While field analysts have mentioned an raise in institutional curiosity in Bitcoin above the previous week. Now, Wall Street traders are actually having into action following Bitcoin futures ETF approval.

Bitcoin has begun correcting to the $ 59,000 price tag zone in the previous two days, following continuing to expand “hot” final week. However, the occasion that the initial Bitcoin ETF in the United States went public nowadays on the New York Stock Exchange straight away pushed the price tag of BTC back down to the $ 63,000 mark. This is the 2nd time that Bitcoin has risen to this price tag degree in just three days. Bitcoin is trading at $ 62,641 at press time.

– See extra: The industry capitalization of cryptocurrencies exceeds $ two.six trillion, setting a new record

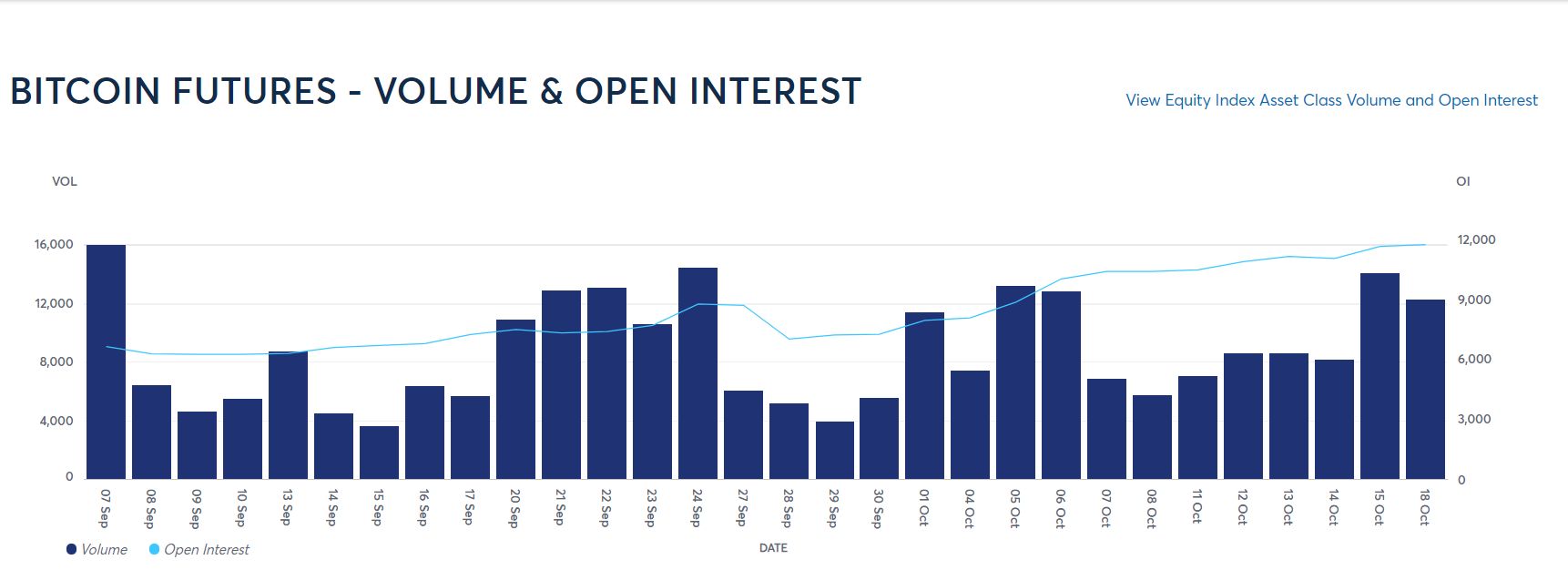

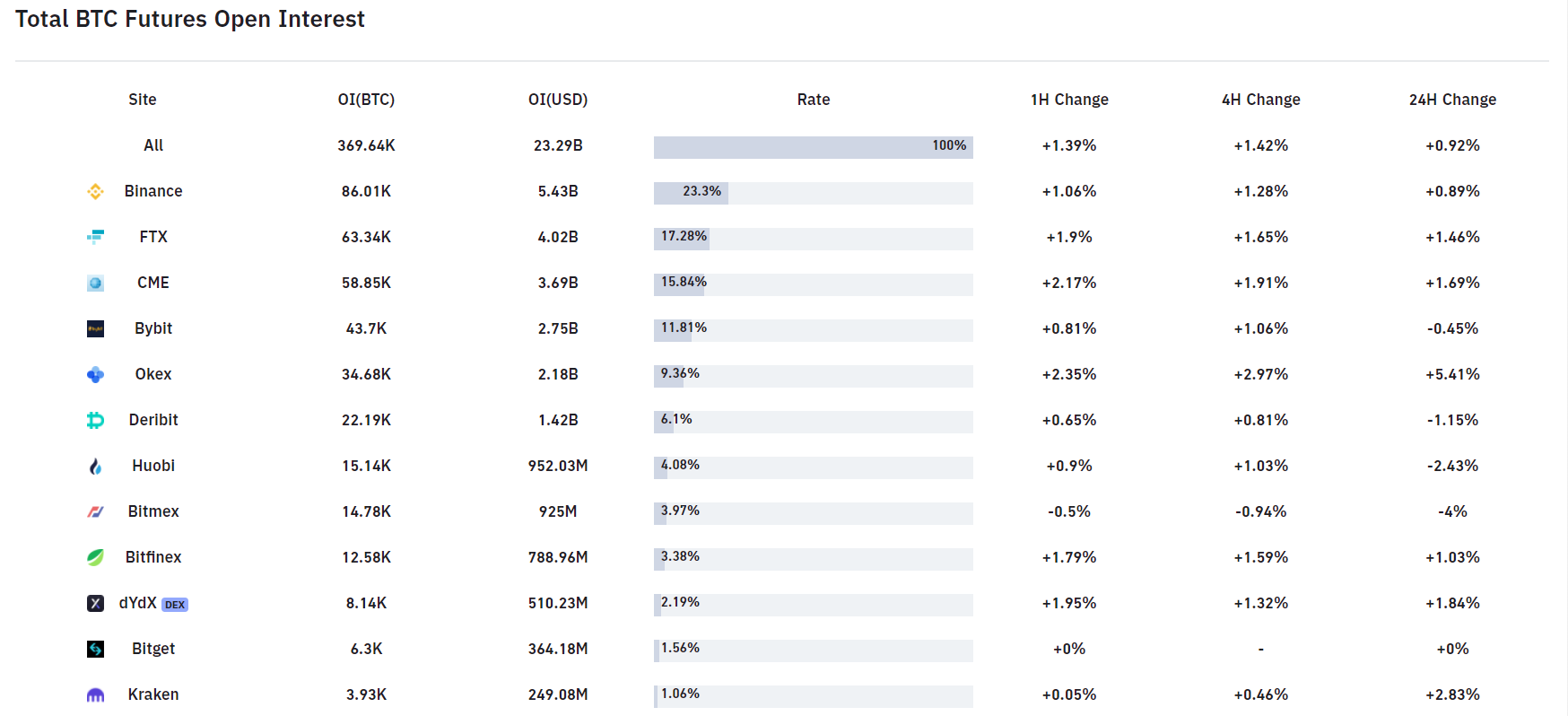

Specifically, open curiosity in Bitcoin futures on the Chicago Mercantile Exchange (CME) at the moment stands at $ three.69 billion, increased than the earlier record set in February. is the principal “gateway” for US-based mostly institutional traders who want to bet on the price tag of Bitcoin futures.

According to Bybit, CME is at the moment accountable for just beneath sixteen% of all open curiosity in Bitcoin futures, behind Binance (23.three%) and FTX (17.28%), in a industry that at the moment supports $ 23 billion. That variety enhanced with the price tag of BTC 6 months in the past, reaching practically $ two billion. Now, with $ three.69 billion on CME, Bitcoin is really possible to repeat the earlier story and break the substantial in the brief phrase.

At the similar time, Bitcoin solutions contracts, which perform like futures but supply events the means to adhere to the contract, have been at their highest degree given that April 15, mixed with the contract’s open curiosity. . Both indicators present that optimism is constructing up between institutional traders.

– See extra: The major a single billion dollar investment in Bitcoin (BTC) was x2

Also nowadays Glassnode pointed out that most of the trading volume comes from traders with bullish positions, with solutions expiring on December 31, 2021 exhibiting a major raise in open curiosity. The bulls are undertaking all they can to assistance the price tag over $ a hundred,000 for Bitcoin, offering an general good industry sentiment.

It seems that a lot of this volume is coming from the bulls, with contact solutions expiring on Dec 31-2021 seeing a major raise in OI.#Bitcoin bulls favor strike costs over $ a hundred,000, offering data on general good industry sentiment.

Real Time Charts: https://t.co/W6ttyYs40Ft pic.twitter.com/LcaMvpZuer

– glassnode (@glassnode) October 18, 2021

In Bitcoin futures, traders speculate on the price tag of BTC at a later on date. Buyers can bargain by locking in a reduced price tag and then viewing the residence raise in worth, the opposite is accurate for sellers. Open curiosity signifies the USD worth of unexpired contracts.

Synthetic currency 68

Maybe you are interested: