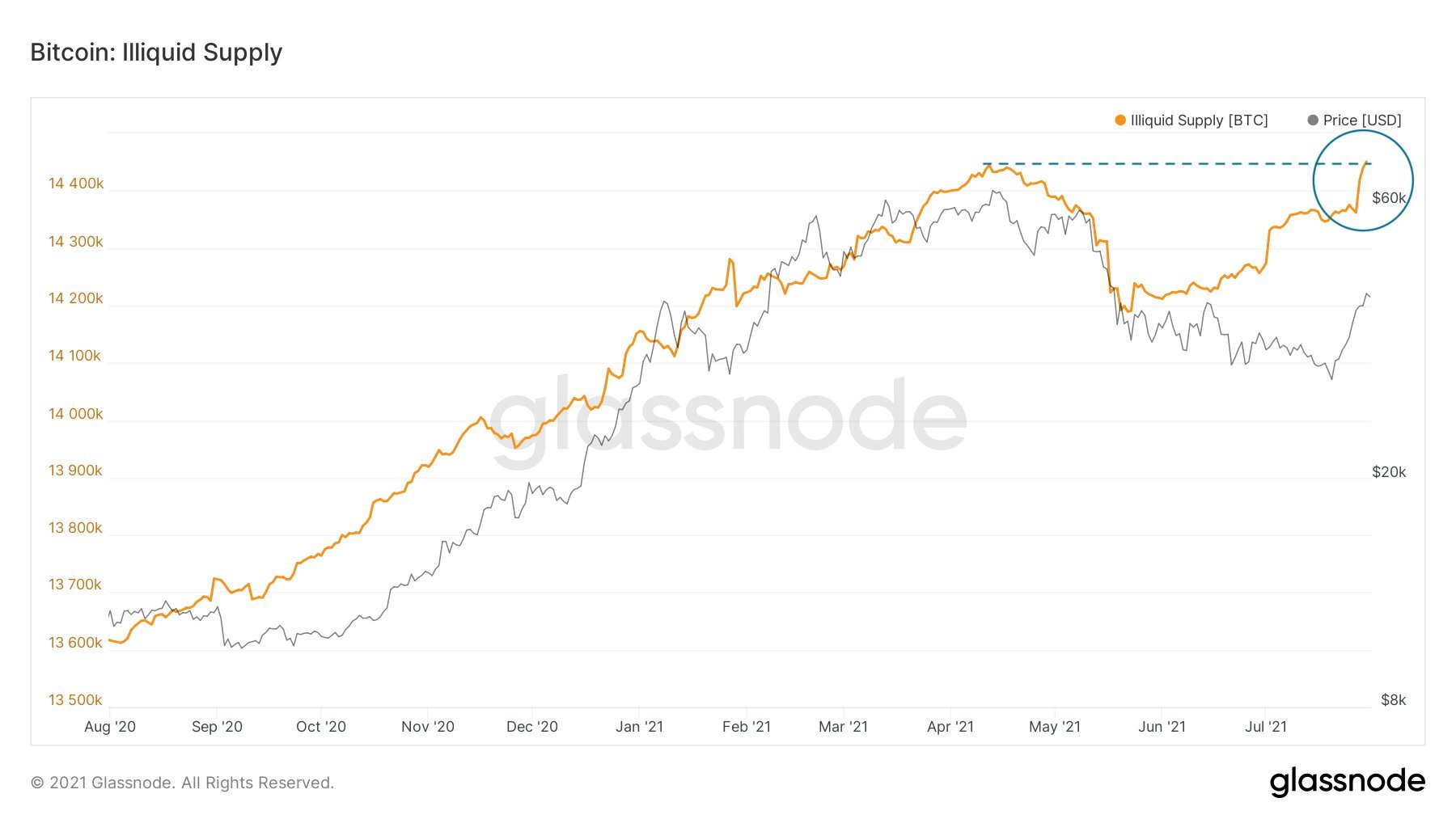

Bitcoin’s illiquid provide has recovered and reached a new all-time substantial of above 14,400 BTC in a gradual return to power.

As the Glassnode information chart displays, the whales with the strongest BTC holders have recovered the Bitcoins offered throughout the latest crash that lasted about 108 days and returned the Bitcoins to their cold storage wallets.

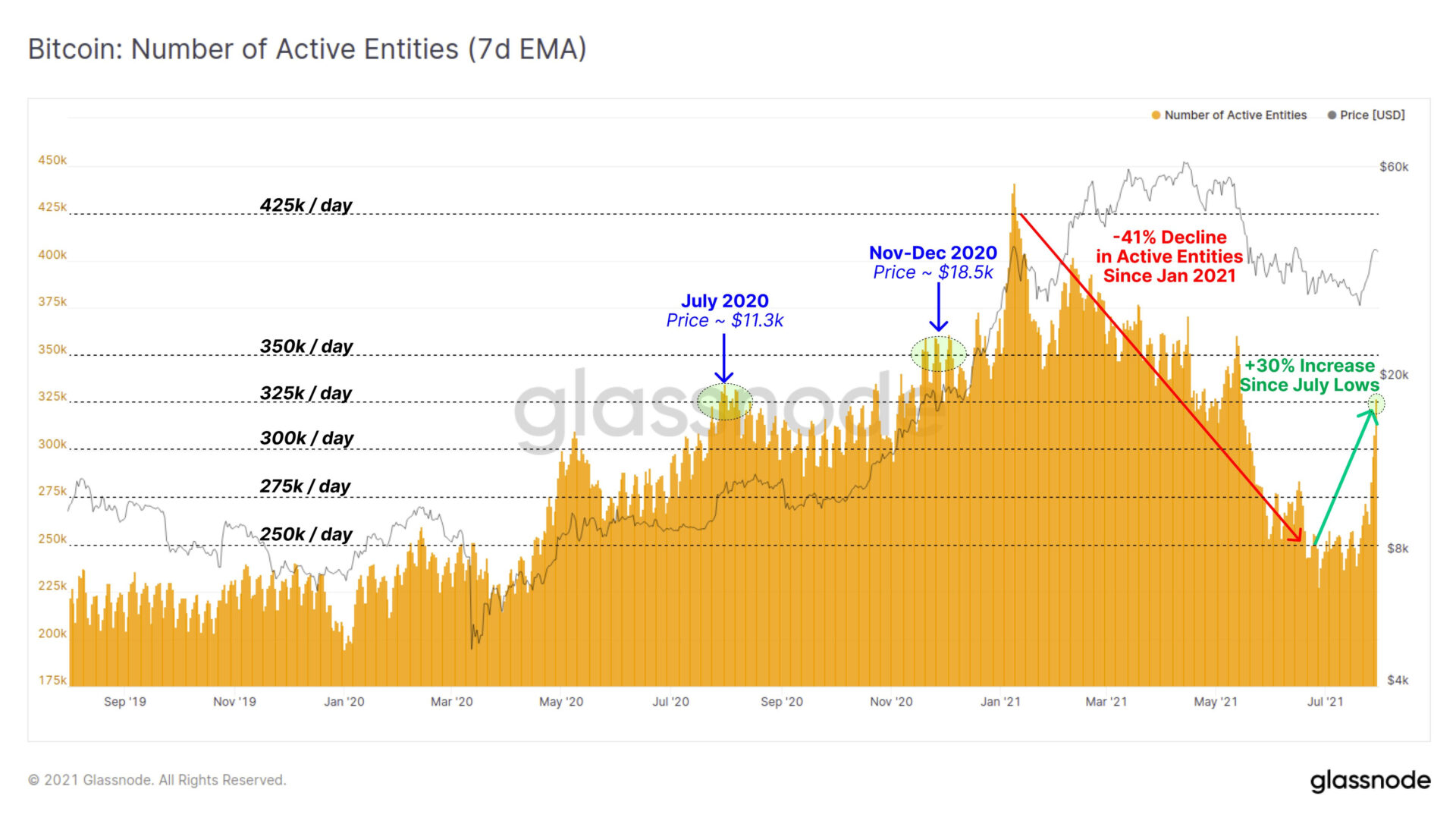

With that, Bitcoin has witnessed a resurgence in the energetic objects index above the previous week, growing by thirty% from 250,000 to 325,000 everyday energetic objects. This degree of exercise was maintained in July 2020, when the cost of BTC was all-around $ eleven,300 in the 2nd quarter of 2020, the start off of a super bullish cycle.

Market sentiment also turned far more constructive soon after two “bloody” months, one hundred,000 Bitcoins had been withdrawn from the exchange in just three days. Currently, at the time of creating, the sentiment index has been raised from “Neutral” to “Greed” with the amount 60.

Bitcoin closed a regular monthly green candle close to over $ 42,000 right now, opening a pretty constructive signal for the approaching development that the local community has substantial expectations for the outdated recovery ranges, maybe also. BTC is now trading all-around the $ 42,300 zone.

From the macro level of see, the action of massive institutional investment money is nevertheless “massively” continuing, the “desire” of Bitcoin has brought about MicroStrategy to proceed to prepare to get far more Bitcoins. State Street Corporation, a $ 42.six trillion asset management empire, just announced its crypto solutions providing.

This displays that the cryptocurrency game has not gone into a economic downturn as a lot of have speculated due to the fact the “bloody” May 19, bringing panic to the local community and traders. If we review the overview of the cryptocurrency marketplace and a lot of other money markets, we are without a doubt “losers” in terms of capitalization and acceptance, so this is just the starting.

Synthetic currency 68

Maybe you are interested: