Vitalik Buterin a short while ago published a website publish explaining the variations among Layer-two, along with notes on the hazards you could experience when implementing these options.

The website opens with Vitalik’s summary of the existing state of the Layer-two marketplace. In unique, Layer-one tasks have a tendency to turn out to be Layer-two. Next is the trend Migration of standard applications to blockchain. And last but not least there is demand Decentralized and safe improvement of daily options this kind of as social networks or video games.

Different kinds of layers twohttps://t.co/ry4VTtWhJ1

— vitalik.eth (@VitalikButerin) October 31, 2023

Trade-off of options

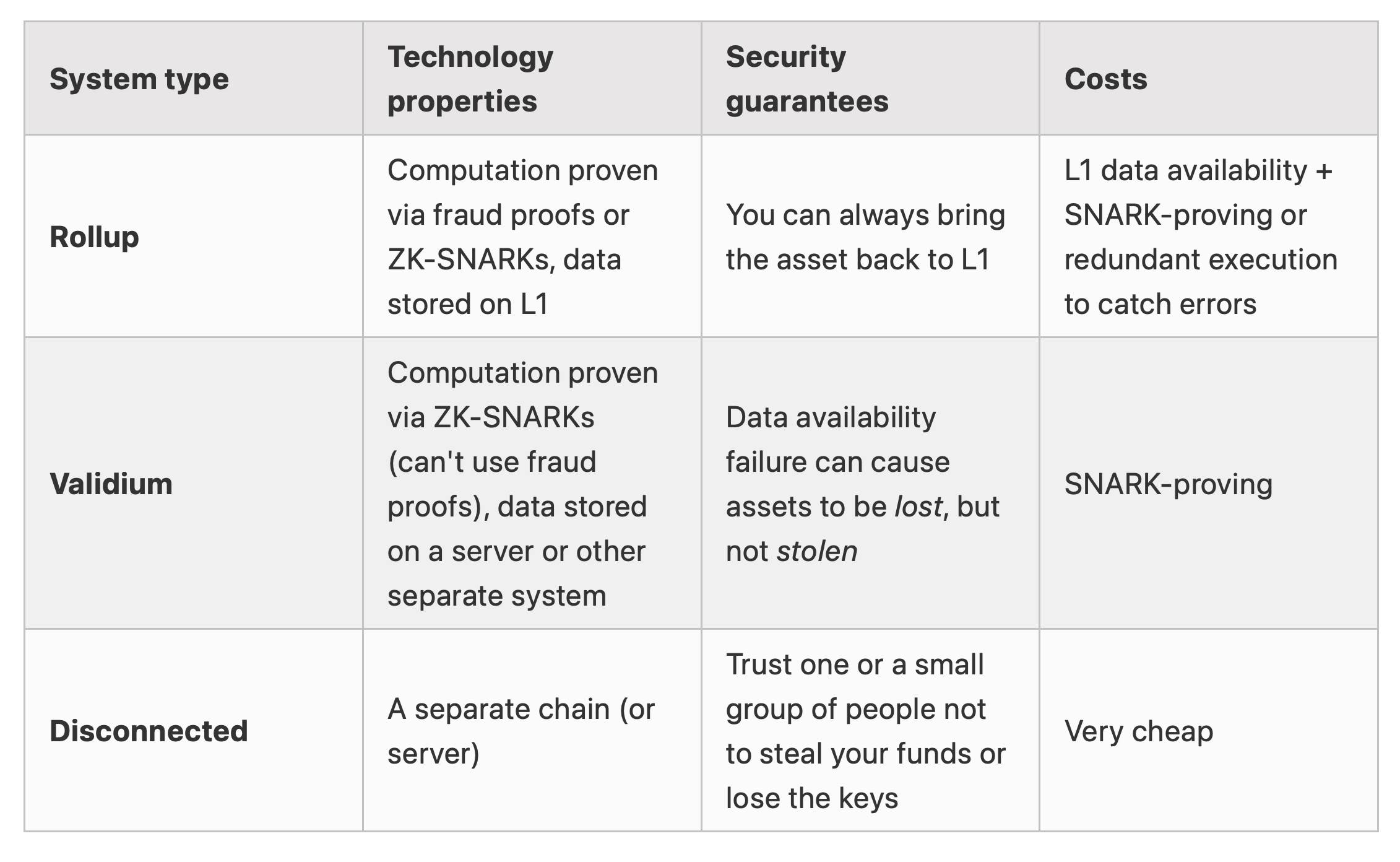

The Ethereum founder then in contrast the “gains and losses” of Layer-two options like Rollup and Validium to fully separate options (Disconnected).

It is effortless to see that the distinction among the approaches lies in the properties Safety AND Expenses to put into action the alternative. If there is no require to connect to the blockchain, the value will be incredibly minimal and, conversely, if a increased degree of protection is required, the expenditures resulting from evidence and information availability will improve (generally in the situation of Rollups).

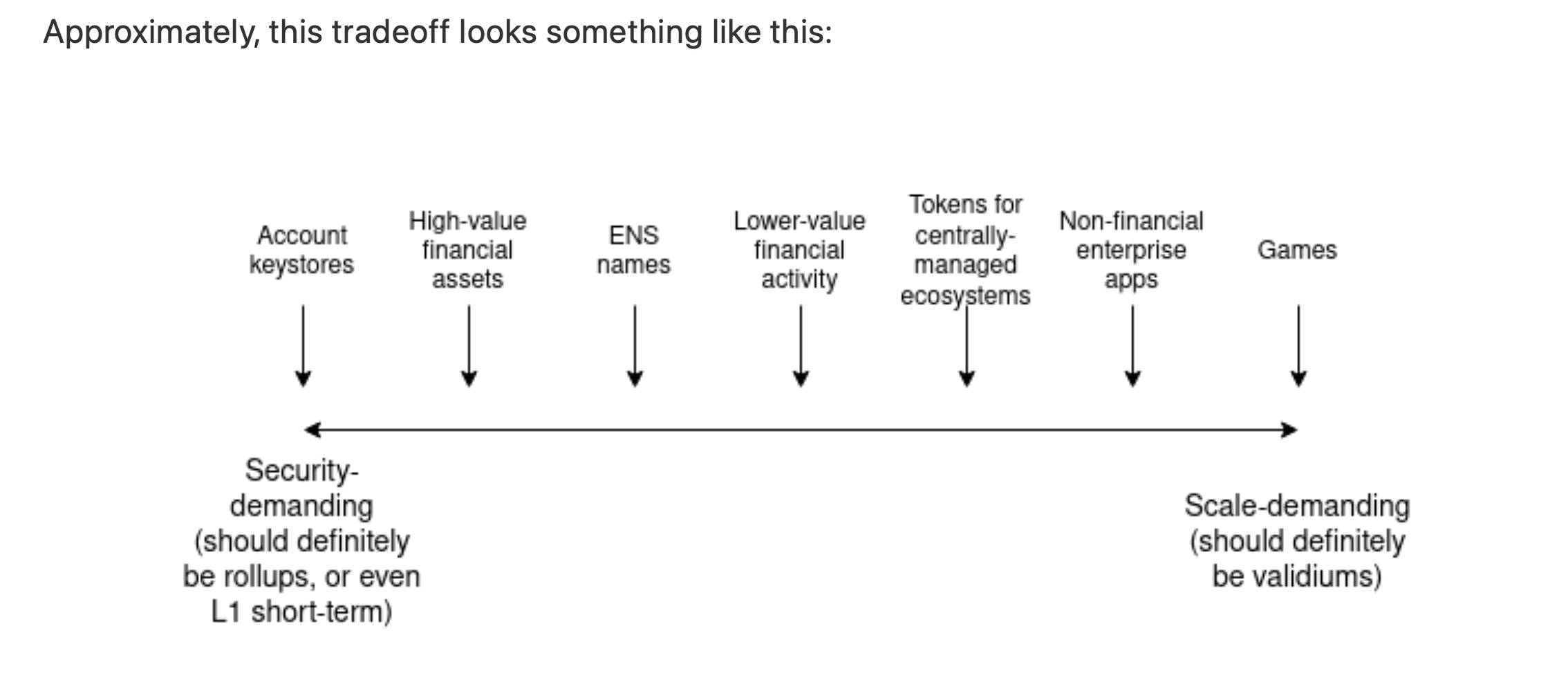

To describe the trade-off among protection and scalability (minimal value), Vitalik Buterin presented a spectrum, the place the left edge signifies large protection desires, though the proper edge represents application utilization and minimal value.

It is effortless to see that asset, domain and protection applications will be on the left side of the spectrum, though gaming applications and non-monetary platforms will require increased growth demand.

Interaction with Ethereum Layer-one

In addition to the compromise of the options, Vitalik also highlighted the skill to interact with Layer-one to assure Layer-two network protection.

The situation pointed out by Vitalik is this when Level-one has a reverse lock stateforemost to separation, nevertheless, Layer-two anchors the information and interacts with an outdated branch. This condition can arise when the network does not have a enough amount of validators participating in signature authentication (Purpose). In May 2023, Ethereum’s failure to attain consensus on Purpose brought about the network to enter a state of idle reduction.

>> Find out a lot more: What is single-slot finality? How does Ethereum advantage from this strategy?

To remedy this difficulty, Vitalik proposed two options:

- Allow Layer-two to study information only from finalized blocks.

- Improved rollback performance for degree two when degree one is reversed.

However, in the publish over, Vitalik Buterin also stated that the preceding two approaches each have their personal limitations.

Stories of bridges

Finally, Vitalik talked about Layer-2’s Bridge Contract strategy. The founder of Ethereum believes that unilaterally implementing a bridge contract on Layer-one will not support independent chains turn out to be safe and viewed as Validium.

>> Find out a lot more: DeFi Discussion ep.166: What is the distinction among Ethereum in layer one and layer two?

As a consequence, the over bridge will have to remedy two difficulties: Validating the state transition AND constantly study information from Ethereum.

However, very similar to the preceding sections, this founder also believes that the options to the preceding two difficulties are not thorough. Especially in the following hypothetical situations:

- Ethereum suffers a 51% assault.

- Ethereum implements really hard fork upgrades

- Independent chains roll out really hard fork updates

Conclusion

Concluding his website publish, Vitalik pointed out the two most vital facets of Ethereum and its Layer-two ecosystem: “Ability to securely withdraw resources to Layer-1″ AND “Ability to continuously read accurate Layer-2 data”.

You can see that the general website publish is a compromise among two or a lot more extremes of just about every alternative. And Vitalik also suggests that tasks continually keep track of infrastructure alterations to support make optimum decisions that meet their desires.

Coinlive compiled

Maybe you are interested:

Join the discussion on the hottest concerns in the DeFi marketplace in the chat group Coinlive Chats Let’s join the administrators of Coinlive!!!