Circle, the corporation behind USDC, announced these days the release of a new products, a euro-backed stablecoin.

The new stablecoin will be known as Euro Coin (EUROC), one hundred% euro-backed, and will have the very same degree of dependability as the USDC, Circle argues.

EUROC is an ERC-twenty token from Ethereum, which is anticipated to help extra blockchains this yr. The complete provide of stablecoins at launch is unknown.

two / Euro Coin is about to depart @Ethereum with the help of a quantity of ecosystem leaders:

Exchanges: @BinanceUS @Bitstamp @FTX_Official @Huobi Global

DeFi: @CompoundFinance @CurveFinance @DFXFinanza @Uniswap

Custodians: @Anchor @CYBAVO @FireblocksHQ

Wallets: @Book @ Institutional MMI– Circle (@circlepay) June 16, 2022

Circle unveiled that EUROC will be listed and open for trading on stock exchanges on June thirty, with help from CEX exchanges which include FTX, Bitstamp, Binance.US, Huobi DEX exchanges consist of Uniswap, Compound, Curve housing units consist of Anchorage Digital, CYBAVO, Fireblocks Ledger and MetaMask wallets.

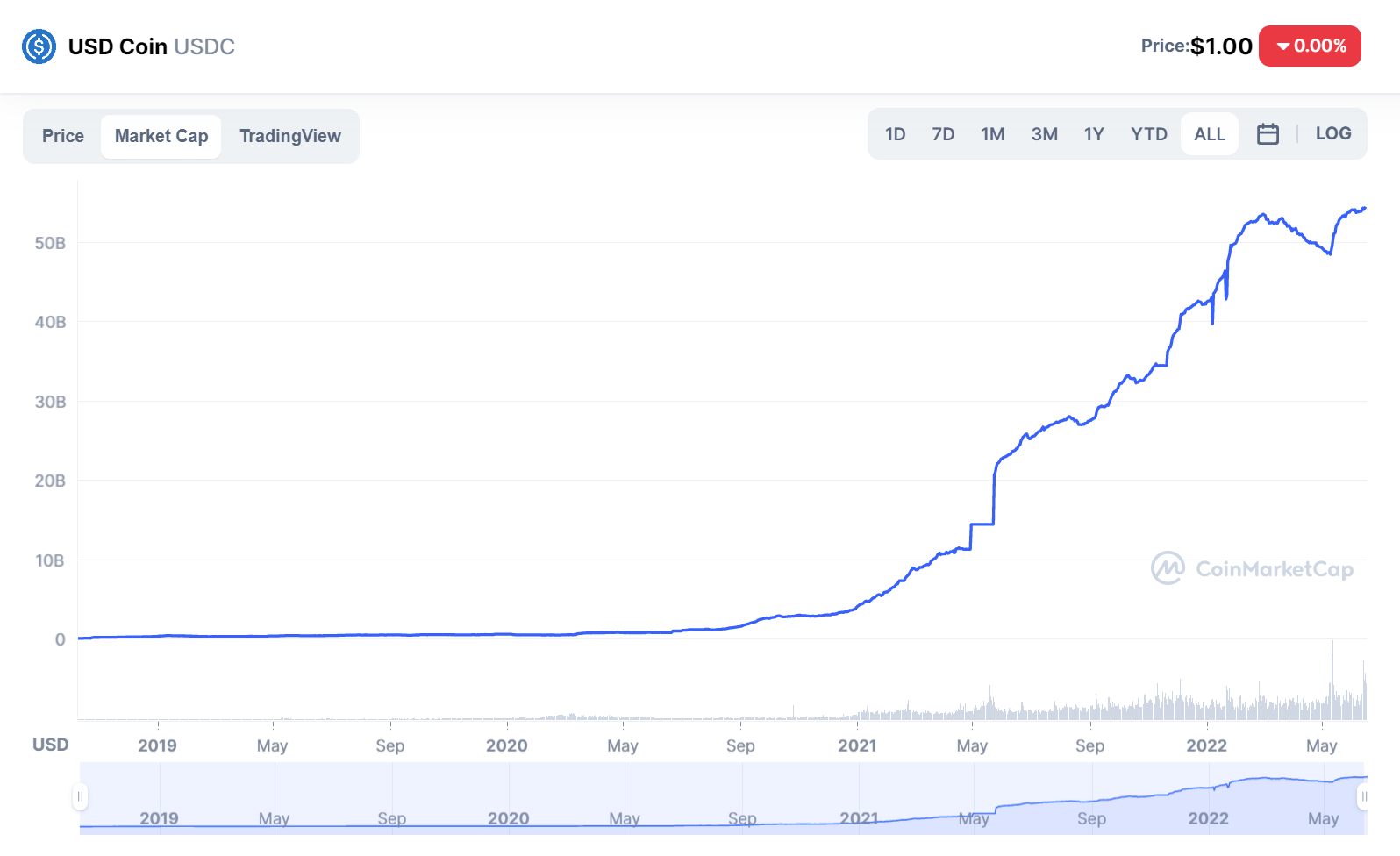

Launched in 2018, Circle is a US stablecoin issuer and has been looking for to apply for a US banking license to be regulated. In just four many years, USDC has turn out to be the 2nd greatest stablecoin in the cryptocurrency market place with a market place capitalization of $ 54.four billion as of June sixteen, near to rival Tether (USDT) with a capitalization of $ 70.eight billion. .

Unlike USDT, USDC has not encountered a lot of troubles in the final two dumps in May and June in the cryptocurrency market place, but conversely, a lot of traders are switching from USDT to USDC and BUSD when evaluating the two stablecoins. of ensures and has extra legal worth than Tether.

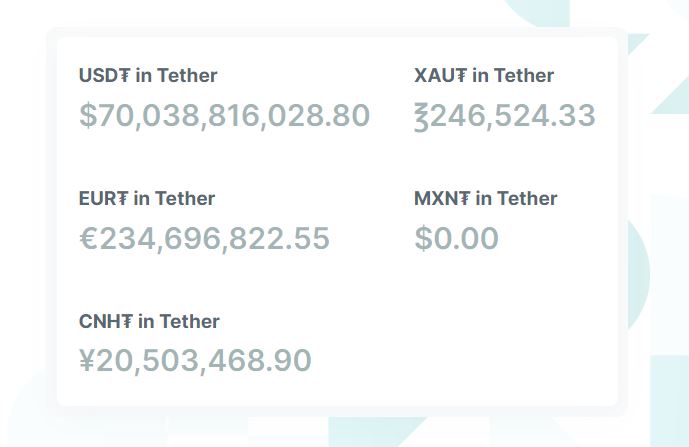

Circle’s euro growth is a move by Tether, which has also issued euro-backed stablecoins (EURT), gold (XAUT), Chinese yuan (CNHT) and new largely Mexican pesos (MXNT).

Currently, European Union (EU) officials are even now defining a regulatory framework for stablecoin issuers in 27 member states. EU lawmakers are even now striving to finalize a code of cryptocurrency legislation known as the “Cryptocurrency Asset Market Regulations” (MiCA), with a series of numerous negotiations lasting for months, but but to be concluded, with a quite clear end result at il current tense.

It is unclear how EU leaders could influence a stablecoin backed by euro but issued in accordance to US specifications. Circle is also awaiting official data from the EU.

Synthetic currency 68

Maybe you are interested: