The biggest cryptocurrency exchange on the planet Binance has expert a significant consumer withdrawal amounting to $831 million in the previous 24 hrs.

Binance continues to encounter a surge in withdrawals

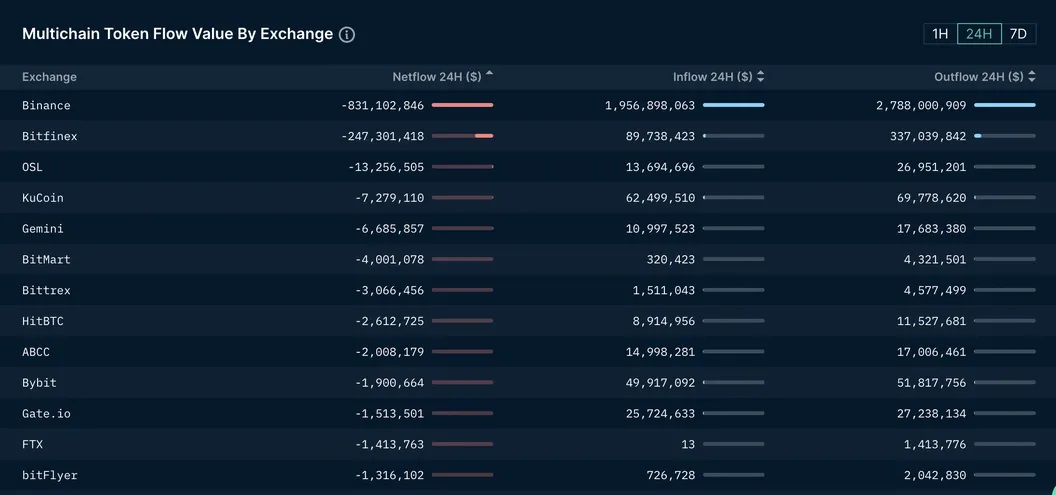

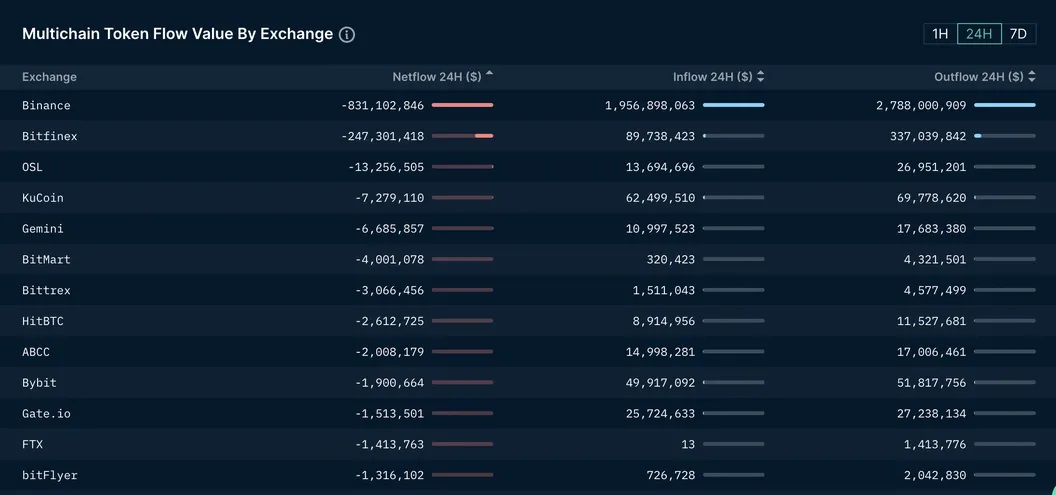

According to the Blockchain Intelligence Unit nansenthere was an estimated net outflow of $831 million from Binance in the final 24 hrs.

Specifically, end users withdrew roughly $two.eight billion in digital assets the former day, nicely over the $two billion in deposits in the identical frame.

This is also the biggest volume of dollars outdoors of Binance given that final November when FTX went bankrupt and the minute FUD circled the floor in December 2022. At that time, net movement (Netflow), the big difference concerning the volume of assets getting into/depositing (Inflow) and leaving/withdrawing (Outflow) from Binance it reached $902 million in 24 hrs.

Now, panic continues to prevail amid traders soon after the crackdown on the stablecoin Binance USD (BUSD) issued by Binance in partnership with Paxos given that 2019.

As Coinlive reported, the New York Department of Financial Services ordered Paxos to quit printing new BUSDs, soon after the US Securities and Exchange Commission (SEC) sent a recognize getting ready to prosecute the stablecoin as a “masked titles”. Originally known as Binance, BUSD is at this time the third-biggest stablecoin by industry capitalization, accounting for 35% of complete trading volume on the world’s biggest cryptocurrency exchange.

Binance’s reserves are the moment once again “tested”.

The regulatory action is severely hurting the exchange as BUSD is the biggest asset in Binance’s reserves (at about $13.four billion) soon after Tether’s USDT, Nansen reflected. This stake represents 22% of the $60 billion in assets on Binance.

$three billion of BNB accounts for almost five% of the exchange’s complete assets, even though Arkham Intelligence estimates the figure to be significantly increased, maybe as higher as $six.9 billion.

Additionally, there is a stream that the latest crackdown is paving the way for key stablecoins to re-set up a new buy.

Since the FTX bankruptcy, Binance has been at the forefront of offering proof of consumer assets and launching an marketplace-broad motion. Binance claims to usually make certain the security of additional than $70 billion of consumer assets. In response to a query about the debt audit report, Binance CEO Changpeng Zhao mentioned that the exchange “owes nothing to anyone.”

However, until eventually the finish of 2022, Binance was hit with a string of negative information, when there have been allegations of dollars laundering and sanctions violations by US authorities. Prior to this information, numerous men and women from huge institutions have been rushed to withdraw their money, primary to the BUSD staying depegged and Binance halting USDC withdrawals due to lack of liquidity. However, later on appearing in an AMA, Mr. Zhao nonetheless calmly mentioned that this is a regular industry response, Binance is nonetheless financially solid to manage any damaging developments.

Synthetic currency68

Maybe you are interested:

The biggest cryptocurrency exchange on the planet Binance has expert a significant consumer withdrawal amounting to $831 million in the previous 24 hrs.

Binance continues to encounter a surge in withdrawals

According to the Blockchain Intelligence Unit nansenthere was an estimated net outflow of $831 million from Binance in the final 24 hrs.

Specifically, end users withdrew roughly $two.eight billion in digital assets the former day, nicely over the $two billion in deposits in the identical frame.

This is also the biggest volume of dollars outdoors of Binance given that final November when FTX went bankrupt and the minute FUD circled the floor in December 2022. At that time, net movement (Netflow), the big difference concerning the volume of assets getting into/depositing (Inflow) and leaving/withdrawing (Outflow) from Binance it reached $902 million in 24 hrs.

Now, panic continues to prevail amid traders soon after the crackdown on the stablecoin Binance USD (BUSD) issued by Binance in partnership with Paxos given that 2019.

As Coinlive reported, the New York Department of Financial Services ordered Paxos to quit printing new BUSDs, soon after the US Securities and Exchange Commission (SEC) sent a recognize getting ready to prosecute the stablecoin as a “masked titles”. Originally known as Binance, BUSD is at this time the third-biggest stablecoin by industry capitalization, accounting for 35% of complete trading volume on the world’s biggest cryptocurrency exchange.

Binance’s reserves are the moment once again “tested”.

The regulatory action is severely hurting the exchange as BUSD is the biggest asset in Binance’s reserves (at about $13.four billion) soon after Tether’s USDT, Nansen reflected. This stake represents 22% of the $60 billion in assets on Binance.

$three billion of BNB accounts for almost five% of the exchange’s complete assets, even though Arkham Intelligence estimates the figure to be significantly increased, maybe as higher as $six.9 billion.

Additionally, there is a stream that the latest crackdown is paving the way for key stablecoins to re-set up a new buy.

Since the FTX bankruptcy, Binance has been at the forefront of offering proof of consumer assets and launching an marketplace-broad motion. Binance claims to usually make certain the security of additional than $70 billion of consumer assets. In response to a query about the debt audit report, Binance CEO Changpeng Zhao mentioned that the exchange “owes nothing to anyone.”

However, until eventually the finish of 2022, Binance was hit with a string of negative information, when there have been allegations of dollars laundering and sanctions violations by US authorities. Prior to this information, numerous men and women from huge institutions have been rushed to withdraw their money, primary to the BUSD staying depegged and Binance halting USDC withdrawals due to lack of liquidity. However, later on appearing in an AMA, Mr. Zhao nonetheless calmly mentioned that this is a regular industry response, Binance is nonetheless financially solid to manage any damaging developments.

Synthetic currency68

Maybe you are interested: