challenge a public observe.

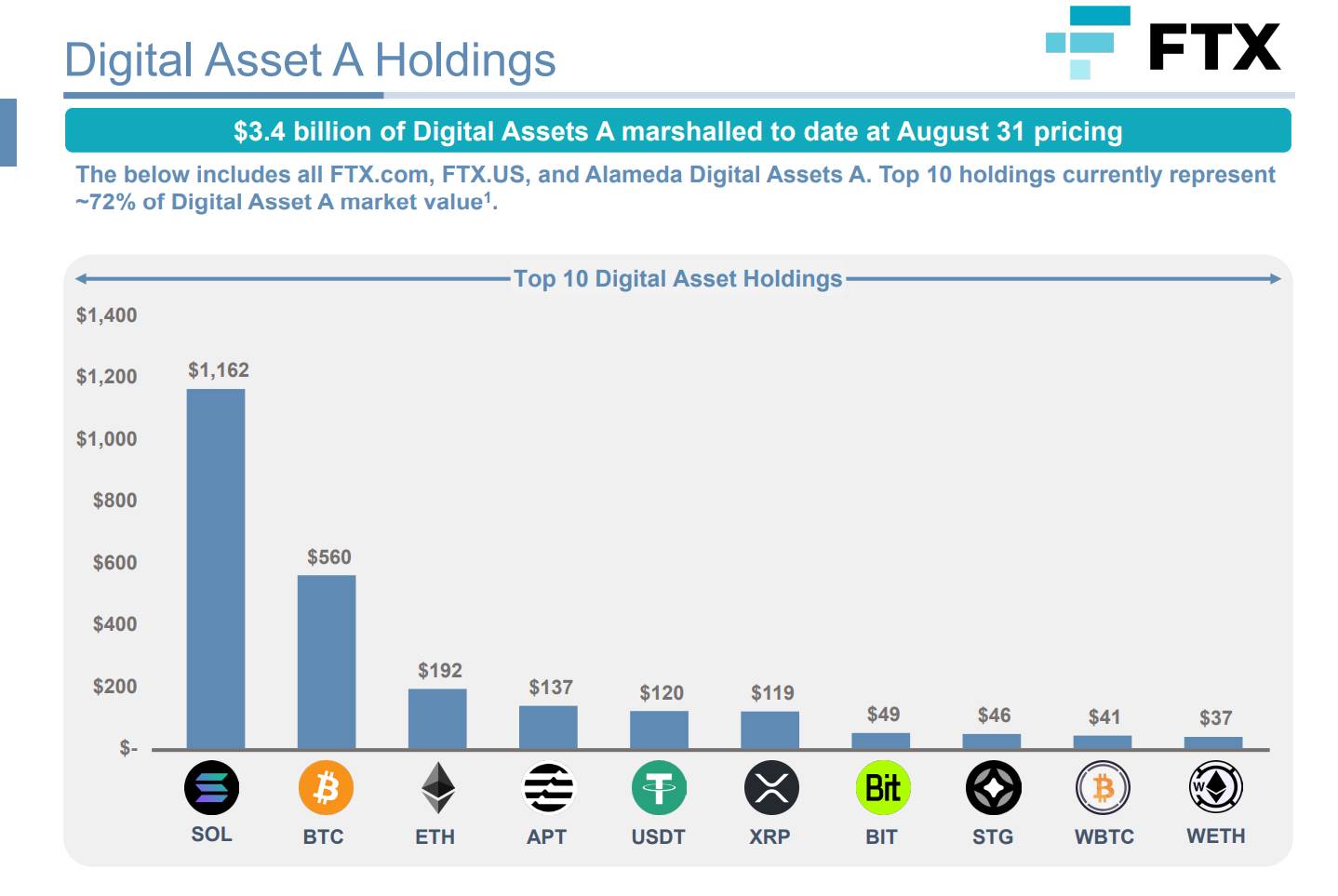

FTX earlier this week announced its asset report as of the finish of August 2023. Based on marketplace price tag, the exchange holds $three.four billion in really liquid cryptocurrencies, largely in the type of Solana ( SOL), Bitcoin (BTC), Ethereum (ETH), Aptos (APT), Tether (USDT), XRP,…

Highly liquid tokens held by FTX as of August 31, 2023

Highly liquid tokens held by FTX as of August 31, 2023

The cryptocurrency local community has expressed concern in current days above the likelihood of FTX releasing tokens onto the marketplace, especially SOL. However, as Coinlive pointed out, the vast majority of the SOL held by FTX is really locked in and will be paid out progressively among now and 2027-2028.

However, acquiring $one hundred-200 million in assets liquidated by FTX each week nonetheless represents tremendous marketing strain on the cryptocurrency marketplace.

Coinlive compiled

Maybe you are interested

Join the discussion on the hottest concerns in the DeFi marketplace in the chat group Coinlive Chats Let’s join the administrators of Coinlive!!!