Vauld, a Singapore-based mostly cryptocurrency trading and lending platform, has come to be the most current cryptocurrency enterprise to halt consumer withdrawals amid industry turmoil.

This was stated by CEO Darshan Bathija a blog post on July 4th the enterprise created the tricky choice to suspend all withdrawals, trading and deposits on the Vauld platform, helpful quickly.

According to Bathija, Vauld is challenged by a blend of variables, together with industry volatility and the monetary problems of trading partners. Since June twelve, the platform has witnessed a huge enhance in consumer withdrawals of just about $ 198 million, triggered by the LUNA / UST catastrophe, the impact of the Celsius chain liquidity crisis, and Three Arrows Capital’s attempted bankruptcy.

To treatment the present condition, Vauld is focusing on a amount of possible restructuring solutions for the enterprise. To this finish, the enterprise promptly employed monetary and legal advisors in India and Singapore. Bathija CEO stated:

“Our management remains fully committed to working with our financial and legal advisors to the best of our abilities to explore and analyze all possible options, including potential restructuring options, in order to best protect the interests of Vauld’s stakeholders. . “

Additionally, Vauld is presently in discussion with traders and authorities.

“We intend to go to the Singapore courts for a postponement, which is the suspension of any proceedings against the companies involved to give us more time in the suggested restructuring process.”

Vauld (formerly Bank of Hodlers) is a cryptocurrency lending platform backed by very well-recognized industry traders, together with Valar Ventures, Coinbase Ventures, and billionaire Peter Thiel’s Pantera Capital. The enterprise has raised $ 27.five million to date.

The information comes much less than a month right after Vauld stated the enterprise would proceed to operate ordinarily in spite of volatile industry disorders on June sixteen. At the time, Vauld claimed the enterprise had no publicity to Celsius and Three Arrows Capital.

“We have maintained adequate liquidity in spite of industry disorders. All withdrawals have been processed ordinarily and this will proceed to occur in the potential. “

Vauld continues to perform as typical

“We have usually maintained a balanced and conservative strategy to liquidity management. Bullish and bear races are inevitably and we put into action basic and powerful approaches that get these cycles into account. “

Read much more right here: https://t.co/6yWVozTydE

– Vauld (@VauldOfficial) June 16, 2022

As this kind of, Vauld grew to become the most current crypto enterprise to protect against customers from withdrawing right after Celsius, Babel Finance, Voyager Digital, and the CoinFLEX exchange. In connected developments, the KuCoin exchange is also getting spread by the crypto neighborhood with rumors that it is about to include its identify to the record over, but CEO Johnny Lyu quickly denied this allegation.

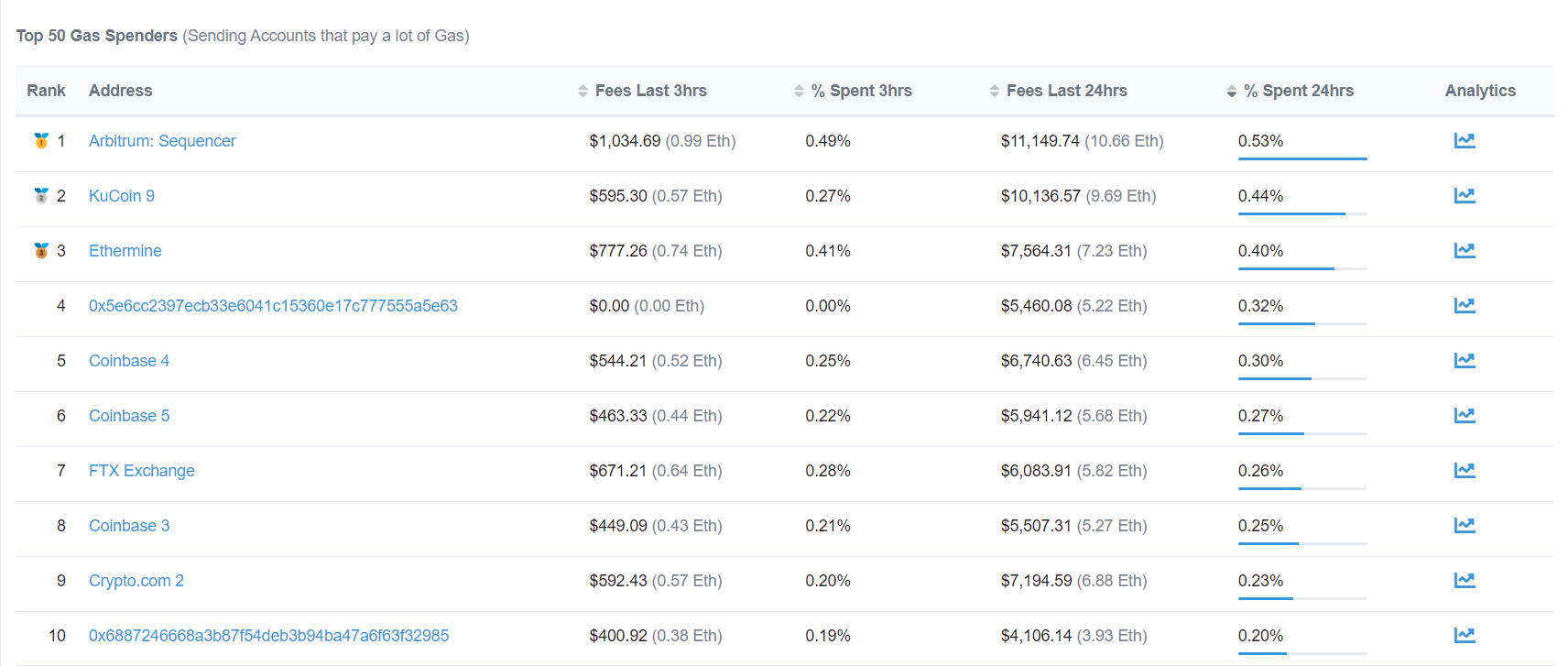

However, customers are even now very baffled by the over information and facts. Based on the information from Etherscan, the KuCoin exchange has all of a sudden come to be the area that consumes the most fuel prices only right after the Layer two scaling answer on Ethereum Arbitrum in the previous 24 hrs, demonstrating that traders are moving.

Synthetic currency 68

Maybe you are interested: