Nearly a quarter of existing deposits at Wall Street Signature Bank come from crypto companies Financial Times information.

Signature Bank (SBNY) will “dump” crypto-relevant deposits of up to $ten billion, as an indicator of the probability of a single of the most crypto-pleasant gamers leaving the digital asset sector in the nation, Wall Street.

Signature Bank, the U.S. loan company whose consumers consist of cryptocurrency exchange FTX, ideas to offload up to $ten billion in cryptocurrency-relevant deposits $SBNY https://t.co/qWho9NakRE

—Joshua Franklin (@FTJFranklin) December 6, 2022

Signature Bank CEO Joe DePaolo mentioned at an investment conference in New York hosted by Goldman Sachs on Dec. six:

“We are not just a crypto bank, we want the industry to be more transparent.”

Nearly a quarter of all deposits, or 25% of the around $103 billion held by Signature Bank, came from the cryptocurrency sector, as of September 2022. However, in a series of unusual latest incidents, Signature has determined to lower publicity to significantly less than 15%, DePaolo explained. This is thought of a important turning level for Signature following its sturdy development by way of the attraction of digital assets.

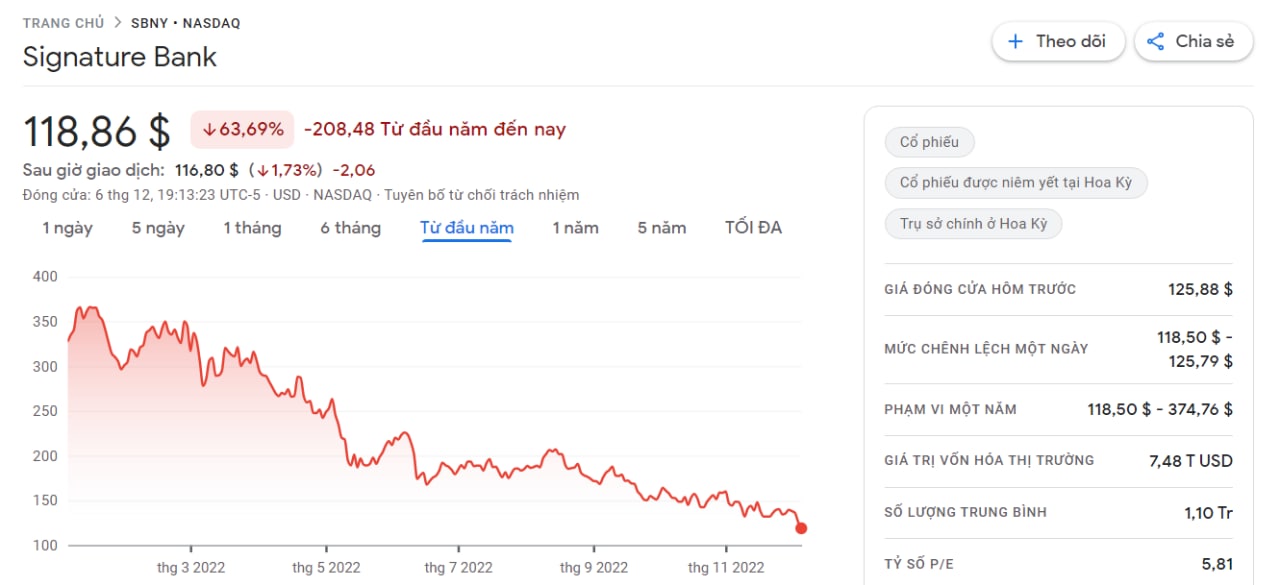

FTX is a single of Signature Bank’s consumers, the minimal deposit at Signature represents significantly less than .one% of the complete. However, the catastrophe that unfolded was ample to get a toll on Signature, CBNY shares fell almost twenty% in November and have misplaced a lot more than 60% 12 months-to-date.

DePaolo exclusively stated that he would like to exit stablecoins, which could be undesirable information for Circle and other stablecoin issuers. Circle extra Signature as a USDC reserve approval banking spouse final April.

Signature Bank, a single of Wall Street’s most crypto-pleasant banking institutions, along with rival Silvergate Bank, has just been asked by US senators to clarify its position in the transfer involving FTX and its subsidiary. Silvergate mentioned FTX accounted for almost ten% of the $eleven.9 billion in deposits from digital asset shoppers, and the company’s stock also tumbled amid FTX’s demise.

Synthetic currency68

Maybe you are interested: