In a speech to the American Enterprise Institute on August five, Federal Reserve Governor Christopher Waller expressed doubts about the positive aspects touted by central financial institution digital currencies (CBDCs). ).

Federal Reserve Governor Christopher Waller Waller explained:

“I remain skeptical that a Federal Reserve CBDC will solve all the major problems plaguing the US payment system. In general, the government should only compete with the private sector to address market failures. This fundamental principle has held true. well America since its foundation, and I don’t think CBDCs should be an exception. “

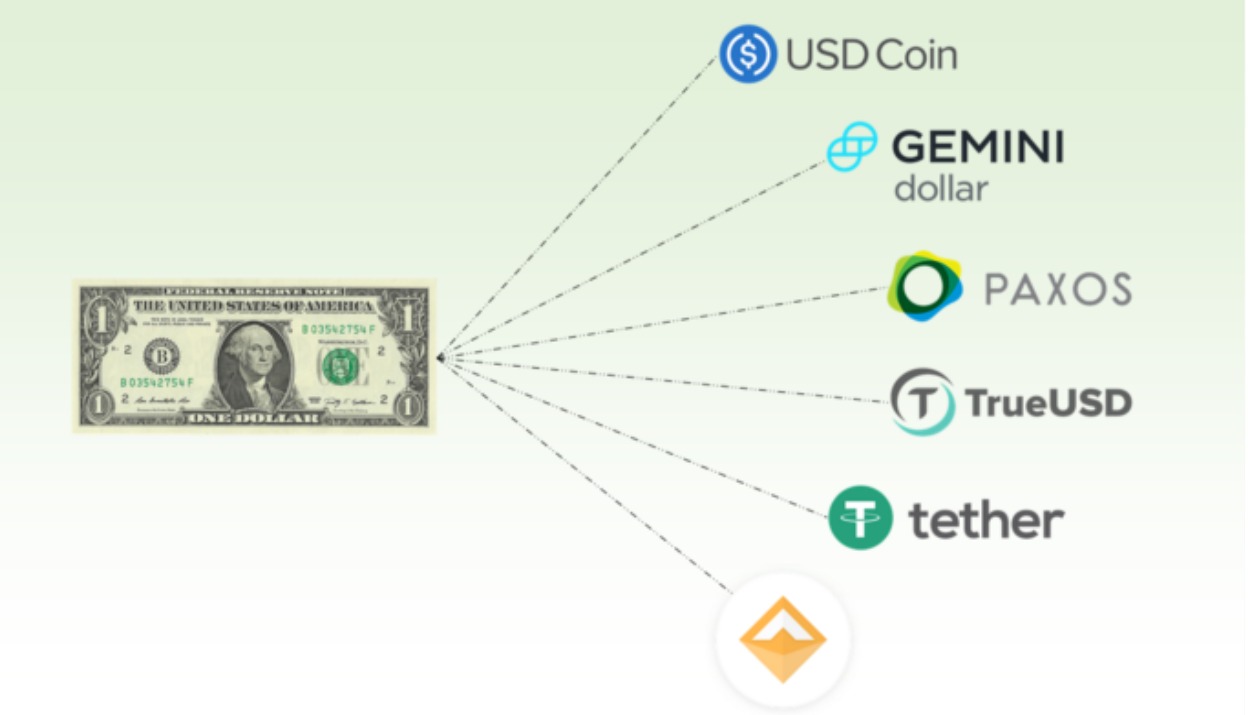

Instead of a Fed-issued digital dollar, Waller seems to be cautiously marketing personal sector advances, notably stablecoins. Mr. Waller mentioned that personal stablecoins could also present competitors to the banking sector that marks digital payments advertised by CBDC advocates.

However, the Stablecoins proved controversial. Waller explained, citing a pending report from the president’s doing work group.

“There are many legal, regulatory and political issues that need to be addressed before stablecoins can safely proliferate.”

Waller’s feedback join a expanding chorus, particularly from the suitable, marketing personal sector stablecoins in excess of CBDCs.

In a current hearing with Fed Chairman Powell, Senator Pat Toomey – like Waller, a Republican – came to the similar conclusion. Mr. Toomey shared:

“If you have stablecoins and cryptocurrencies in use, you may not need a CBDC.”

Synthetic Currency 68

Maybe you are interested: