After Deribit was hacked yesterday for $ 28 million, the industry witnessed yet another exploit these days. This is Skyward Finance of the Close to method.

According to the official Twitter announcement of the undertaking, Skyward Finance’s intelligent contract has been exploited. The attackers exploited the vulnerability to exploit, main to the withdrawal of Skyward Treasury money. From there, develop SKYWARD tokens invalid.

We are sorry to inform you that the Skyward Treasury has been drained due to a contractual exploit, rendering the Treasury and the $ SKYWARD token proficiently worthless. However, existing and preceding token product sales are not impacted

– Skyward Finance (@skywardfinance) November 2, 2022

To stick to CoineckoSKYWARD selling price down 94% in the previous 24 hrs, at the moment hovering all-around USD .75. Meanwhile, the ATH selling price of $ 99.five was recorded in January of the 12 months.

Furthermore, hackers also pull back a whole lot of Close to, so this impacts the total Close to ecosystem in basic. TVL of the Close to method somewhat decreased by about three% 2nd DefiLama.

Skyward Finance is a launch platform constructed on the Near protocol blockchain. Many individuals concern that the assault will influence token product sales on Skyward. However, the undertaking confirms that token product sales have been and are taking area Unaltered.

However, with the SKYWARD token mined main to a reduction in worth, the local community is waiting to see a option from the undertaking workforce.

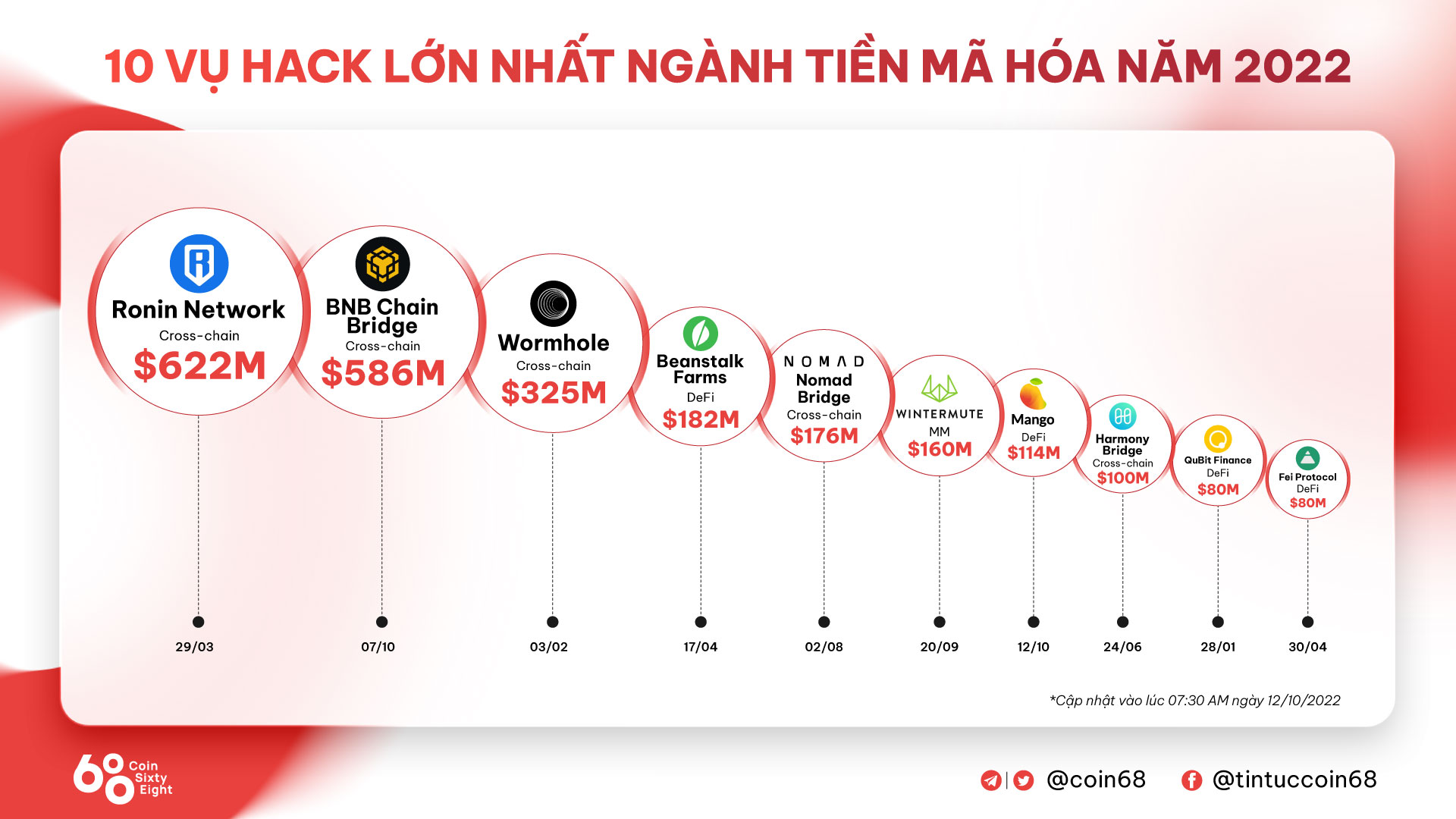

Although only three days have passed in November, the industry has noticed two attacks, Deribit and Skyward. Meanwhile, October had six hacks, respectively Transit Swap ($ 21 million), BNB Chain bridge ($ 586 million), Mango Markets ($ 114 million), Moola Market ($ eight.four million). ), Olympus DAO ($ 300,000) and Team Finance ($ 15.eight). hundreds of thousands).

Synthetic currency 68

Maybe you are interested: