USDD – Justin Sun’s “handpicked” stablecoin and Tron blockchain have misplaced their peg, bottoming immediately after the collapse of the Terra ecosystem.

To adhere to Conecko, the USDD plunged to close to $.9695 early on Dec. twelve. This is the minute lose the peg The most significant of the coin “founded by Justin Sun” considering the fact that the historic collapse of LUNA-UST.

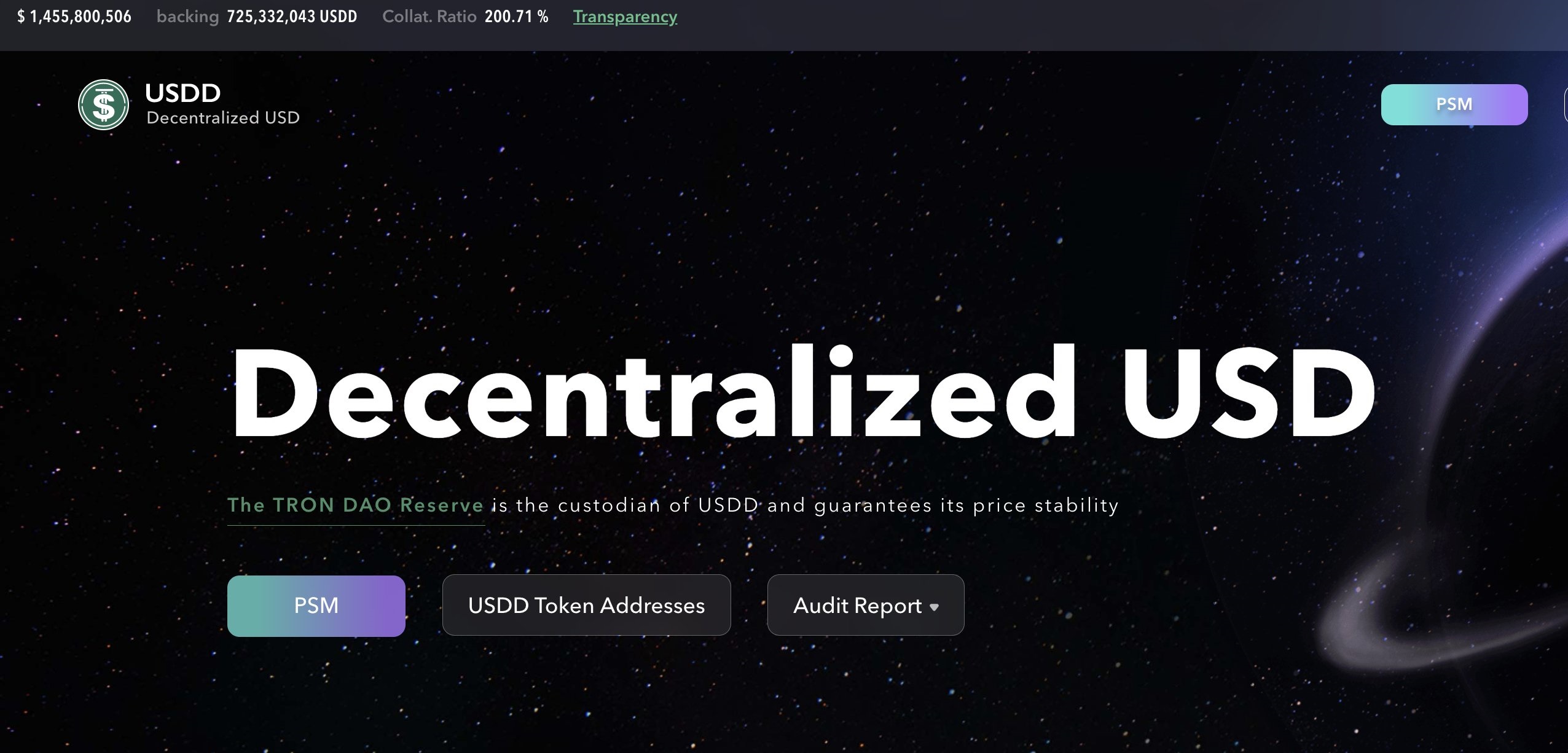

#USDGG The guarantee ratio is In excess of 200% now! Assets with a mixed worth of a lot more than $one.45 billion are safeguarding the #USDGG pegs!

🧐You can check out our side pursuits at any time on https://t.co/CZjLJsQHQW And https://t.co/qOAE7gYIaA.

To keep #BUIDLing!💪 pic.twitter.com/ihIThpZzVF

— USDD (@usddio) December 12, 2022

This is not the initial time USDD has “met a turnaround.” A month in the past, in the heart of the FTX catastrophe, market place-dominant stablecoins this kind of as USDT and USDC have been also shaken, but promptly regained their footing. The USDD was no exception, deviating from the $.98 peg.

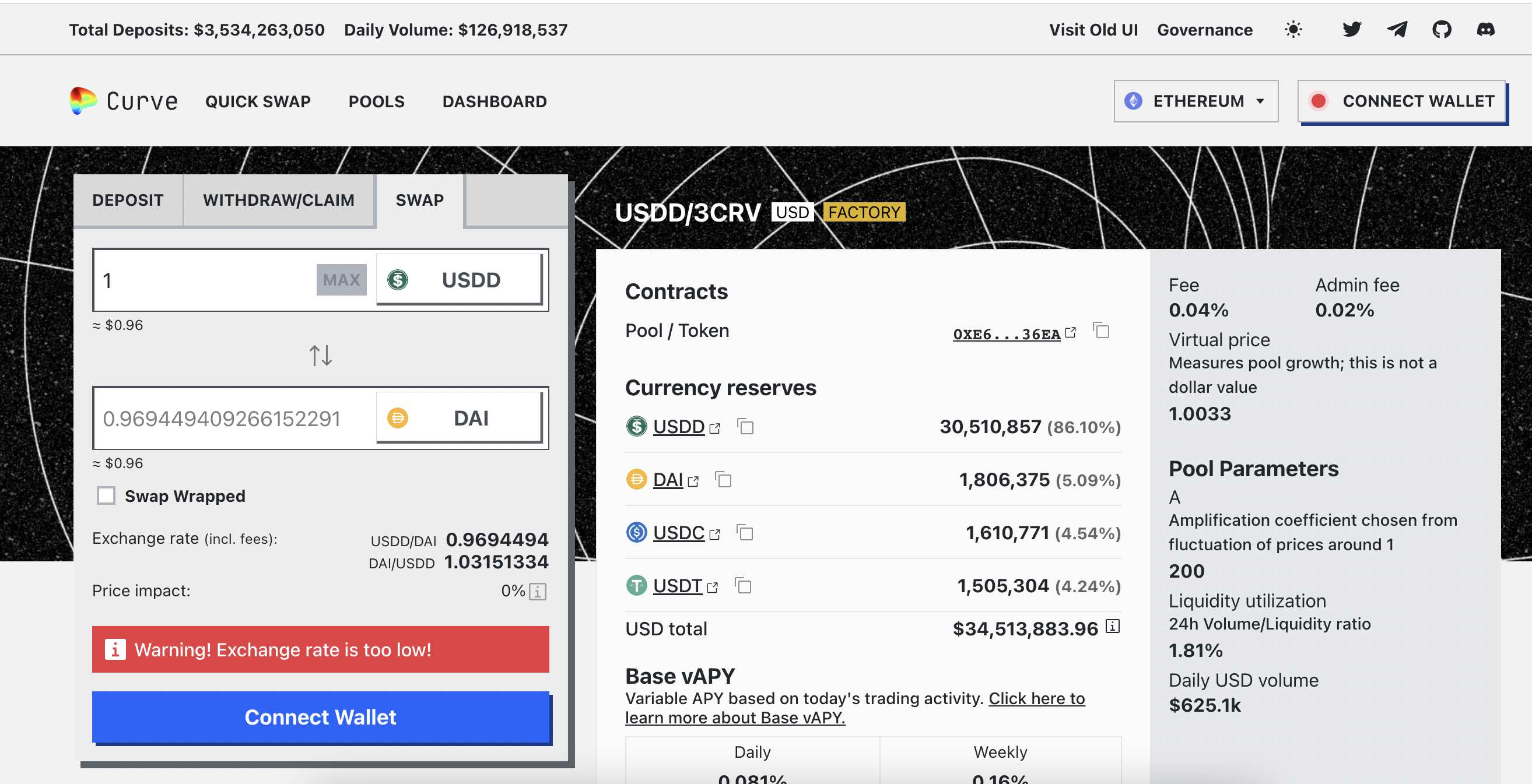

As USDD loses its rate equilibrium, this stablecoin’s share of the USDD/3CRV liquidity pool on Curve continues to maximize. USDD at the moment accounts for 86% of the complete liquidity in the $34.five million pool, up from 80% as measured on Nov. 18. The reduction of the peg displays the trend of customers to trade USDD for other stablecoins this kind of as DAI, USDC and USDT.

USDD (Decentralized USD) to be algorithmic stablecoins issued by TRON (TRX) with the ambition of getting stablecoin three.. TRON launched USDD in May 2022, just days just before LUNA-UST evaporated. USDD operates like UST, one USDD equals one USD. Thus, building panic amid the investment local community, fearing that USDD will be the 2nd UST to fail.

four/

👉🏻 $ USD DD (@justinsuntronThe Terra/LUNA clone) has just dropped under the $.97 depeg threshold they had set, as the reserve collateral and Curve pools are becoming dried up. pic.twitter.com/qeM3ZbvHSo— Eloisa Marchesoni (@eloisamarcheson) December 11, 2022

In an try to appease the market place, Justin Sun posted declare is raising money to safeguard USDD and reiterate that this algorithmic stablecoin has an escrow ratio of up to 200%.

Deploy a lot more capital – quiet guys https://t.co/55pra5wQMi https://t.co/CexyaBy2hx

— HE Justin Sun🌞🇬🇩🇩🇲🔥 (@justinsuntron) December 12, 2022

Till now, USDD is hovering close to the $.98 take care of, it has risen somewhat but has not been capable to recover the $one peg. Meanwhile, TRX rate is even now at bottom and not exhibiting prevent indicators.

Synthetic currency68

Maybe you are interested: