Ethereum founder Vitalik Buterin created his very first comment on FTX’s “spectacular crash” on the evening of November eleven, accusing former FTX CEO Sam Bankman-Fried of “falsehood.”

Unlike other crashes, FTX and Sam Bankman-Fried in their efforts to polish the picture of the cryptocurrency sector have acquired a great deal of help and believe in from consumers and regulators due to their lofty missions.

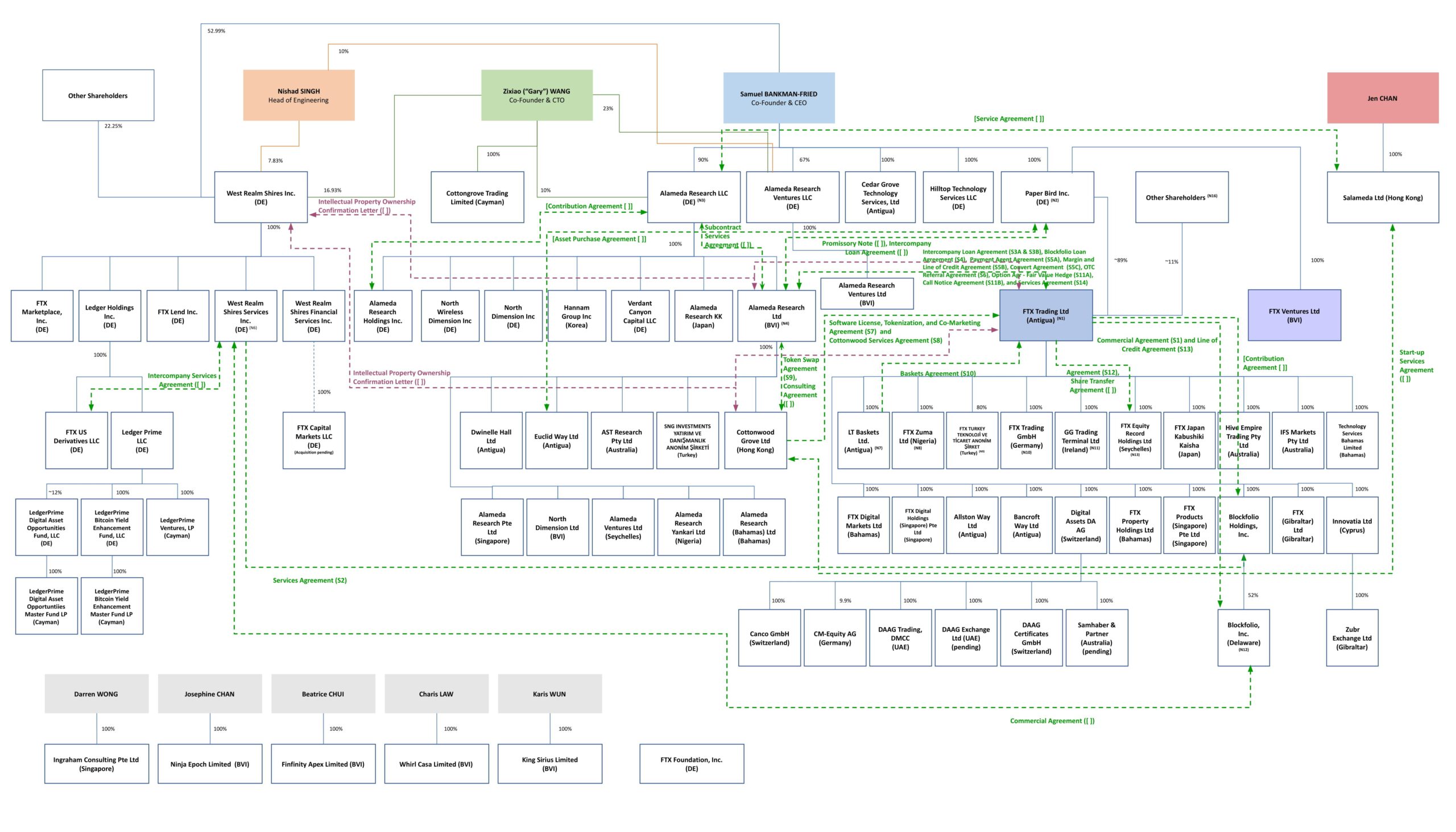

On the evening of eleven/eleven/2022, FTX filed for bankruptcy for FTX, FTX US, Alameda Research investment fund with each other additional than 130 branches in the FTX network.

This incident shook the entire sector, even folks significantly less concerned in dramas like Vitalik Buterin also commented on his Twitter that:

MtGox “looked” inaccurate and by no means experimented with as well challenging to whiten himself. Luna as well. FTX was the opposite and signaled the virtue of complete compliance (not the exact same as compliance)

The 2nd form of fraud goes deeper than the very first.

– vitalik.eth (@VitalikButerin) November 11, 2022

“MtGox” looks “inaccurate and by no means tries to mask the reality. Luna as well. FTX is the opposite when he experimented with to justify himself. And this does additional harm than the very first.

MT. Gox is a Tokyo-based mostly exchange that went bankrupt in 2014 right after hundreds of 1000’s of Bitcoins had been stolen. The Fall of the Moon The starting of this 12 months also induced a shock to the total cryptocurrency sector and a liquidity crisis spread from there.

Also, at the LaBitConf conference, when asked about his views right after the surprising failure of FTX, Buterin stated that the collapse was inevitable due to its “centralized nature”.

Buterin explains that folks are interested in FTX due to the fact of how the promoting platform is connected with SBF’s “personal image”. Buterin notes that this resembles the “dictatorship of the 1930s” and that it is “in direct opposition” to the core worth of the cryptocurrency sector to be decentralized.

FTX applied to be a single of the greatest cryptocurrency exchanges on the planet, but they are there rumors that the former SBF CEO applied consumer deposits to invest and reduceleading to tens of billions of bucks to “evaporate” and reduce asset worth to $ one deprived of the title of “billionaire”.

Synthetic currency68

Coinlive published a series of articles or blog posts summarizing the Binance – FTX – Alameda drama, readers can see additional right here:

– Binance liquidates its total USD 580 million investment in FTX tokens

– Users massively withdraw from FTX

– The entire industry was heavily dumped, FTT misplaced 22 USD

– Binance has reached an agreement to acquire back FTX – Market promote-off

– FTX CEO’s assets down $14.six billion, he wrote a letter apologizing to traders

– CZ urges exchanges to deliver evidence of buyer deposit

– The Solana program “bears the battle”

– Binance cancels FTX acquisition and most current updates

– Continuously several organizations declare “union” from FTX

– Sam Bankman-Fried writes a letter of apology and updates on the FTX – Alameda catastrophe

– Update the FTX circumstance on the morning of eleven/eleven/2022

– FTX declares bankruptcy, Sam Bankman-Fried resigns as CEO