Michael Saylor’s enterprise MicroStrategy is estimated to earn $ one.four billion from the ETH investment rather of the $ one.three billion in losses with BTC as it is now.

MicroStrategy is shedding $ one.three billion to Bitcoin (BTC)

One of the critical names that initiated the Bitcoin (BTC) bullish cycle in 2020-2021 is software package enterprise MicroStrategy, led by CEO Michael Saylor.

As a consequence, the CEO and his enterprise positioned a series of huge orders to obtain Bitcoin for the duration of the aforementioned time period. MicroStrategy’s to start with buy of BTC took area in September 2020, when the selling price of Bitcoin reached just $ eleven,000.

During that time, the enterprise amassed a complete of 130,000 Bitcoins, well worth $ two.six billion at press time. However, as the typical buy selling price of these delivers is $ thirty,634 and the selling price of BTC at the time of the update is $ twenty,290, MicroStrategy is dealing with a big reduction. reduction of one.three billion bucks for his Bitcoin investment.

Calculated in the 2nd quarter of 2022, when the cryptocurrency marketplace shook violently due to the LUNA-UST crash, MicroStrategy was forced to report a reduction of up to $ 918 million from its Bitcoin investment. This is a consequence of CEO Michael Saylor becoming also assured in BTC’s development prospective customers, acquiring constantly even as the marketplace tends to go down. In the most current Q3 2022 report, the enterprise stated it misplaced $ 727,000 from its Bitcoin holdings, due to a lack of marketplace volatility. However, the enterprise also only manufactured one new BTC buy with a meager worth of just $ six million.

In addition to the truth that the enterprise has borrowed big sums of income to help its BTC acquiring approach, traders have expressed concern about MicroStrategy’s management. As a consequence, Mr. Michael Saylor had to announce that he would depart the CEO place and move to the place of President, but he however promised to maintain his conviction and It will not promote Bitcoin.

The CEO is also well known in the cryptocurrency investment neighborhood on Twitter for his optimistic statements about Bitcoin. In a 2021 interview, when asked which is the 2nd finest coin soon after Bitcoin, Saylor stated: “There is no second currency, Bitcoin is the best”. He also recommended the public to do what ever it requires to improve the volume of Bitcoin he owns, irrespective of whether it truly is a home loan on a property or an asset sale.

Due to these eloquent statements, CEO Michael Saylor gets more and more the object of “derision” from the crypto neighborhood as Bitcoin continues to decline. However, Mr. Saylor nevertheless posts “shill” articles or blog posts about Bitcoin on his personalized Twitter web page on a day by day basis.

November is a excellent month to stroll the Orange Trail. #Bitcoin pic.twitter.com/9Dc9gSWp77

– Michael Saylor⚡️ (@saylor) November 1, 2022

But MicroStrategy can nevertheless “get ashore” if it chooses Ethereum (ETH)

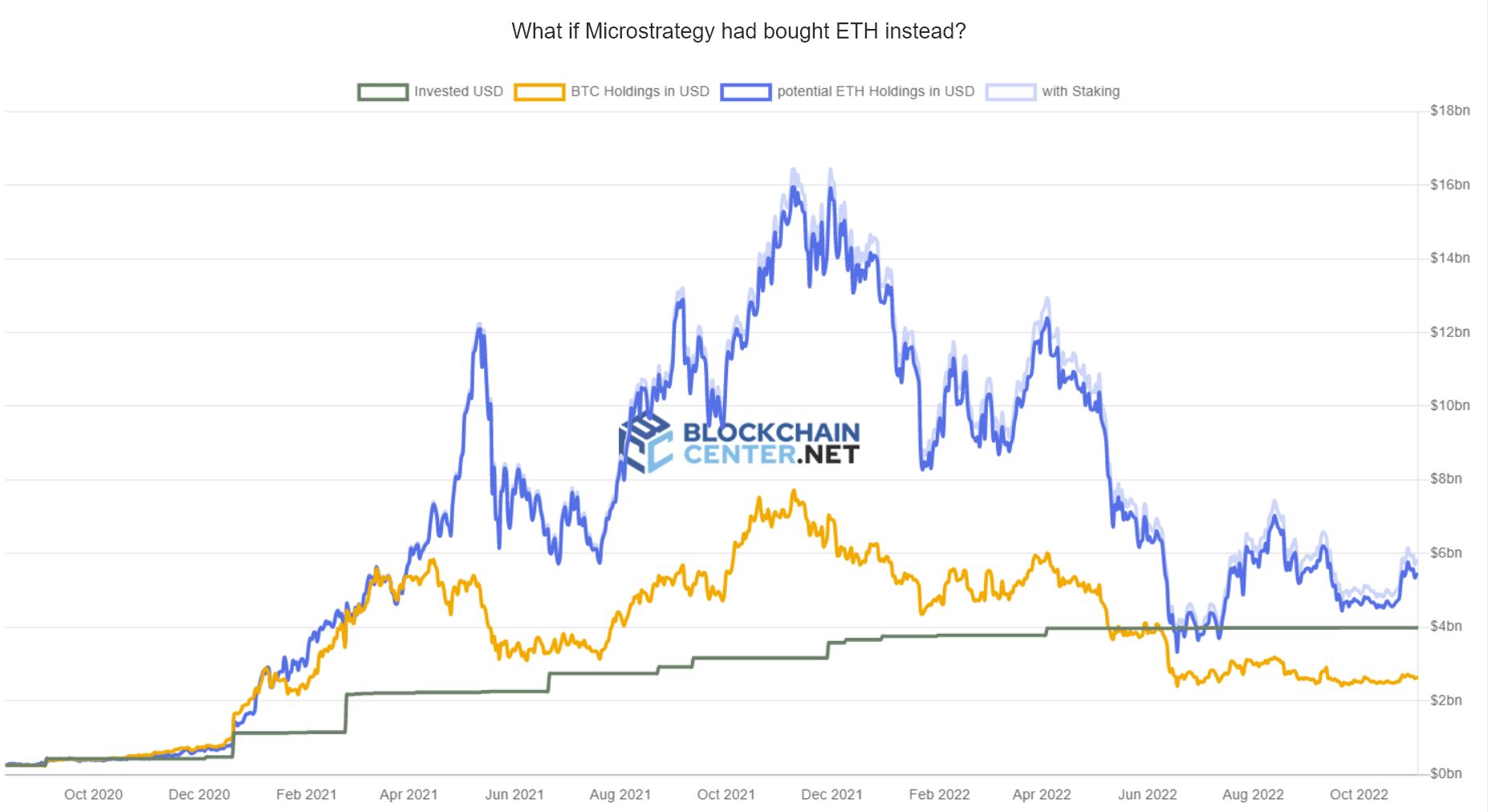

On November four, the BlockchainCenter.net statistical unit made a web-site to determine which course historical past would go if MicroStrategy had selected Ethereum more than Bitcoin.

I did a single factor, I get in touch with it: “THERE IS NO BETTER SECOND HERE!”

“What occurs if @saylor had purchased ETH (at the moment 2nd) rather of BTC? “

These views give the reply:https://t.co/9IBQJmEUxE

– Holger (@rhomeo_de) November 3, 2022

BlockchainCenter.net claims that if you devote all of the USD utilized to obtain BTC in ETH “all-in”, rather of shedding $ one.three billion as at the moment, MicroStrategy will. revenue of up to one.four billion bucks – generating this a coin that is not only “second best, but also best”, contrary to Michael Saylor’s statement over.

Specifically, if only it pursued Ethereum, the enterprise will have extra than three.five million ETH, well worth $ five.four billion. When calculated at the highest ATH selling price of ETH in November 2021, the total volume of Ethereum will be equivalent to almost $ sixteen billion in treasury.

At the top rated of November 2021, his portfolio would have been $ sixteen billion! pic.twitter.com/t3OndSVq7o

– Holger (@rhomeo_de) November 3, 2022

Without stopping there, if it utilizes Ethereum to participate in staking, Mr. Saylor’s enterprise can increase almost 240,000 extra ETH (well worth $ 370 million) to carry complete assets to three.seven million ETH.

Having staking will aid an investment organization like MicroStrategy earn passive revenue from its big volume of cryptocurrency rather of leaving it inactive, which Michael Saylor himself after admitted and intends to lend Bitcoin. .

Also, if Mr. Saylor modifications his thoughts and buys Ethereum now, he will earn one.seven million ETH (assuming there is no slippage) and make a revenue of $ 132 million per 12 months by wagering that income.

And even even though he now swaps his stack for ETH and bets, he can nevertheless have one.seven million ETH and earn 132 million a 12 months from staking. pic.twitter.com/GXhJdJNgmf

– Holger (@rhomeo_de) November 3, 2022

The selling price of ETH in the quick phrase also has a lot of beneficial deflationary results from The Merge update, as nicely as the availability of a vibrant ecosystem of DeFi, Layer-two, GameFi and NFT applications. These are usually utilized motives for Ethereum supporters to believe ETH is a improved investment than BTC.

Even so, in the eyes of avid Bitcoin advocates like Saylor and the United States Securities and Exchange Commission (SEC), Ethereum’s staking model displays indicators of a stock partnership and will have to be physically registered / administered. This will be a motive why MicroStrategy will not be concerned with Ethereum if it isn’t going to want to endure legal consequences later on on.

Synthetic currency 68

Maybe you are interested: