The worth of stablecoin USDC fell under the $one threshold right after its mother or father enterprise Circle admitted to obtaining contacts with Silicon Valley Bank.

Summary of Silicon Valley Bank developments

As reported by Coinlive, the information that has acquired the most interest in the final 24 hrs in the US stock marketplace and cryptocurrency field is the quick collapse of Silicon Valley Bank, the 16th biggest industrial financial institution in the nation. additional than 200 billion bucks.

Silicon Valley Bank earlier this week showed indicators of income shortages, obtaining had to promote stocks at a reduction and difficulty additional shares to increase additional income, but it has not been thriving. The California State Financial Conduct Authority and the Federal Deposit Insurance Corporation (FDIC) had been forced to intervene, closing banking institutions and seizing assets. The FDIC announced it will open withdrawals to insured consumers up coming Monday, though uninsured depositors will have to wait for the bank’s assets to be liquidated.

Silicon Valley Bank is the 2nd biggest industrial financial institution failure in the background of the US fiscal sector, as nicely as the most critical considering the fact that the 2008 fiscal crisis.

The affect of the over occasion has not however been entirely quantified, due to the danger of producing a knock-on result for other big banking institutions, as nicely as men and women and corporations depositing revenue with Silicon Valley Bank. Particularly in the cryptocurrency marketplace, observers are also particularly concerned about the prospect of cryptocurrency corporations holding the revenue over, since Silicon Valley Bank is a identify that specializes in supplying solutions to tech startups and investment money in the globe. globe. center of the United States.

In the late morning of March ten and early morning of March eleven, Binance and stablecoin company Paxos explained they had been not concerned with Silicon Valley Bank.

Circle hit by Silicon Valley Bank, USDC depeg is most serious in three many years

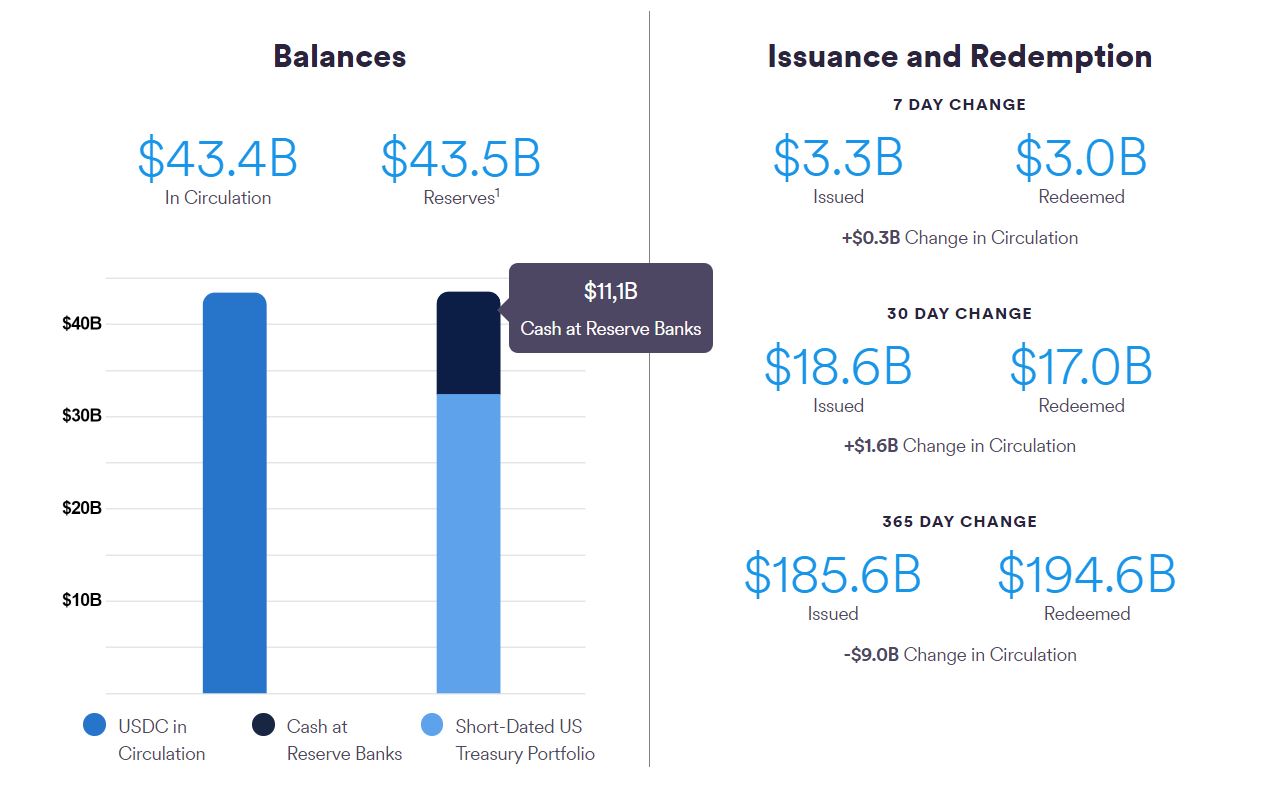

By the morning of March eleven (Vietnam time), right after a extended time period of silence, the stablecoin issuer Circle – the proprietor of the 2nd biggest stablecoin in the cryptocurrency marketplace, USDC with a marketplace capitalization of 43.four billion bucks – he confirmed that he was depositing element of the income as a promise on Silicon Banca della Valle.

Silicon Valley Bank is a single of 6 banking partners Circle employs to control the approximately 25% share of USDC reserves held in income. While we await clarity on how SVB’s FDIC receivership will affect its depositors, Circle and USDC proceed to operate as standard.https://t.co/NU82jnajjY

— Circle (@circle) March 10, 2023

Circle’s announcement reads:

“Silicon Valley Bank is a single of 6 banking partners applied by Circle to control roughly 25% of its USDC income reserves. While we wait to see what affect the FDIC acquisition will have on depositors, operations of Circle and USDC will proceed as standard.”

According to up to date facts from Circle’s web site, the enterprise holds $43.five billion in collateral for USDC, such as $eleven.one billion in income. Thus, 25% of that figure is about $two.seven billion held in 6 banking institutions, such as Silicon Valley Bank. The enterprise has not disclosed the particular volume, leaving the crypto local community alone to speculate even further.

However, some traders made a decision not to wait any longer and fled the USDC. According to the statistics of the blockchain information monitoring unit nansenCircle elaborated a $one.six billion USDC needed to be converted back to income in the final 24 hrs.

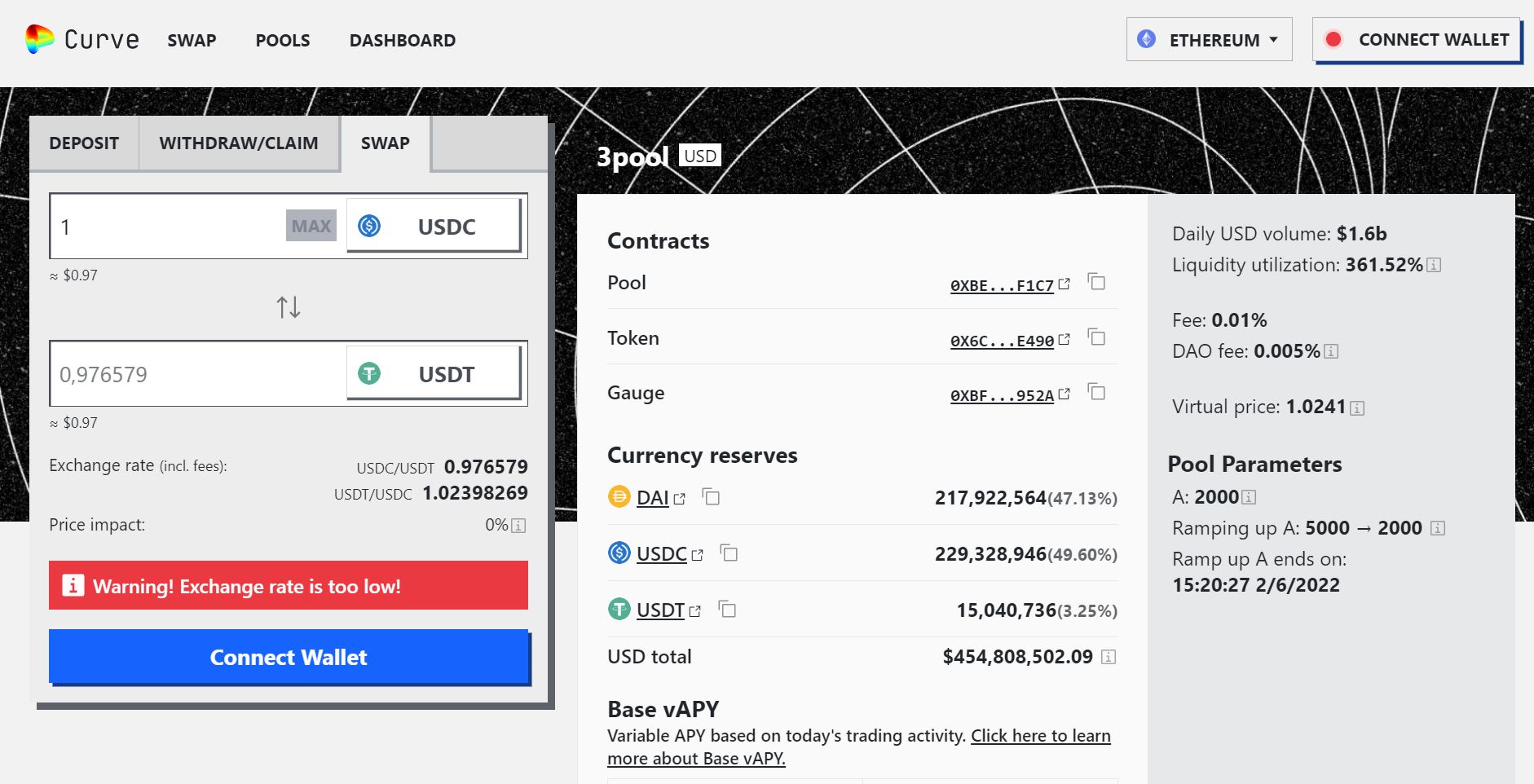

At the identical time, the most abundant stablecoin liquidity pool in the DeFi sector, Curve’s 3pool, which incorporates USDT, USDC and DAI, was also withdrawn as traders massively swapped USDC for USDT, leading to USDT fee in pool dropped to just three%. The USDC to USDT swap fee fell to just USD .97. In the previous 24 hrs, 3pool’s transaction volume reached $one.five billion.

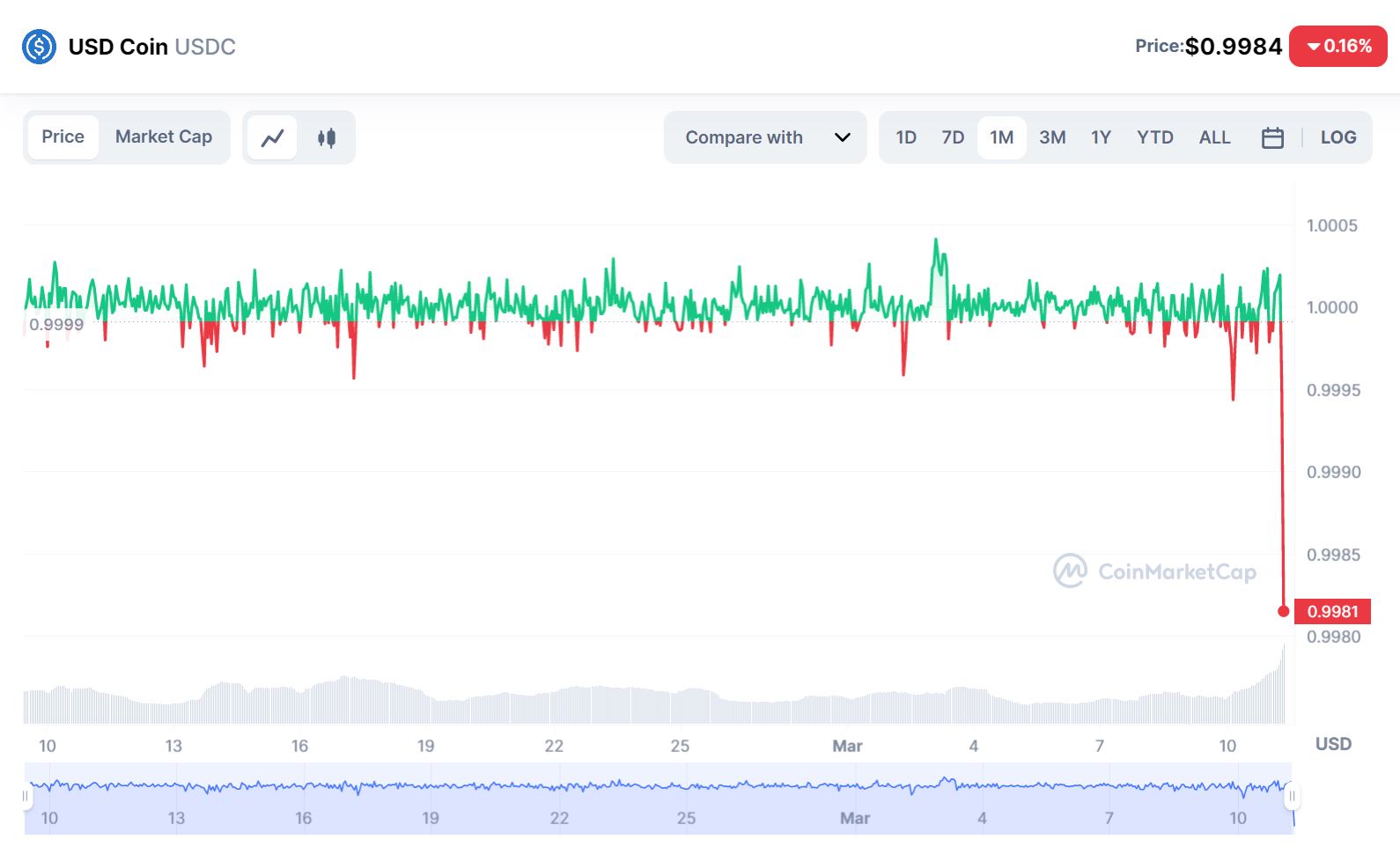

USDC value depegged (falling off the USD one manage) on the detrimental information over, dropping to USD .9980 degree. This is USDC’s deepest depeg considering the fact that July 2020, reduce than crises like LUNA-UST or FTX.

On the morning of March eleven, the world’s biggest cryptocurrency exchange, Binance, announced it would quit converting USDC to BUSD “due to market conditions,” linked to enhanced deposits and conversion strain. stablecoins.

Binance has temporarily suspended the automated conversion of USDC to BUSD due to present marketplace situations, primarily linked to substantial inflows and the increasing burden to help the conversion.

This is a standard procedural danger management phase to get though we check the scenario.

— Binance (@binance) March 11, 2023

Binance at the moment holds the biggest quantity of USDC with a worth of more than USD two billion, followed by good contracts of lots of crypto tasks this kind of as MakerDAO, Arbitrum, Polygon, Aave, Optimims, dYdX, and Compound.

BUSD value is also deeply depeg right after USDC due to new Binance updates. BUSD has by now hit $.9873, which is under the very low when the Binance stablecoin was FUD in mid-February.

Synthetic currency68

Maybe you are interested: