On November one (US time), President Biden’s Financial Markets Advisory Group launched a prolonged-awaited 23-web page report on the stablecoin industry’s picture.

The President’s Financial Markets Advisory Group is a gathering of senior money officials from the Biden administration, like Treasury Secretary Janet Yellen, Federal Reserve Chairman Jerome Powell, and US Securities and Exchange Commission (SEC) Chairman Gary Gensler , between other folks.

The standard conclusions reached by this report continue to be the very same as these of the US Treasury Department and the former White House, namely:

“Stablecoins and their operating model raise a lot of concerns regarding investor protection and market stability.”

Much of the team’s issues nevertheless revolve all around stablecoin securitization and info transparency on the ground. As reported by Coinlive, not only the cryptocurrency sector and the mainstream media have just lately warned about the unclear standing of the collateral info of Tether (USDT), the biggest stablecoin in the crypto sector with a marketplace capitalization of more than 70 billion. bucks, up five instances in 2021 alone.

As a consequence, the Financial Markets Advisory Group advisable that Congress pass legislation restricting who can situation stablecoins. The report reads:

“To counter the risks to stablecoin users and prevent massive withdrawals, the new law should require issuers of stablecoins to be insured depository institutions, subject to supervision and sound management similar to the banking sector. The new law should also prohibit the remaining institutions from participating in the issuance of stablecoins ”.

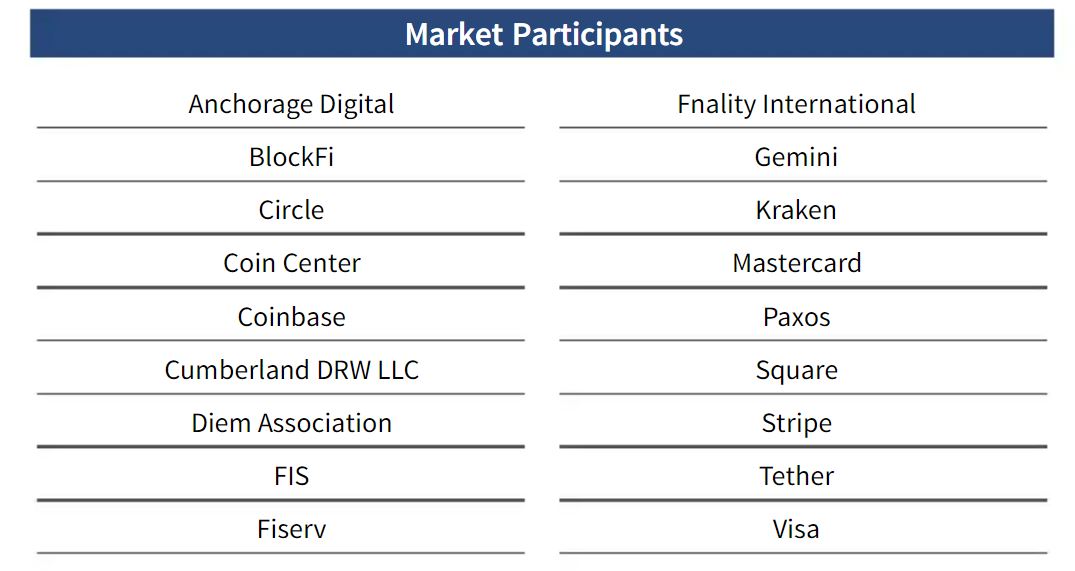

The report also listed the issuers / participants with publicity to stablecoins that the advisory group is preserving an eye on. In unique, the title Diem also appeared, the stablecoin that Facebook intends to construct, even if the undertaking has been stalled for some time.

The advisory group also uncovered that as a result of the get in touch with procedure with the aforementioned stablecoin providers, most of them are prepared to be topic to government management and will quickly demand legal clarity.

Another difficulty that requirements to be solved is which US money regulator will oversee the cryptocurrency sector in standard and stablecoins in unique. The advisory group suggests that lawmakers assign this endeavor to an current company, rather than producing new departments. The listing of proposed regulators consists of: the Department of the Treasury, the Federal Reserve (Fed), the Securities and Exchange Commission (SEC) and the Futures Trading Commission (CFTC), with the SEC and CFTC as the two principal companies. The report also mentions banking regulators this kind of as the Federal Deposit Insurance Corporation and the Office of the Comptroller of the Currency.

Interested readers can see the report right here:

StableCoin report November 1 from Michael Patrick McSweeney

Synthetic Currency 68

Maybe you are interested: